This version of the form is not currently in use and is provided for reference only. Download this version of

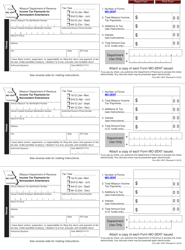

Form MO-1NR

for the current year.

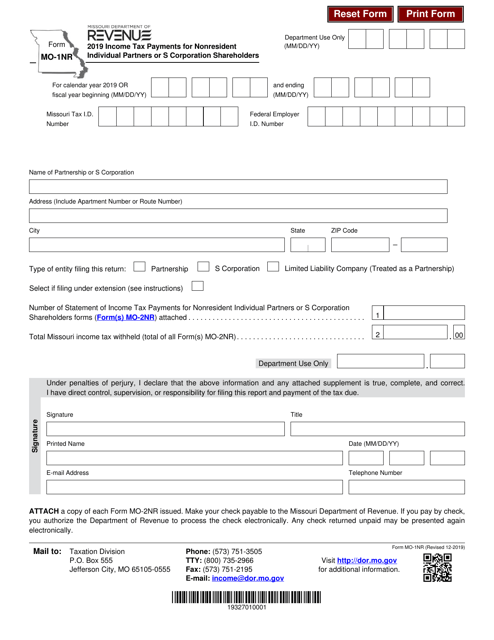

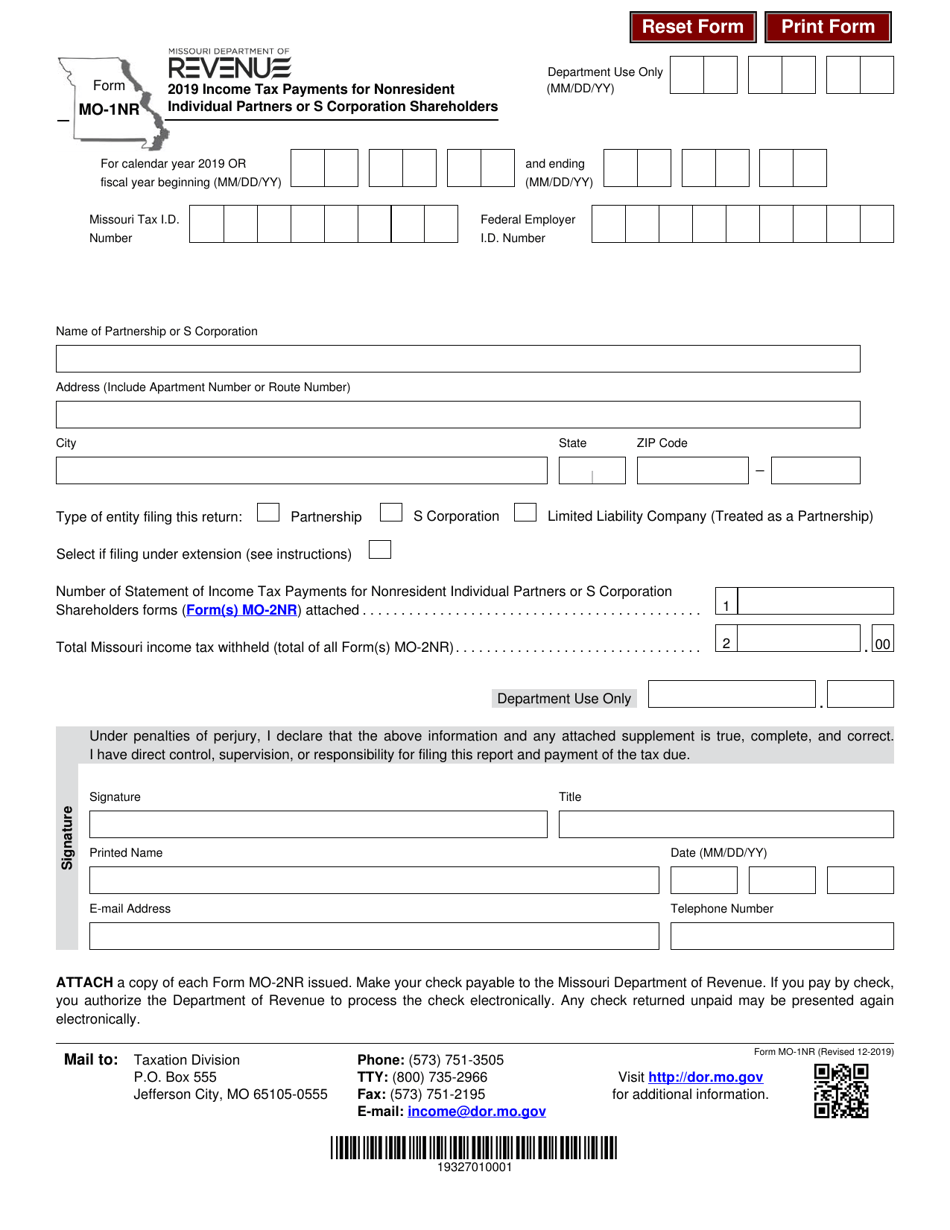

Form MO-1NR Income Tax Payments for Nonresident Individual Partners or S Corporation Shareholders - Missouri

What Is Form MO-1NR?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-1NR?

A: Form MO-1NR is used to report income tax payments for nonresident individual partners or S corporation shareholders in Missouri.

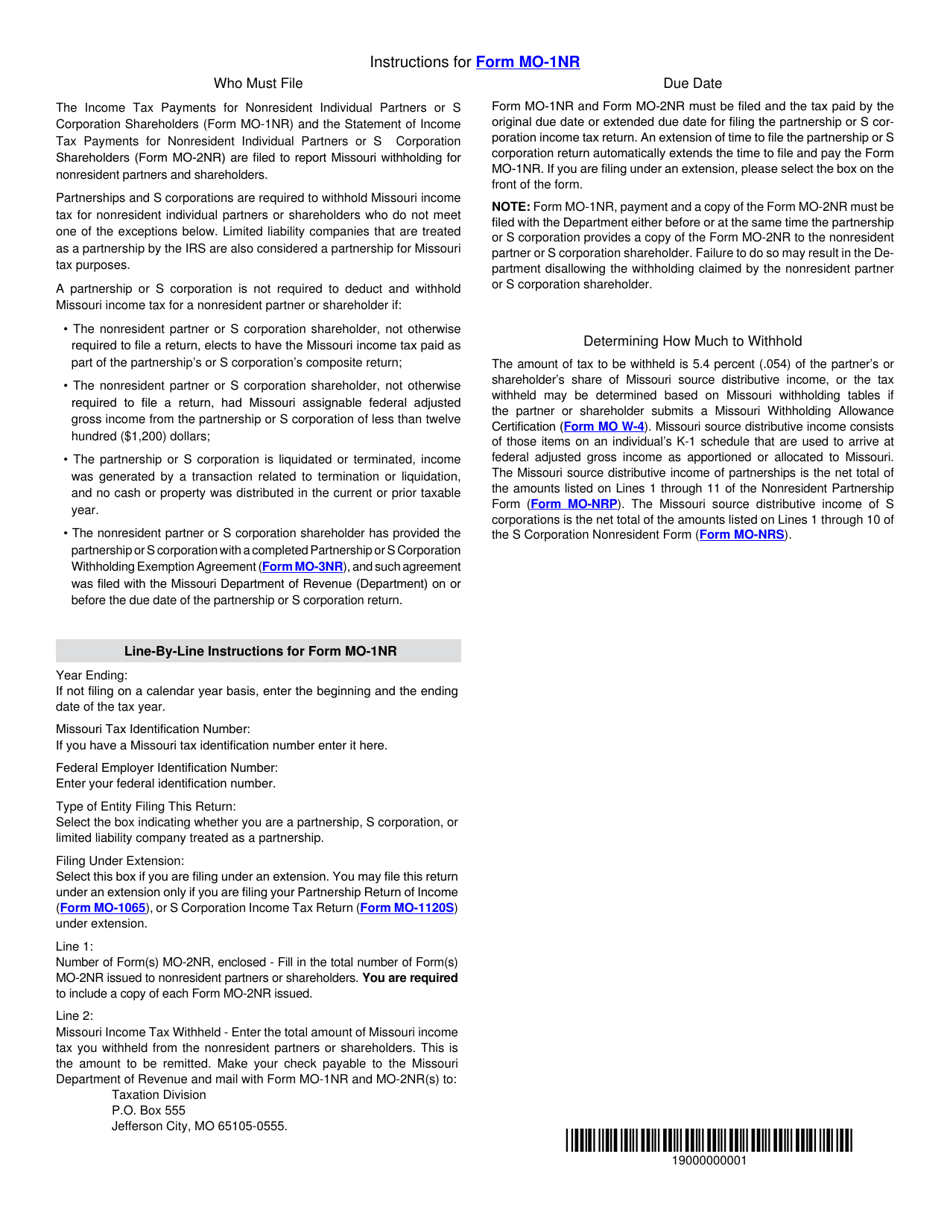

Q: Who needs to file Form MO-1NR?

A: Nonresident individual partners or S corporation shareholders in Missouri who have made income tax payments need to file Form MO-1NR.

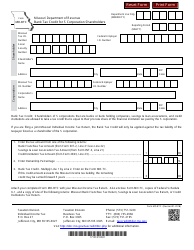

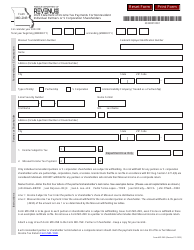

Q: What information is required on Form MO-1NR?

A: Form MO-1NR requires information such as the taxpayer's name, social security number, address, and the amount of income tax payments made.

Q: When is the deadline for filing Form MO-1NR?

A: The deadline for filing Form MO-1NR is the same as the deadline for filing your income tax return in Missouri, which is generally April 15th.

Q: What should I do if I am unable to pay the full amount of tax due?

A: If you are unable to pay the full amount of tax due, you should still file Form MO-1NR on time and then contact the Missouri Department of Revenue to discuss payment options.

Q: Are there any penalties for late filing of Form MO-1NR?

A: Yes, there may be penalties for late filing of Form MO-1NR. It is important to file the form on time to avoid penalties.

Q: Can I make corrections to Form MO-1NR after filing?

A: Yes, if you discover errors or need to make changes to Form MO-1NR after filing, you can file an amended return using Form MO-1120XNR.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Missouri Department of Revenue;

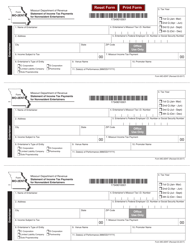

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1NR by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.