This version of the form is not currently in use and is provided for reference only. Download this version of

Form MO-5090

for the current year.

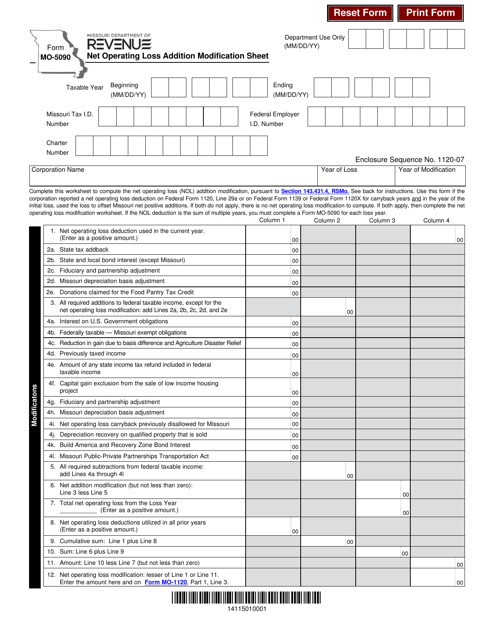

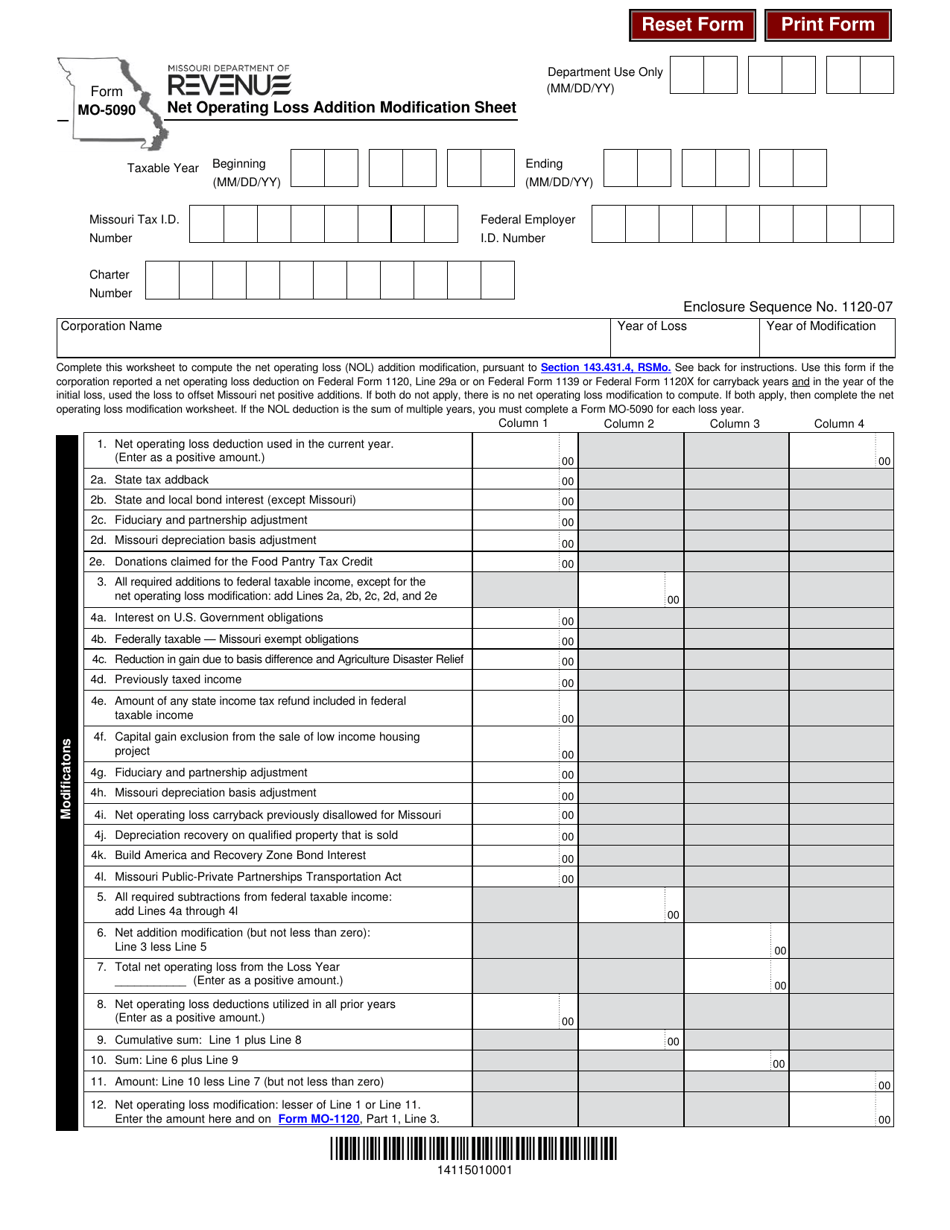

Form MO-5090 Net Operating Loss Addition Modification Worksheet - Missouri

What Is Form MO-5090?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

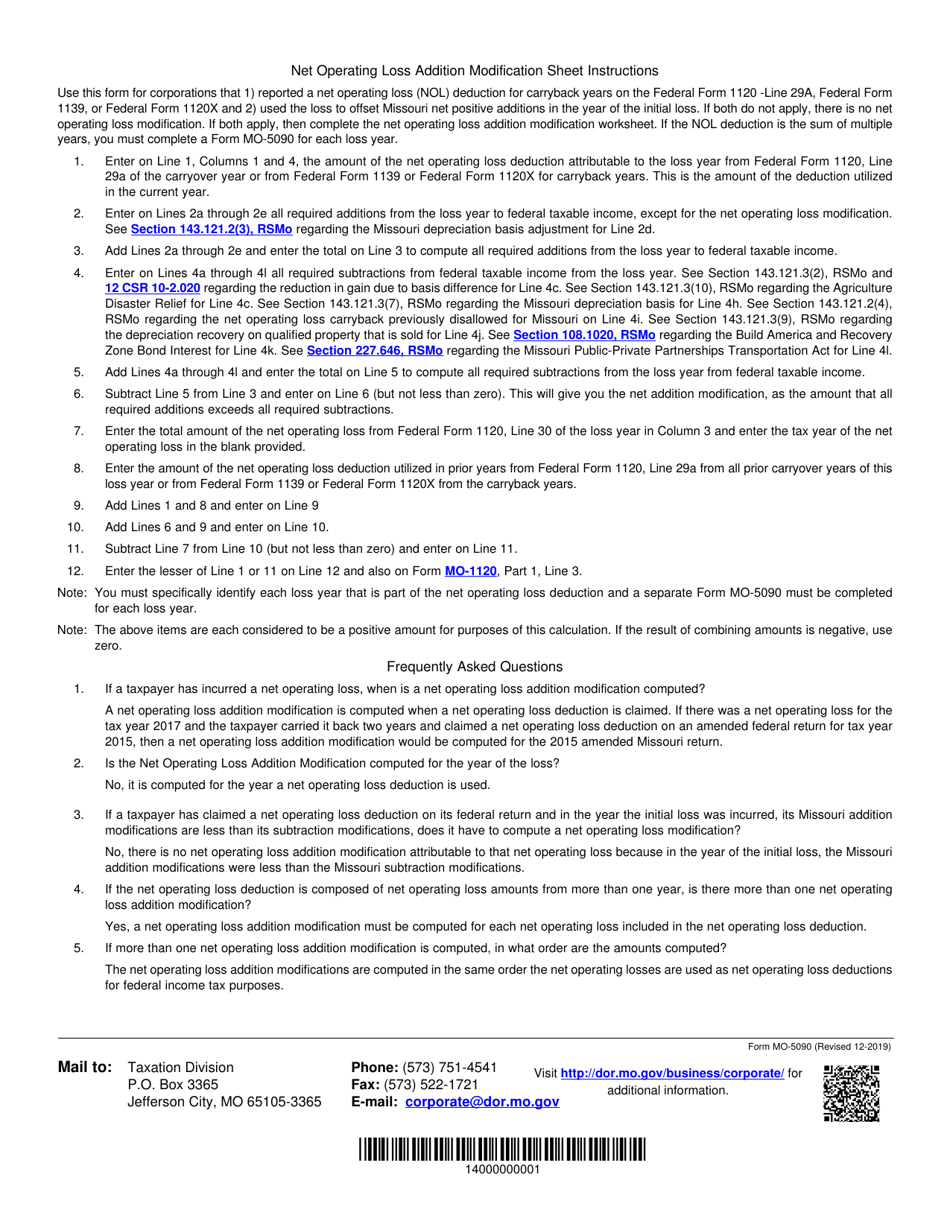

Q: What is Form MO-5090?

A: Form MO-5090 is the Net Operating Loss Addition Modification Worksheet for the state of Missouri.

Q: What is a net operating loss?

A: A net operating loss occurs when a company's deductible expenses exceed its taxable income.

Q: Why would I need to file Form MO-5090?

A: You would need to file Form MO-5090 if you have a net operating loss that you want to carry forward or carry back.

Q: What is the purpose of Form MO-5090?

A: The purpose of Form MO-5090 is to calculate the amount of net operating loss that can be claimed on your Missouri tax return.

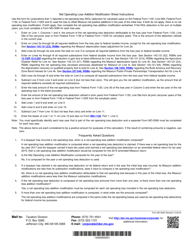

Q: How do I fill out Form MO-5090?

A: You will need to follow the instructions provided on the form and complete the necessary sections, including the calculation of the net operating loss.

Q: When is Form MO-5090 due?

A: Form MO-5090 is typically due on the same date as your Missouri income tax return, which is April 15th for most individuals.

Q: Are there any penalties for not filing Form MO-5090?

A: If you have a net operating loss and fail to file Form MO-5090, you may lose the opportunity to carry forward or carry back the loss to offset future or past taxable income.

Q: Can I file Form MO-5090 electronically?

A: Yes, you can file Form MO-5090 electronically if you are using a tax preparation software that supports Missouri state tax returns.

Q: Is Form MO-5090 for individuals or businesses?

A: Form MO-5090 can be used by both individuals and businesses who have a net operating loss in Missouri.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-5090 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.