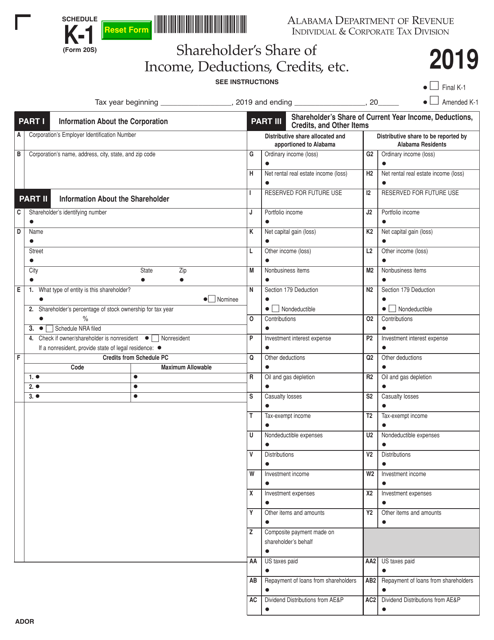

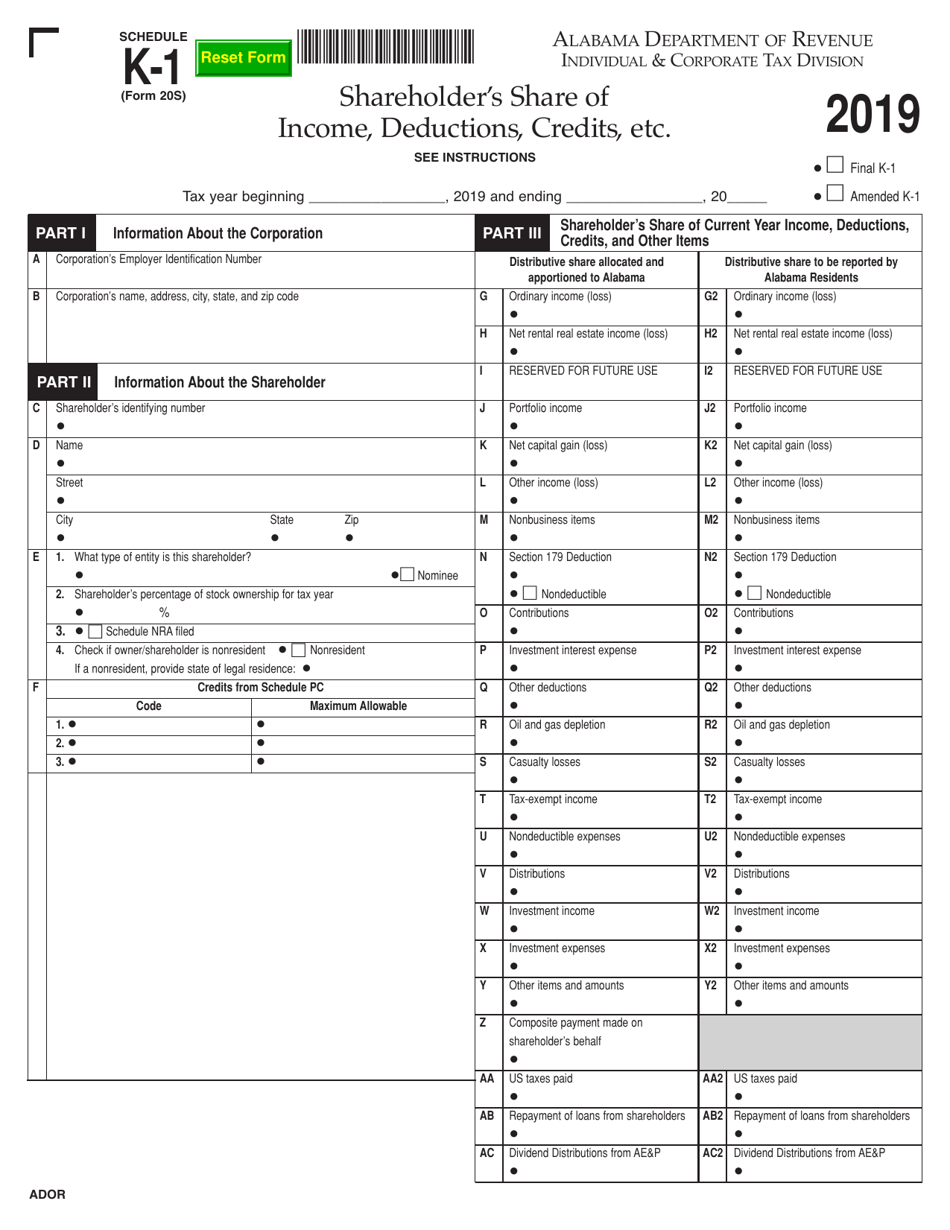

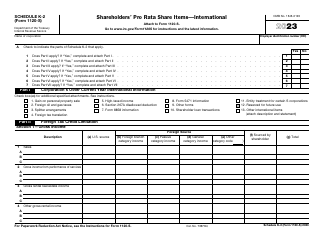

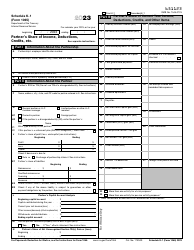

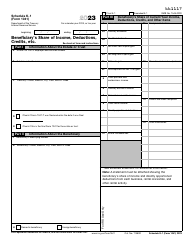

Form 20S Schedule K-1 Shareholder's Share of Income, Deductions, Credits, Etc. - Alabama

What Is Form 20S Schedule K-1?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 20S Schedule K-1?

A: Form 20S Schedule K-1 is a tax form used by shareholders of Alabama S corporations to report their share of income, deductions, credits, and other items.

Q: Who needs to file Form 20S Schedule K-1?

A: Shareholders of Alabama S corporations need to file Form 20S Schedule K-1.

Q: What information is reported on Form 20S Schedule K-1?

A: Form 20S Schedule K-1 reports a shareholder's share of the S corporation's income, deductions, credits, and other items.

Q: Is Form 20S Schedule K-1 required for individual taxpayers?

A: Yes, individual taxpayers who are shareholders of Alabama S corporations are required to file Form 20S Schedule K-1.

Q: When is the deadline to file Form 20S Schedule K-1?

A: The deadline to file Form 20S Schedule K-1 is generally the same as the deadline for filing your Alabama income tax return, which is April 15th.

Q: What if I need more time to file Form 20S Schedule K-1?

A: If you need more time to file Form 20S Schedule K-1, you can request an extension by filing Form 4868 with the Alabama Department of Revenue.

Q: Are there any penalties for not filing Form 20S Schedule K-1?

A: Yes, there are penalties for not filing Form 20S Schedule K-1, including late filing penalties and interest on any unpaid taxes.

Q: Do I need to include a copy of Form 20S Schedule K-1 with my federal tax return?

A: No, you do not need to include a copy of Form 20S Schedule K-1 with your federal tax return. It is only for state tax purposes.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 20S Schedule K-1 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.