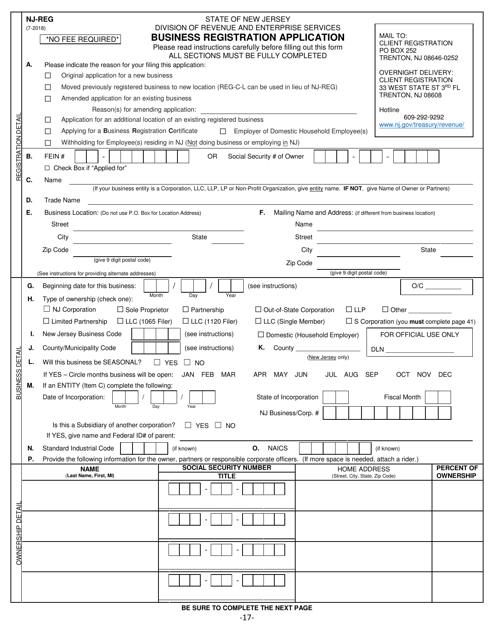

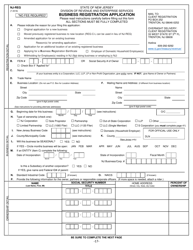

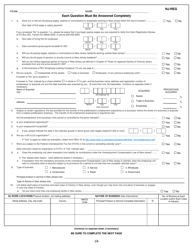

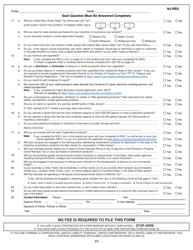

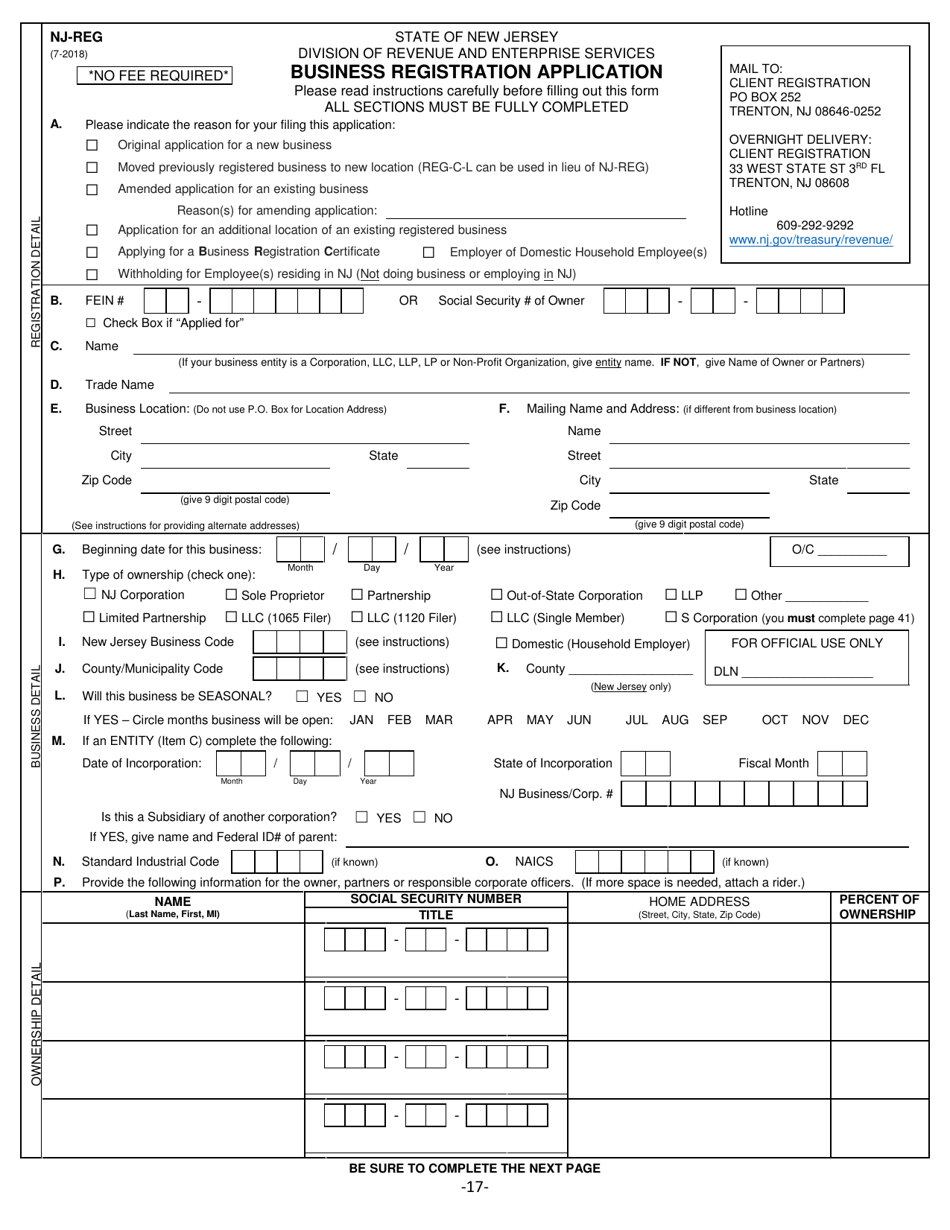

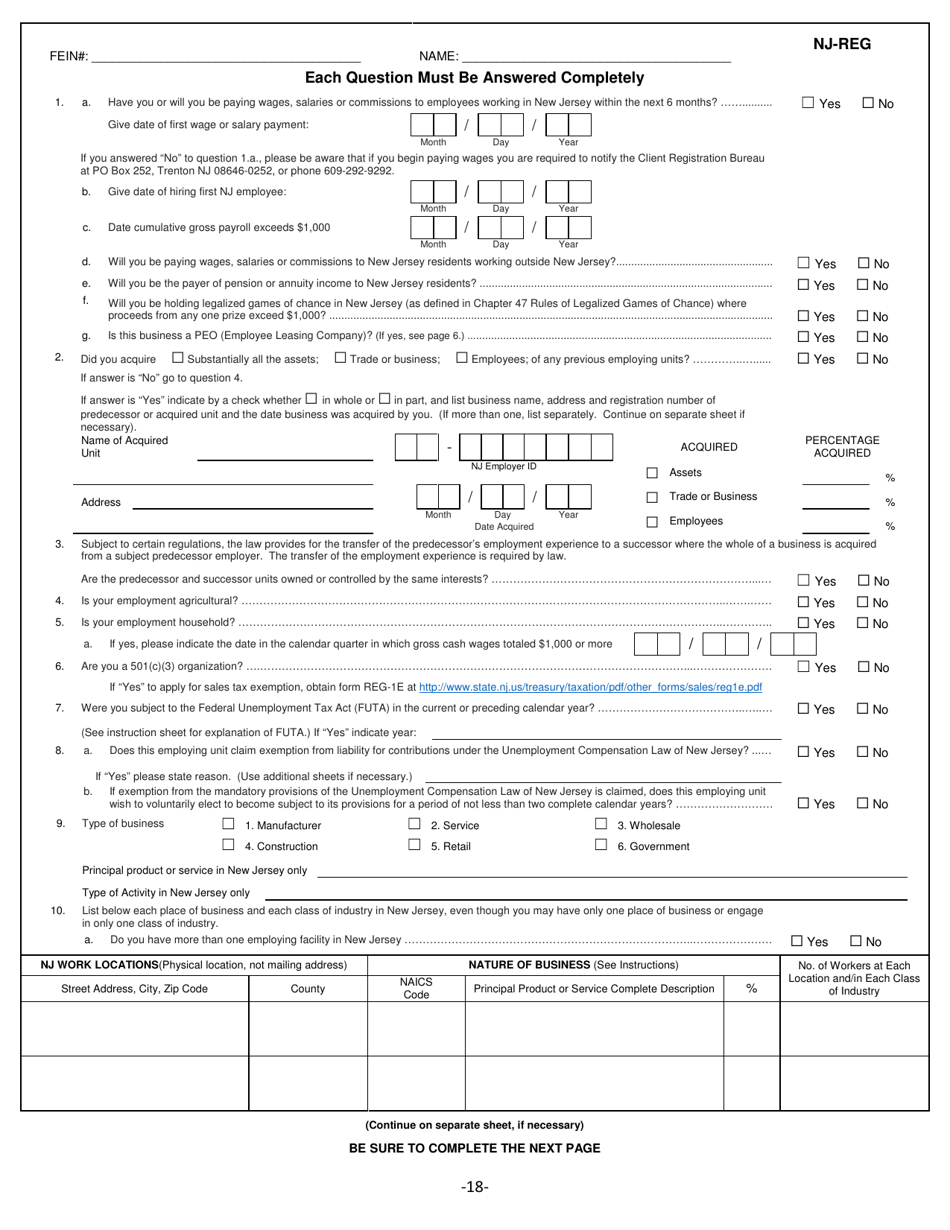

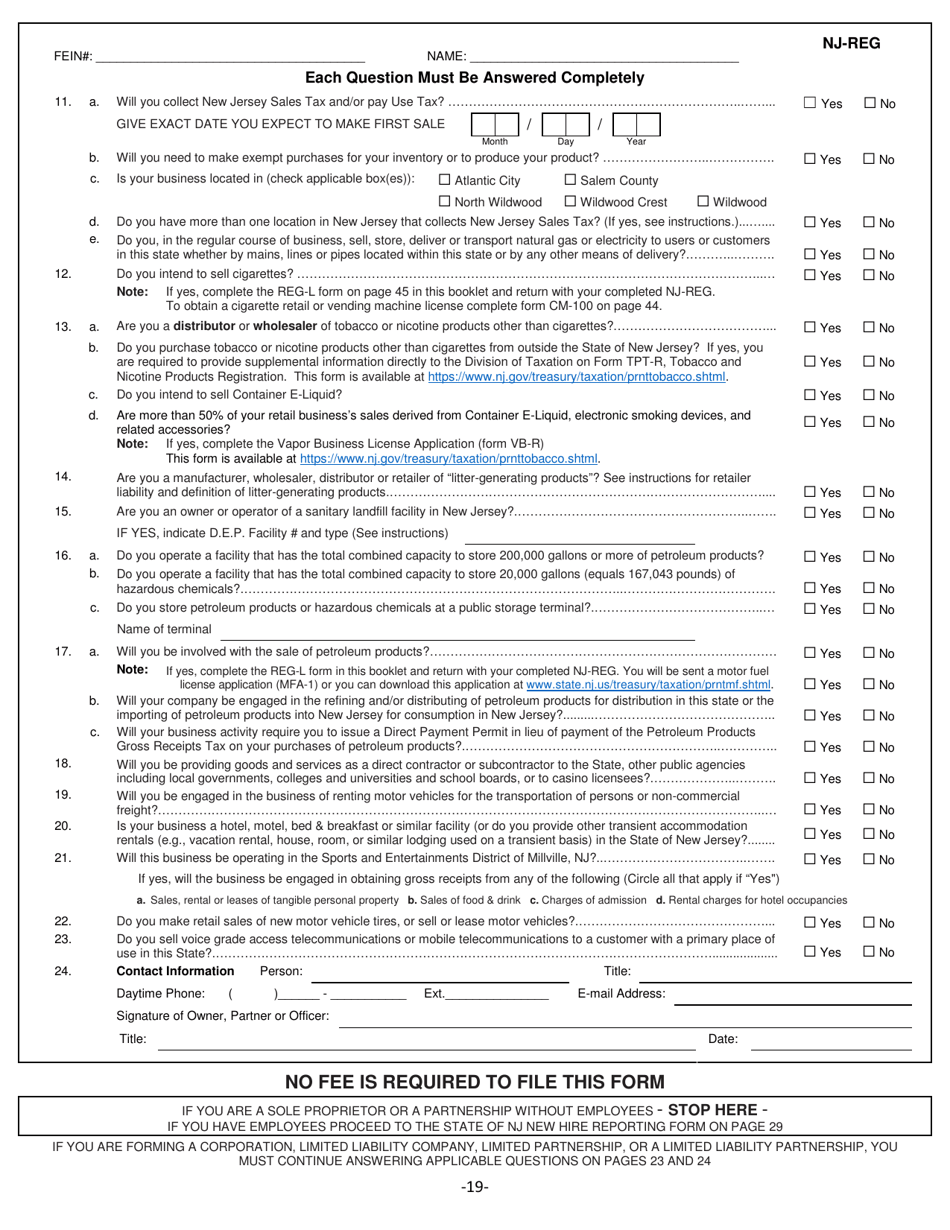

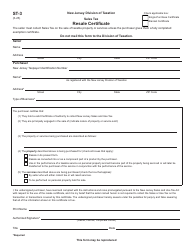

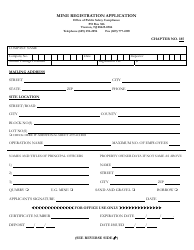

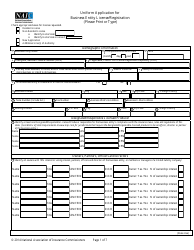

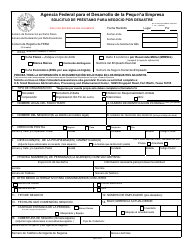

Form NJ-REG Business Registration Application - New Jersey

What Is Form NJ-REG?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-REG?

A: Form NJ-REG is the Business Registration Application used in the state of New Jersey.

Q: What is the purpose of Form NJ-REG?

A: Form NJ-REG is used to register a new business or update existing business information in New Jersey.

Q: Who needs to file Form NJ-REG?

A: Any individual, partnership, corporation, or other business entity that is starting a new business or operating a business in New Jersey must file Form NJ-REG.

Q: What information is required on Form NJ-REG?

A: Form NJ-REG requires information such as the business name, business address, type of business entity, owner's information, and other details related to the business.

Q: Is there a fee to file Form NJ-REG?

A: Yes, there is a fee associated with filing Form NJ-REG. The fee amount depends on the type of business entity and other factors.

Q: When should Form NJ-REG be filed?

A: Form NJ-REG should be filed before starting a new business or within 60 days of starting operations in New Jersey.

Q: What happens after filing Form NJ-REG?

A: After filing Form NJ-REG, the business will receive a unique identification number for tax purposes, known as the New Jersey Business Identification Number (BIN).

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-REG by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.