This version of the form is not currently in use and is provided for reference only. Download this version of

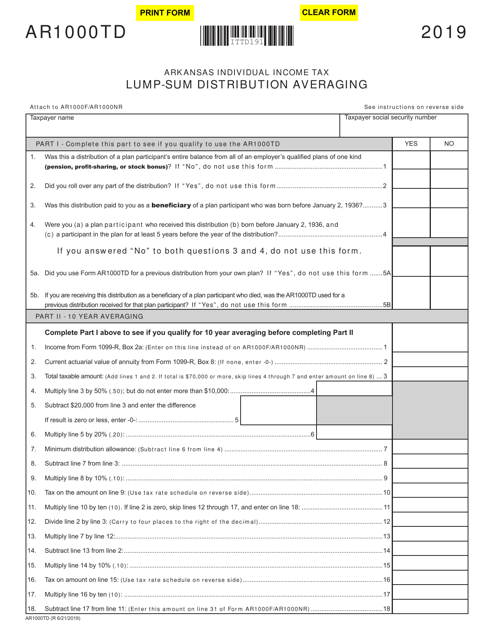

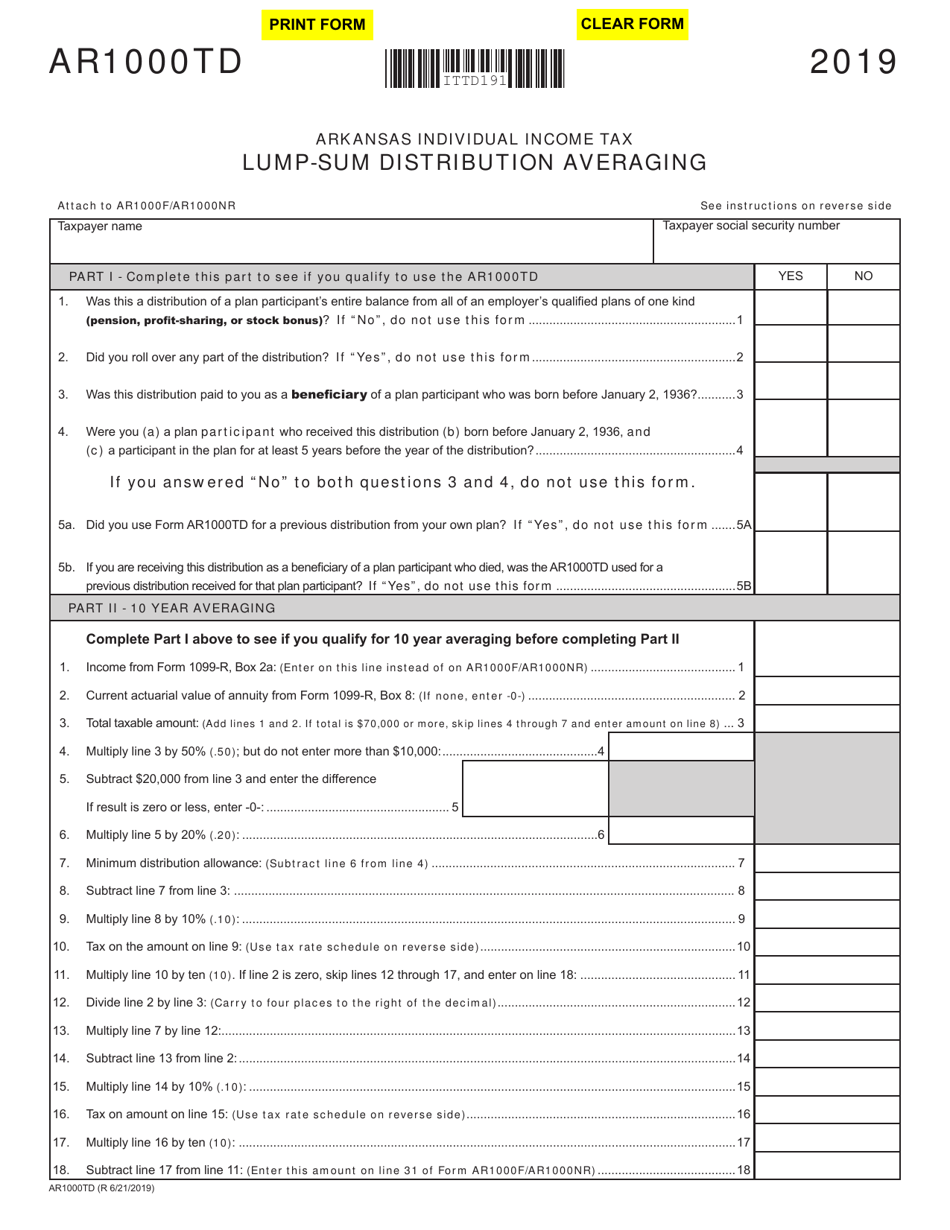

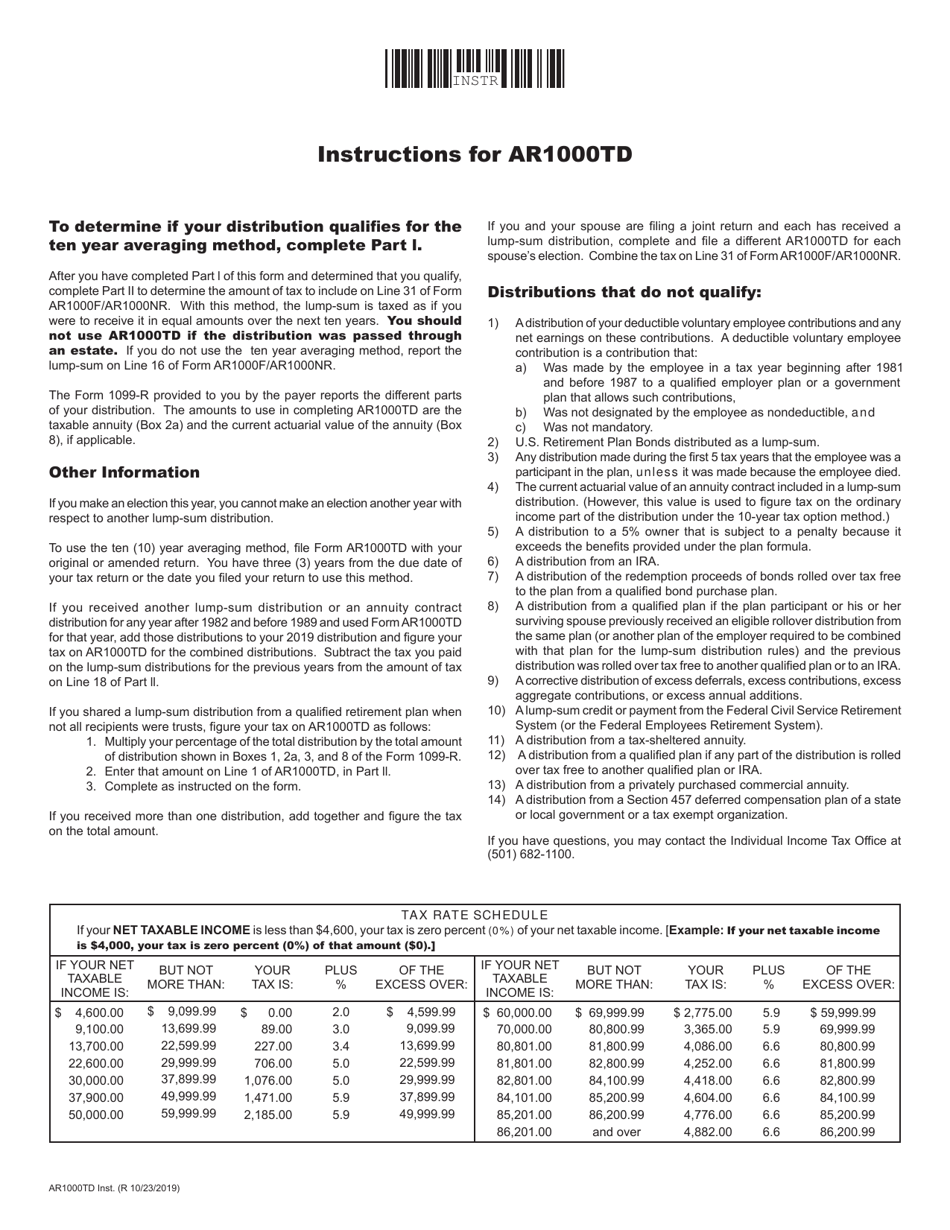

Form AR1000TD

for the current year.

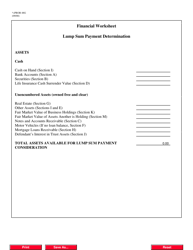

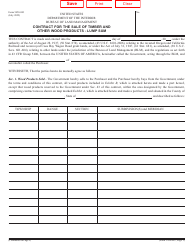

Form AR1000TD Lump-Sum Distribution Averaging - Arkansas

What Is Form AR1000TD?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR1000TD?

A: Form AR1000TD is a tax form used by residents of Arkansas to report lump-sum distributions and calculate the averaging of the tax.

Q: What is a lump-sum distribution?

A: A lump-sum distribution refers to a one-time payment received from a retirement plan, such as a pension or an IRA.

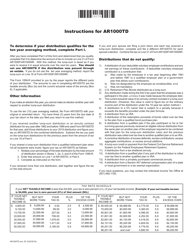

Q: How does the averaging of the tax work for lump-sum distributions in Arkansas?

A: The averaging of the tax allows taxpayers to spread out the tax liability of the lump-sum distribution over a period of three years.

Q: Who needs to file Form AR1000TD?

A: Residents of Arkansas who received a lump-sum distribution and want to take advantage of the tax averaging option need to file Form AR1000TD.

Q: Are there any eligibility requirements to use the tax averaging option?

A: Yes, there are specific eligibility requirements that taxpayers must meet to be able to use the tax averaging option. These requirements are outlined in the instructions for Form AR1000TD.

Q: When is the deadline to file Form AR1000TD?

A: The deadline to file Form AR1000TD is the same as the deadline for filing the annual Arkansas income tax return, which is usually April 15th, unless it falls on a weekend or holiday.

Q: Is there any fee associated with filing Form AR1000TD?

A: There is no fee associated with filing Form AR1000TD. However, taxpayers may need to pay taxes on the lump-sum distribution depending on their individual tax situation.

Q: Can Form AR1000TD be filed electronically?

A: Yes, Form AR1000TD can be filed electronically through the Arkansas Taxpayer Access Point (ATAP) system or through approved tax software.

Q: What supporting documents are required to be attached with Form AR1000TD?

A: Taxpayers are typically required to attach a copy of the federal Form 1040 and any other relevant forms or documentation related to the lump-sum distribution.

Q: Can I amend my return if I make a mistake on Form AR1000TD?

A: Yes, if you make a mistake on Form AR1000TD, you can file an amended return using Form AR-Amended. Make sure to follow the instructions provided with the form.

Form Details:

- Released on October 23, 2019;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1000TD by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.