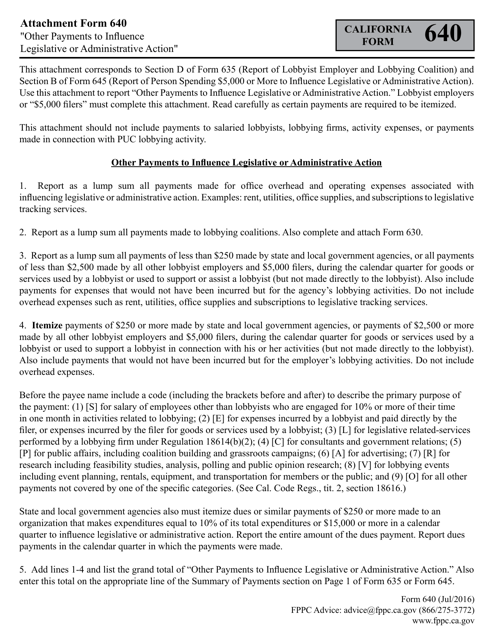

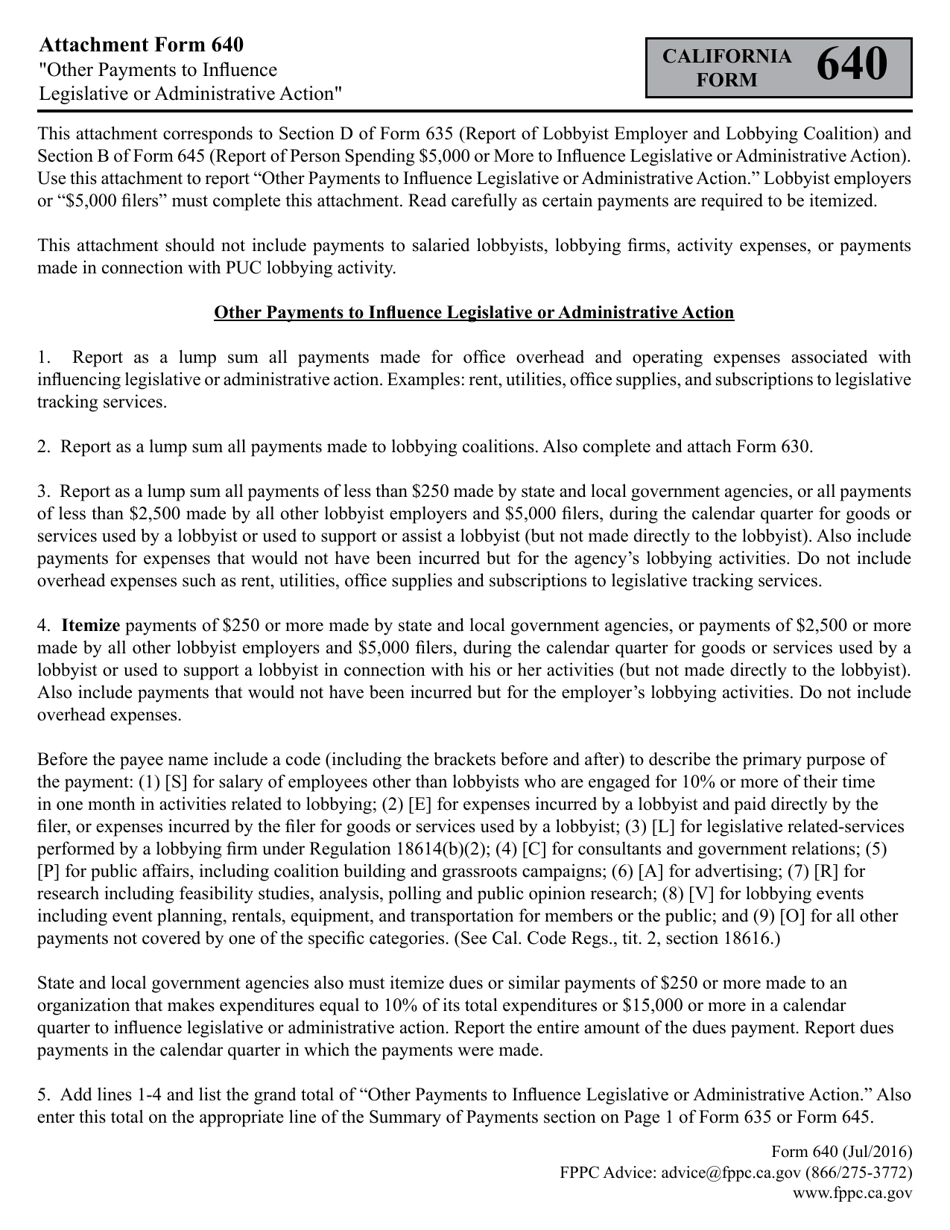

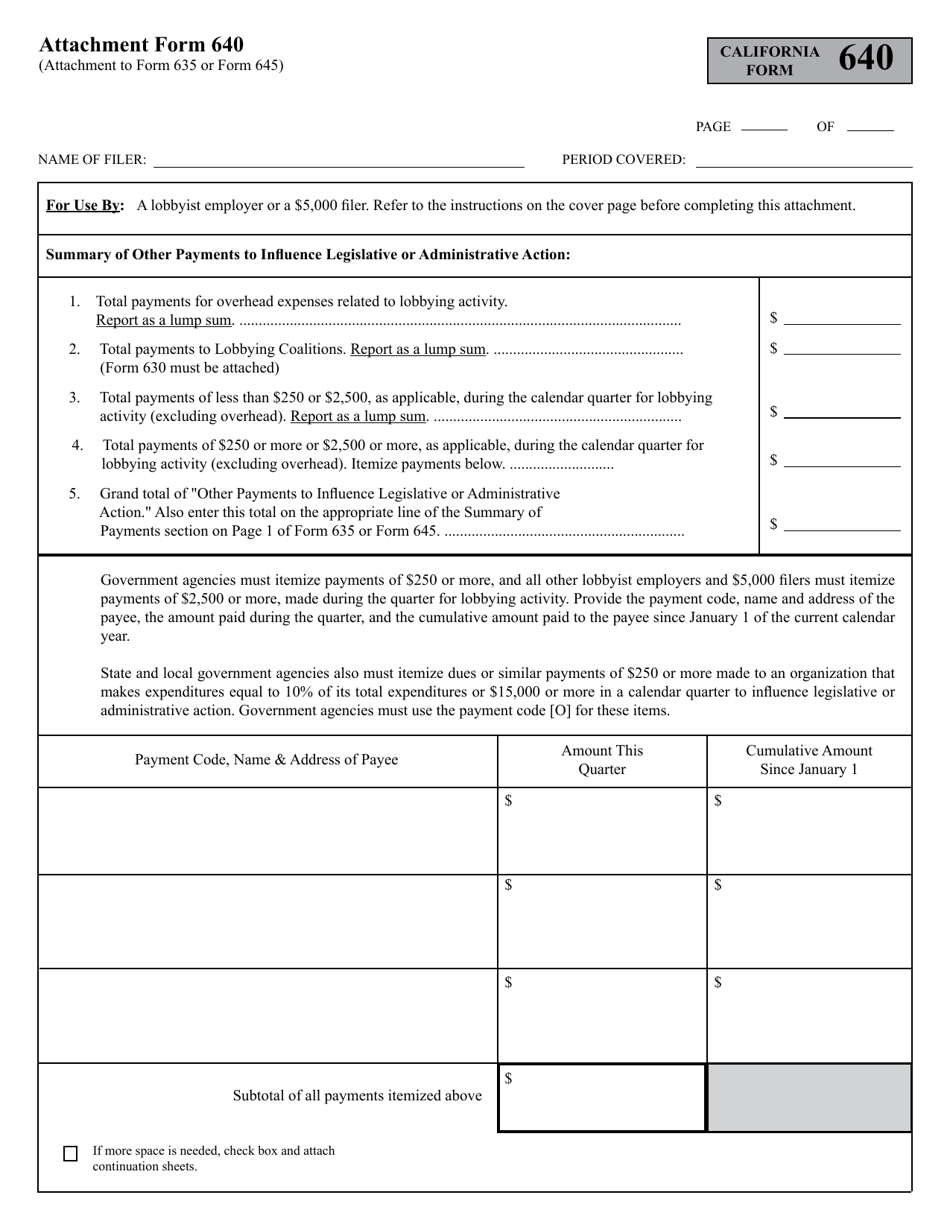

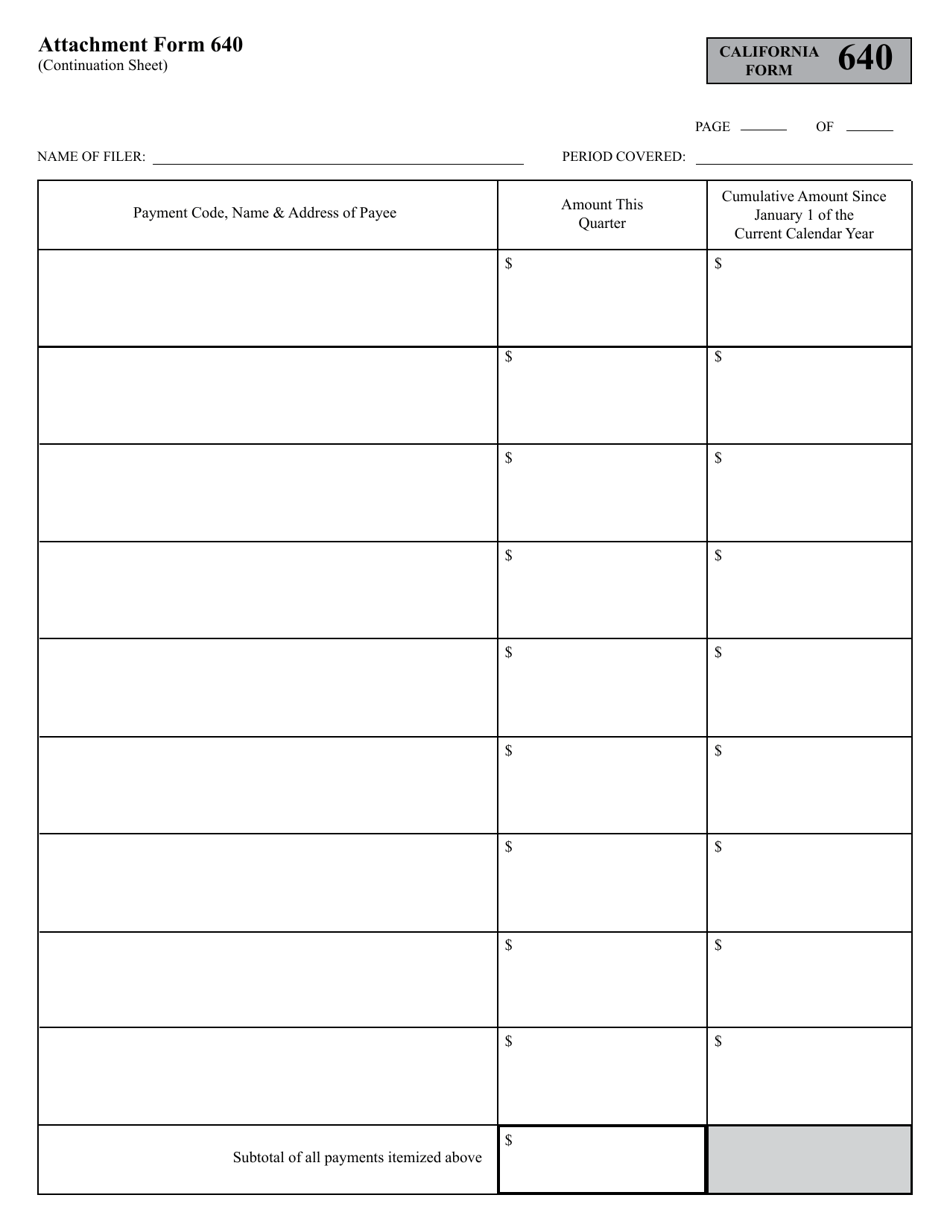

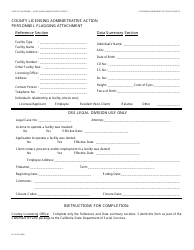

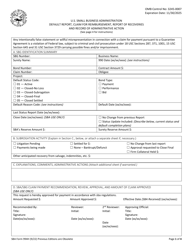

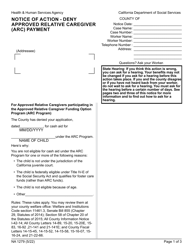

Form 640 Other Payments to Influence Legislative or Administrative Action - California

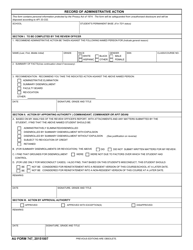

What Is Form 640?

This is a legal form that was released by the California Fair Political Practices Commission - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 640?

A: Form 640 is a document used in California for reporting payments made to influence legislative or administrative action.

Q: What are the purposes of Form 640?

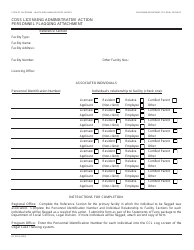

A: The purposes of Form 640 are to provide transparency and accountability by reporting payments made to influence legislative or administrative action.

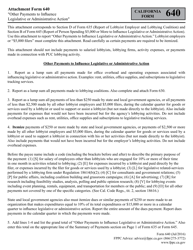

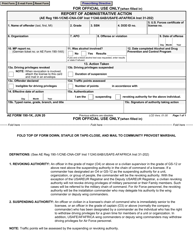

Q: Who is required to file Form 640?

A: Individuals or organizations that have made payments totaling $2,000 or more in a calendar month to influence legislative or administrative action are required to file Form 640.

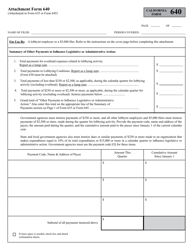

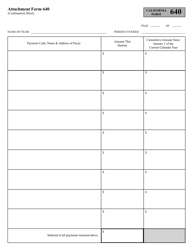

Q: What information is required on Form 640?

A: Form 640 requires the filer to provide details about the payments made, including the amount, recipient, and purpose of the payment.

Q: When is Form 640 due?

A: Form 640 is due on the 15th day of the month following the calendar month in which the payments were made.

Q: Are there any penalties for failing to file Form 640?

A: Yes, there may be penalties for failing to file Form 640, including fines and potential criminal charges.

Q: Is Form 640 required for all types of payments?

A: No, Form 640 is only required for payments made to influence legislative or administrative action.

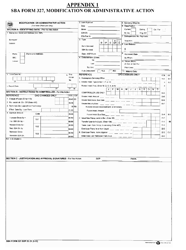

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the California Fair Political Practices Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 640 by clicking the link below or browse more documents and templates provided by the California Fair Political Practices Commission.