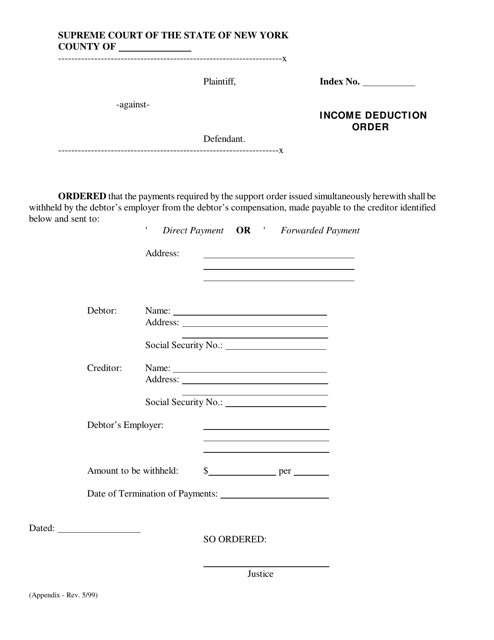

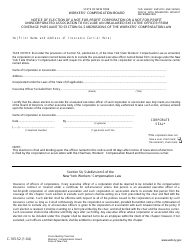

Income Deduction Order - New York

Income Deduction Order is a legal document that was released by the New York Supreme Court - a government authority operating within New York.

FAQ

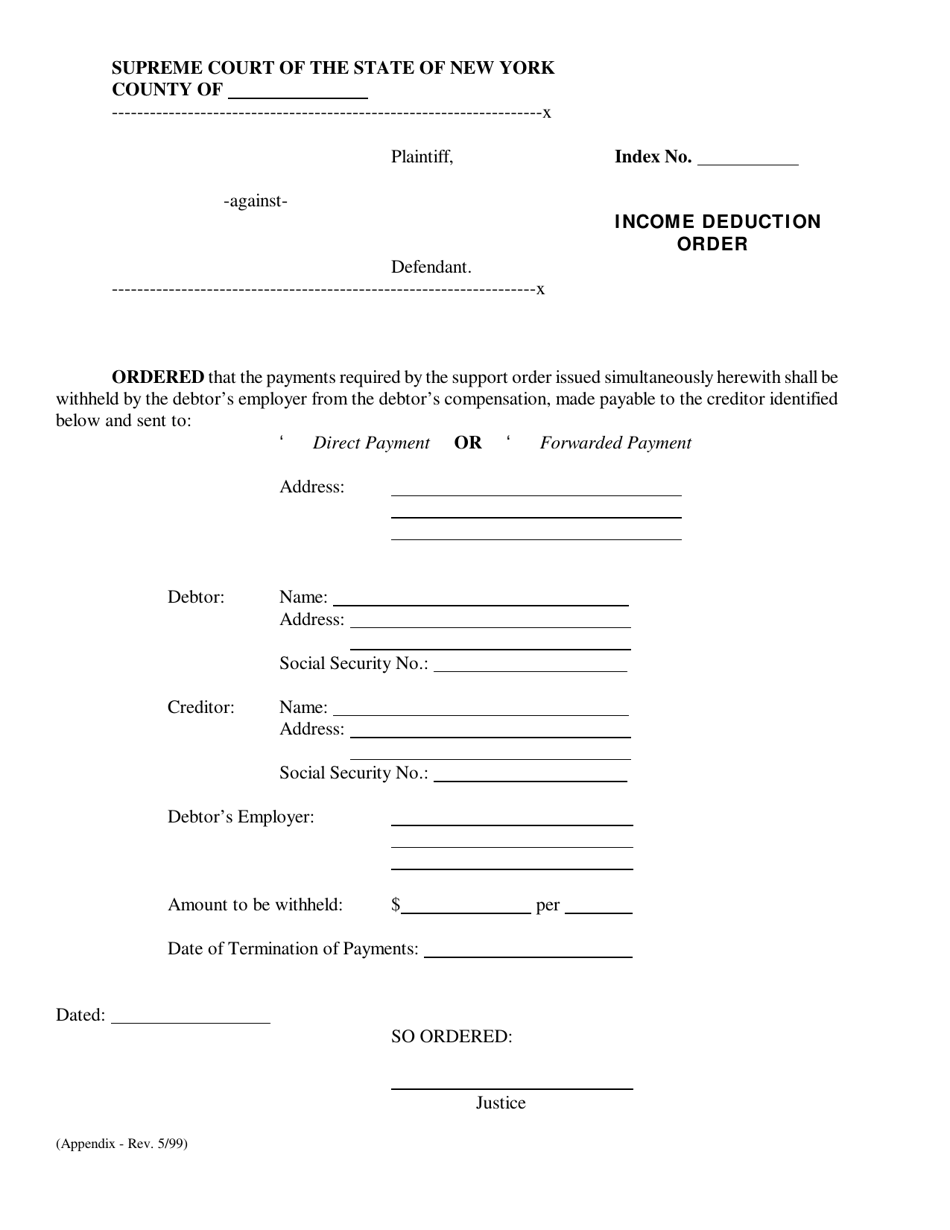

Q: What is an Income Deduction Order?

A: An Income Deduction Order is a legal order that requires an employer to withhold a portion of an employee's income to satisfy a debt or obligation.

Q: Who can obtain an Income Deduction Order in New York?

A: Various individuals and agencies, such as child support recipients, government agencies, and creditors, can obtain an Income Deduction Order in New York.

Q: What types of debts can an Income Deduction Order be used for?

A: An Income Deduction Order can be used for various types of debts, including child support, spousal support, unpaid taxes, and court-ordered fines or penalties.

Q: How does an Income Deduction Order work?

A: Once an Income Deduction Order is issued, the employer is required to withhold a specified amount from the employee's paycheck and send it directly to the designated recipient or agency.

Q: What happens if an employer fails to comply with an Income Deduction Order?

A: If an employer fails to comply with an Income Deduction Order, they may be subject to penalties and legal consequences, including fines and potential legal action.

Form Details:

- Released on May 1, 1999;

- The latest edition currently provided by the New York Supreme Court;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York Supreme Court.