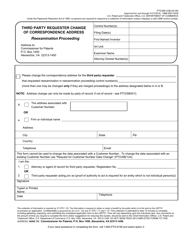

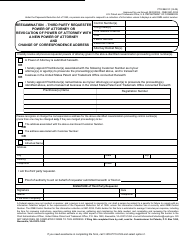

IRS Form 8822-B Change of Address or Responsible Party - Business

What Is IRS Form 8822-B?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8822-B?

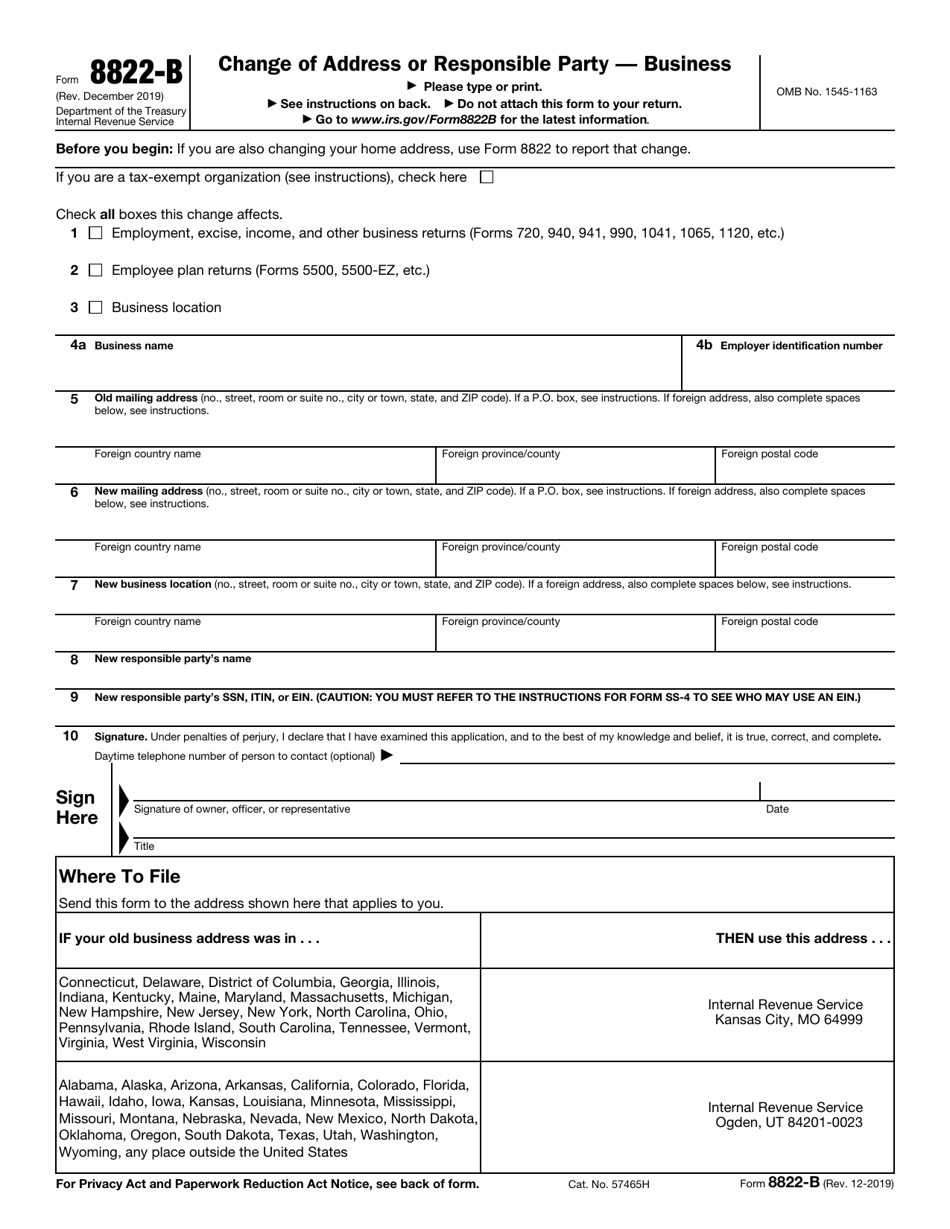

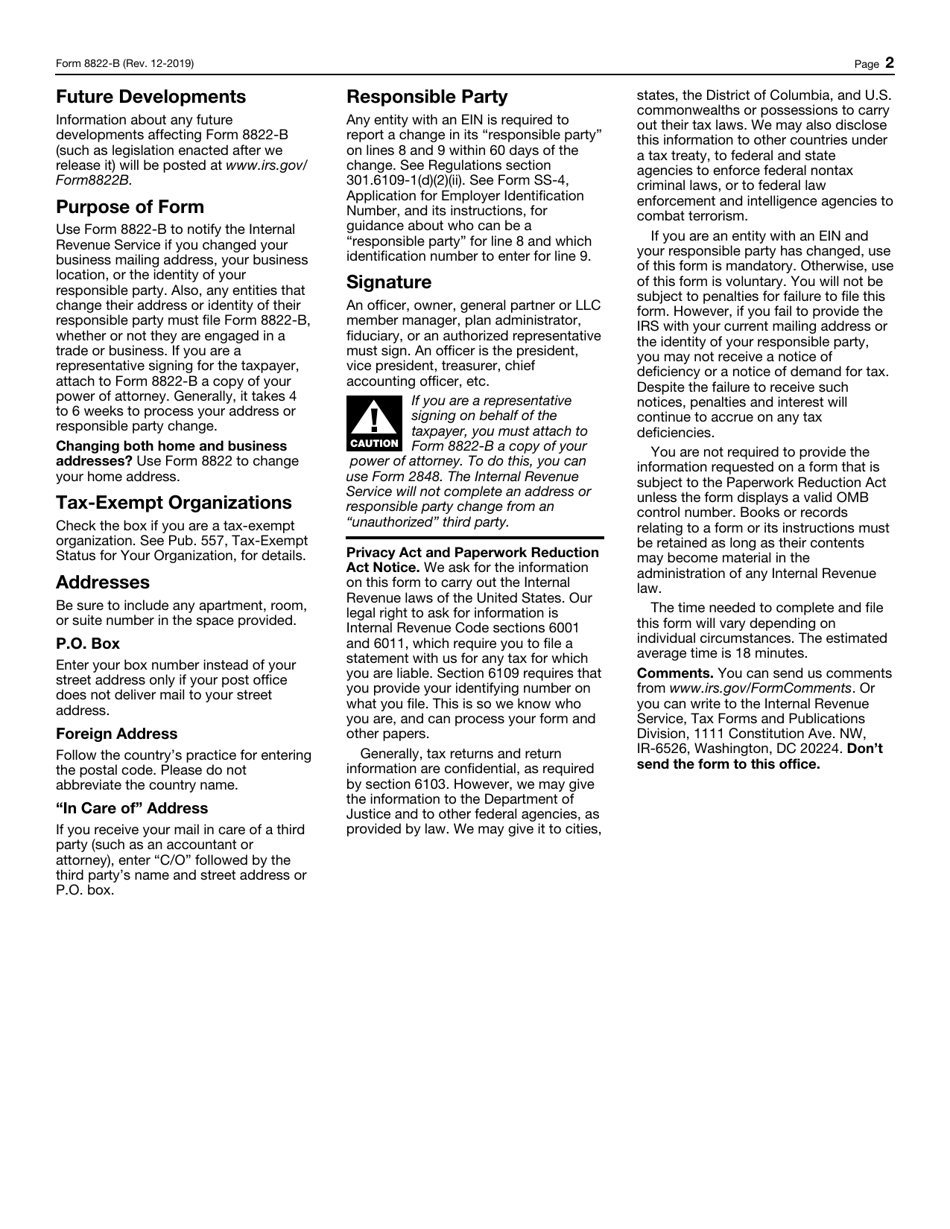

A: IRS Form 8822-B is a form used to notify the Internal Revenue Service (IRS) of changes in the address or responsible party for businesses.

Q: Who should use Form 8822-B?

A: Businesses should use Form 8822-B to update the IRS with any changes in their address or responsible party.

Q: When should I use Form 8822-B?

A: You should use Form 8822-B when there are changes in your business's address or responsible party.

Q: How do I fill out Form 8822-B?

A: To fill out Form 8822-B, you will need to provide your business name, employer identification number (EIN), old address, new address, and details of the responsible party.

Q: Is there a fee to submit Form 8822-B?

A: No, there is no fee for submitting Form 8822-B.

Q: What happens after I submit Form 8822-B?

A: After submitting Form 8822-B, the IRS will update their records with the new address or responsible party information for your business.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8822-B through the link below or browse more documents in our library of IRS Forms.