This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form ST-1, 002

for the current year.

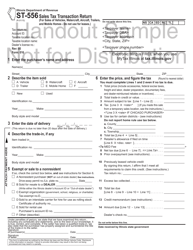

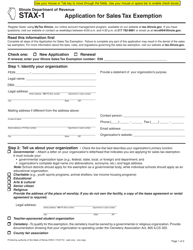

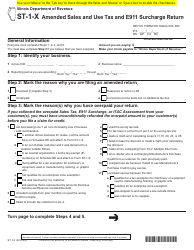

Instructions for Form ST-1, 002 Sales and Use Tax and E911 Surcharge Return - Illinois

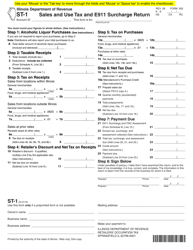

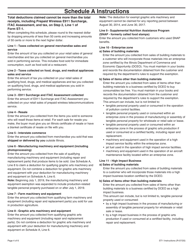

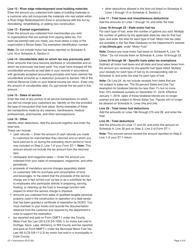

This document contains official instructions for Form ST-1 , and Form 002 . Both forms are released and collected by the Illinois Department of Revenue. An up-to-date fillable Form ST-1 is available for download through this link.

FAQ

Q: What is Form ST-1?

A: Form ST-1 is the Sales and Use Tax and E911 Surcharge Return in Illinois.

Q: What is the purpose of Form ST-1?

A: The purpose of Form ST-1 is to report and pay sales and use tax, as well as the E911 surcharge, in Illinois.

Q: Who needs to file Form ST-1?

A: Businesses engaged in selling tangible personal property or taxable services in Illinois need to file Form ST-1.

Q: How often do I need to file Form ST-1?

A: Most businesses need to file Form ST-1 on a monthly basis. However, some businesses may be eligible for quarterly or annual filing.

Q: What is the E911 surcharge?

A: The E911 surcharge is a fee imposed on certain telecommunication services in Illinois to fund the state's emergency telephone system.

Q: What are the penalties for not filing Form ST-1?

A: Failure to file Form ST-1 or pay the required taxes can result in penalties, interest, and other enforcement actions by the Illinois Department of Revenue.

Q: What information do I need to complete Form ST-1?

A: You will need information about your business, sales and use tax collected, and the E911 surcharge collected.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.