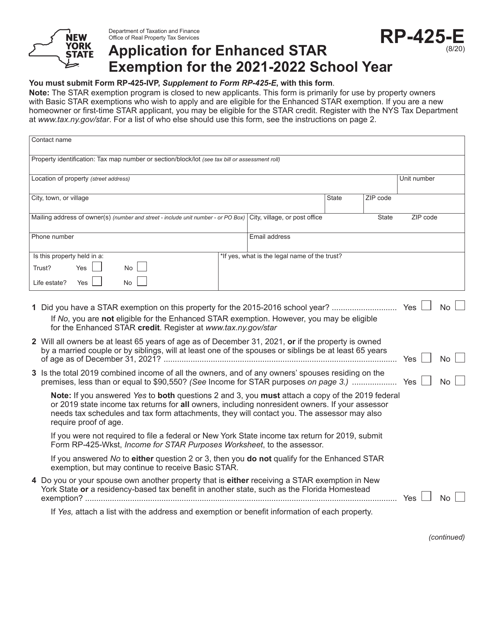

This version of the form is not currently in use and is provided for reference only. Download this version of

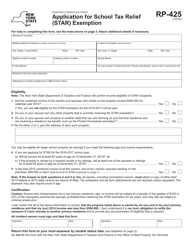

Form RP-425-E

for the current year.

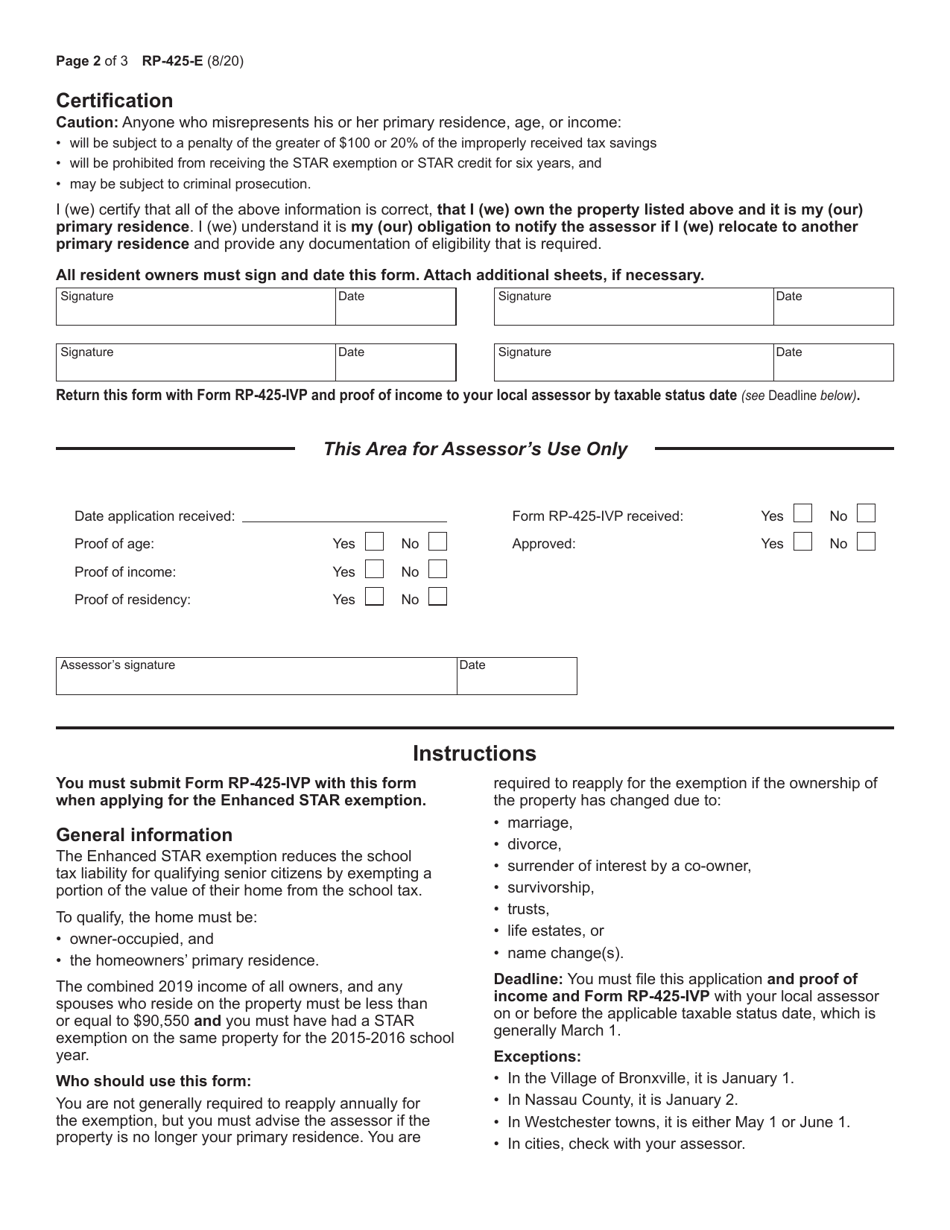

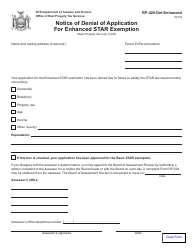

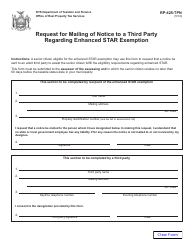

Form RP-425-E Application for Enhanced Star Exemption - New York

What Is Form RP-425-E?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

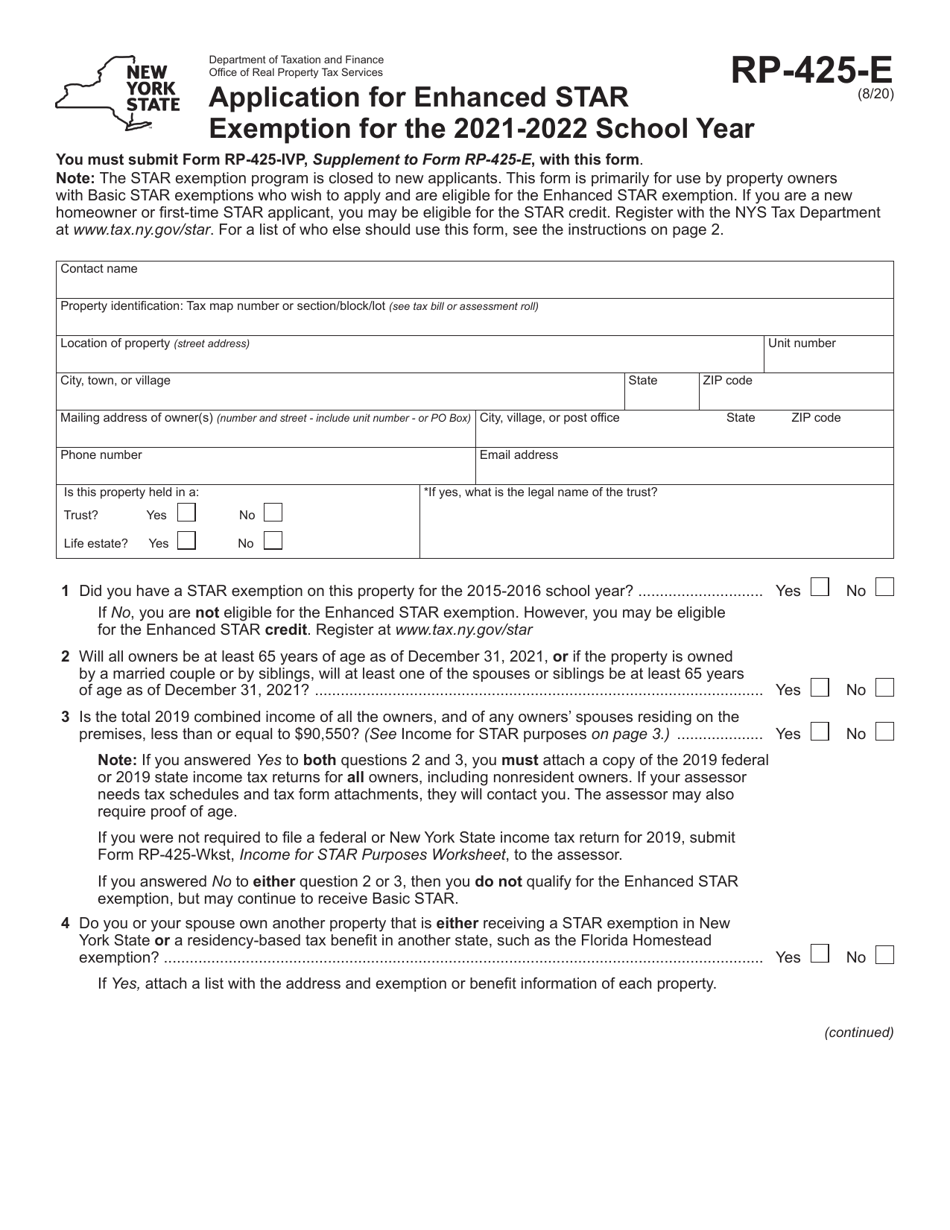

Q: What is Form RP-425-E?

A: Form RP-425-E is the application for Enhanced Star Exemption in New York.

Q: What is the Enhanced Star Exemption?

A: The Enhanced Star Exemption is a property tax exemption program in New York that provides additional benefits to eligible senior citizens.

Q: Who is eligible for the Enhanced Star Exemption?

A: To be eligible for the Enhanced Star Exemption, you must be 65 years or older, have a household income below the set limit, and own and occupy the property as your primary residence.

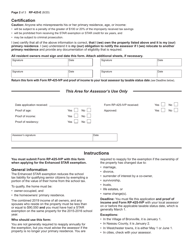

Q: How do I apply for the Enhanced Star Exemption?

A: You can apply for the Enhanced Star Exemption by filling out Form RP-425-E and submitting it to your local assessor's office.

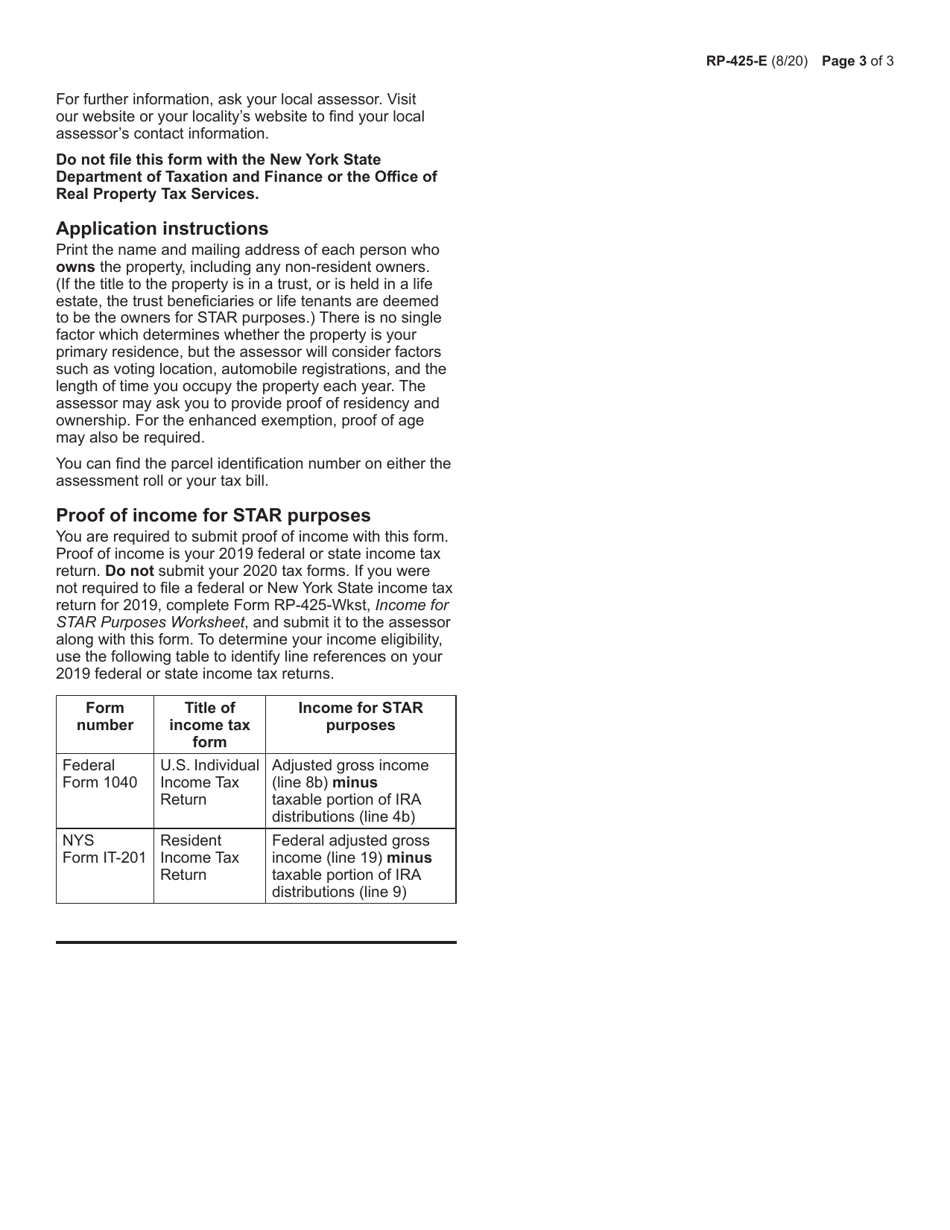

Q: What documents do I need to include with the application?

A: Along with the application form, you may need to provide proof of age, proof of income, and proof of residency.

Q: When is the deadline to file the application?

A: The deadline to file the application for Enhanced Star Exemption is generally March 1st, but it may vary depending on your locality. It is recommended to check with your local assessor's office for the exact deadline.

Q: Can I apply for Enhanced Star Exemption if I rent my property?

A: No, the Enhanced Star Exemption is only available to senior citizens who own and occupy their property as their primary residence.

Q: What are the benefits of the Enhanced Star Exemption?

A: The Enhanced Star Exemption provides an additional reduction in property taxes for eligible senior citizens, helping to make housing more affordable.

Q: Is the Enhanced Star Exemption available in all counties of New York?

A: Yes, the Enhanced Star Exemption is available in all counties of New York.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-425-E by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.