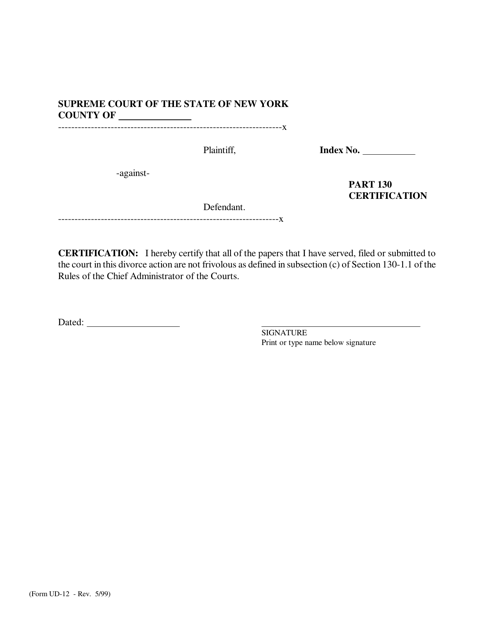

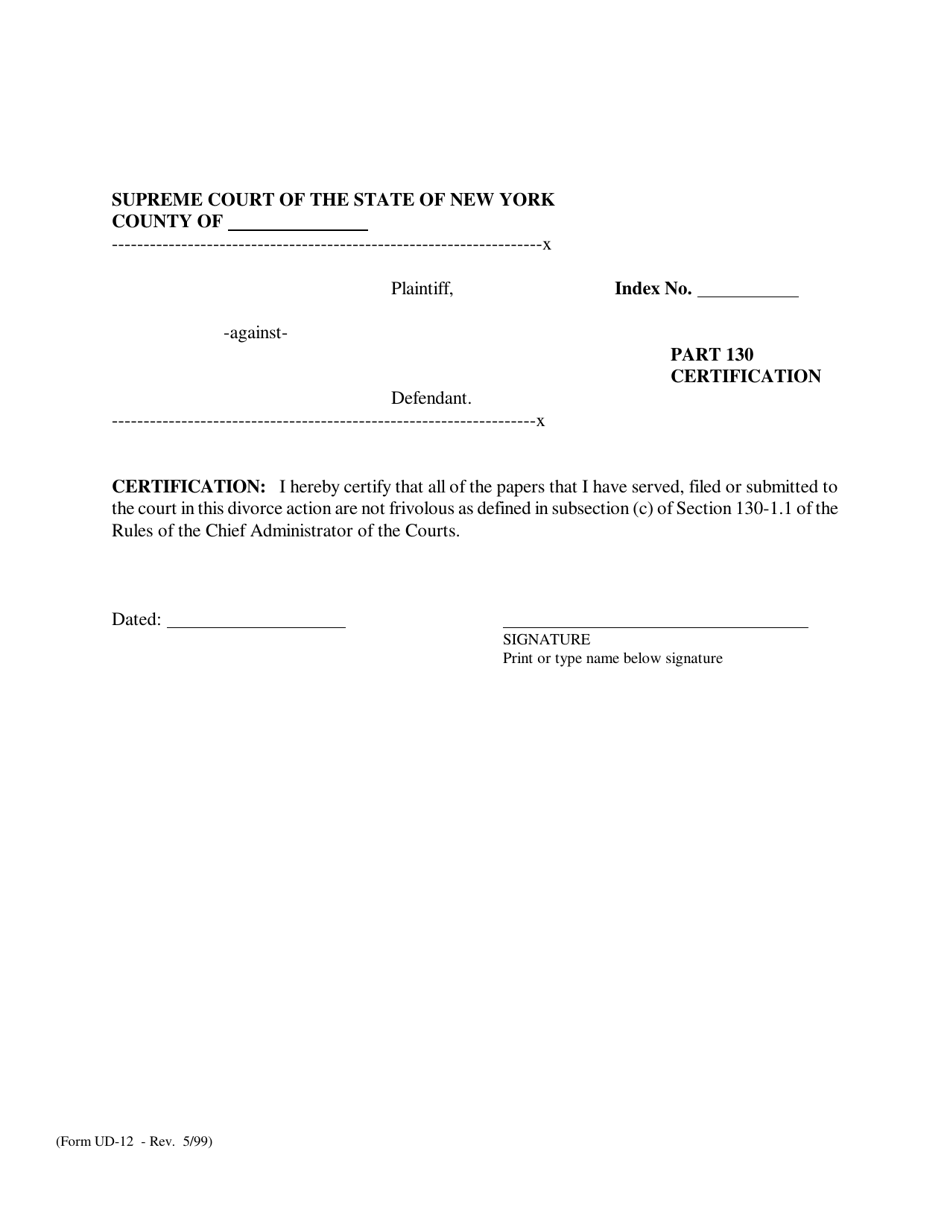

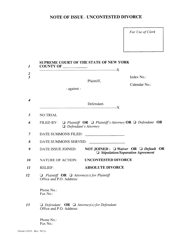

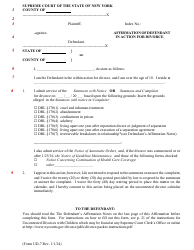

Form UD-12 Part 130 Certification - New York

What Is Form UD-12?

This is a legal form that was released by the New York Supreme Court - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

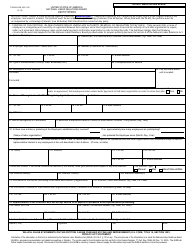

Q: What is Form UD-12 Part 130 Certification?

A: Form UD-12 Part 130 Certification is a form used in New York for certifying compliance with certain requirements for the collection of sales and use tax on motor fuel and diesel motor fuel.

Q: Who needs to file Form UD-12 Part 130 Certification?

A: Any person engaged in the business of selling motor fuel or diesel motor fuel in New York must file Form UD-12 Part 130 Certification.

Q: What are the requirements for filing Form UD-12 Part 130 Certification?

A: The requirements for filing Form UD-12 Part 130 Certification include maintaining records to support the tax-exempt sales and having a valid sales tax registration certificate.

Q: When should Form UD-12 Part 130 Certification be filed?

A: Form UD-12 Part 130 Certification must be filed on a quarterly basis, along with the quarterly sales tax return.

Q: What is the purpose of Form UD-12 Part 130 Certification?

A: The purpose of Form UD-12 Part 130 Certification is to certify compliance with the requirements for tax-exempt sales of motor fuel and diesel motor fuel in New York.

Form Details:

- Released on May 1, 1999;

- The latest edition provided by the New York Supreme Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UD-12 by clicking the link below or browse more documents and templates provided by the New York Supreme Court.