This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8822

for the current year.

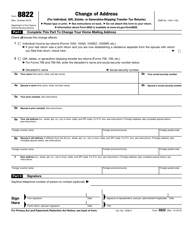

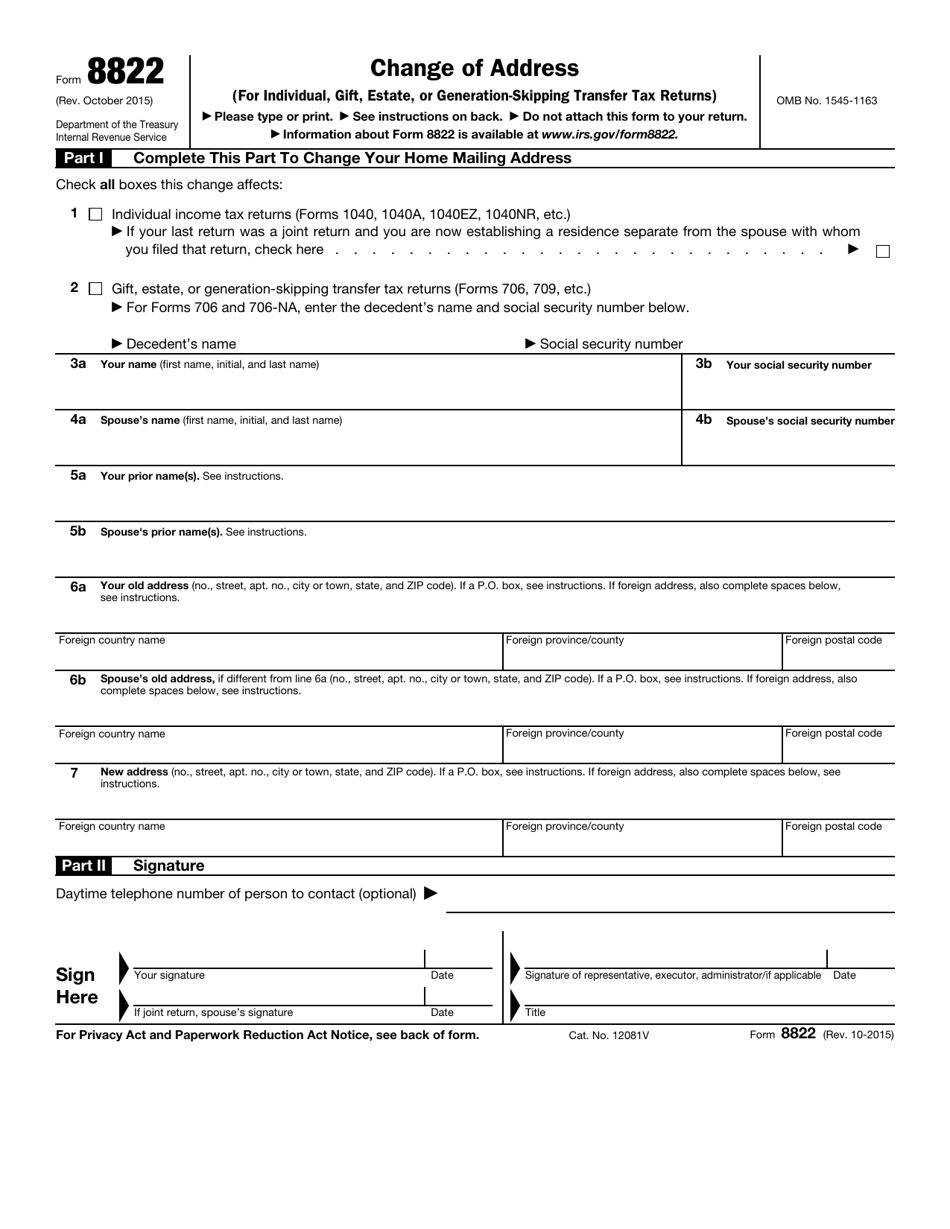

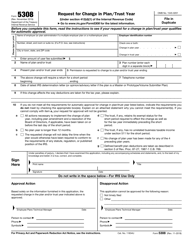

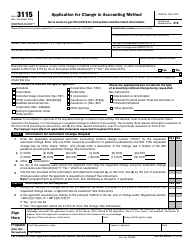

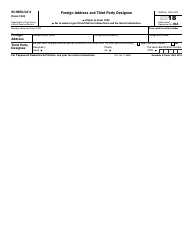

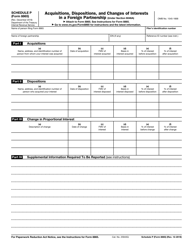

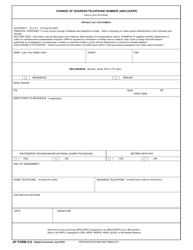

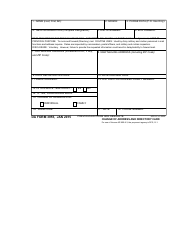

IRS Form 8822 Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns)

What Is IRS Form 8822?

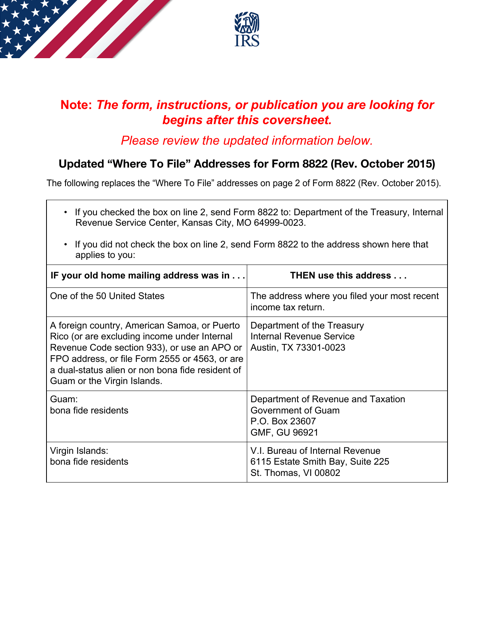

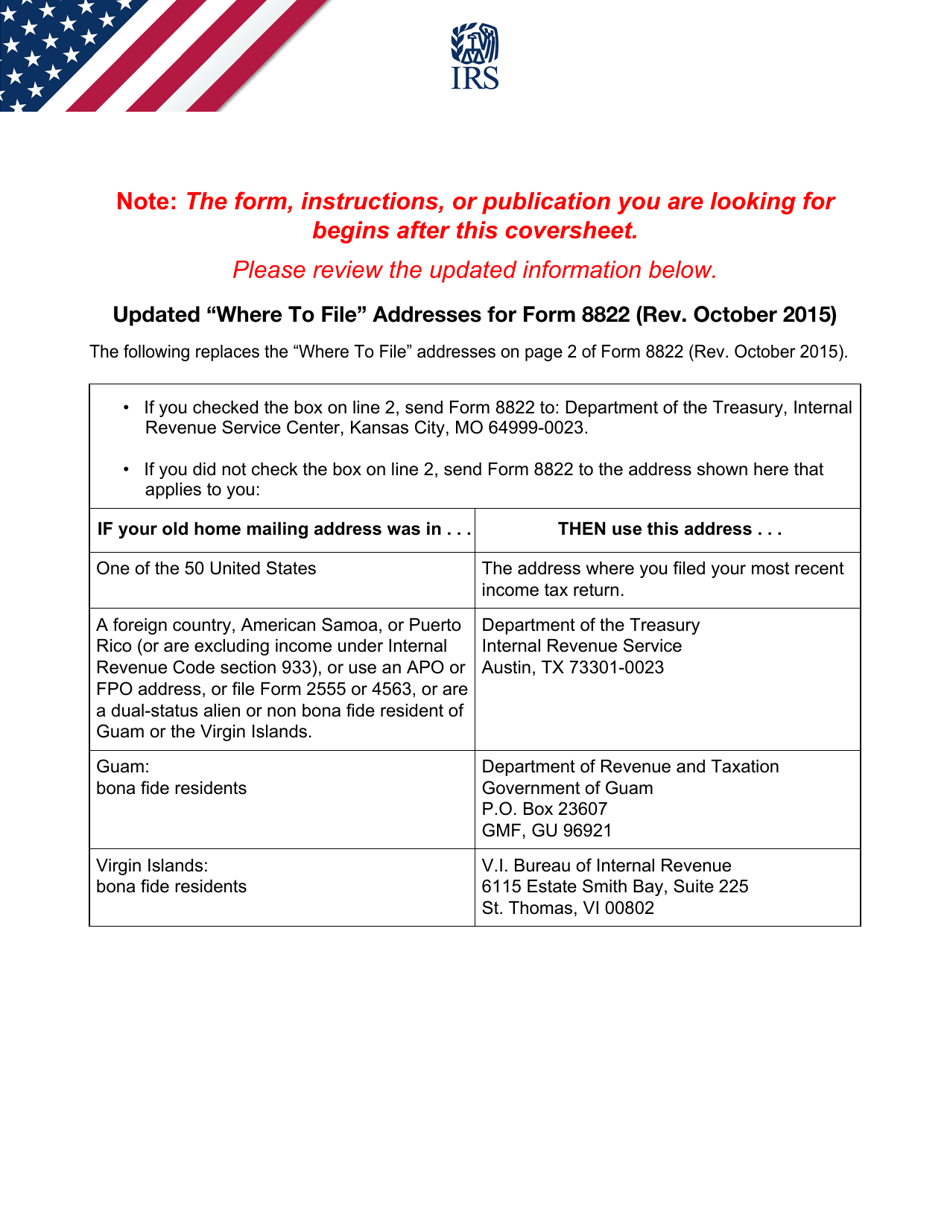

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2015. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8822?

A: IRS Form 8822 is used to notify the IRS of a change in address for Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns.

Q: Who needs to file IRS Form 8822?

A: Individuals, estates, trusts, and gift tax filers who have changed their address need to file IRS Form 8822.

Q: What is the purpose of filing IRS Form 8822?

A: The purpose of filing IRS Form 8822 is to ensure that the IRS has the most up-to-date address information for tax returns.

Q: When should I file IRS Form 8822?

A: You should file IRS Form 8822 as soon as you have a change in address.

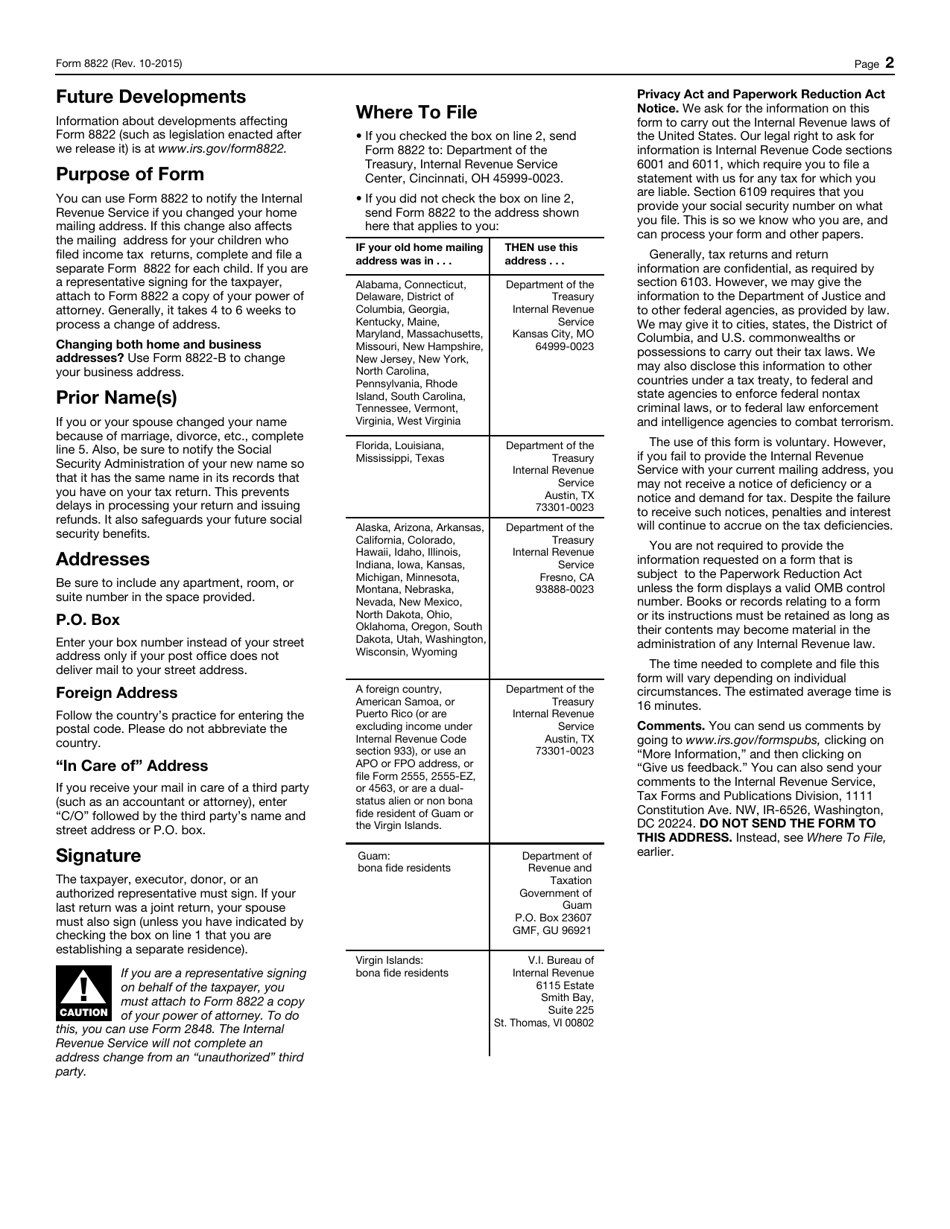

Q: How do I file IRS Form 8822?

A: You can file IRS Form 8822 by mail or electronically.

Q: Is there a fee to file IRS Form 8822?

A: No, there is no fee to file IRS Form 8822.

Q: What happens if I don't file IRS Form 8822?

A: If you don't file IRS Form 8822, the IRS may continue to send important documents or notices to your old address, which could result in missed deadlines or penalties.

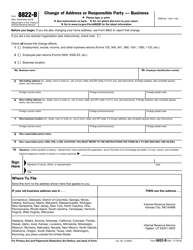

Q: Can I change my address for other tax forms using IRS Form 8822?

A: No, IRS Form 8822 is only used to change your address for Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns.

Q: Do I need to notify any other government agencies of my address change?

A: In addition to filing IRS Form 8822, you may need to update your address with other government agencies, such as the Social Security Administration or the U.S. Postal Service.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8822 through the link below or browse more documents in our library of IRS Forms.