This version of the form is not currently in use and is provided for reference only. Download this version of

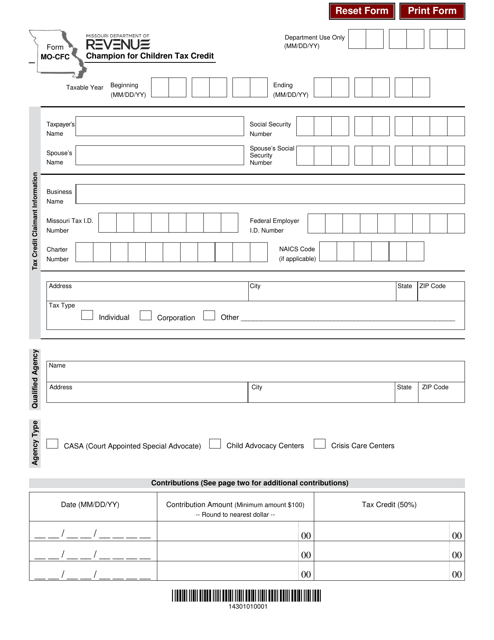

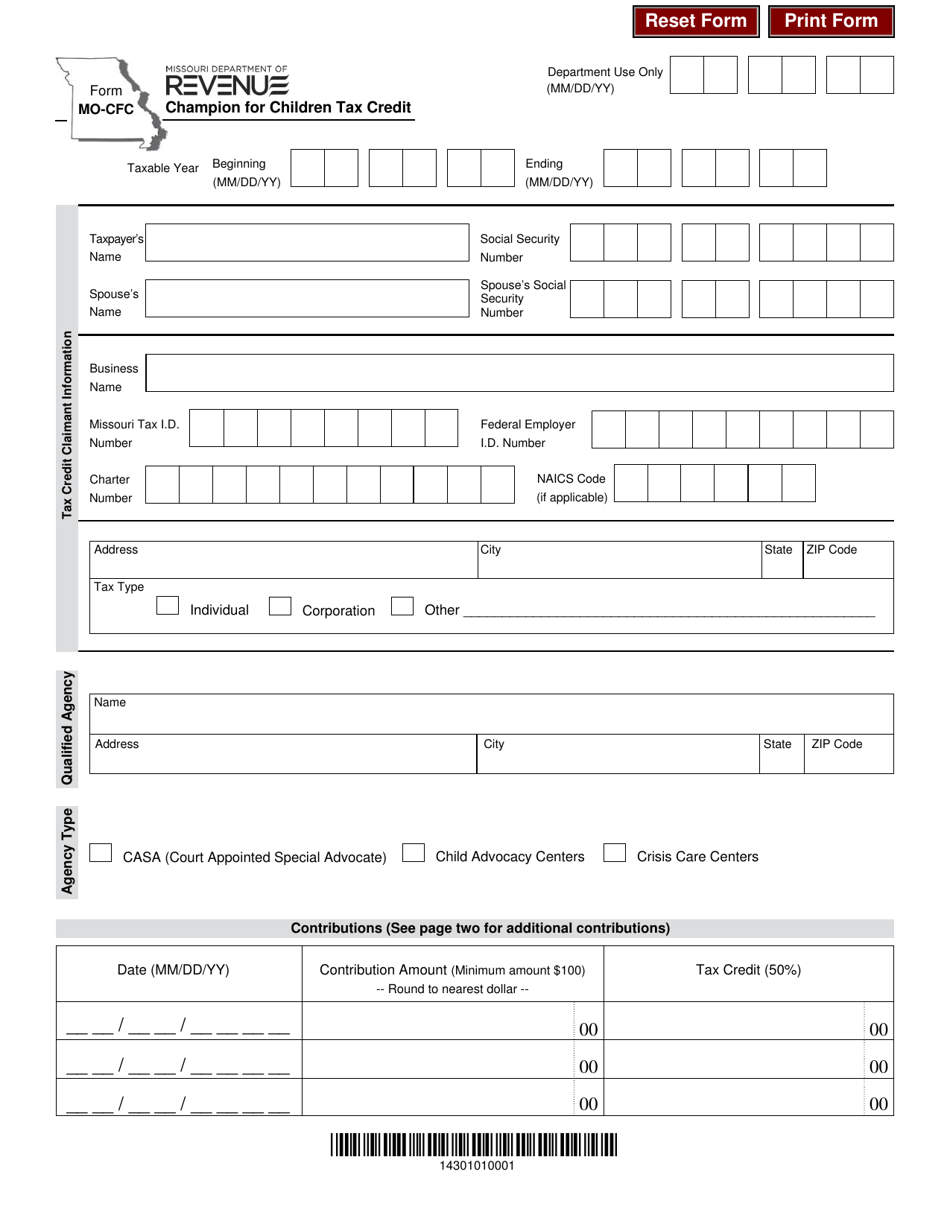

Form MO-CFC

for the current year.

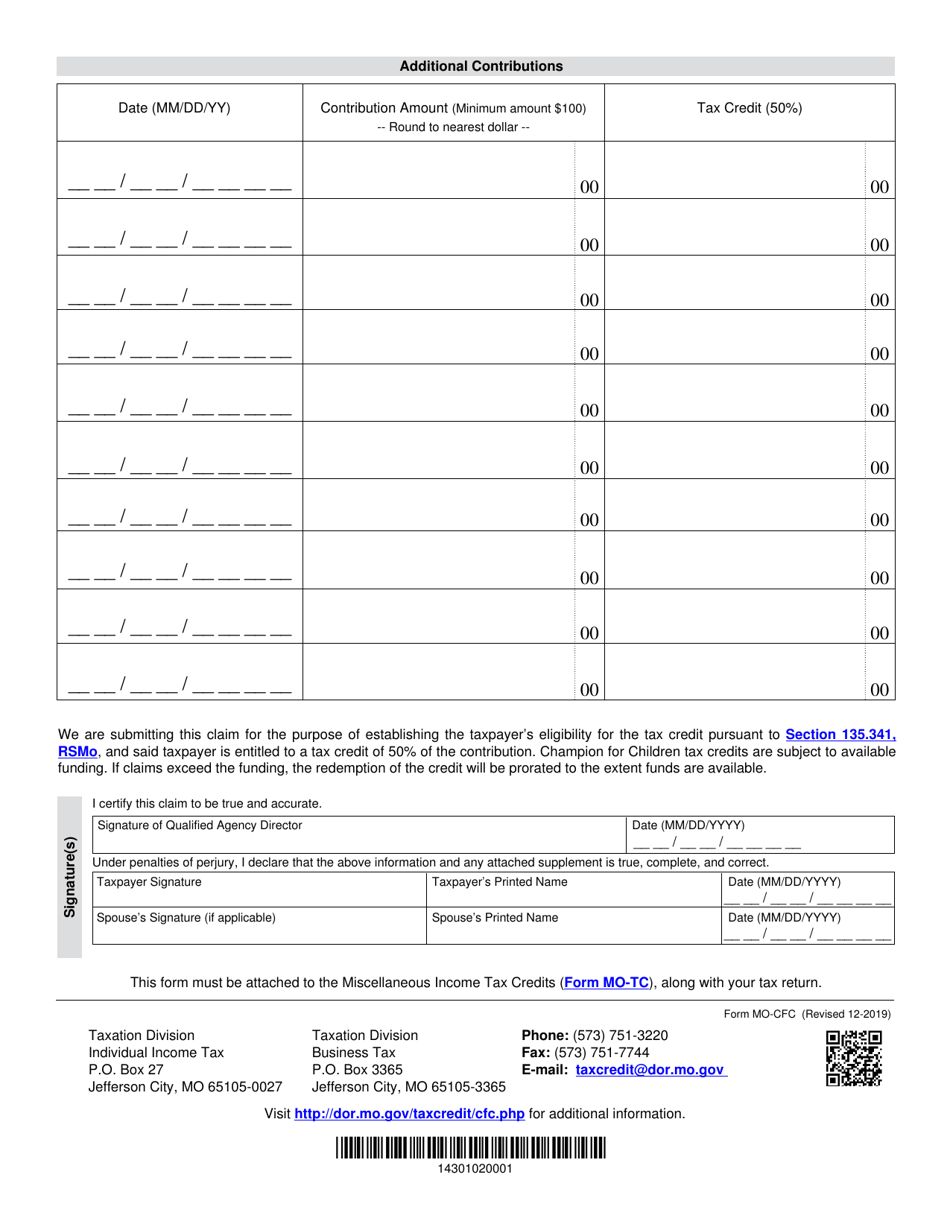

Form MO-CFC Champion for Children Tax Credit - Missouri

What Is Form MO-CFC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-CFC Champion for Children Tax Credit in Missouri?

A: The MO-CFC Champion for Children Tax Credit is a tax credit in Missouri that supports organizations working to improve the lives of children.

Q: Who is eligible for the MO-CFC Champion for Children Tax Credit?

A: Individuals, corporations, and businesses in Missouri are eligible to claim the MO-CFC Champion for Children Tax Credit.

Q: How much is the MO-CFC Champion for Children Tax Credit?

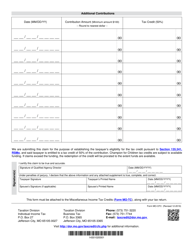

A: The tax credit is equal to 50% of the donation made to a qualified organization, up to a maximum of $200,000 per taxpayer or $500,000 per married couple filing a joint return.

Q: What is a qualified organization for the MO-CFC Champion for Children Tax Credit?

A: Qualified organizations include nonprofit 501(c)(3) organizations that are engaged in providing services to children in Missouri.

Q: How do I claim the MO-CFC Champion for Children Tax Credit?

A: To claim the tax credit, you need to complete Form MO-CFC and submit it with your Missouri state tax return.

Q: Is the MO-CFC Champion for Children Tax Credit refundable?

A: No, the MO-CFC Champion for Children Tax Credit is non-refundable. It can only be used to offset your Missouri state income tax liability.

Q: Are there any limitations on the MO-CFC Champion for Children Tax Credit?

A: Yes, there are limitations on the tax credit. The total amount of credits available each year is capped, and the credits are awarded on a first-come, first-served basis.

Q: Can I carry forward any unused MO-CFC Champion for Children Tax Credit?

A: No, any unused tax credit cannot be carried forward to future tax years.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-CFC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.