Standard for Automatic Exchange of Financial Account Information - Oecd

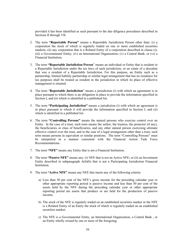

The Standard for Automatic Exchange of Financial Account Information, also known as the Common Reporting Standard (CRS), is a framework developed by the Organization for Economic Cooperation and Development (OECD). It allows for the exchange of financial information between countries to combat tax evasion and promote transparency in global financial systems.

The OECD (Organization for Economic Cooperation and Development) files the standard for Automatic Exchange of Financial Account Information.

FAQ

Q: What is the Standard for Automatic Exchange of Financial Account Information?

A: The Standard for Automatic Exchange of Financial Account Information is a global legal framework developed by the Organization for Economic Co-operation and Development (OECD) to facilitate the exchange of financial information between countries.

Q: Why was the Standard for Automatic Exchange of Financial Account Information created?

A: The standard was created to combat tax evasion and improve transparency in the global financial system.

Q: Which countries are part of the Standard for Automatic Exchange of Financial Account Information?

A: Over 100 countries, including the United States and Canada, are part of the standard.

Q: What type of information is exchanged under the standard?

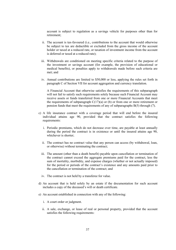

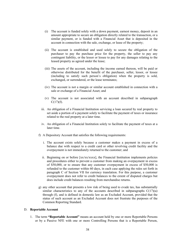

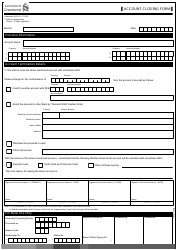

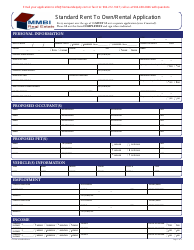

A: Under the standard, participating countries exchange information on financial accounts held by non-residents, including balances, interest, dividends, and proceeds from the sale of financial assets.

Q: How does the Standard for Automatic Exchange of Financial Account Information work?

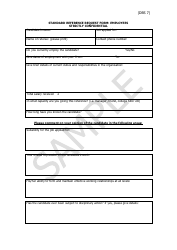

A: Financial institutions in participating countries collect information on their clients' accounts and report it to the appropriate tax authorities. The tax authorities then exchange this information with other participating countries on an annual basis.

Q: What are the benefits of the Standard for Automatic Exchange of Financial Account Information?

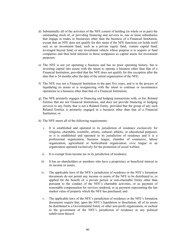

A: The standard helps countries tackle tax evasion, improve tax compliance, and enhance the effectiveness of their tax systems. It also facilitates global cooperation and fosters a more transparent and fair international tax environment.

Q: Does the Standard for Automatic Exchange of Financial Account Information infringe on privacy?

A: The standard includes robust safeguards to protect the confidentiality and security of the exchanged information, ensuring that privacy rights are respected.

Q: How does the Standard for Automatic Exchange of Financial Account Information affect individuals?

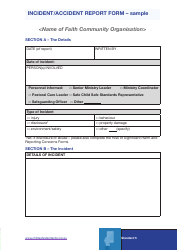

A: The standard may result in increased scrutiny of individuals' financial activities by tax authorities. It is important for individuals to comply with their tax obligations and properly report their financial information.

Q: Is participation in the Standard for Automatic Exchange of Financial Account Information mandatory?

A: Participation in the standard is voluntary, but many countries have committed to implementing it as part of their efforts to combat tax evasion. Non-participating countries may face reputational and economic consequences.

Q: Is the Standard for Automatic Exchange of Financial Account Information effective?

A: The standard has been widely implemented and has significantly improved tax transparency and cooperation between countries. However, its effectiveness ultimately depends on the commitment and cooperation of participating countries.