This version of the form is not currently in use and is provided for reference only. Download this version of

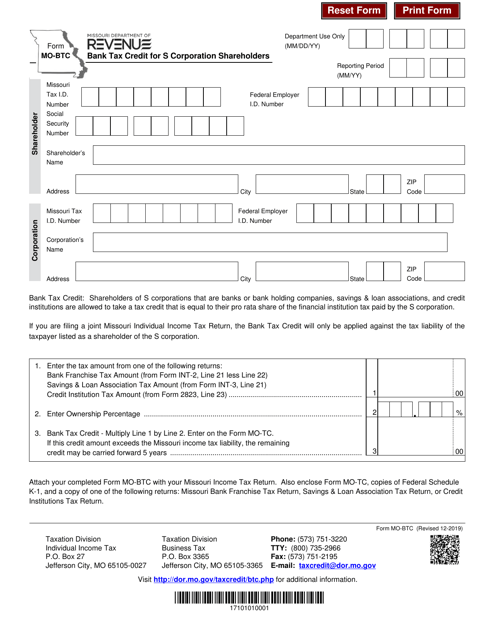

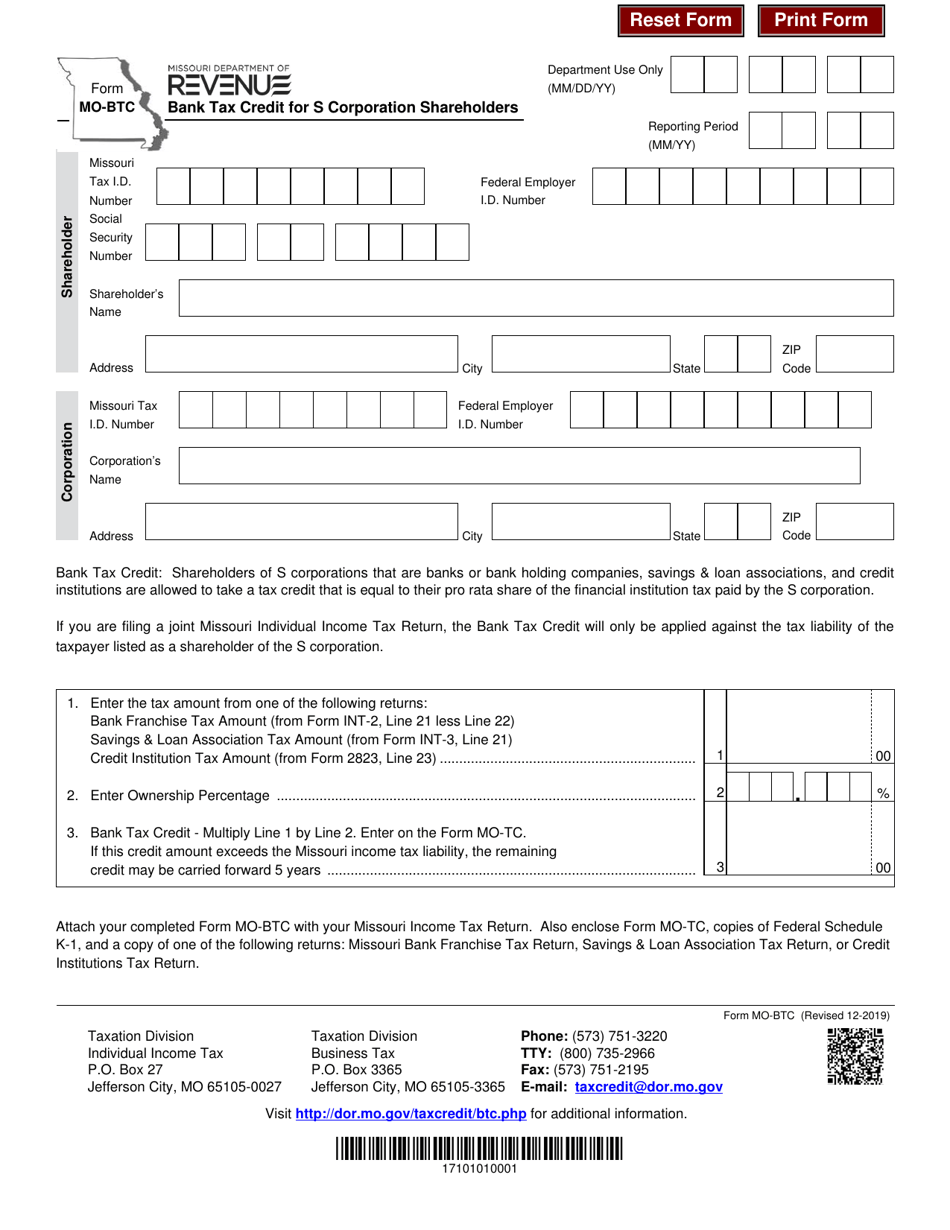

Form MO-BTC

for the current year.

Form MO-BTC Bank Tax Credit for S Corporation Shareholders - Missouri

What Is Form MO-BTC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-BTC Bank Tax Credit?

A: The MO-BTC Bank Tax Credit is a tax credit available to S Corporation shareholders in Missouri.

Q: Who is eligible for the MO-BTC Bank Tax Credit?

A: S Corporation shareholders in Missouri are eligible for the MO-BTC Bank Tax Credit.

Q: How do I apply for the MO-BTC Bank Tax Credit?

A: You can apply for the MO-BTC Bank Tax Credit by completing and filing Form MO-BTC.

Q: What is the purpose of the MO-BTC Bank Tax Credit?

A: The purpose of the MO-BTC Bank Tax Credit is to incentivize investment in certain banks and financial institutions in Missouri.

Q: What are the benefits of the MO-BTC Bank Tax Credit?

A: The benefits of the MO-BTC Bank Tax Credit include a reduction in state income tax liability for eligible S Corporation shareholders.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-BTC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.