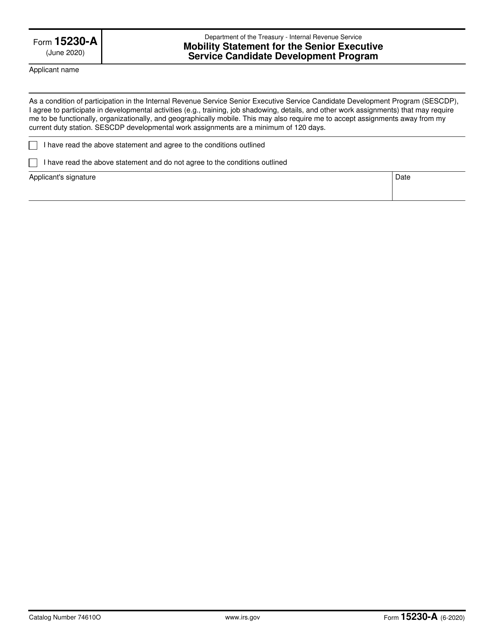

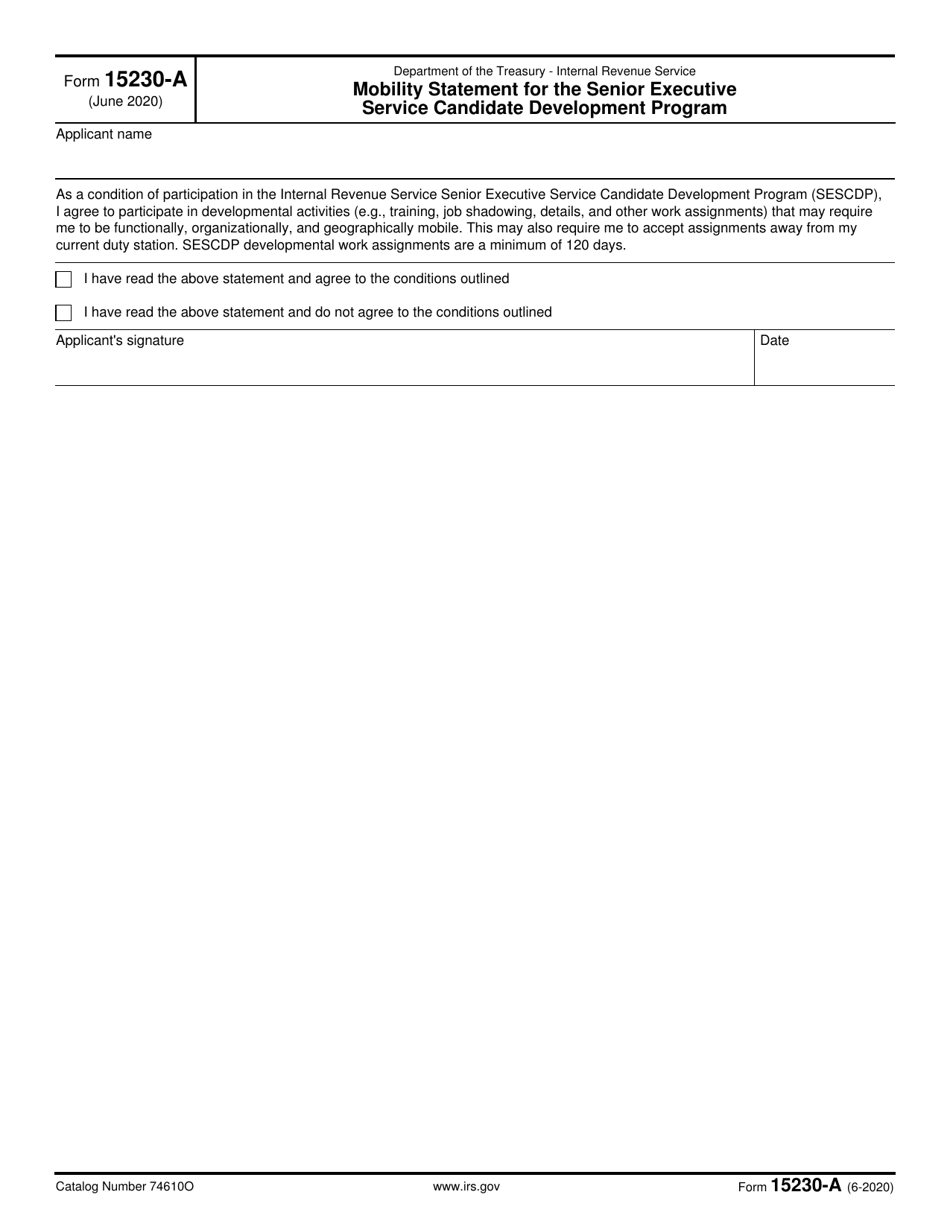

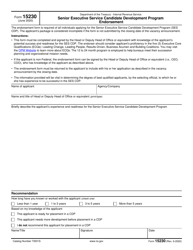

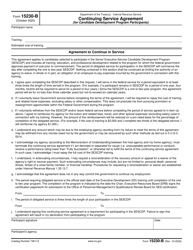

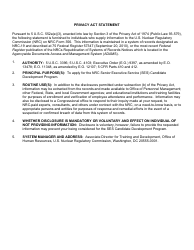

IRS Form 15230-A Mobility Statement for the Senior Executive Service Candidate Development Program

What Is IRS Form 15230-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2020. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 15230-A?

A: IRS Form 15230-A is a Mobility Statement for the Senior Executive Service Candidate Development Program.

Q: What is the purpose of IRS Form 15230-A?

A: The purpose of IRS Form 15230-A is to gather information about a candidate's mobility and willingness to relocate for the Senior Executive Service Candidate Development Program.

Q: Who needs to fill out IRS Form 15230-A?

A: Candidates applying for the Senior Executive Service Candidate Development Program need to fill out IRS Form 15230-A.

Q: Is filling out IRS Form 15230-A mandatory?

A: Yes, filling out IRS Form 15230-A is mandatory for candidates applying to the Senior Executive Service Candidate Development Program.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 15230-A through the link below or browse more documents in our library of IRS Forms.