This version of the form is not currently in use and is provided for reference only. Download this version of

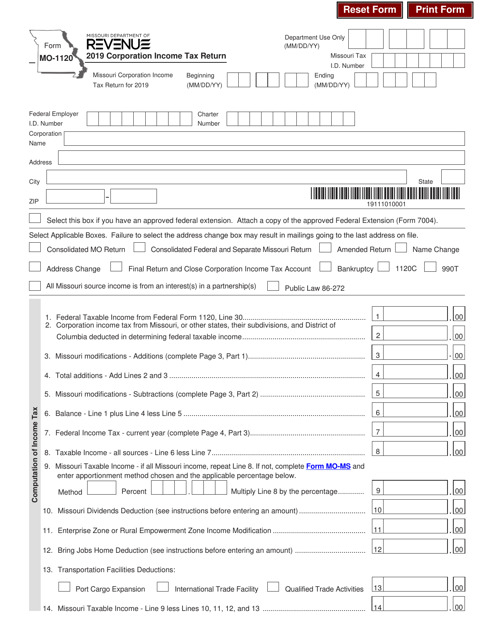

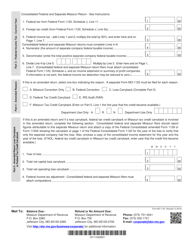

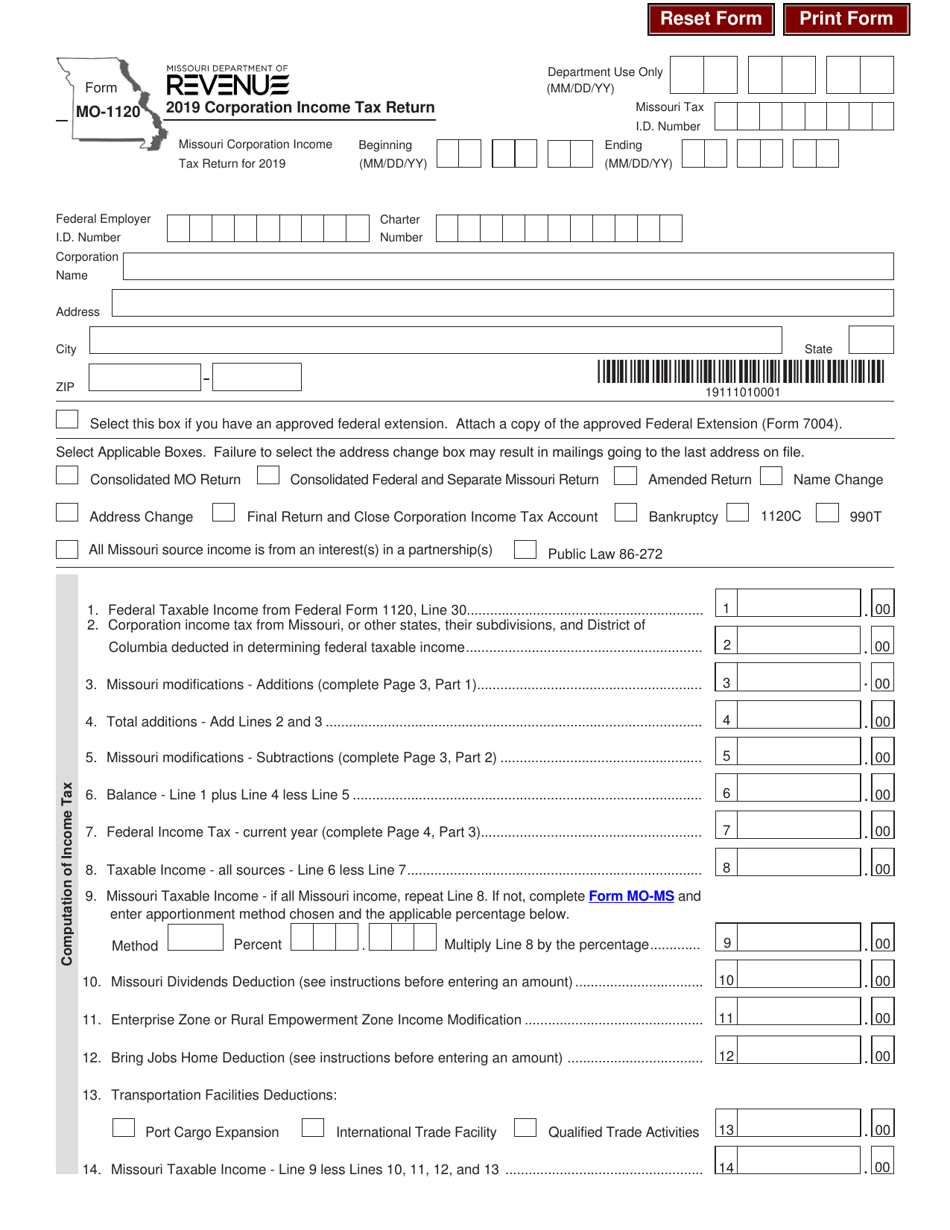

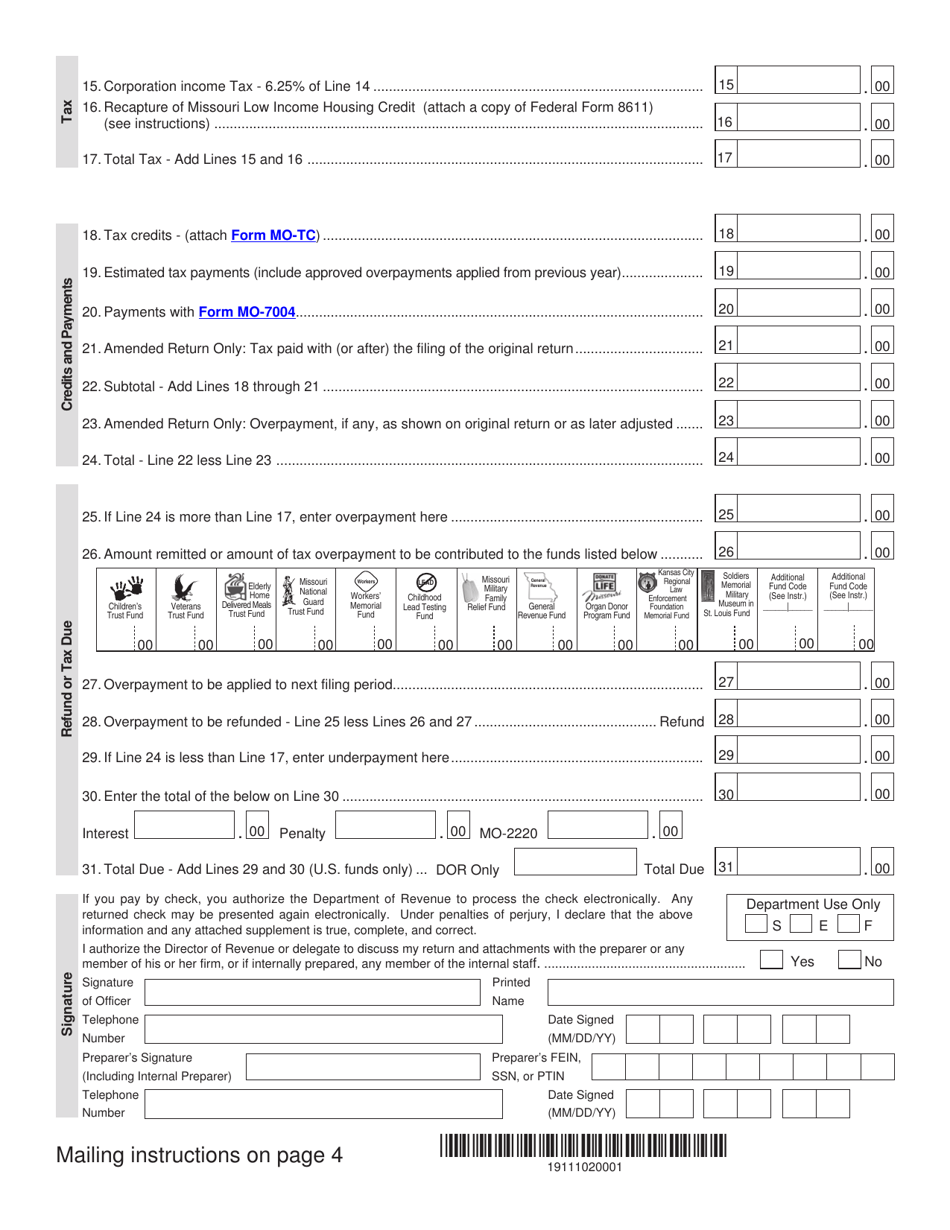

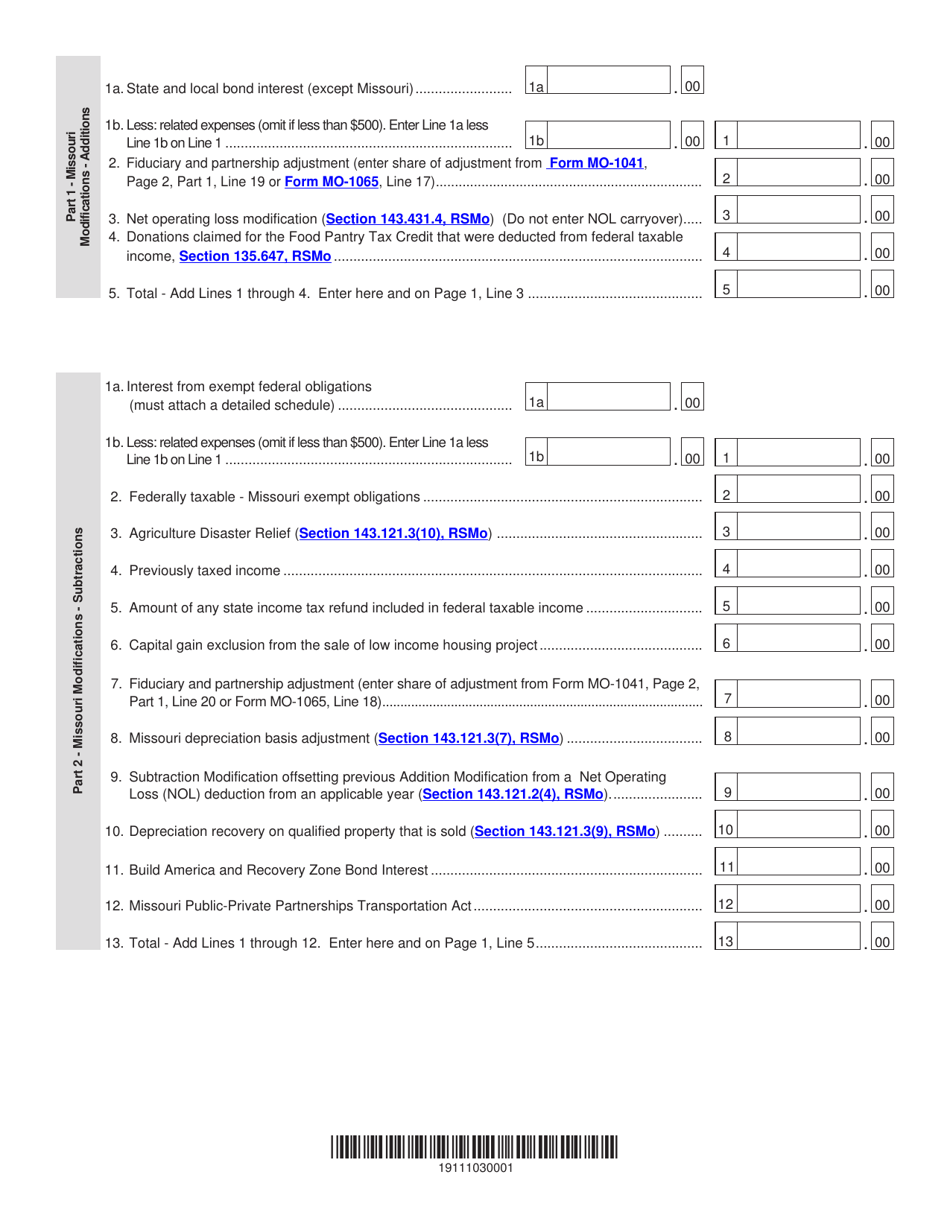

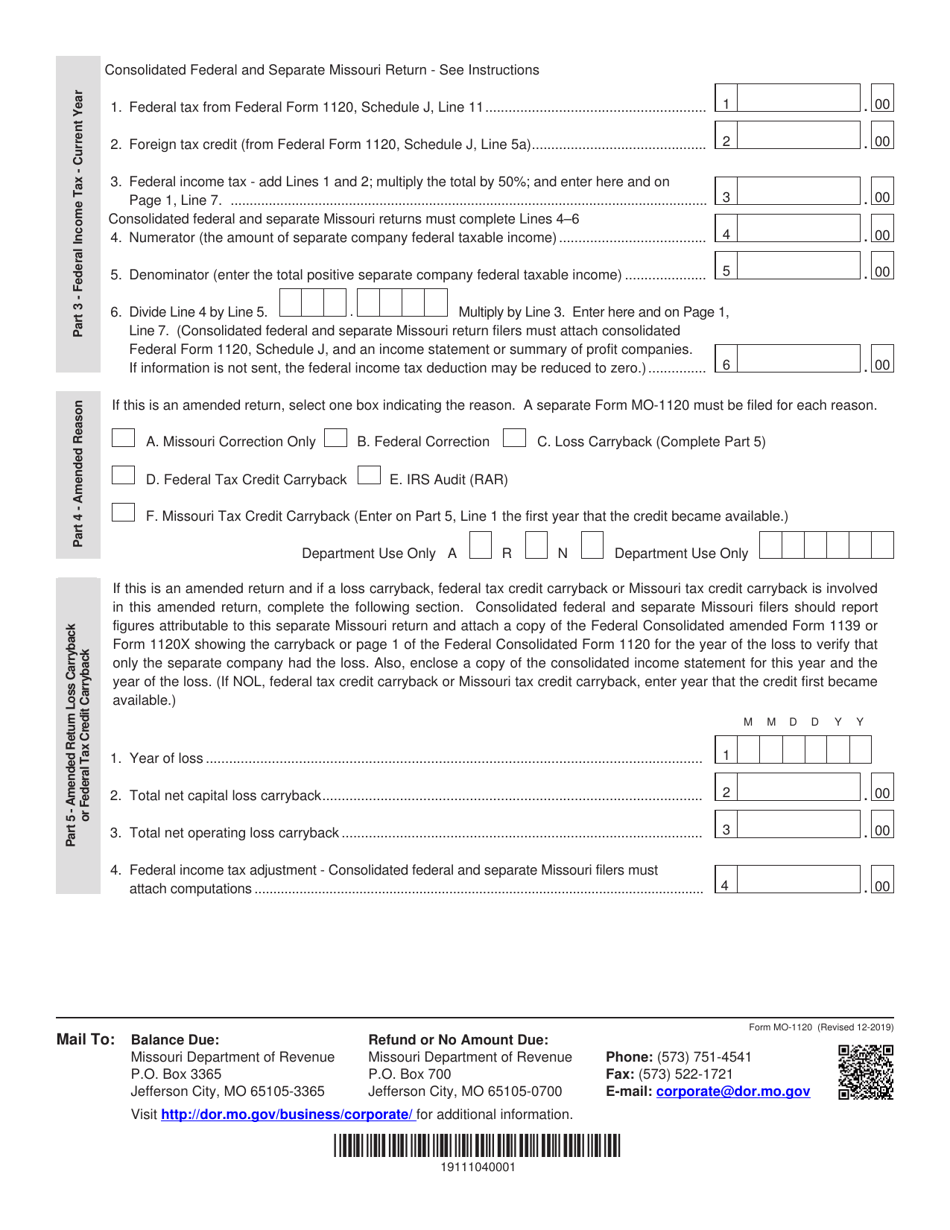

Form MO-1120

for the current year.

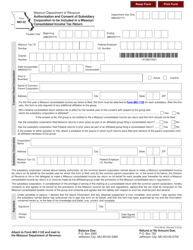

Form MO-1120 Corporation Income Tax Return - Missouri

What Is Form MO-1120?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-1120?

A: Form MO-1120 is the Corporation Income Tax Return form for businesses in Missouri.

Q: Who needs to file Form MO-1120?

A: All corporations, including S corporations, that generate income in Missouri need to file Form MO-1120.

Q: When is the deadline to file Form MO-1120?

A: The deadline to file Form MO-1120 is on or before the 15th day of the fourth month following the end of the tax year.

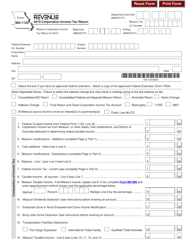

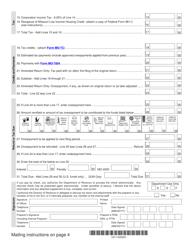

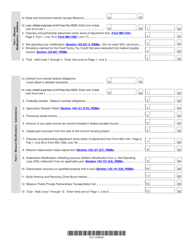

Q: What information is required to complete Form MO-1120?

A: You will need to provide details about your corporation's income, deductions, credits, and other relevant financial information.

Q: Are there any penalties for late filing or non-filing of Form MO-1120?

A: Yes, failure to file or filing late can result in penalties and interest charges. It is important to file the form by the deadline to avoid these penalties.

Q: Are there any special considerations for S corporations?

A: S corporations need to file Form MO-1120S instead of Form MO-1120. This form is specifically designed for S corporations in Missouri.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1120 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.