This version of the form is not currently in use and is provided for reference only. Download this version of

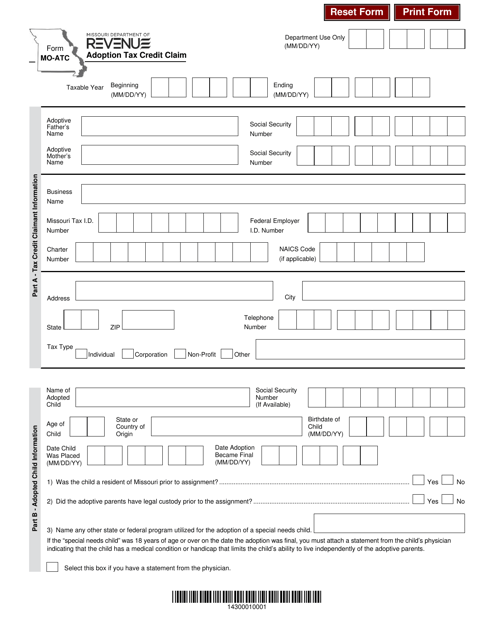

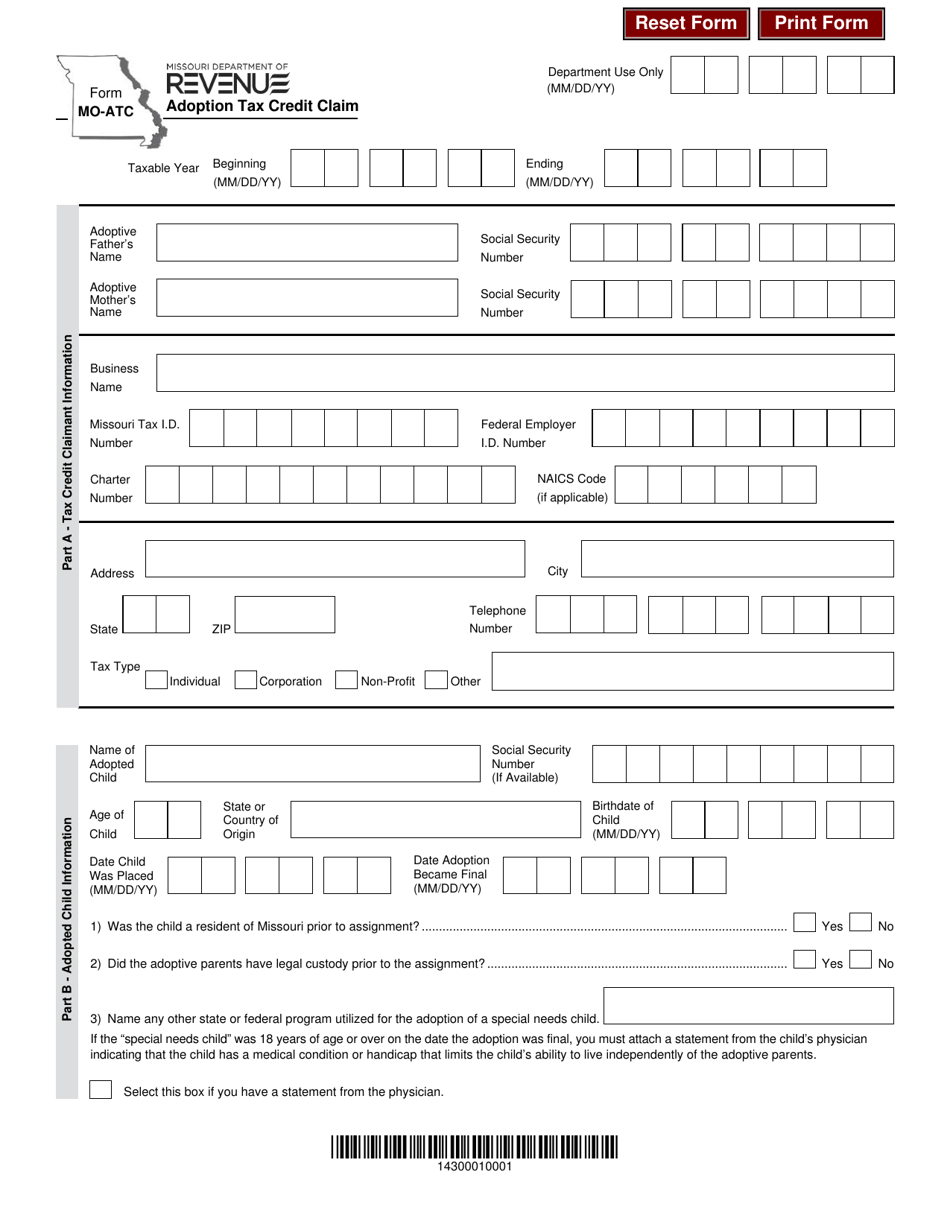

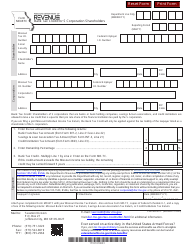

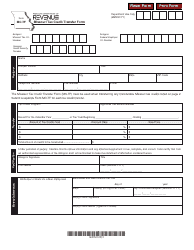

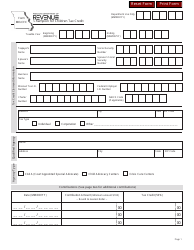

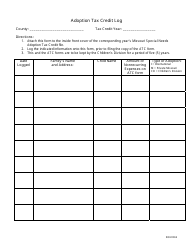

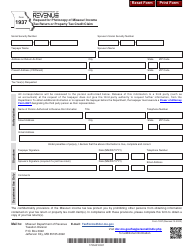

Form MO-ATC

for the current year.

Form MO-ATC Adoption Tax Credit Claim - Missouri

What Is Form MO-ATC?

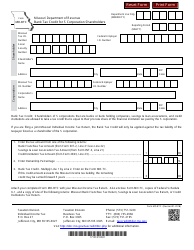

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form MO-ATC?

A: Form MO-ATC is the Adoption Tax Credit Claim form in Missouri.

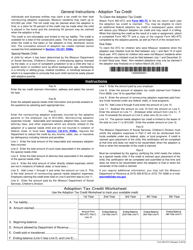

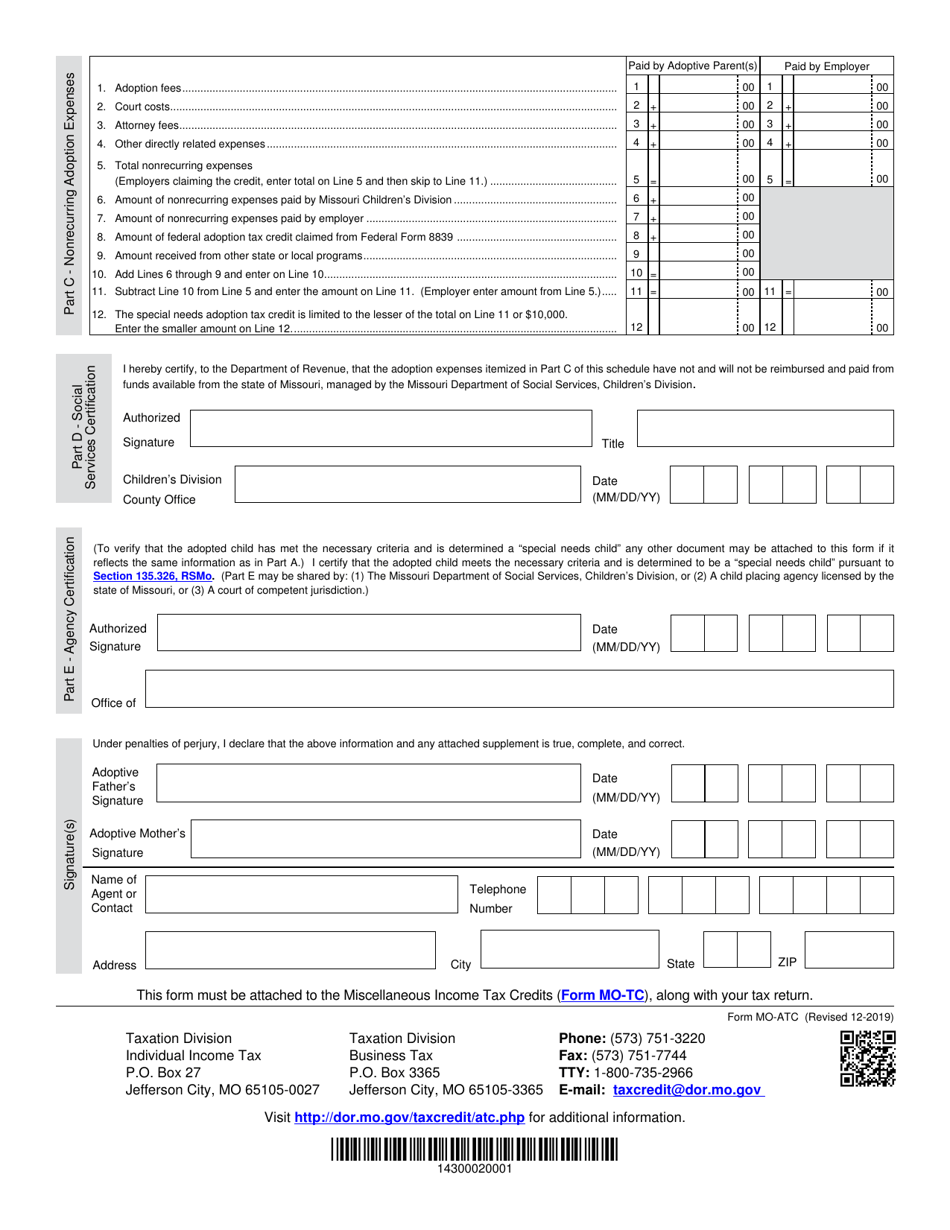

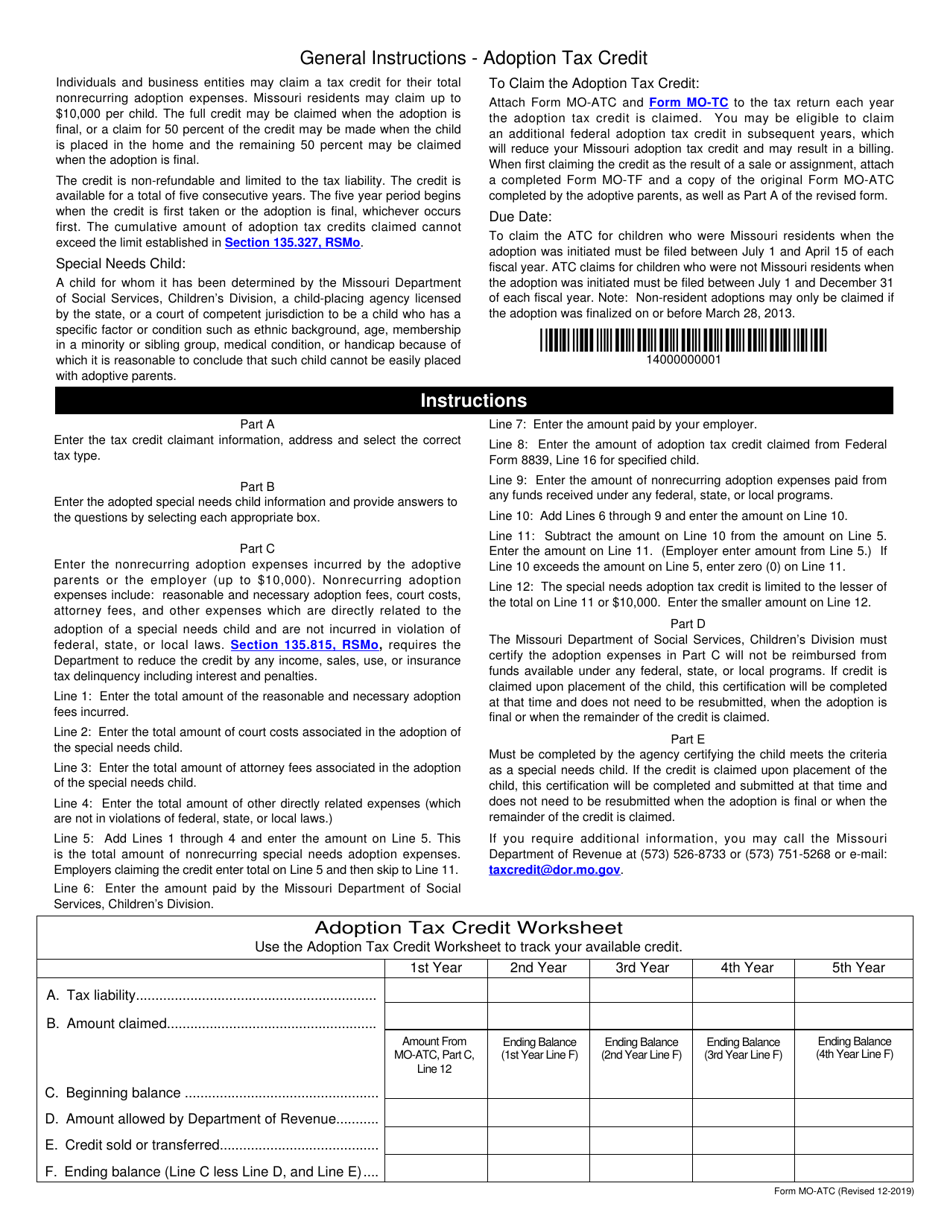

Q: What is the Adoption Tax Credit?

A: The Adoption Tax Credit is a tax credit provided to individuals or families who have adopted a child.

Q: Who is eligible to claim the Adoption Tax Credit in Missouri?

A: Individuals or families who have adopted a child and meet certain requirements may be eligible to claim the Adoption Tax Credit in Missouri.

Q: What are the requirements to claim the Adoption Tax Credit in Missouri?

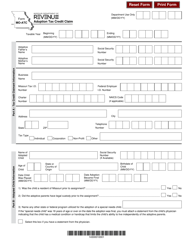

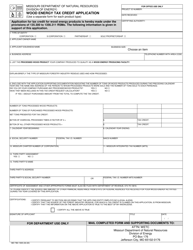

A: Some of the requirements to claim the Adoption Tax Credit in Missouri include the completion of an adoption of a child under the age of 18, incurring qualified adoption expenses, and having a modified adjusted gross income below certain limits.

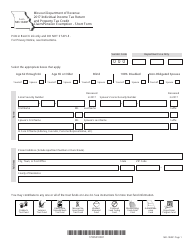

Q: How much is the Adoption Tax Credit in Missouri?

A: The amount of the Adoption Tax Credit in Missouri can vary each year. It is recommended to consult the instructions for Form MO-ATC or a tax professional for the specific amount.

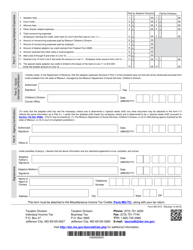

Q: How do I claim the Adoption Tax Credit in Missouri?

A: To claim the Adoption Tax Credit in Missouri, you need to complete and file Form MO-ATC with the Missouri Department of Revenue.

Q: Are there any other forms or documentation required to claim the Adoption Tax Credit in Missouri?

A: Yes, you may need to provide supporting documentation, such as adoption agency invoices or receipts for qualified adoption expenses, when filing Form MO-ATC.

Q: Is there a deadline to file Form MO-ATC?

A: Yes, you must file Form MO-ATC by the due date of your Missouri income tax return, which is typically April 15th.

Q: Can the Adoption Tax Credit be carried forward or back in Missouri?

A: No, the Adoption Tax Credit in Missouri cannot be carried forward or back to other tax years.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-ATC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.