This version of the form is not currently in use and is provided for reference only. Download this version of

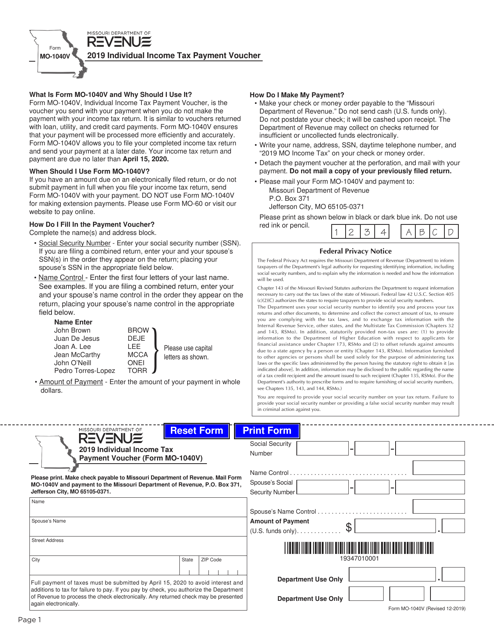

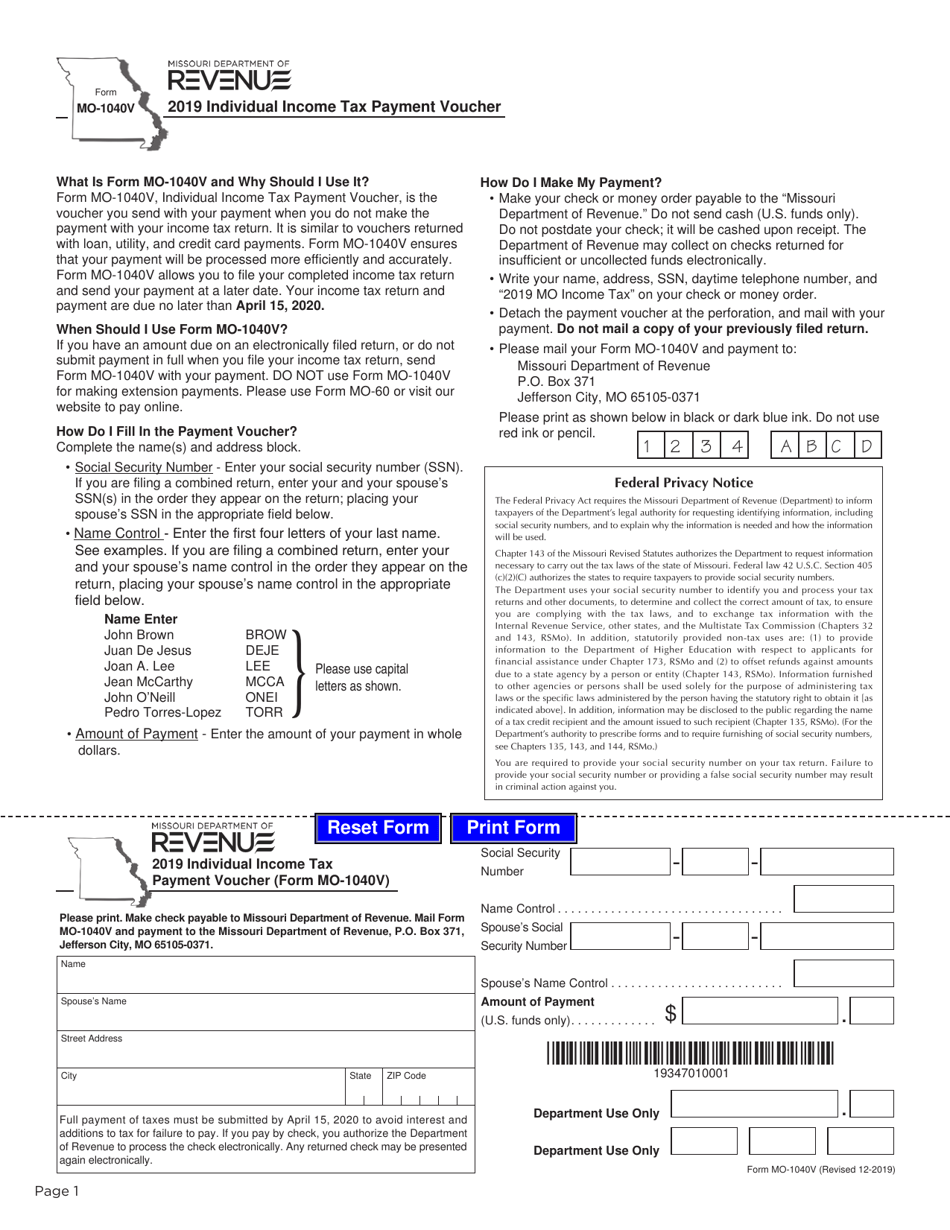

Form MO-1040V

for the current year.

Form MO-1040V Individual Income Tax Payment Voucher - Missouri

What Is Form MO-1040V?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-1040V form?

A: The MO-1040V is a payment voucher for individual income tax in Missouri.

Q: Who should use the MO-1040V form?

A: Individuals in Missouri who need to make a payment for their income tax.

Q: What is the purpose of the MO-1040V form?

A: The form is used to submit a payment for individual income tax owed to the state of Missouri.

Q: Do I need to file the MO-1040V form if I am due a refund?

A: No, the form is only used to make payments for owed income tax. If you are due a refund, you do not need to submit this form.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1040V by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.