This version of the form is not currently in use and is provided for reference only. Download this version of

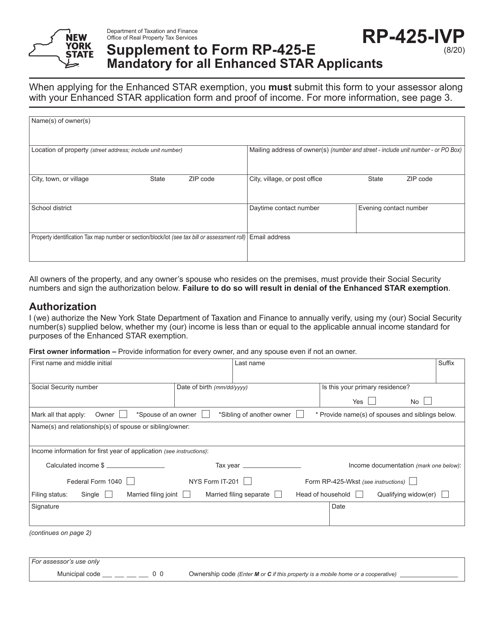

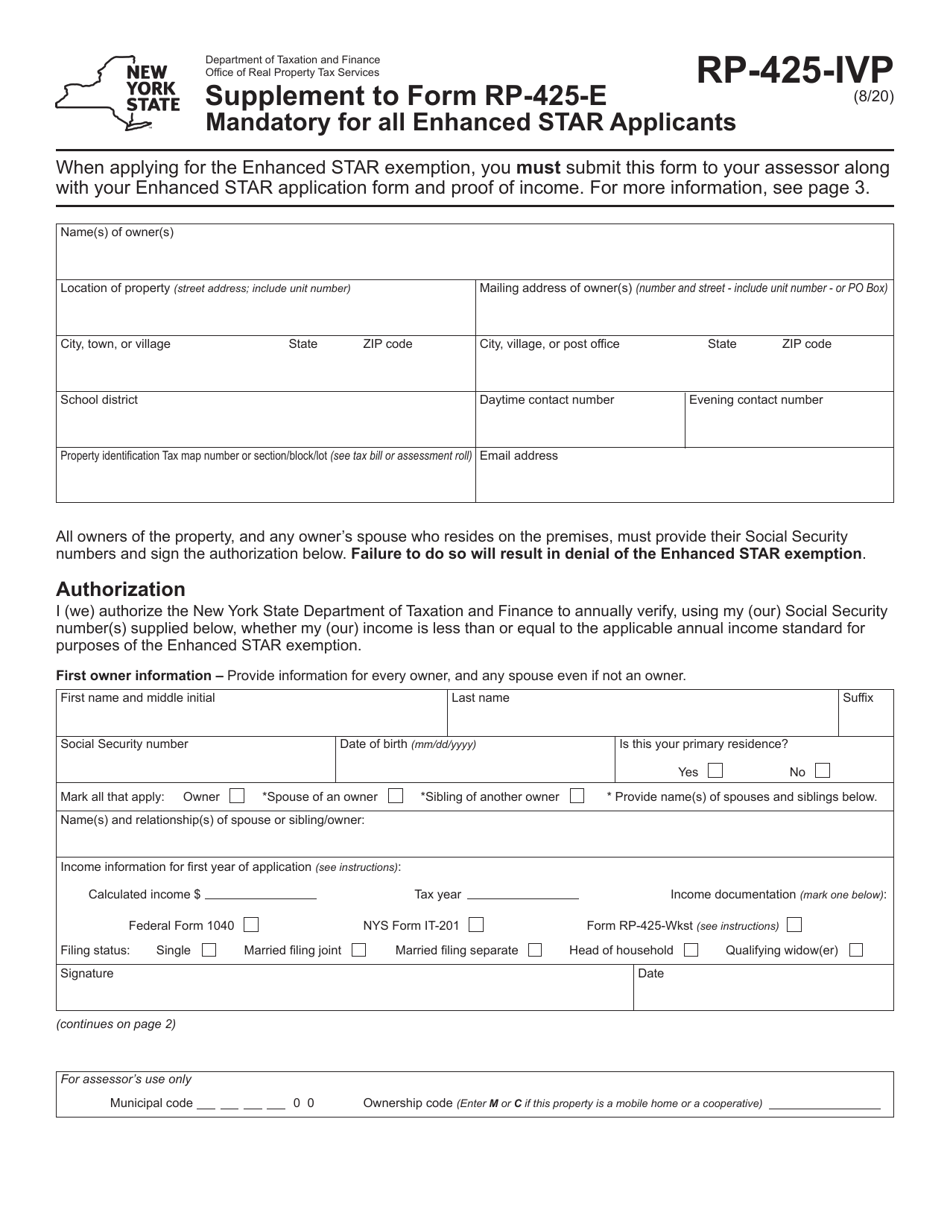

Form RP-425-IVP

for the current year.

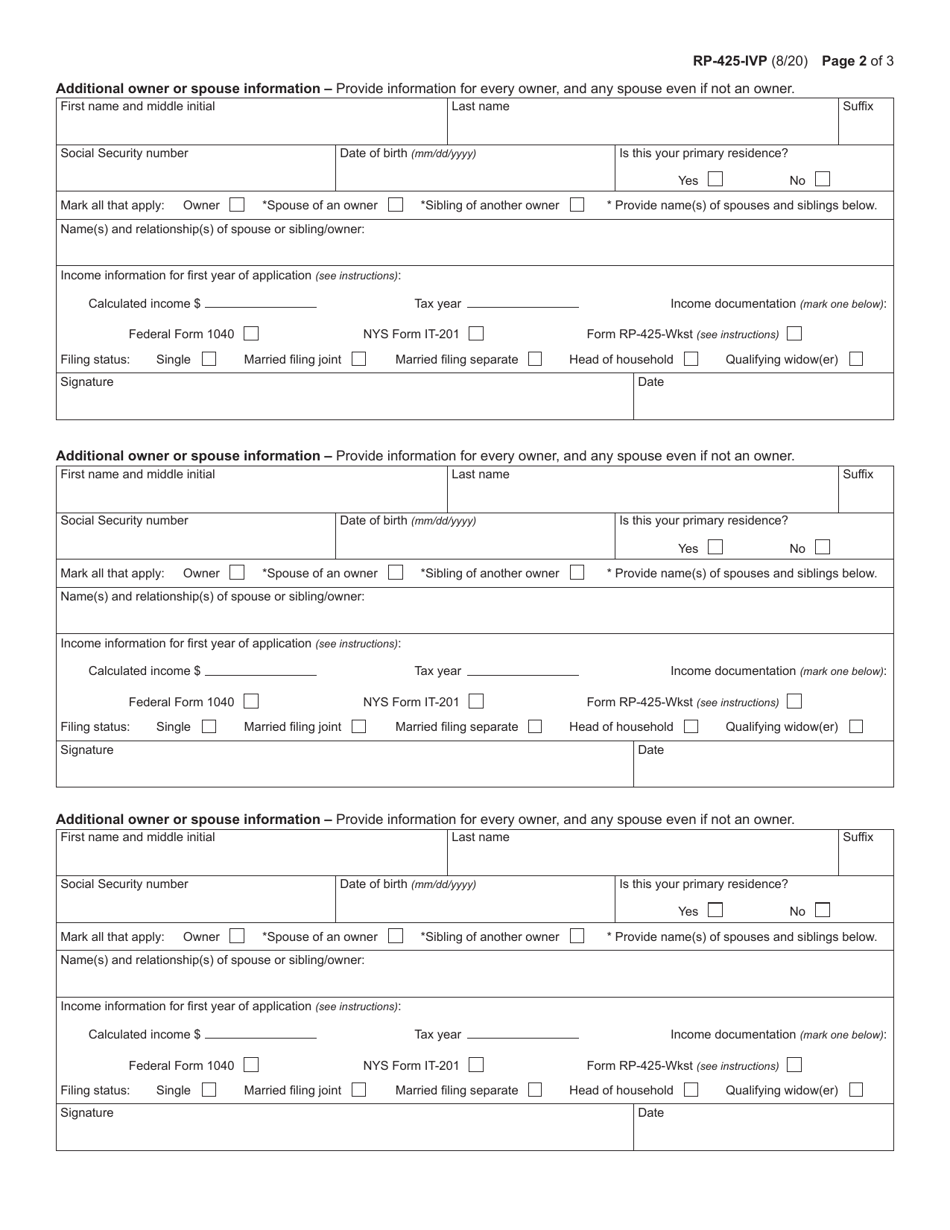

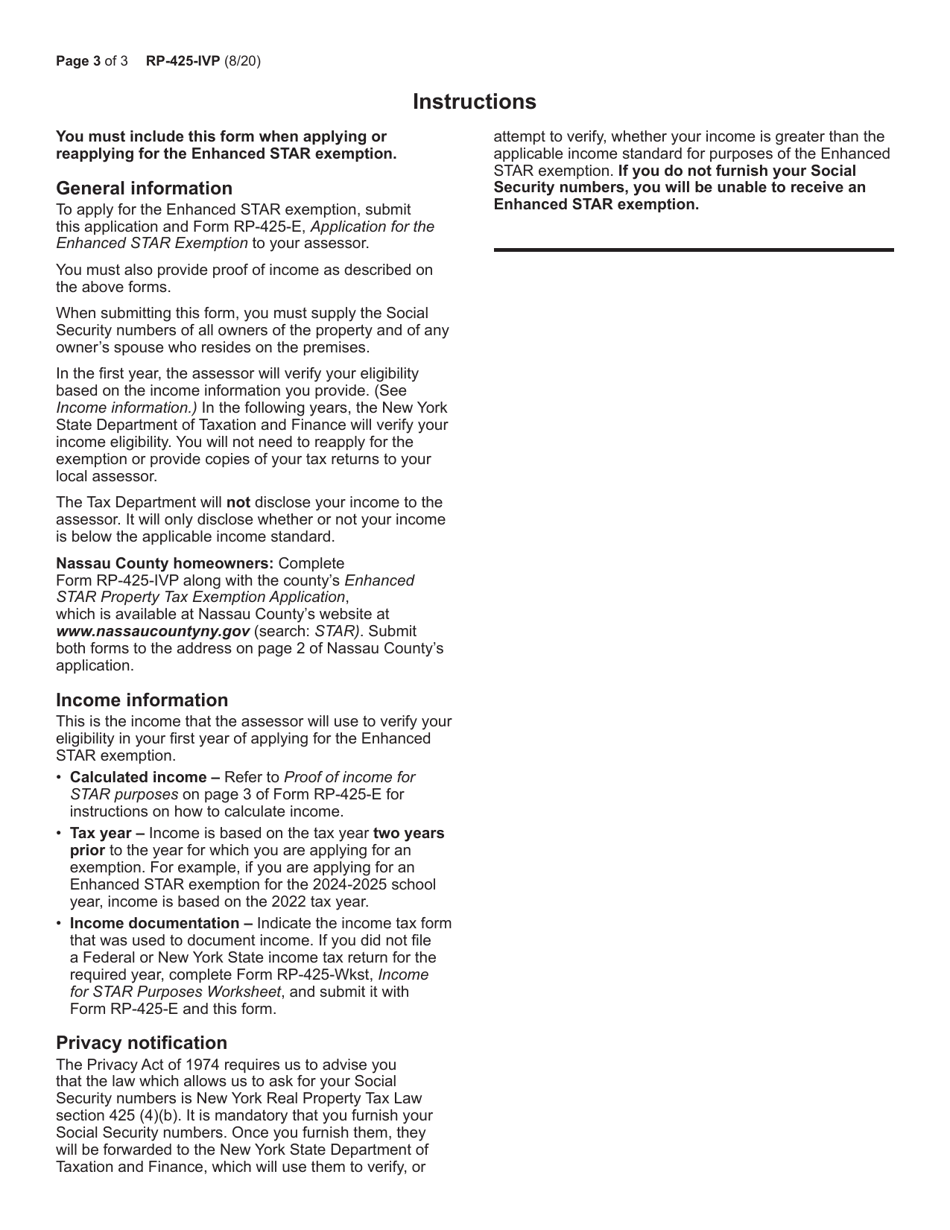

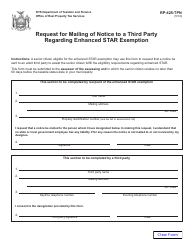

Form RP-425-IVP Mandatory for All Enhanced Star Applicants - New York

What Is Form RP-425-IVP?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-425-IVP?

A: Form RP-425-IVP is a mandatory form for all Enhanced Star applicants in New York.

Q: Who needs to fill out Form RP-425-IVP?

A: All Enhanced Star applicants in New York need to fill out Form RP-425-IVP.

Q: What is the purpose of Form RP-425-IVP?

A: Form RP-425-IVP is used to verify income eligibility for the Enhanced Star program.

Q: When do I need to submit Form RP-425-IVP?

A: Form RP-425-IVP should be submitted along with your Enhanced Star application, typically before the deadline specified by your local assessor's office.

Q: What happens if I don't submit Form RP-425-IVP?

A: Failure to submit Form RP-425-IVP may result in the denial of your Enhanced Star application.

Q: What documents are required to be submitted with Form RP-425-IVP?

A: You will need to provide documentation of your income, such as tax returns, social security benefits statements, or pension statements, as specified on the form.

Q: Can I get assistance in filling out Form RP-425-IVP?

A: Yes, you can seek assistance from your local assessor's office or a qualified tax professional to help you fill out Form RP-425-IVP.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-425-IVP by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.