This version of the form is not currently in use and is provided for reference only. Download this version of

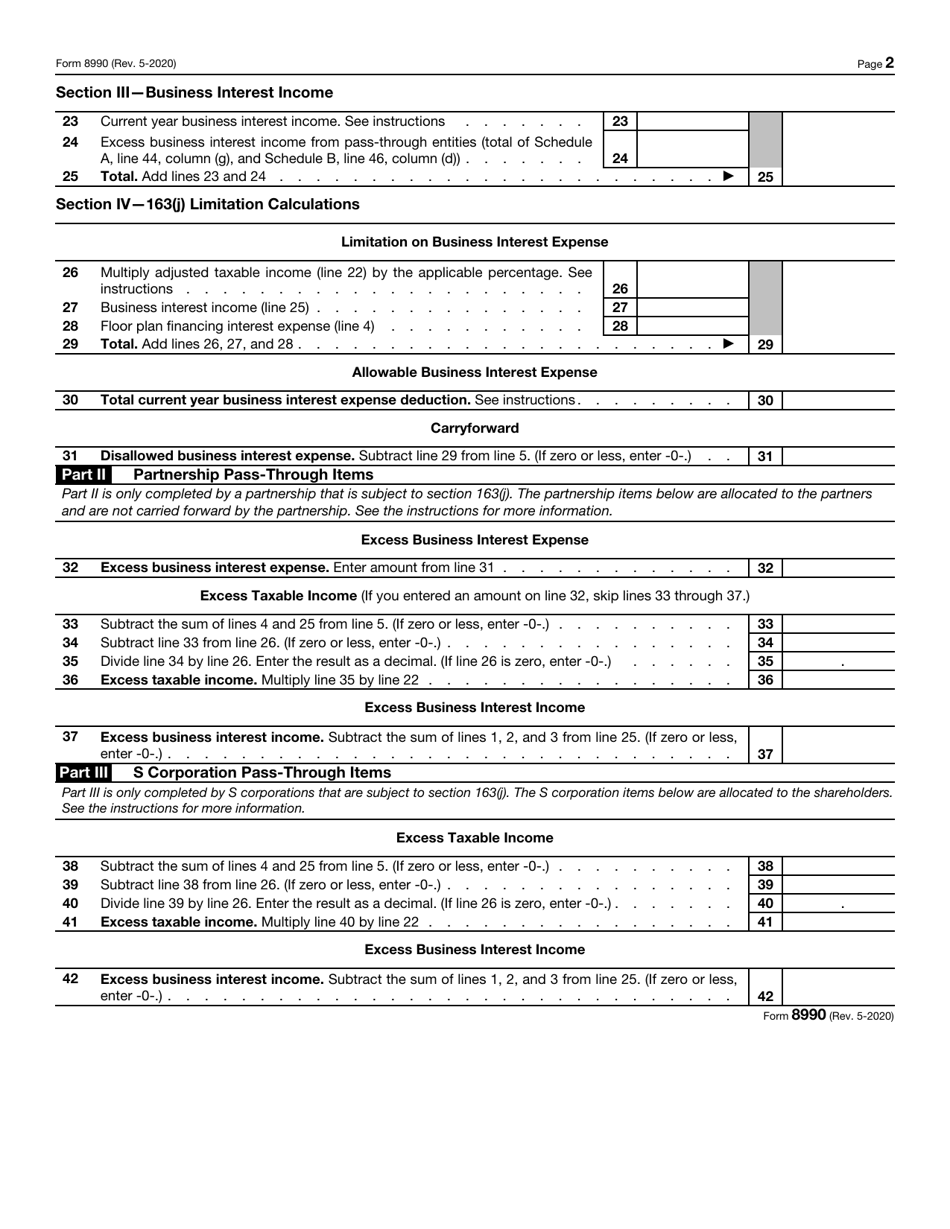

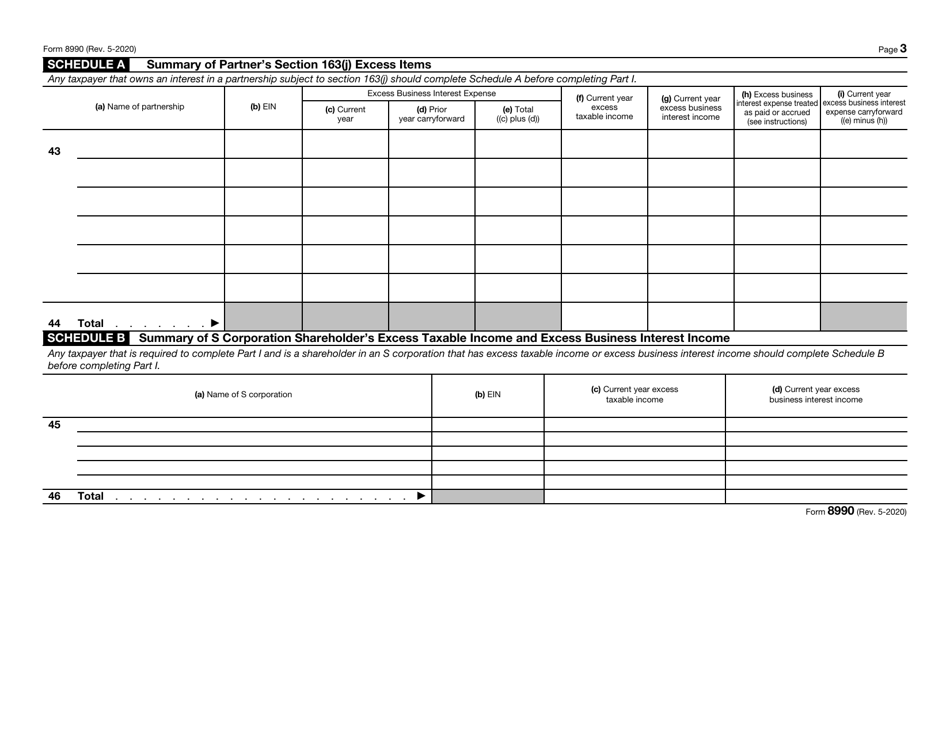

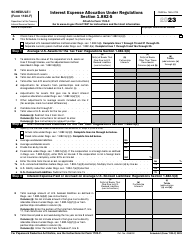

IRS Form 8990

for the current year.

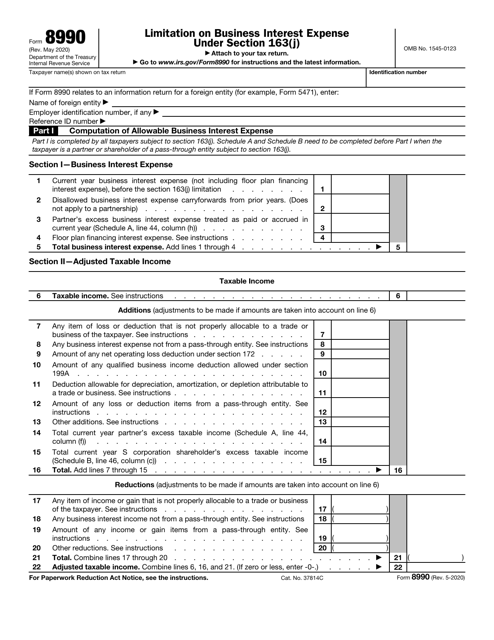

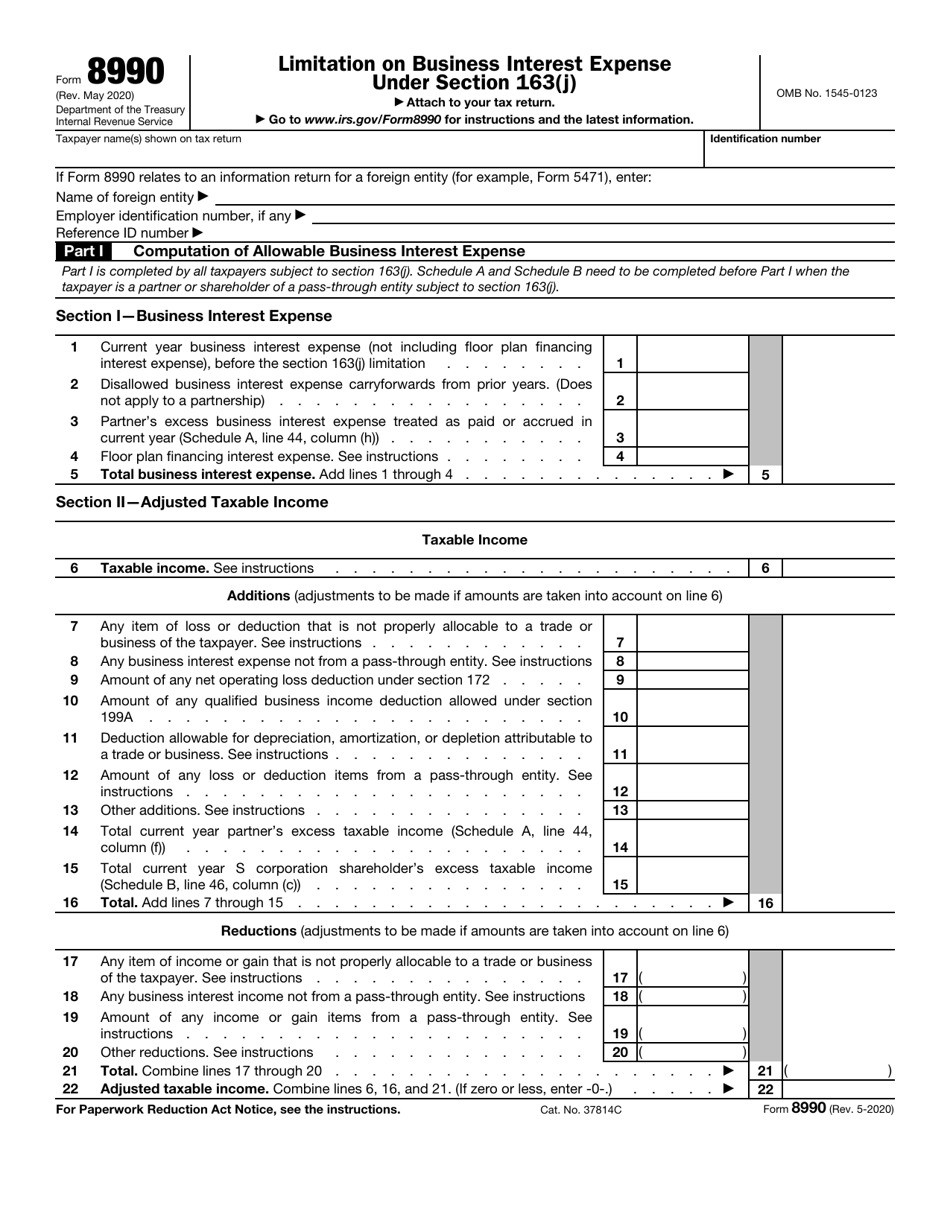

IRS Form 8990 Limitation on Business Interest Expense Under Section 163(J)

What Is IRS Form 8990?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on May 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8990?

A: IRS Form 8990 is a form used to calculate and report the limitation on business interest expense under Section 163(j) of the tax code.

Q: What is the purpose of Form 8990?

A: The purpose of Form 8990 is to determine the maximum amount of business interest expense that can be deducted for tax purposes.

Q: Who needs to file Form 8990?

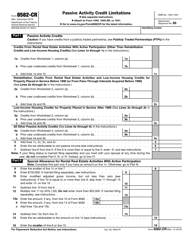

A: Form 8990 must be filed by taxpayers who have business interest expenses exceeding $25 million or who are electing to use the small business exception.

Q: What is the small business exception?

A: The small business exception allows certain businesses with average annual gross receipts of $26 million or less for the three preceding tax years to be exempt from the limitation on business interest expense.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8990 through the link below or browse more documents in our library of IRS Forms.