This version of the form is not currently in use and is provided for reference only. Download this version of

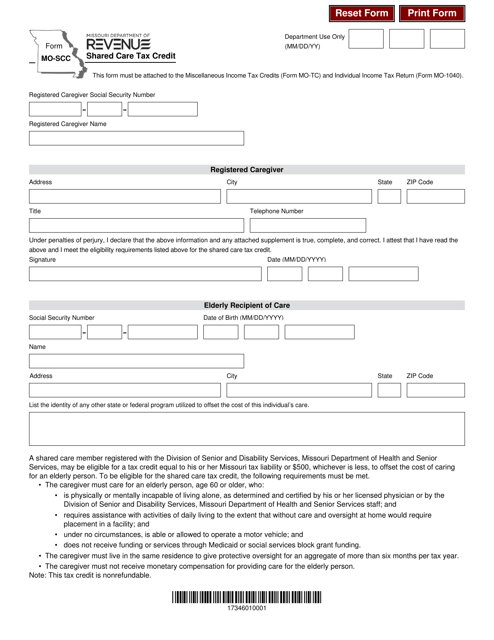

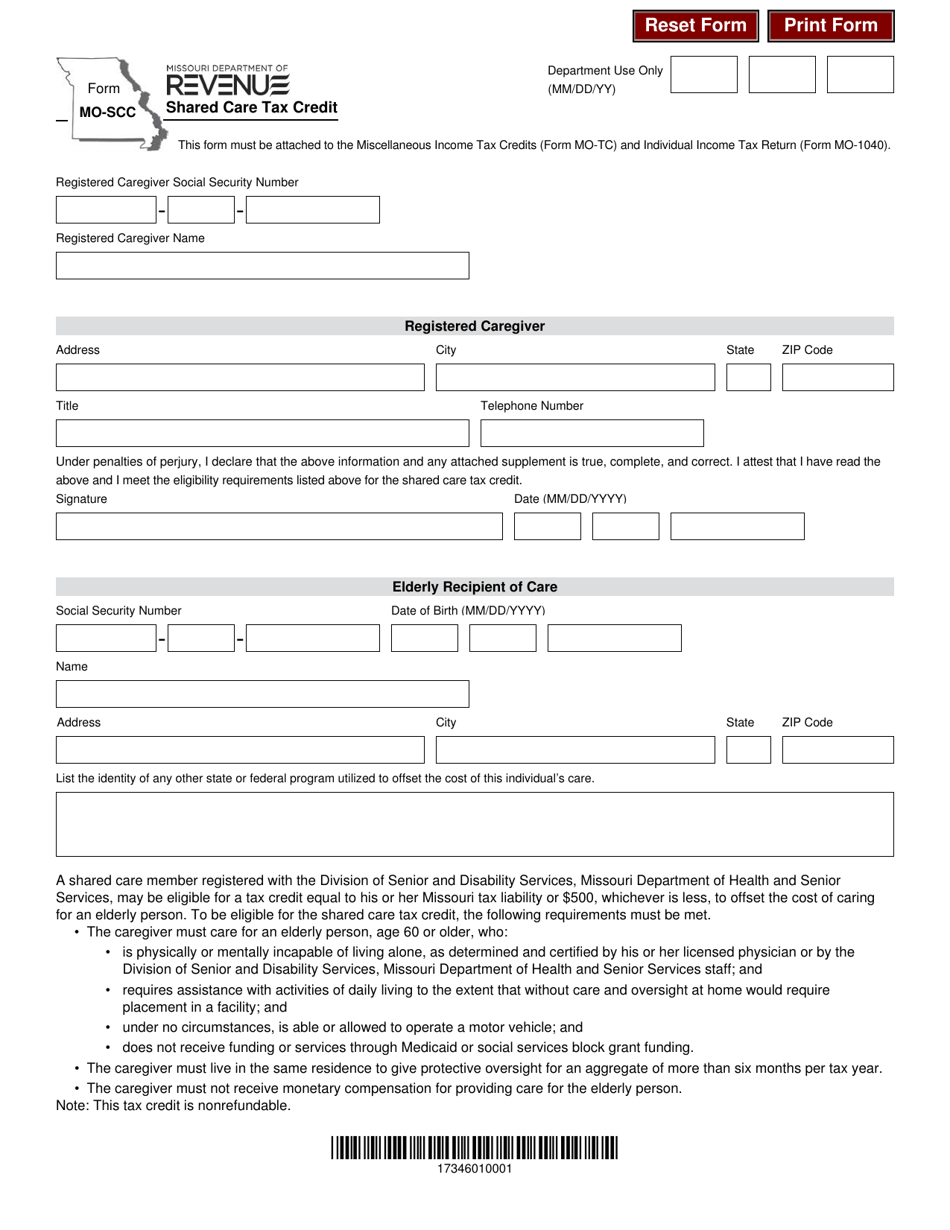

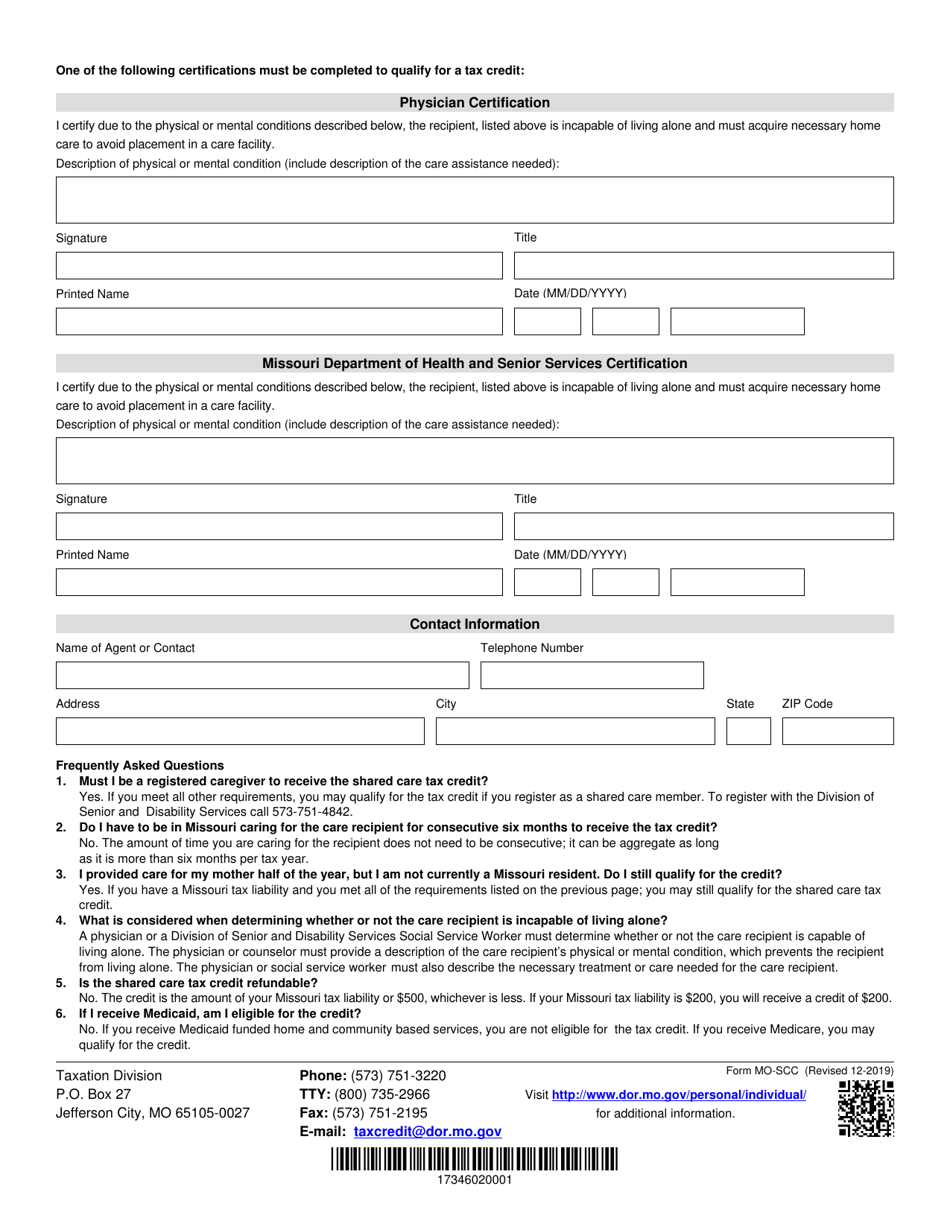

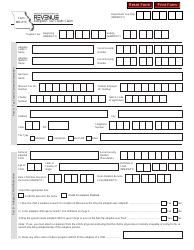

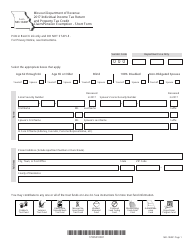

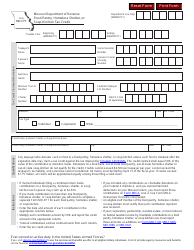

Form MO-SCC

for the current year.

Form MO-SCC Shared Care Tax Credit - Missouri

What Is Form MO-SCC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

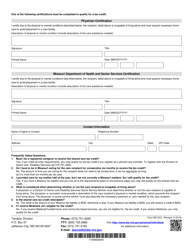

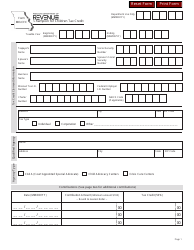

Q: What is the MO-SCC Shared Care Tax Credit?

A: The MO-SCC Shared Care Tax Credit is a tax credit available to Missouri taxpayers who contribute to qualified child care facilities.

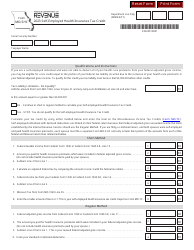

Q: Who is eligible for the MO-SCC Shared Care Tax Credit?

A: Missouri taxpayers who contribute to qualified child care facilities and meet certain income requirements are eligible for the tax credit.

Q: What is a qualified child care facility?

A: A qualified child care facility is a facility licensed or regulated by the state of Missouri that provides care for children under the age of 13.

Q: How much is the MO-SCC Shared Care Tax Credit?

A: The tax credit is equal to 50% of the taxpayer's eligible contribution, up to a maximum credit of $500 for individuals and $1,000 for married couples filing jointly.

Q: How do I claim the MO-SCC Shared Care Tax Credit?

A: To claim the tax credit, you must complete and attach Form MO-SCC to your Missouri state tax return.

Q: Is there a limit to the total amount of tax credits available?

A: Yes, there is an annual cap on the total amount of tax credits available. Once the cap is reached, no additional tax credits will be issued for that year.

Q: Can I carry forward unused tax credits?

A: No, unused tax credits cannot be carried forward to future years. They must be claimed in the year they were earned.

Q: When is the deadline to claim the MO-SCC Shared Care Tax Credit?

A: The deadline to claim the tax credit is the same as the deadline to file your Missouri state tax return, which is usually April 15th.

Q: Are there any other requirements to qualify for the MO-SCC Shared Care Tax Credit?

A: In addition to contributing to a qualified child care facility, you must also meet certain income requirements to qualify for the tax credit.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-SCC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.