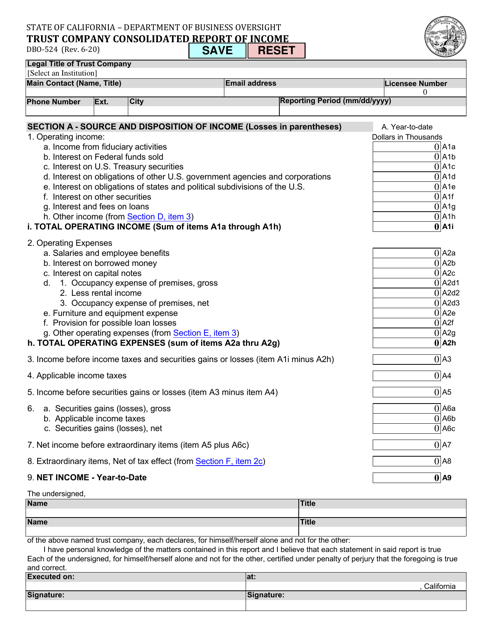

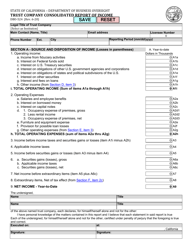

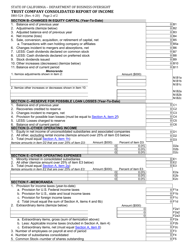

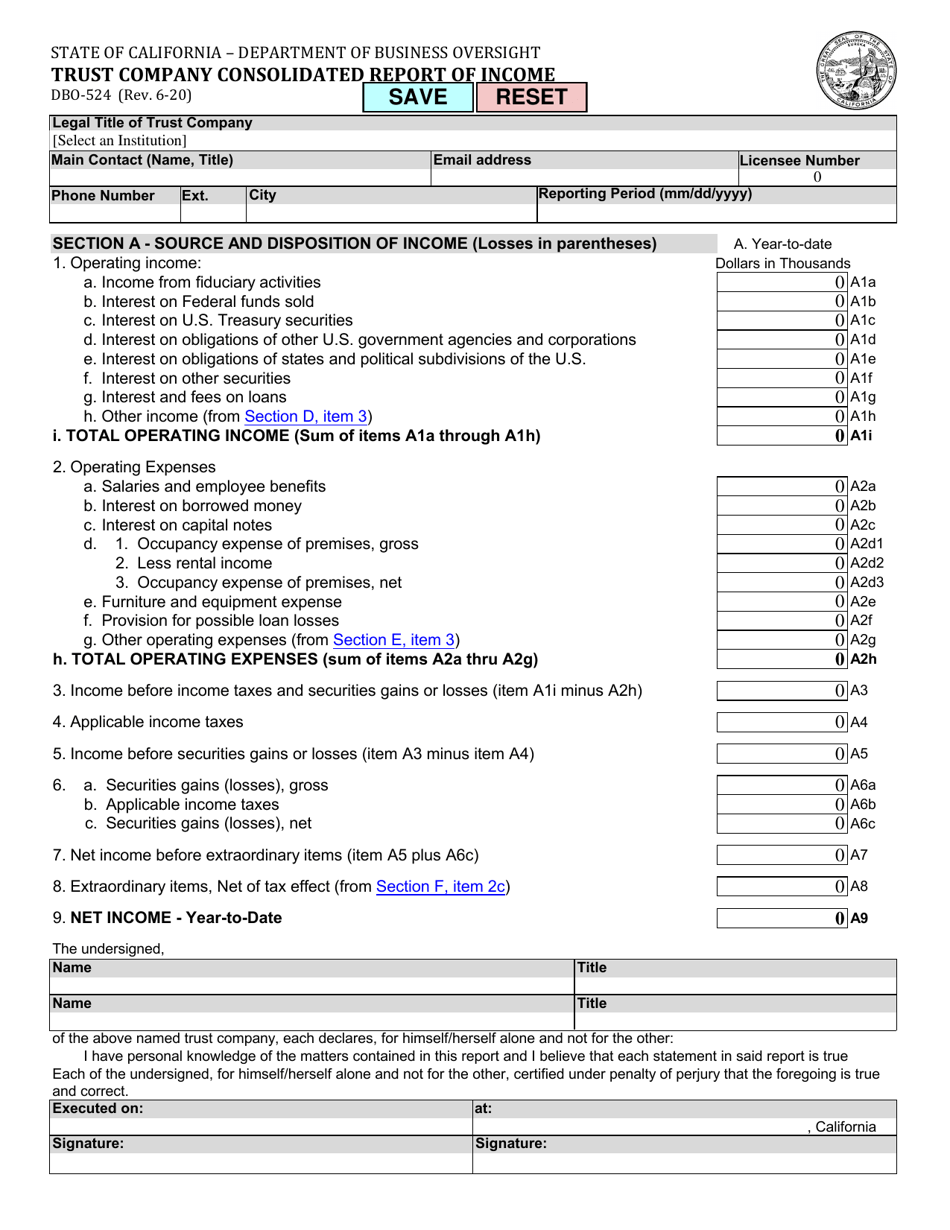

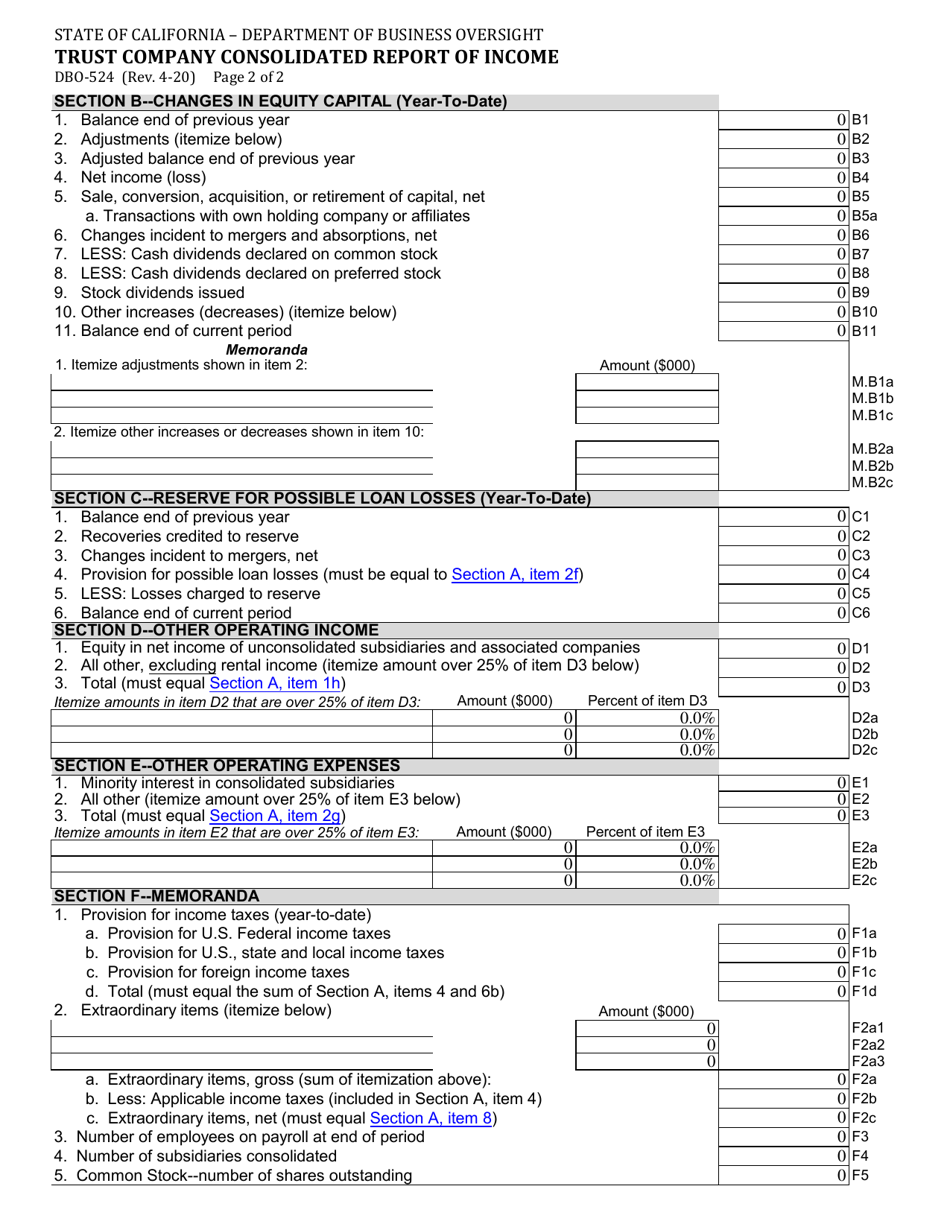

Form DBO-524 Trust Company Consolidated Report of Income - California

What Is Form DBO-524?

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DBO-524?

A: Form DBO-524 is the Trust CompanyConsolidated Report of Income for the state of California.

Q: Who needs to file Form DBO-524?

A: Trust companies in California need to file Form DBO-524.

Q: What is the purpose of Form DBO-524?

A: The purpose of Form DBO-524 is to report the consolidated income of trust companies in California.

Q: When is the deadline to file Form DBO-524?

A: The deadline to file Form DBO-524 is usually April 15th of each year.

Q: Is there a penalty for not filing Form DBO-524?

A: Yes, there may be penalties for not filing Form DBO-524 or for filing it late.

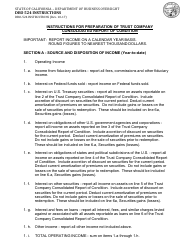

Q: Are there any specific instructions for filling out Form DBO-524?

A: Yes, the California DBO provides detailed instructions for filling out Form DBO-524.

Q: Can I e-file Form DBO-524?

A: Yes, you can e-file Form DBO-524 if you prefer.

Q: Is Form DBO-524 applicable only to trust companies?

A: Yes, Form DBO-524 is specifically for trust companies in California.

Q: Can I request an extension for filing Form DBO-524?

A: Yes, you can request an extension for filing Form DBO-524 by contacting the California DBO.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DBO-524 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.