This version of the form is not currently in use and is provided for reference only. Download this version of

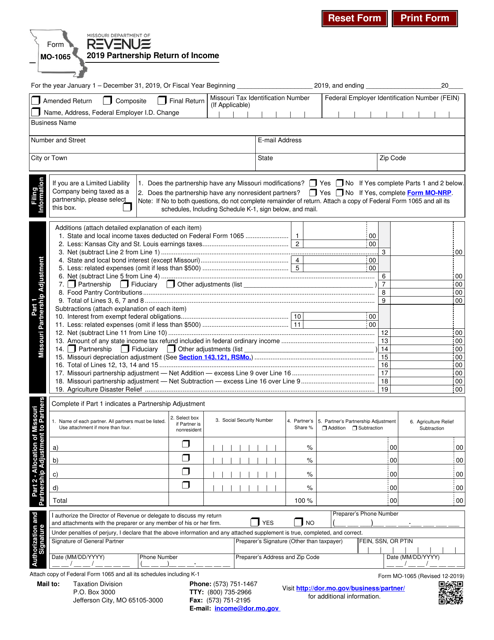

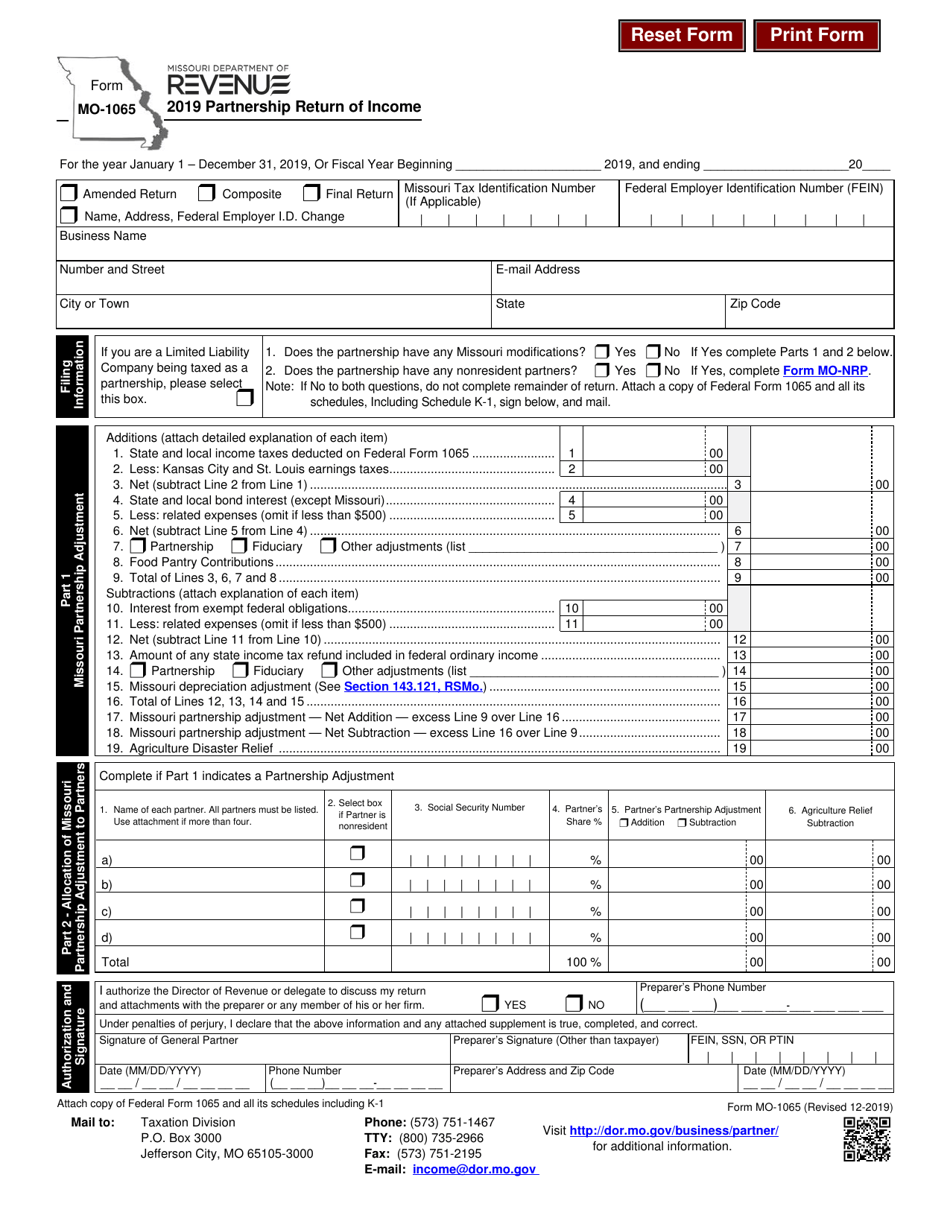

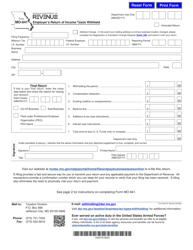

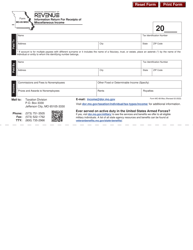

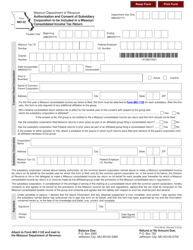

Form MO-1065

for the current year.

Form MO-1065 Partnership Return of Income - Missouri

What Is Form MO-1065?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-1065 form?

A: The MO-1065 form is the Partnership Return of Income form for the state of Missouri.

Q: Who needs to file the MO-1065 form?

A: Partnerships operating in Missouri need to file the MO-1065 form.

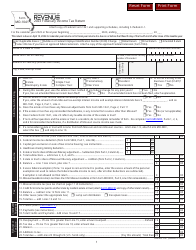

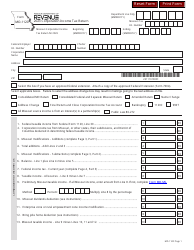

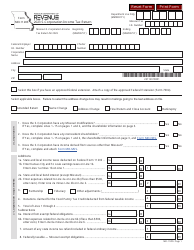

Q: What is the purpose of filing the MO-1065 form?

A: The purpose of filing the MO-1065 form is to report partnership income, deductions, credits, and to calculate the tax liability for the partnership.

Q: When is the deadline for filing the MO-1065 form?

A: The MO-1065 form is due on or before the 15th day of the fourth month following the close of the partnership's taxable year.

Q: Are there any penalties for late filing or non-filing of the MO-1065 form?

A: Yes, there are penalties for late filing or non-filing of the MO-1065 form. It is important to file the form on time to avoid these penalties.

Q: Is there a fee for filing the MO-1065 form?

A: No, there is no fee for filing the MO-1065 form. It is a free form provided by the Missouri Department of Revenue.

Q: What supporting documents do I need to submit with the MO-1065 form?

A: You may need to submit additional schedules and attachments with the MO-1065 form, depending on the partnership's activities and financial transactions. Refer to the form instructions for details.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1065 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.