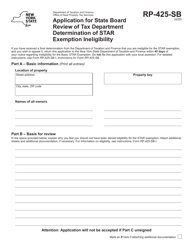

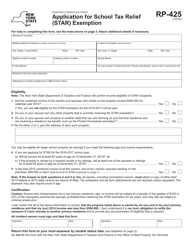

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RP-425-B

for the current year.

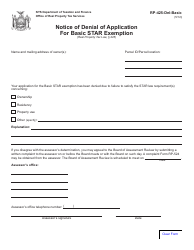

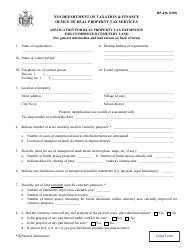

Form RP-425-B Application for Basic Star Exemption - New York

What Is Form RP-425-B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

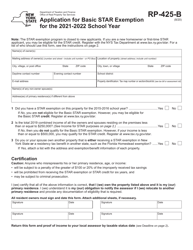

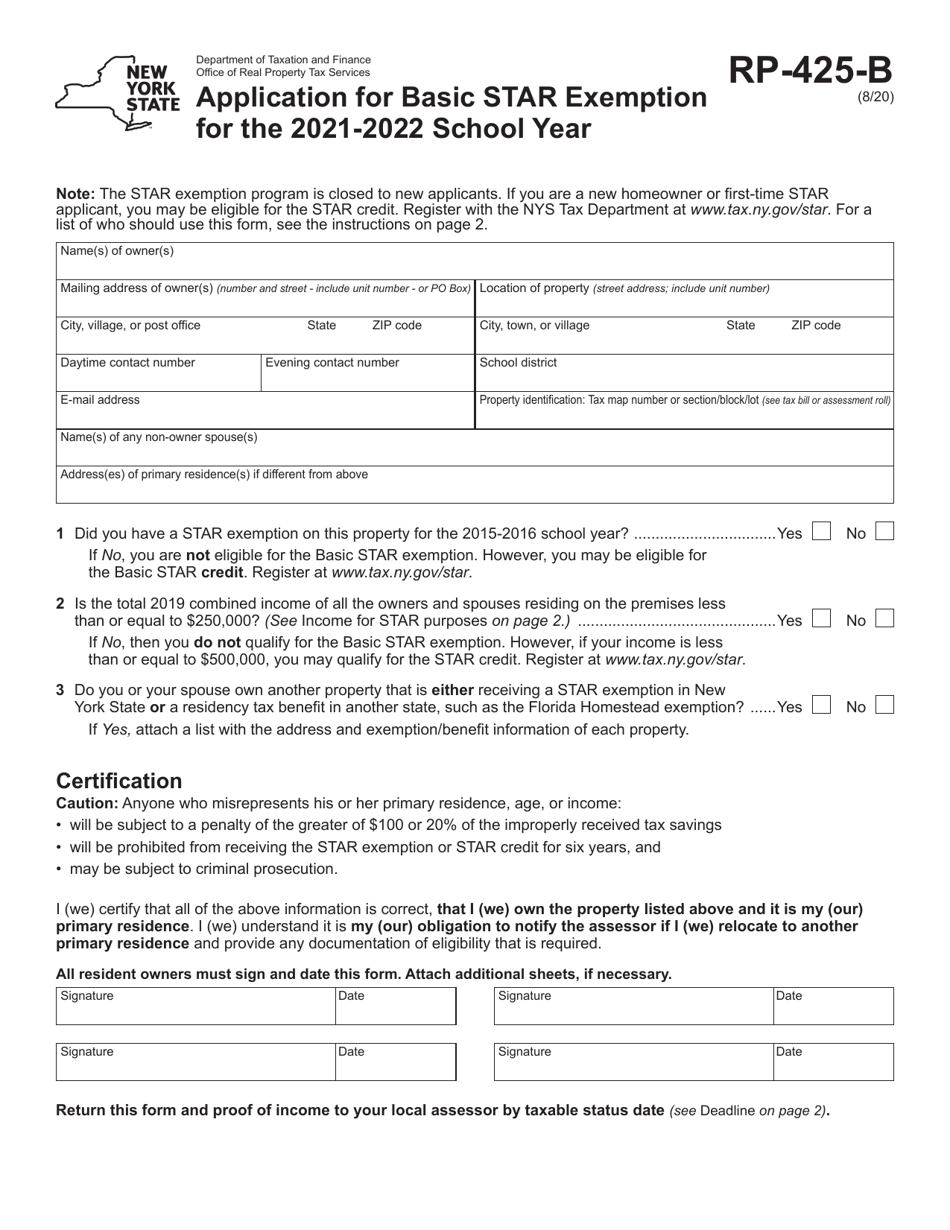

Q: What is the RP-425-B Application for Basic Star Exemption?

A: The RP-425-B Application for Basic Star Exemption is a form used in New York to apply for a property tax exemption called the Basic Star Exemption.

Q: What is the Basic Star Exemption?

A: The Basic Star Exemption is a property tax exemption in New York that provides eligible homeowners with a reduction in their property taxes.

Q: Who is eligible for the Basic Star Exemption?

A: To be eligible for the Basic Star Exemption, you must own and occupy your primary residence in New York and have a total combined income of $500,000 or less.

Q: How do I apply for the Basic Star Exemption?

A: You can apply for the Basic Star Exemption by completing the RP-425-B Application for Basic Star Exemption and submitting it to your local assessor's office.

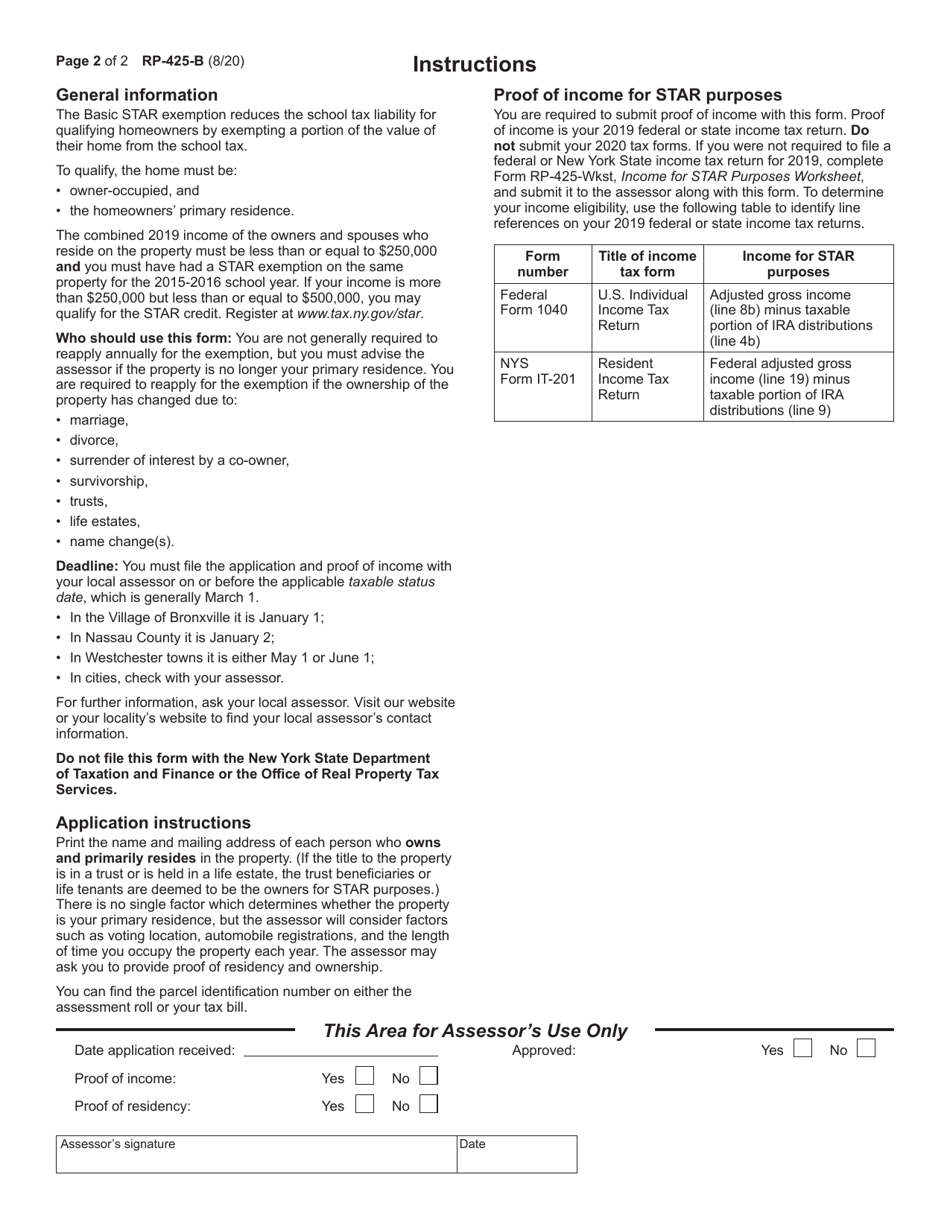

Q: What documents do I need to include with the application?

A: You will need to include proof of residency, such as a copy of your driver's license or utility bill, and proof of income, such as your latest tax return or W-2 form.

Q: When is the deadline to apply for the Basic Star Exemption?

A: The deadline to apply for the Basic Star Exemption is generally March 1st of each year, although there may be exceptions for certain situations.

Q: Will the Basic Star Exemption automatically renew?

A: No, you will need to reapply for the Basic Star Exemption each year to continue receiving the benefit.

Q: Is there an income limit for the Basic Star Exemption?

A: Yes, the total combined income of all owners and spouse cannot exceed $500,000 in order to be eligible for the Basic Star Exemption.

Q: What happens if I sell my home after receiving the Basic Star Exemption?

A: If you sell your home, you must notify your local assessor's office within 30 days. The new owner may be eligible to apply for the Basic Star Exemption if they meet the eligibility requirements.

Form Details:

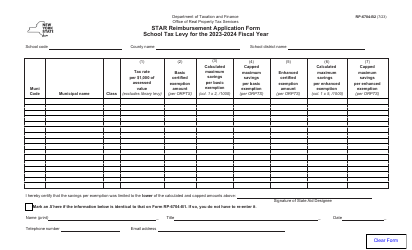

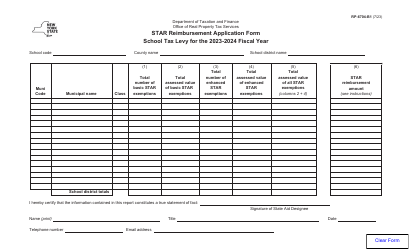

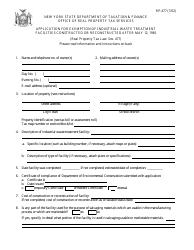

- Released on August 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-425-B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.