This version of the form is not currently in use and is provided for reference only. Download this version of

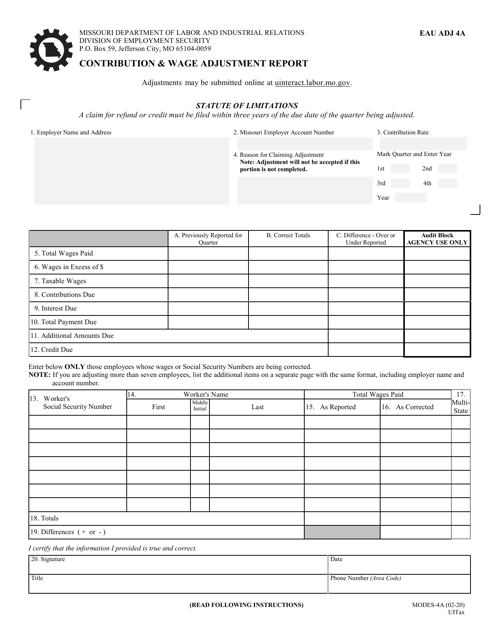

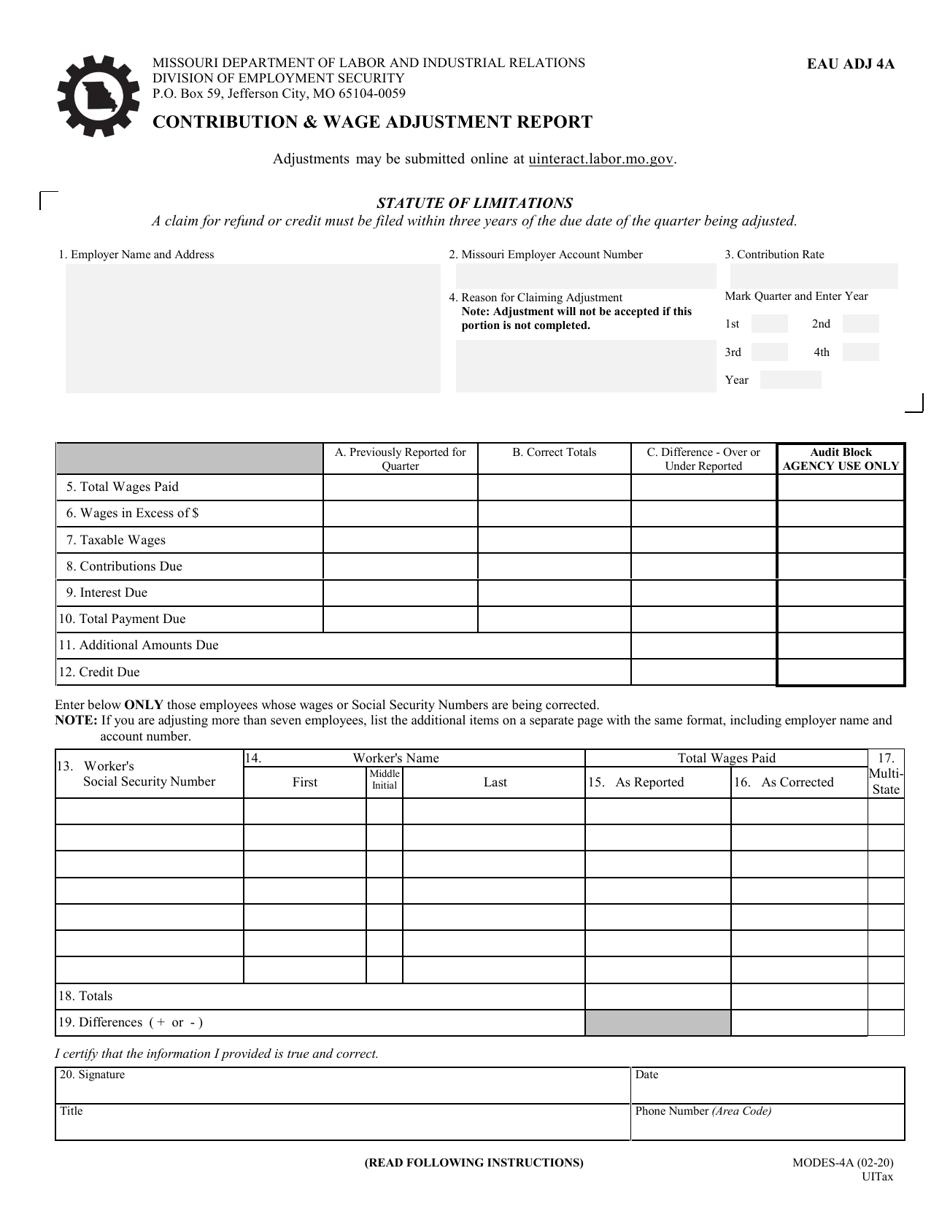

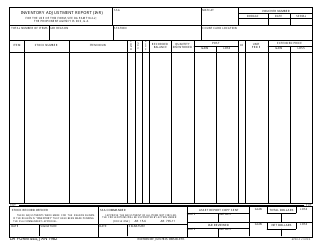

Form MODES-4A

for the current year.

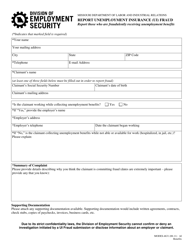

Form MODES-4A Contribution & Wage Adjustment Report - Missouri

What Is Form MODES-4A?

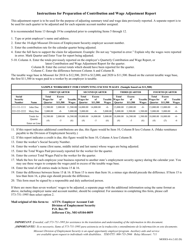

This is a legal form that was released by the Missouri Department of Labor and Industrial Relations - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

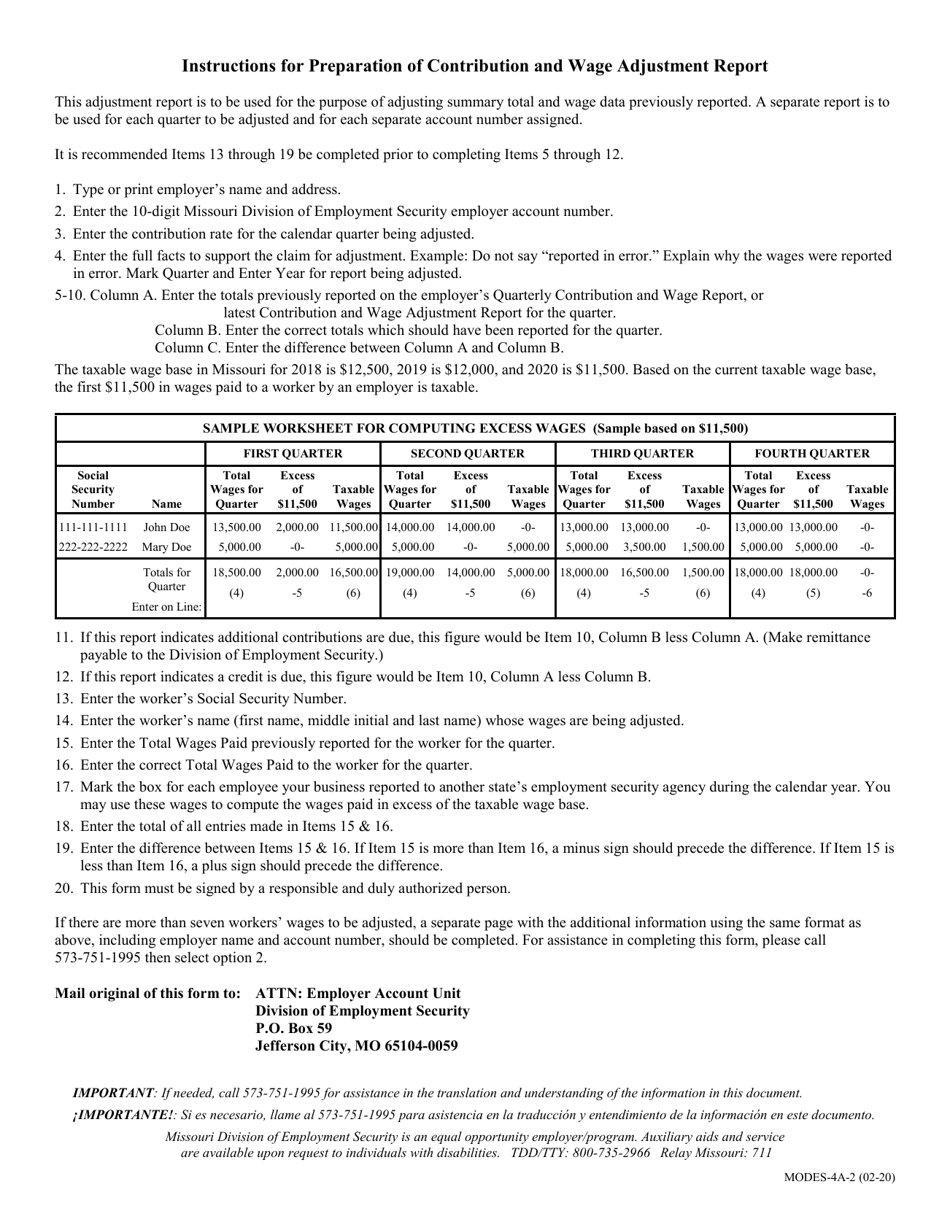

Q: What is the MODES-4A Contribution & Wage Adjustment Report?

A: The MODES-4A Contribution & Wage Adjustment Report is a document used in Missouri to report employment contributions and wage adjustments for tax purposes.

Q: Who needs to file the MODES-4A Contribution & Wage Adjustment Report?

A: Employers in Missouri who are required to contribute to the state's unemployment insurance program need to file the MODES-4A Contribution & Wage Adjustment Report.

Q: How often is the MODES-4A Contribution & Wage Adjustment Report filed?

A: The MODES-4A Contribution & Wage Adjustment Report is filed on a quarterly basis.

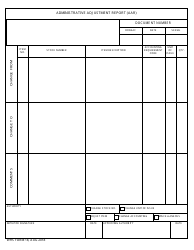

Q: What information is required on the MODES-4A Contribution & Wage Adjustment Report?

A: The report requires information about the employer, including their name, address, and tax identification number, as well as details about their employees' wages and contributions.

Q: Are there any penalties for not filing the MODES-4A Contribution & Wage Adjustment Report?

A: Yes, failure to file the report or filing it late can result in penalties and interest charges.

Q: What is the deadline for filing the MODES-4A Contribution & Wage Adjustment Report?

A: The deadline for filing the report is the last day of the month following the end of the calendar quarter.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Missouri Department of Labor and Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MODES-4A by clicking the link below or browse more documents and templates provided by the Missouri Department of Labor and Industrial Relations.