This version of the form is not currently in use and is provided for reference only. Download this version of

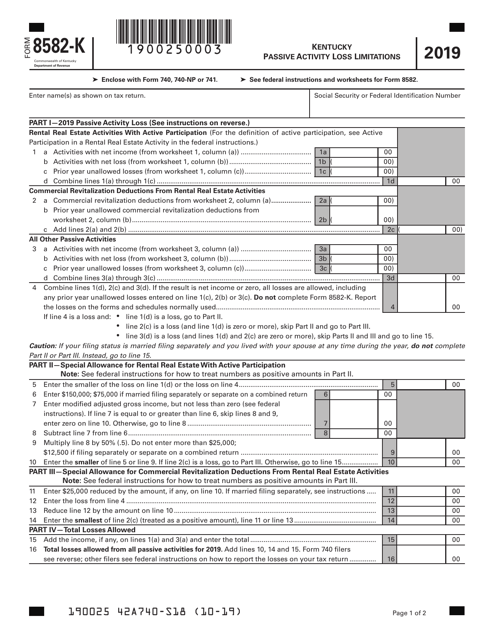

Form 8582-K

for the current year.

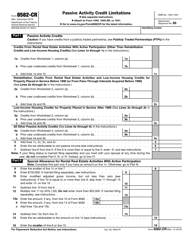

Form 8582-K Kentucky Passive Activity Loss Limitation - Kentucky

What Is Form 8582-K?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 8582-K?

A: Form 8582-K is the Kentucky Passive Activity Loss Limitation form.

Q: What is the purpose of Form 8582-K?

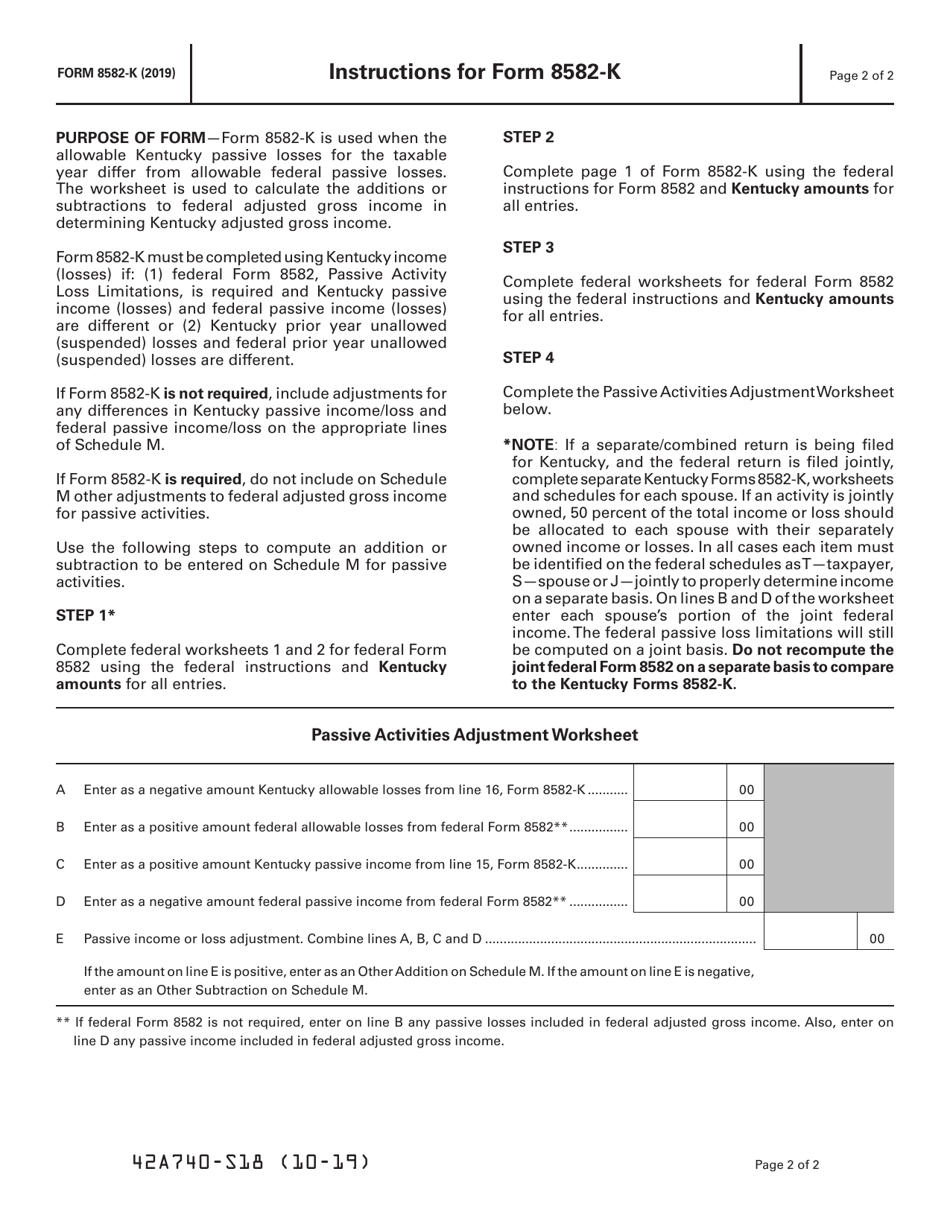

A: The purpose of Form 8582-K is to calculate the amount of passive activity loss that can be deducted on your Kentucky state tax return.

Q: Who needs to file Form 8582-K?

A: Kentucky residents who have passive activity income or losses need to file Form 8582-K.

Q: What is passive activity loss?

A: Passive activity loss is a loss that comes from a rental activity, trade or business in which you do not materially participate, or a partnership or S corporation in which you are a limited partner or shareholder.

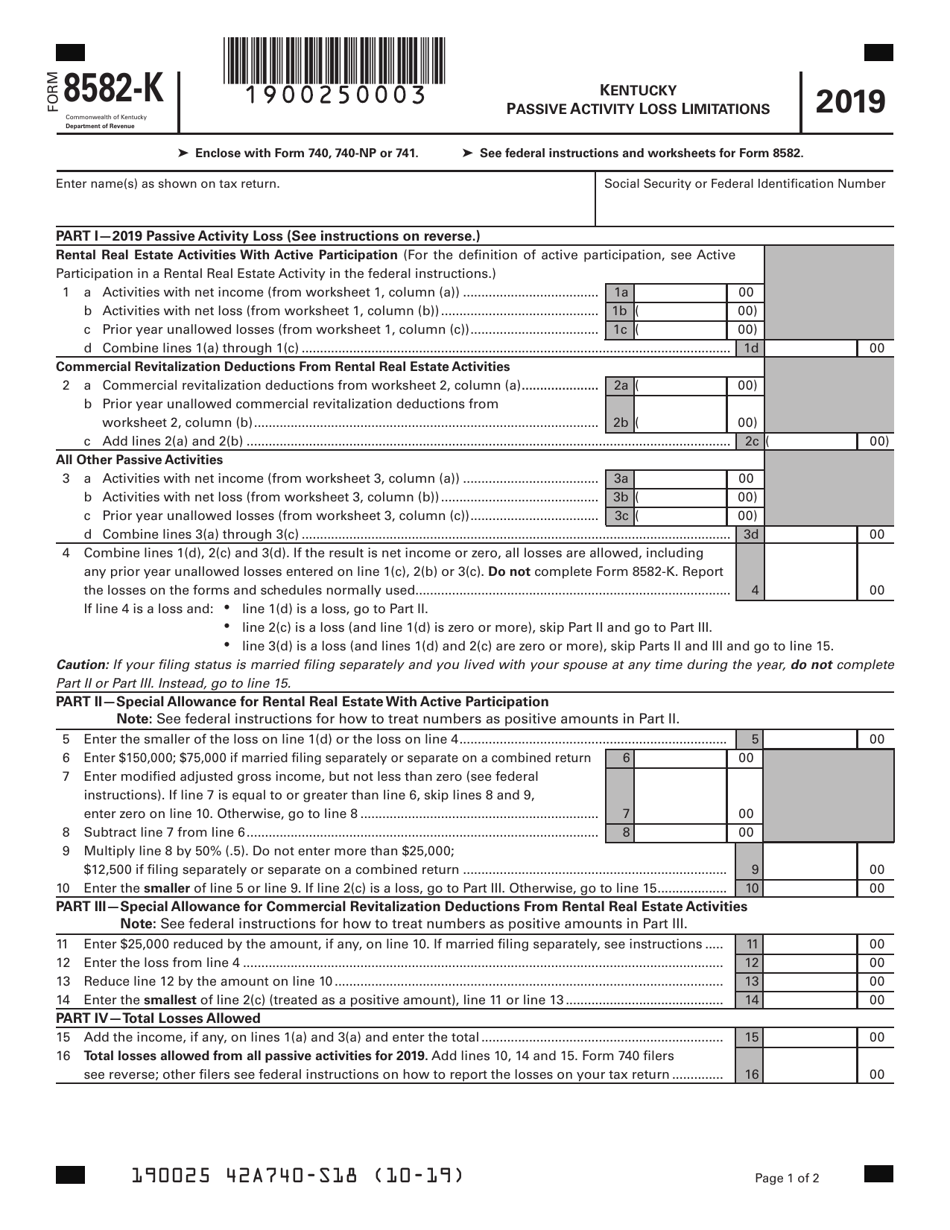

Q: How do I fill out Form 8582-K?

A: To fill out Form 8582-K, you will need to report your passive activity income and losses, calculate the allowable passive activity loss, and determine the amount to carry forward to future tax years.

Q: When is Form 8582-K due?

A: Form 8582-K is generally due on the same day as your Kentucky state tax return, which is April 15th.

Q: Is there a fee for filing Form 8582-K?

A: There is no fee for filing Form 8582-K.

Q: What happens if I don't file Form 8582-K?

A: If you have passive activity income or losses and fail to file Form 8582-K, you may not be able to deduct the full amount of your passive activity losses on your Kentucky state tax return.

Form Details:

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 8582-K by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.