This version of the form is not currently in use and is provided for reference only. Download this version of

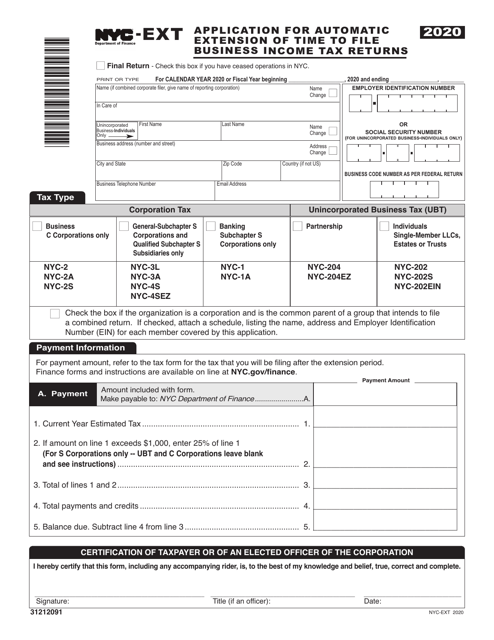

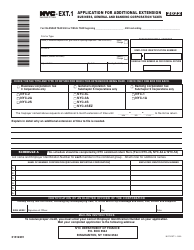

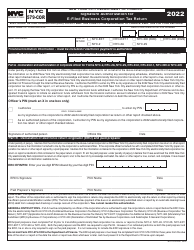

Form NYC-EXT

for the current year.

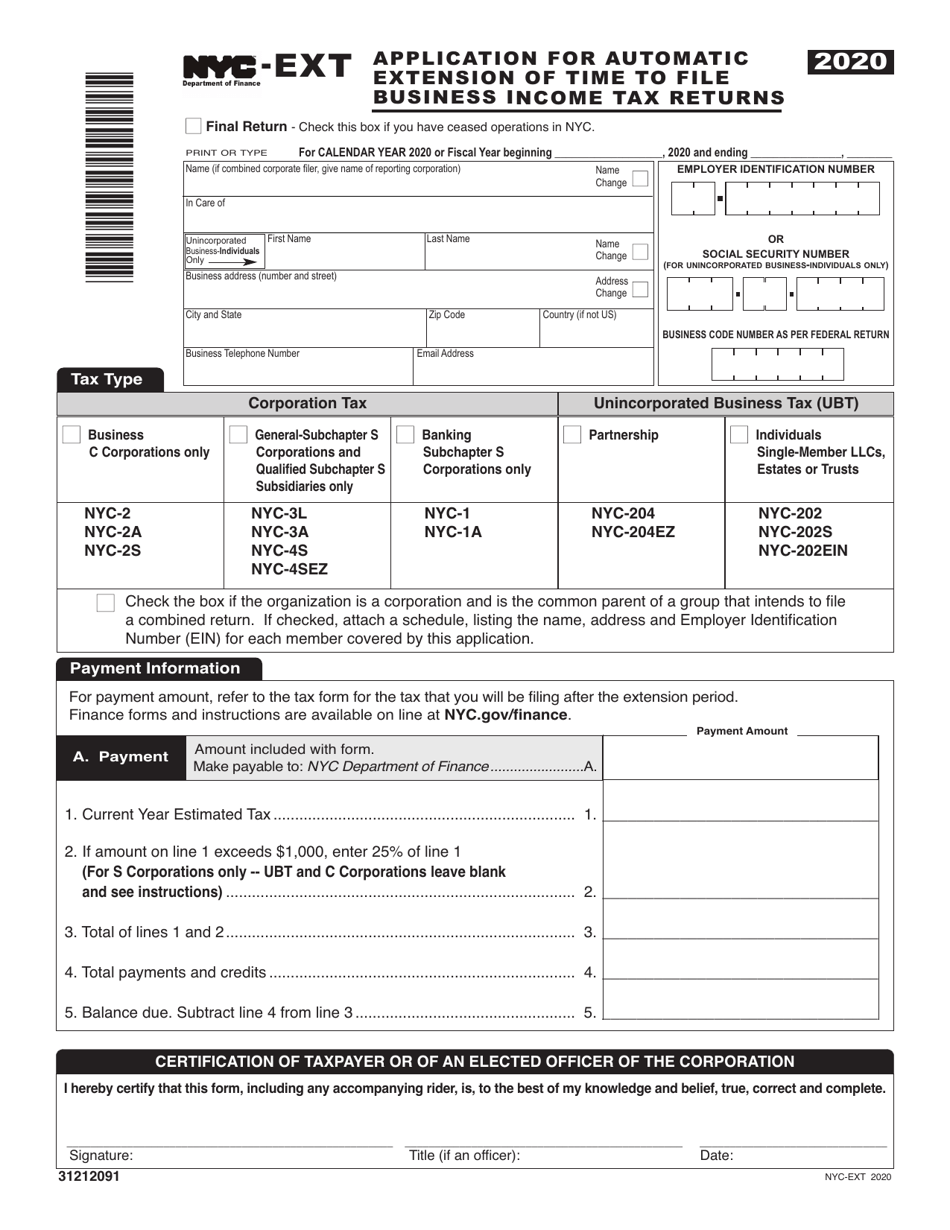

Form NYC-EXT Application for Automatic Extension of Time to File Business Income Tax Returns - New York City

What Is Form NYC-EXT?

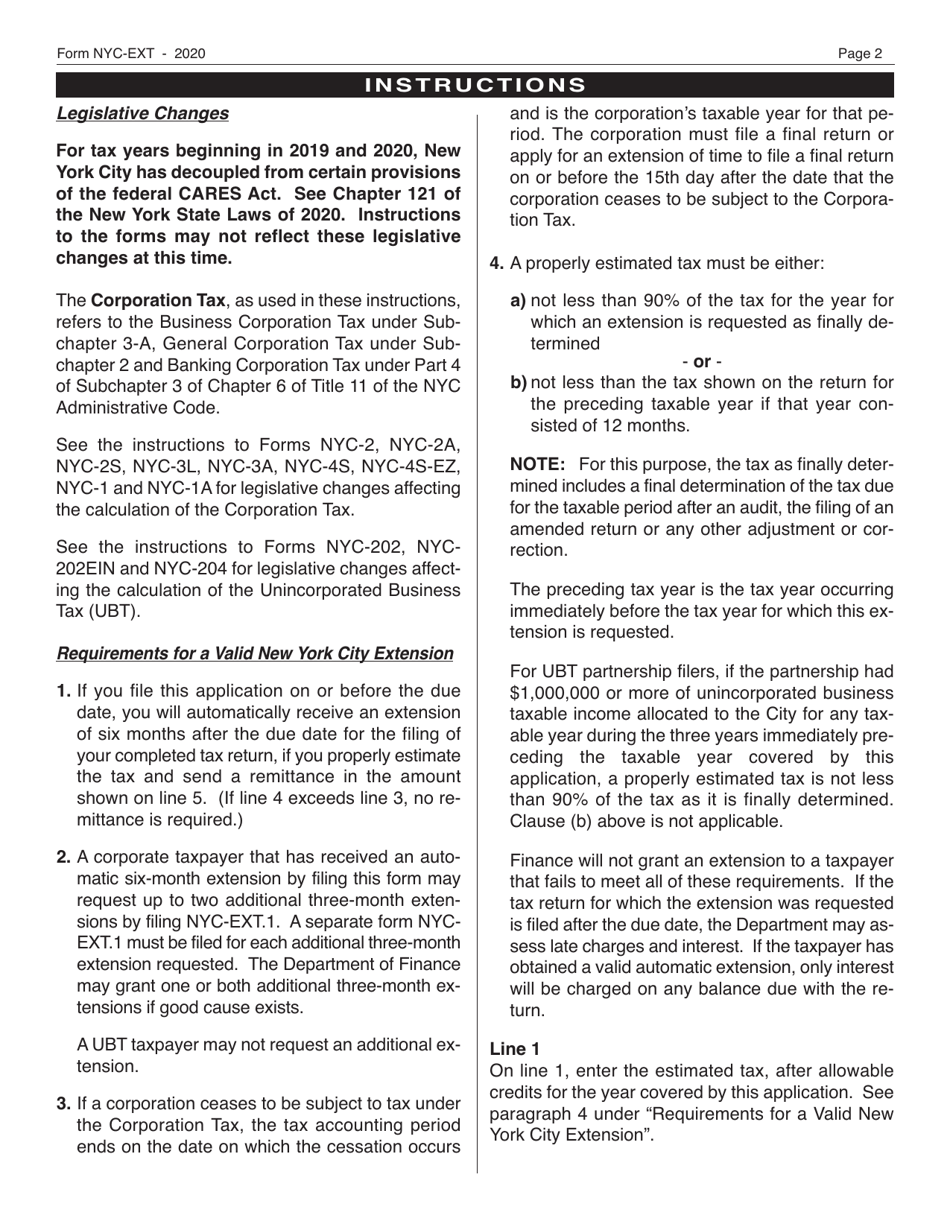

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-EXT?

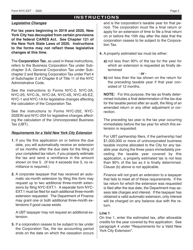

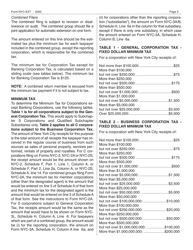

A: NYC-EXT is an application for automatic extension of time to filebusiness income tax returns in New York City.

Q: Who can use the NYC-EXT application?

A: Businesses in New York City who need additional time to file their income tax returns can use the NYC-EXT application.

Q: Why would a business need an extension to file their tax returns?

A: A business may need an extension if they are unable to meet the original filing deadline.

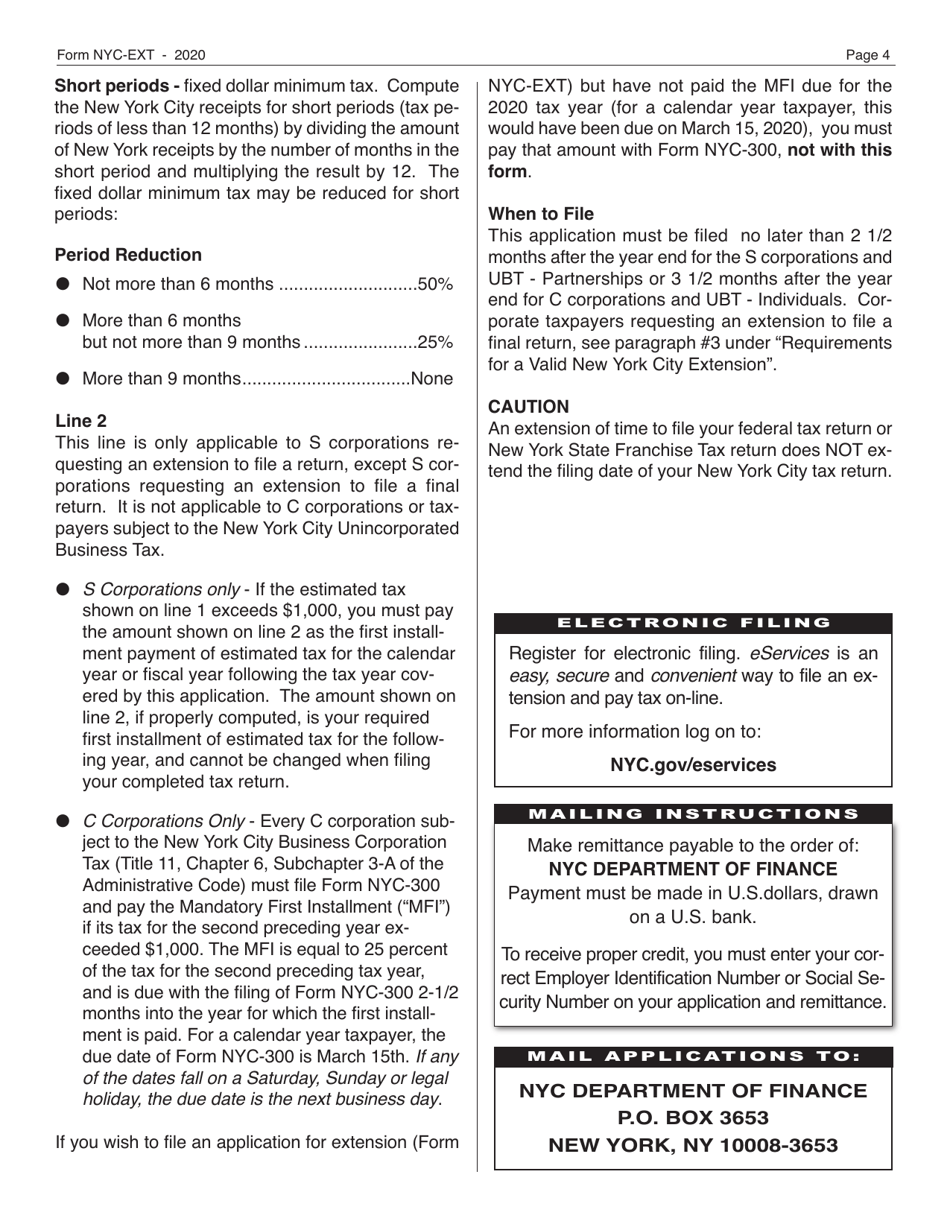

Q: What is the deadline to file the NYC-EXT application?

A: The NYC-EXT application must be filed on or before the original due date of the tax return.

Q: Is there a fee for filing the NYC-EXT application?

A: No, there is no fee for filing the NYC-EXT application.

Q: How long is the extension granted for?

A: The extension granted by the NYC-EXT application is usually six months.

Q: What if I need more than six months to file my tax return?

A: If you need more than six months to file your tax return, you may need to request an additional extension.

Q: Can I use the NYC-EXT application for personal income tax returns?

A: No, the NYC-EXT application is specifically for business income tax returns.

Q: What happens if I do not file the NYC-EXT application or file my tax return by the extended deadline?

A: If you do not file the NYC-EXT application or file your tax return by the extended deadline, you may be subject to penalties and interest charges.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-EXT by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.