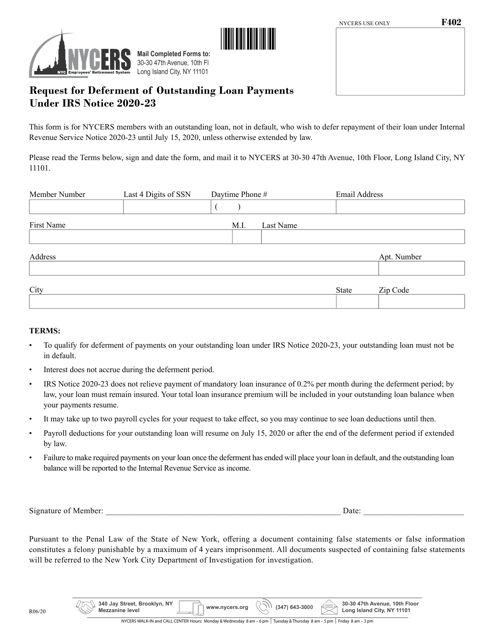

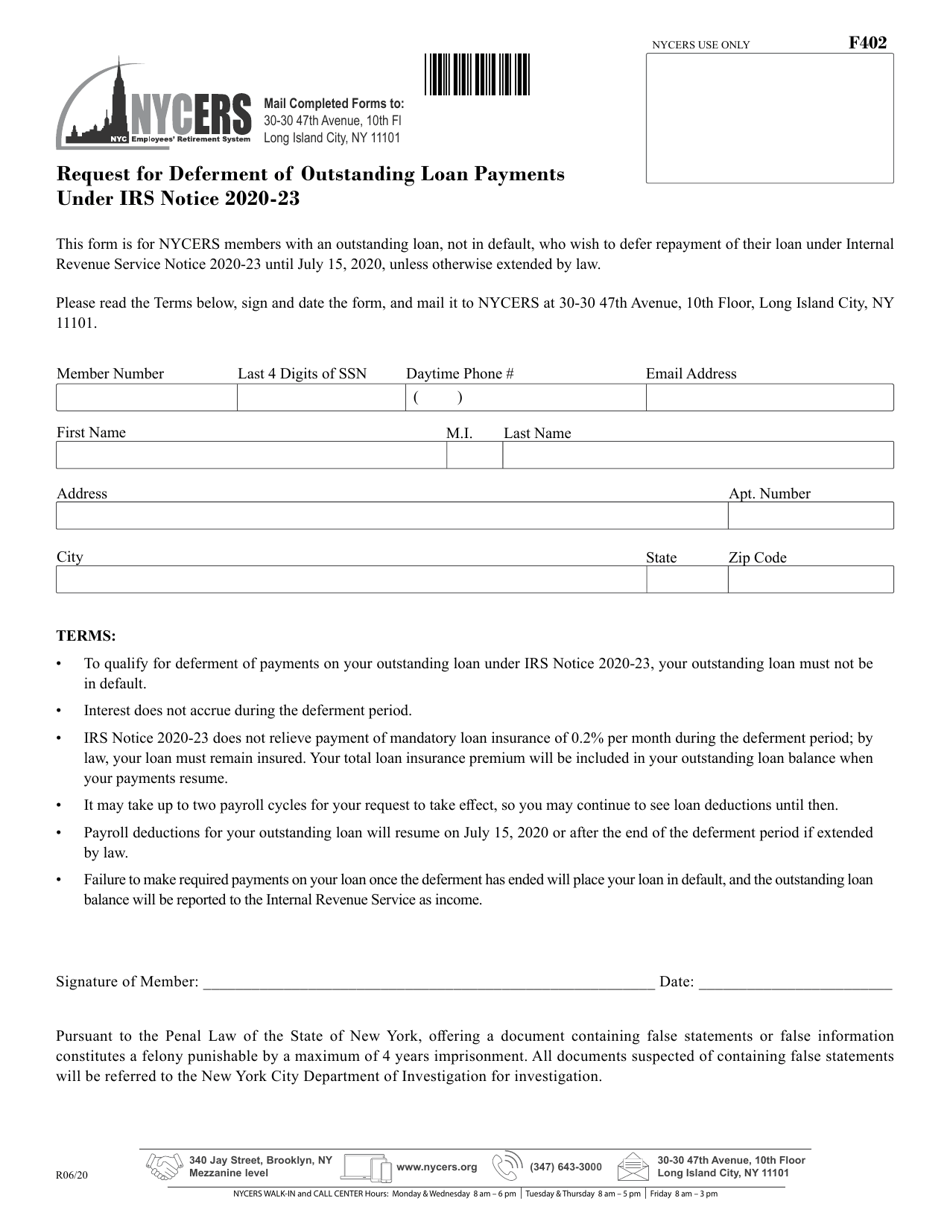

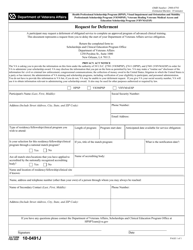

Form F402 Request for Deferment of Outstanding Loan Payments Under IRS Notice 2020-23 - New York City

What Is Form F402?

This is a legal form that was released by the New York City Employees' Retirement System - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F402?

A: Form F402 is a request for deferment of outstanding loan payments under IRS Notice 2020-23.

Q: Who can use Form F402?

A: New York City residents who are seeking deferment of outstanding loan payments can use Form F402.

Q: What is the purpose of Form F402?

A: The purpose of Form F402 is to request deferment of outstanding loan payments under IRS Notice 2020-23.

Q: Is Form F402 specific to New York City?

A: Yes, Form F402 is specific to New York City residents.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the New York City Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F402 by clicking the link below or browse more documents and templates provided by the New York City Employees' Retirement System.