This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8915-C

for the current year.

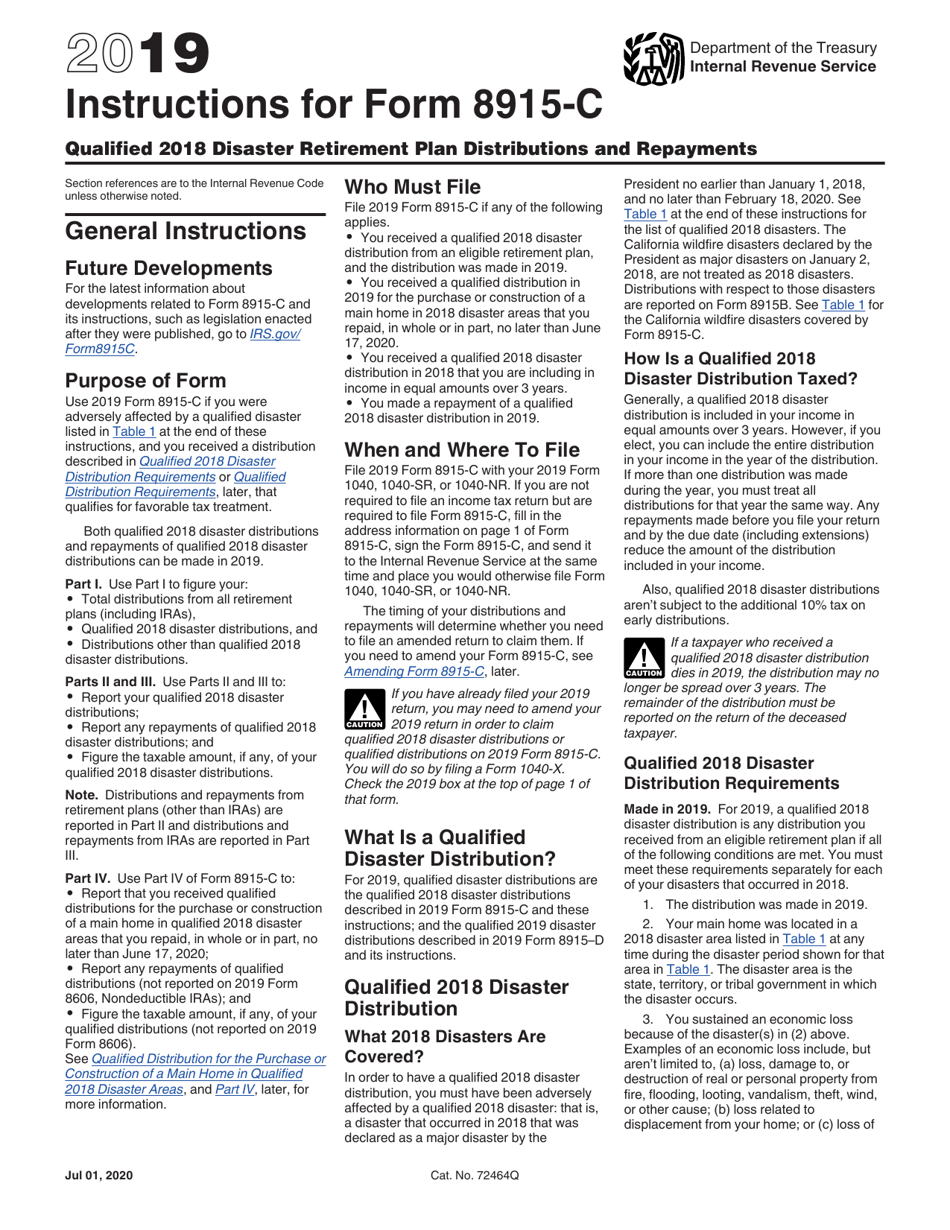

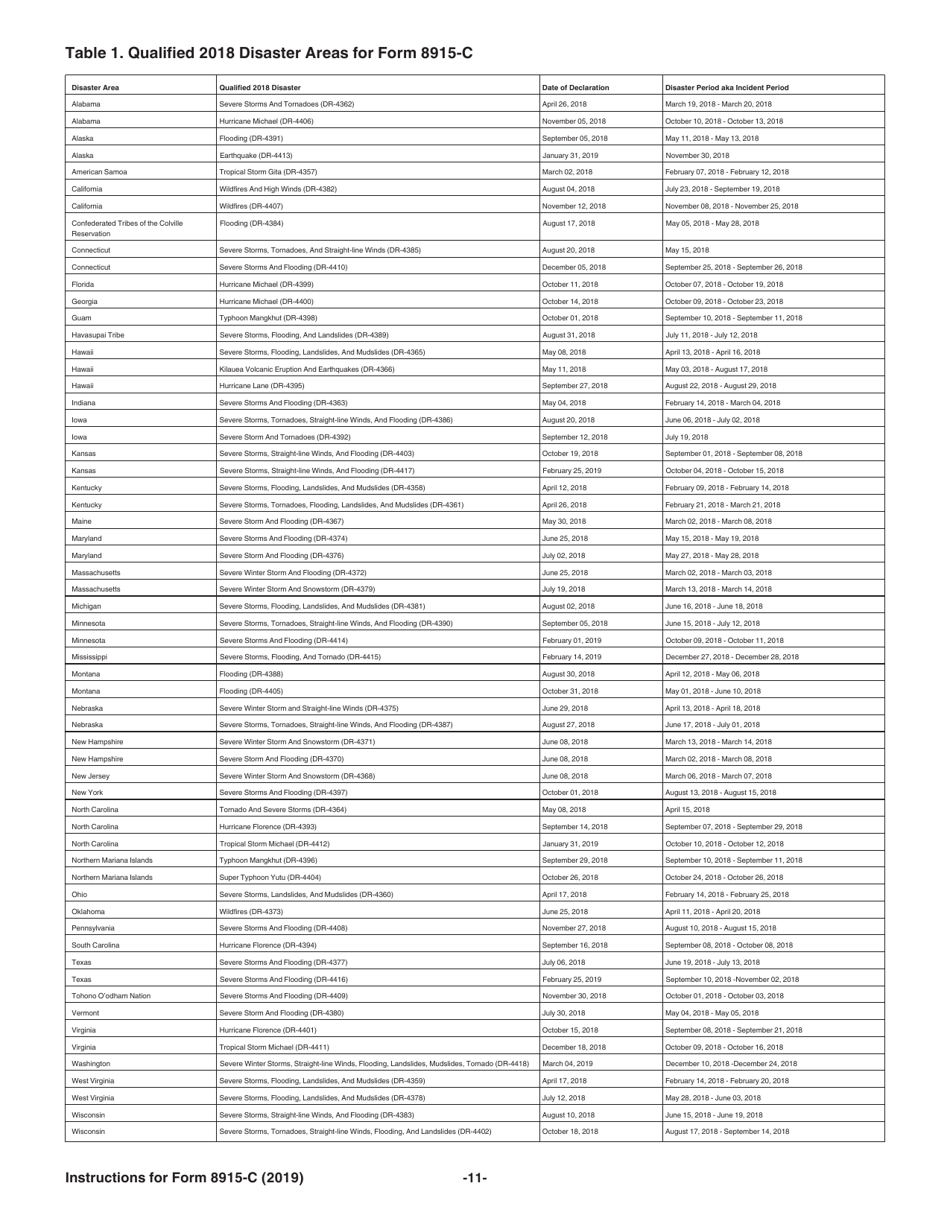

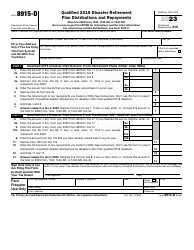

Instructions for IRS Form 8915-C Qualified 2018 Disaster Retirement Plan Distributions and Repayments

This document contains official instructions for IRS Form 8915-C , Qualified 2018 Disaster Retirement Plan Distributions and Repayments - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8915-C is available for download through this link.

FAQ

Q: What is IRS Form 8915-C?

A: IRS Form 8915-C is a form used for reporting qualified disaster retirement plan distributions and repayments.

Q: What are qualified disaster retirement plan distributions?

A: Qualified disaster retirement plan distributions are distributions from retirement plans made on account of a natural disaster.

Q: What types of retirement plans are included?

A: Qualified disaster retirement plan distributions can come from IRAs, 401(k) plans, and other eligible retirement plans.

Q: What is the purpose of Form 8915-C?

A: The purpose of Form 8915-C is to report qualified disaster retirement plan distributions and repayments, as well as to claim any related tax benefits.

Q: What needs to be reported on Form 8915-C?

A: On Form 8915-C, you will need to report the amount of qualified disaster retirement plan distributions you received and any repayments you made.

Q: What tax benefits can be claimed with Form 8915-C?

A: With Form 8915-C, you can claim tax benefits such as spreading the tax liability over three years or avoiding early withdrawal penalties.

Q: Is Form 8915-C only for the 2018 tax year?

A: Yes, Form 8915-C is specifically for the 2018 tax year. If you are reporting qualified disaster retirement plan distributions for other years, you will need to use a different form.

Q: Are there any special instructions or requirements for Form 8915-C?

A: Yes, it is important to carefully review the instructions provided with Form 8915-C to ensure proper completion and to determine if you qualify for any tax benefits.

Instruction Details:

- This 11-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.