This version of the form is not currently in use and is provided for reference only. Download this version of

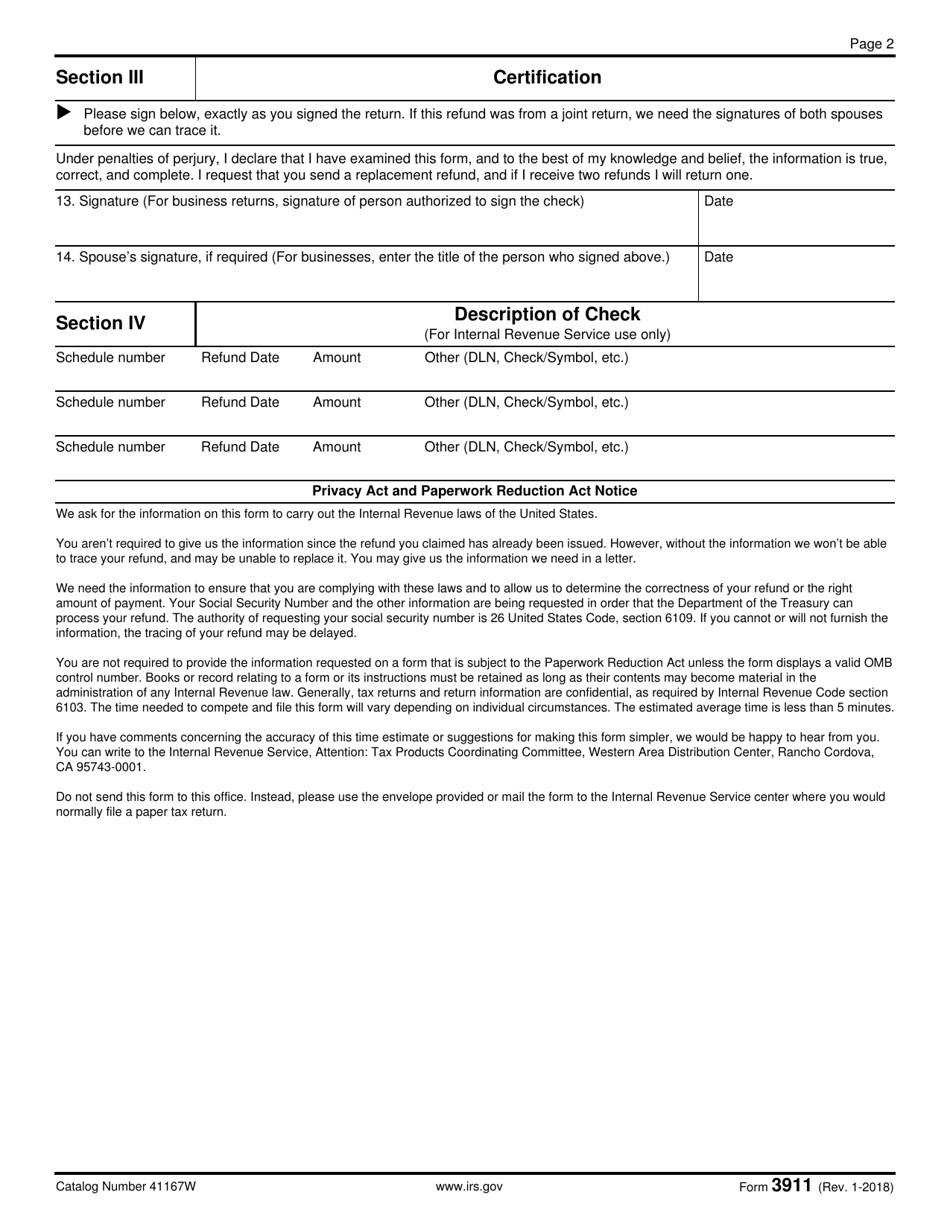

IRS Form 3911

for the current year.

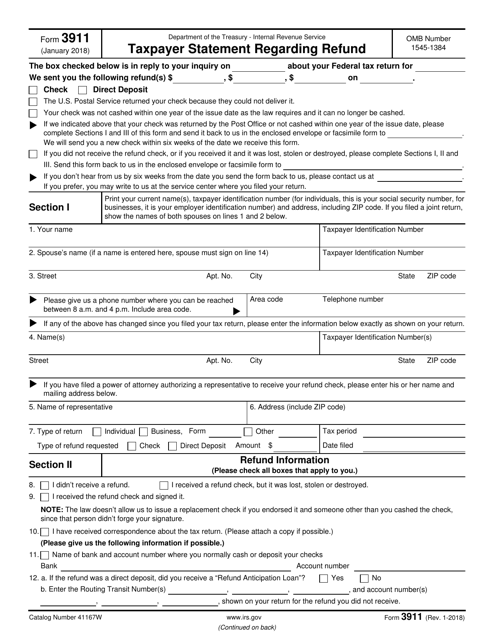

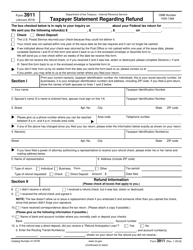

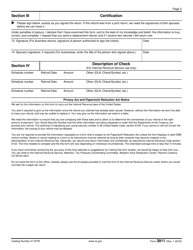

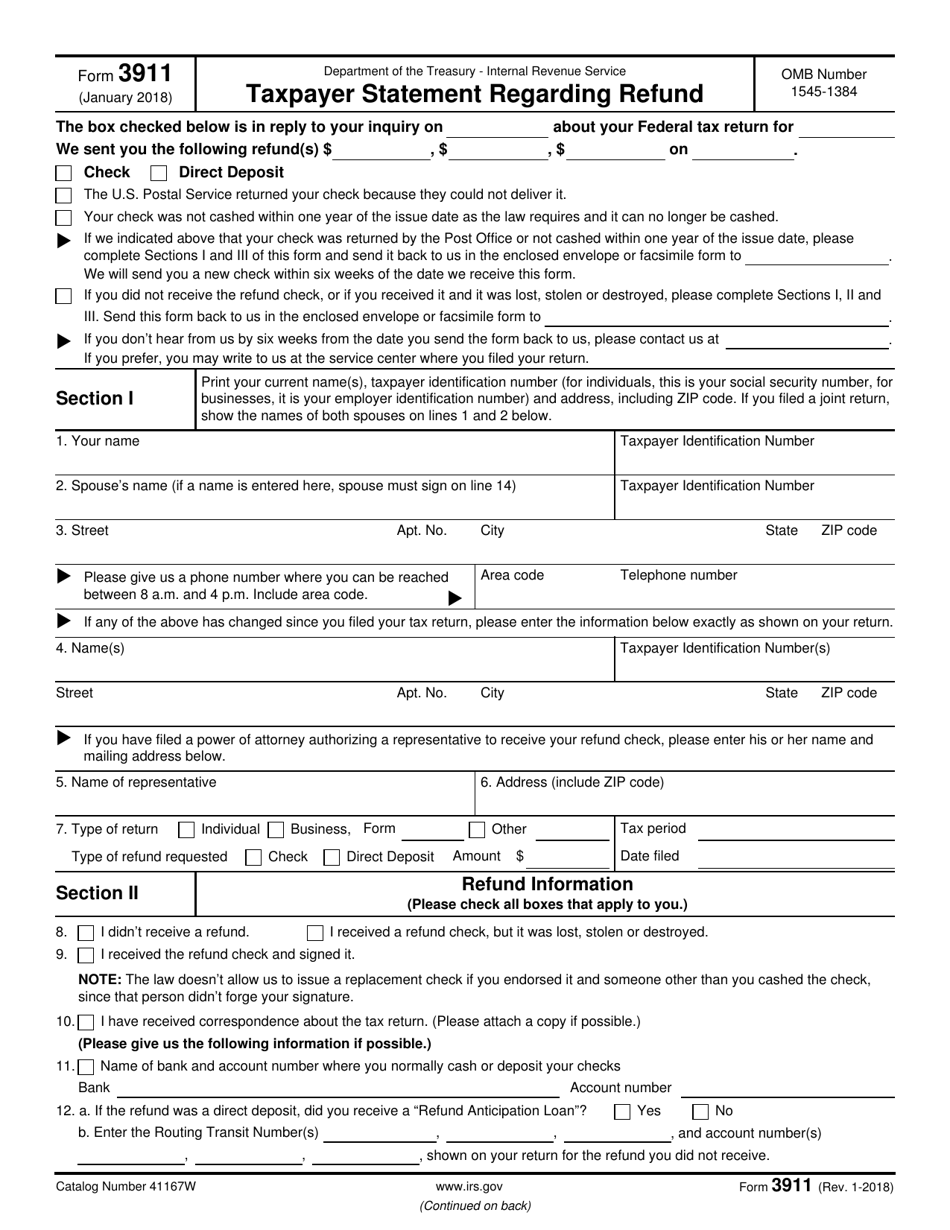

IRS Form 3911 Taxpayer Statement Regarding Refund

What Is IRS Form 3911?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 3911?

A: IRS Form 3911 is a taxpayer statement used to declare problems or issues with an expected tax refund.

Q: When should I use IRS Form 3911?

A: You should use IRS Form 3911 if you have not received your expected tax refund within a reasonable time after filing your tax return.

Q: How do I fill out IRS Form 3911?

A: You need to provide your personal information, including your name, address, Social Security number, and filing status. Additionally, you need to explain the issue with your refund and provide any supporting documents.

Q: Can I submit IRS Form 3911 electronically?

A: No, IRS Form 3911 cannot be submitted electronically. You must mail it to the IRS.

Q: How long does it take to receive a response after submitting IRS Form 3911?

A: It may take up to six weeks to receive a response from the IRS after submitting Form 3911.

Q: What should I do if I made a mistake on IRS Form 3911?

A: If you made a mistake on Form 3911, you should submit a new, corrected form with the updated information.

Q: Is there a deadline for submitting IRS Form 3911?

A: There is no specific deadline for submitting Form 3911, but it is recommended to file it as soon as you realize there is an issue with your refund.

Q: Do I need to include any fees or payments with IRS Form 3911?

A: No, there are no fees or payments required when submitting Form 3911.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- A Spanish version of IRS Form 3911 is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 3911 through the link below or browse more documents in our library of IRS Forms.