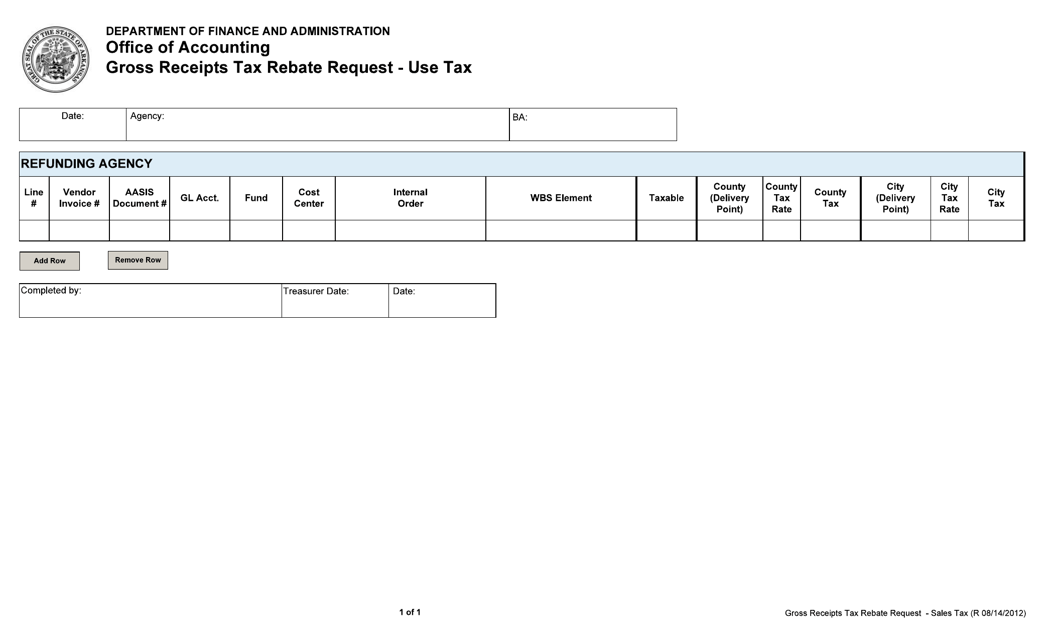

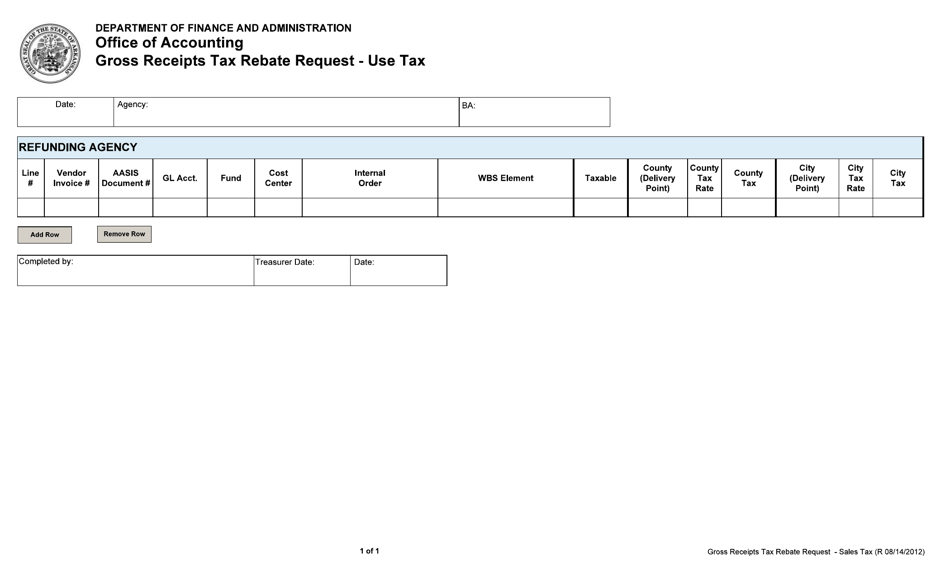

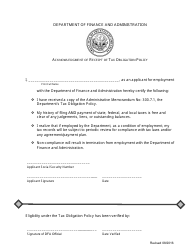

Gross Receipts Tax Rebate Request - Use Tax - Arkansas

Gross Receipts Tax Rebate Request - Use Tax is a legal document that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas.

FAQ

Q: What is a Gross Receipts Tax?

A: The Gross Receipts Tax is a tax on the total sales or revenues of a business.

Q: What is a Tax Rebate Request?

A: A Tax Rebate Request is a formal application made to the government to refund a portion of the taxes paid.

Q: What is Use Tax?

A: Use Tax is a tax that is generally imposed on the use, consumption, or storage of tangible personal property.

Q: How do I request a Gross Receipts Tax Rebate?

A: You can request a Gross Receipts Tax Rebate by submitting a formal application to the Arkansas state government.

Q: What is the purpose of the Gross Receipts Tax Rebate?

A: The purpose of the Gross Receipts Tax Rebate is to provide financial relief to businesses by refunding a portion of the taxes paid.

Q: Who is eligible for the Gross Receipts Tax Rebate?

A: Businesses that meet certain criteria, such as being located in Arkansas and having paid the Gross Receipts Tax, may be eligible for the rebate.

Q: How much of the Gross Receipts Tax can be rebated?

A: The amount of the rebate can vary and is determined by the Arkansas state government.

Q: What supporting documents are required for the Gross Receipts Tax Rebate?

A: Supporting documents may include sales receipts, business records, and proof of payment of the Gross Receipts Tax.

Q: What is the deadline for submitting the Tax Rebate Request?

A: The deadline for submitting the Tax Rebate Request may vary and is typically specified by the Arkansas state government.

Form Details:

- Released on August 14, 2012;

- The latest edition currently provided by the Arkansas Department of Finance & Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.