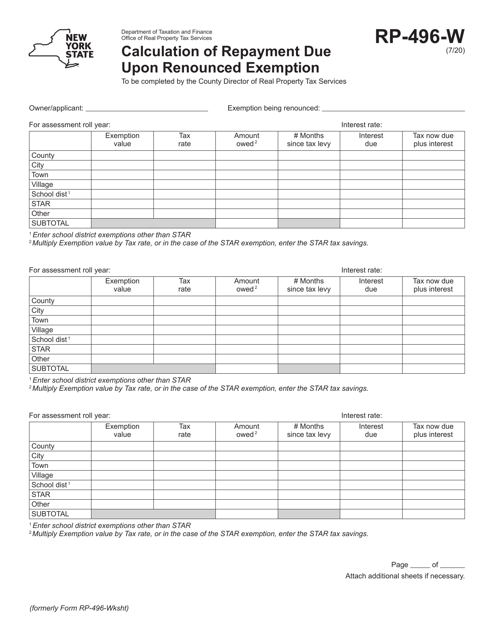

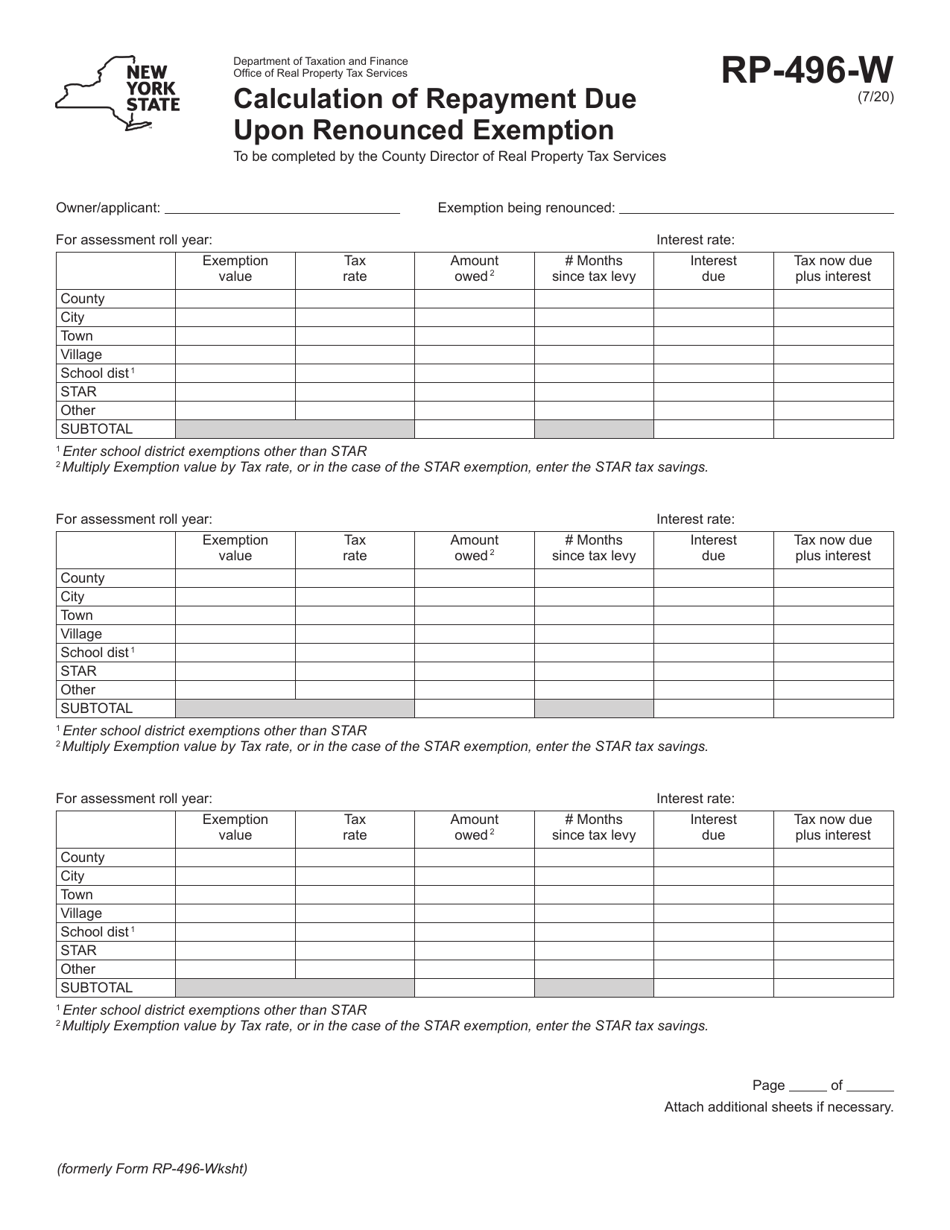

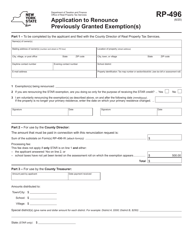

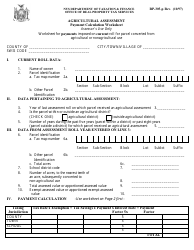

Form RP-496-W Calculation of Repayment Due Upon Renounced Exemption - New York

What Is Form RP-496-W?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-496-W?

A: Form RP-496-W is a document used in New York to calculate the repayment due upon renounced exemption.

Q: What does Form RP-496-W calculate?

A: Form RP-496-W calculates the amount of repayment that is required when a property owner renounces a previously received exemption.

Q: When is Form RP-496-W used?

A: Form RP-496-W is used when a property owner wants to renounce a previously received exemption and needs to calculate the repayment amount.

Q: Who needs to fill out Form RP-496-W?

A: Property owners in New York who are renouncing a previously received exemption need to fill out Form RP-496-W.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-496-W by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.