This version of the form is not currently in use and is provided for reference only. Download this version of

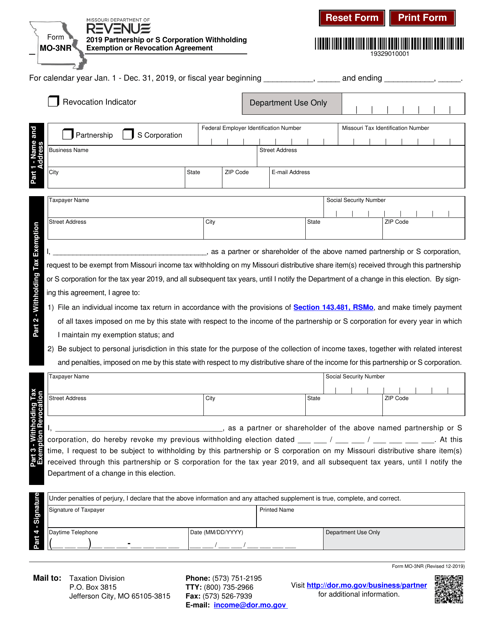

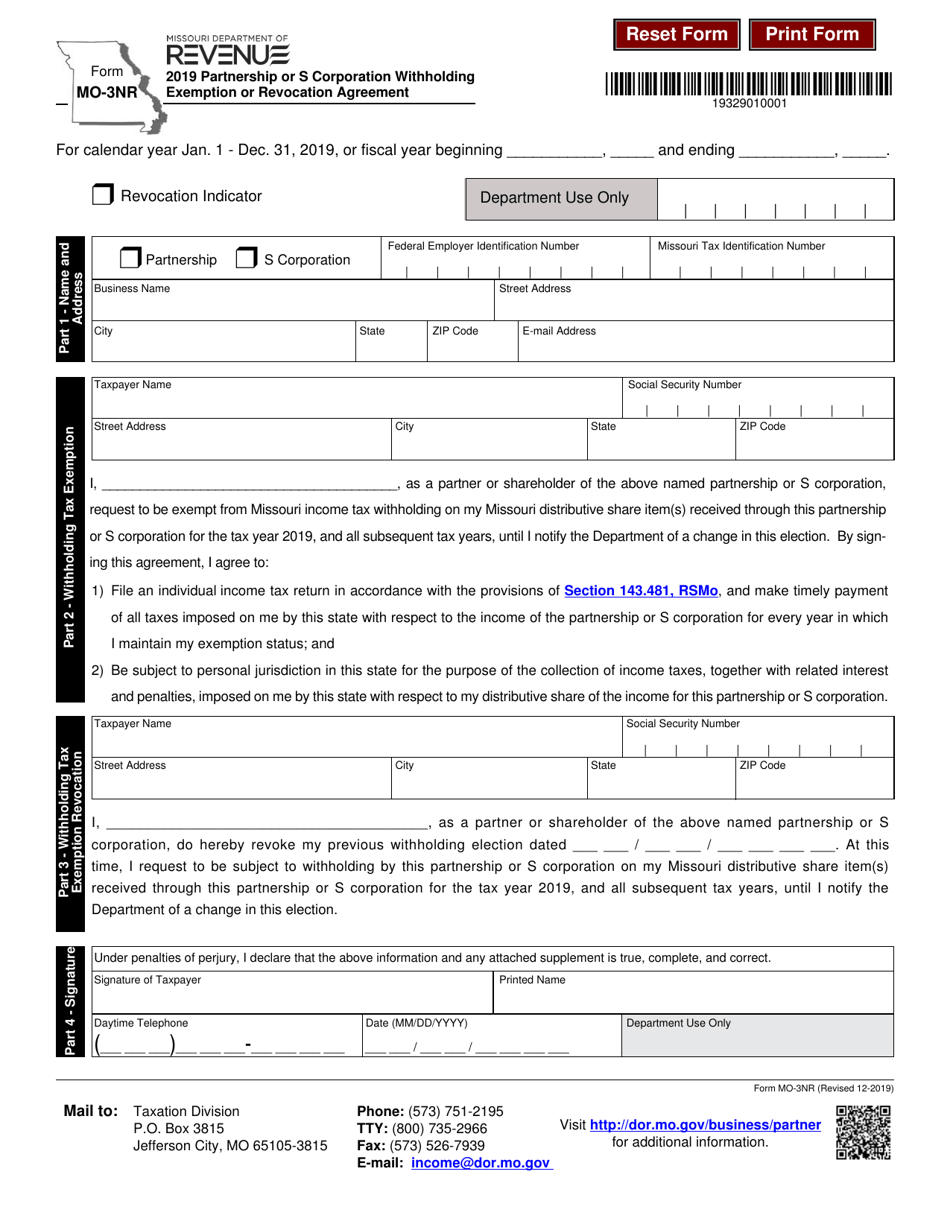

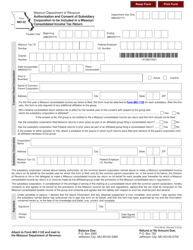

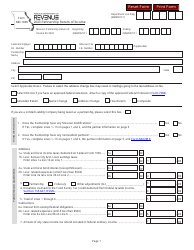

Form MO-3NR

for the current year.

Form MO-3NR Partnership or S Corporation Withholding Exemption or Revocation Agreement - Missouri

What Is Form MO-3NR?

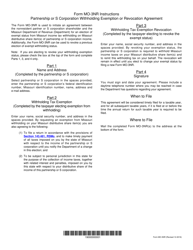

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-3NR?

A: Form MO-3NR is the Partnership or S Corporation Withholding Exemption or Revocation Agreement in Missouri.

Q: Who needs to fill out Form MO-3NR?

A: Partnerships or S Corporations in Missouri.

Q: What is the purpose of Form MO-3NR?

A: The purpose of Form MO-3NR is to claim an exemption from state withholding on behalf of a partner or shareholder who is a nonresident individual or entity.

Q: When should Form MO-3NR be filed?

A: Form MO-3NR should be filed within 10 days of the partnership or S corporation being formed or within 10 days of the exemption being revoked.

Q: Is there a fee to file Form MO-3NR?

A: No, there is no fee to file Form MO-3NR.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-3NR by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.