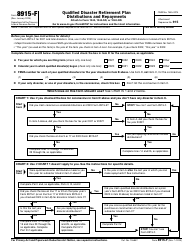

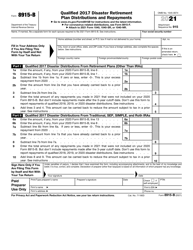

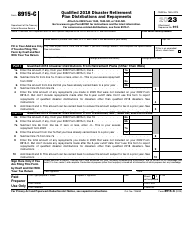

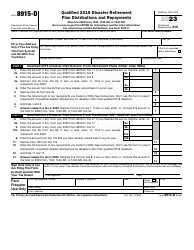

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8915-A

for the current year.

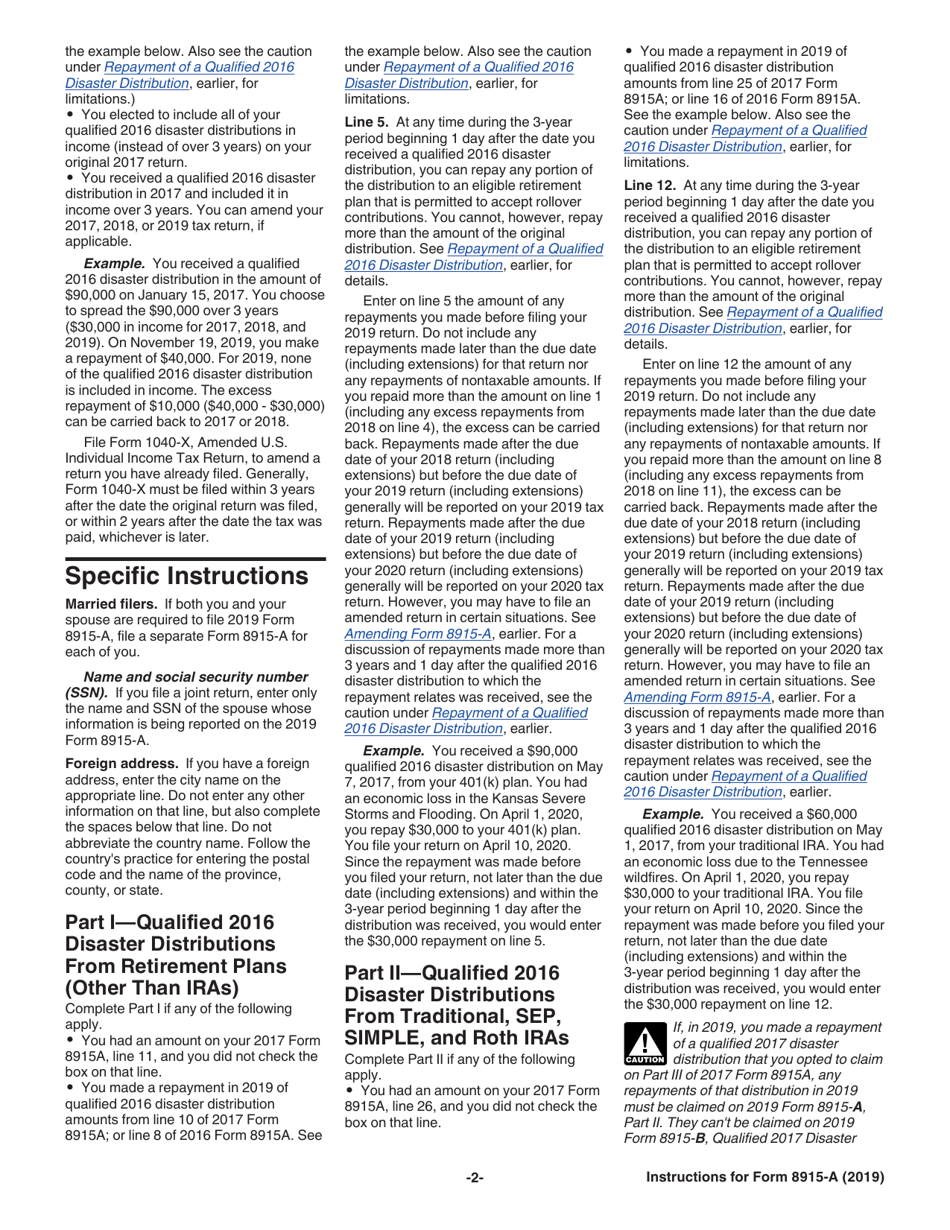

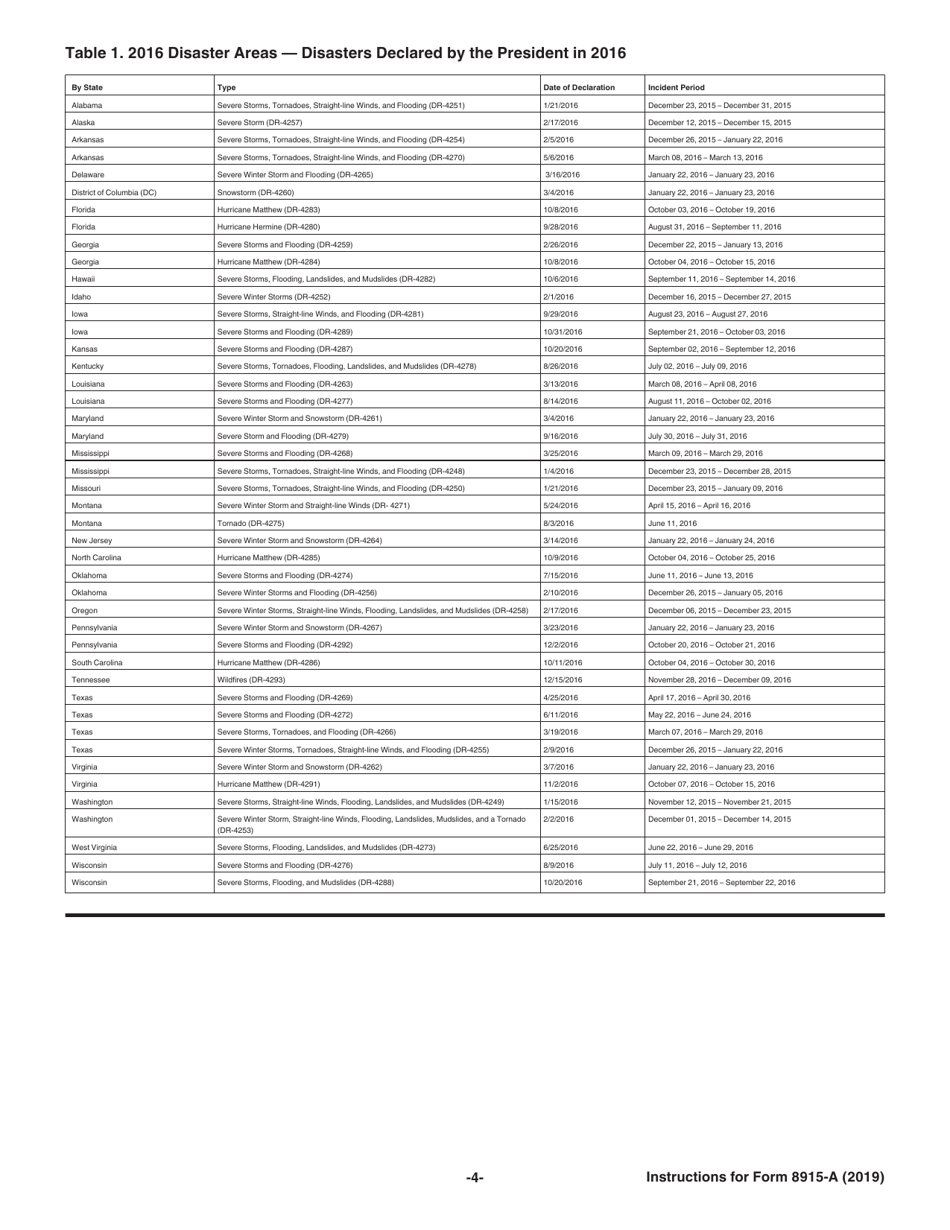

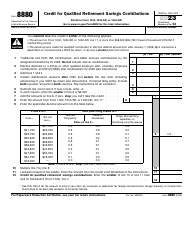

Instructions for IRS Form 8915-A Qualified 2016 Disaster Retirement Plan Distributions and Repayments

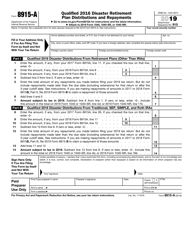

This document contains official instructions for IRS Form 8915-A , Qualified 2016 Disaster Retirement Plan Distributions and Repayments - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8915-A is available for download through this link.

FAQ

Q: What is IRS Form 8915-A?

A: IRS Form 8915-A is a form used to report qualified disaster-related distributions and repayments made from retirement plans in 2016.

Q: Who should use IRS Form 8915-A?

A: Individuals who took qualified disaster-related distributions from retirement plans in 2016 and want to report and repay those distributions should use IRS Form 8915-A.

Q: What are qualified disaster-related distributions?

A: Qualified disaster-related distributions are distributions from retirement plans that were made on account of a qualified 2016 disaster.

Q: What are the requirements to be eligible for the favorable tax treatment of qualified disaster-related distributions?

A: To be eligible, the distribution must be taken from an eligible retirement plan, the individual's main home must have been located in a federally declared disaster area, and the distribution must have been made between specified dates.

Q: Do qualified disaster-related distributions have any tax implications?

A: Yes, qualified disaster-related distributions are generally included in taxable income. However, the tax on these distributions can be spread over three years, and taxpayers have the option to repay the distribution to avoid taxation.

Q: How do I report and repay qualified disaster-related distributions?

A: You report and repay qualified disaster-related distributions using IRS Form 8915-A. The form provides instructions for reporting the distributions and calculating the repayment amount.

Q: What if I have questions or need help with IRS Form 8915-A?

A: If you have questions or need help with IRS Form 8915-A, you can contact the IRS directly or consult a tax professional for assistance.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.