This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

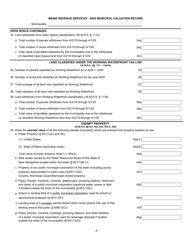

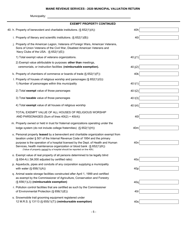

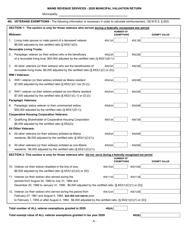

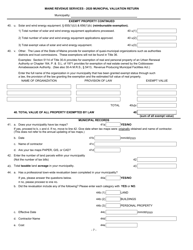

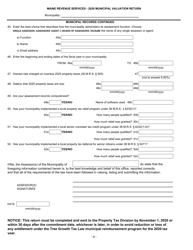

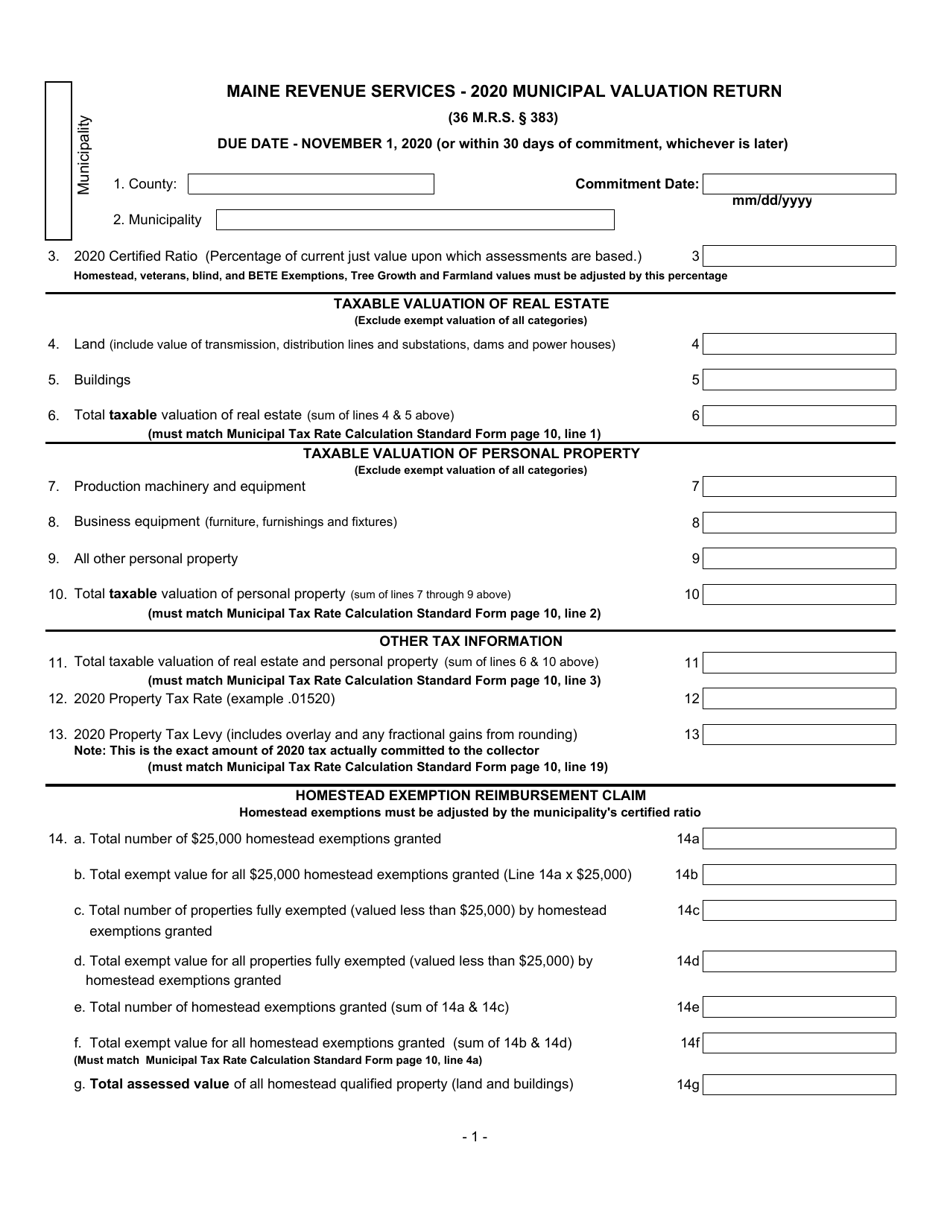

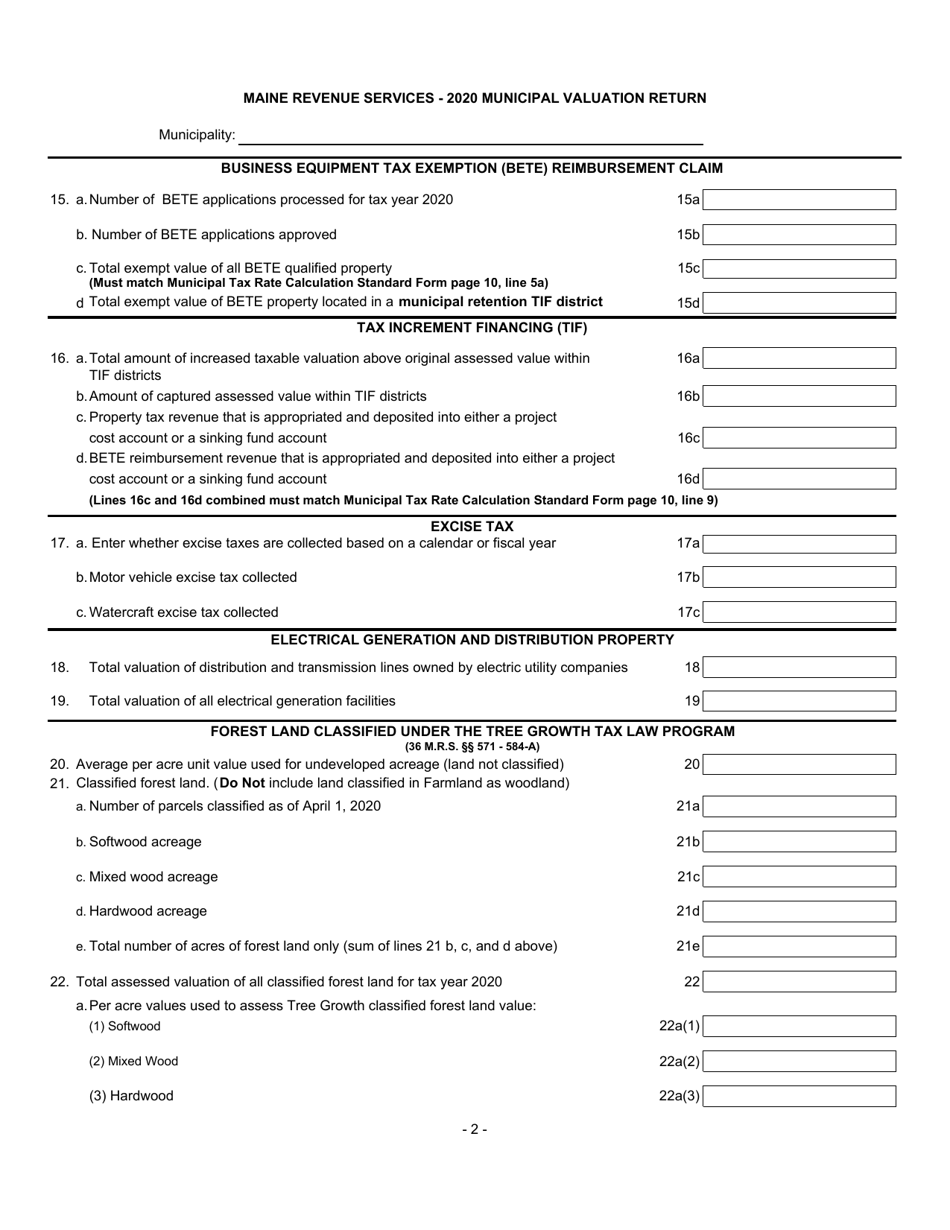

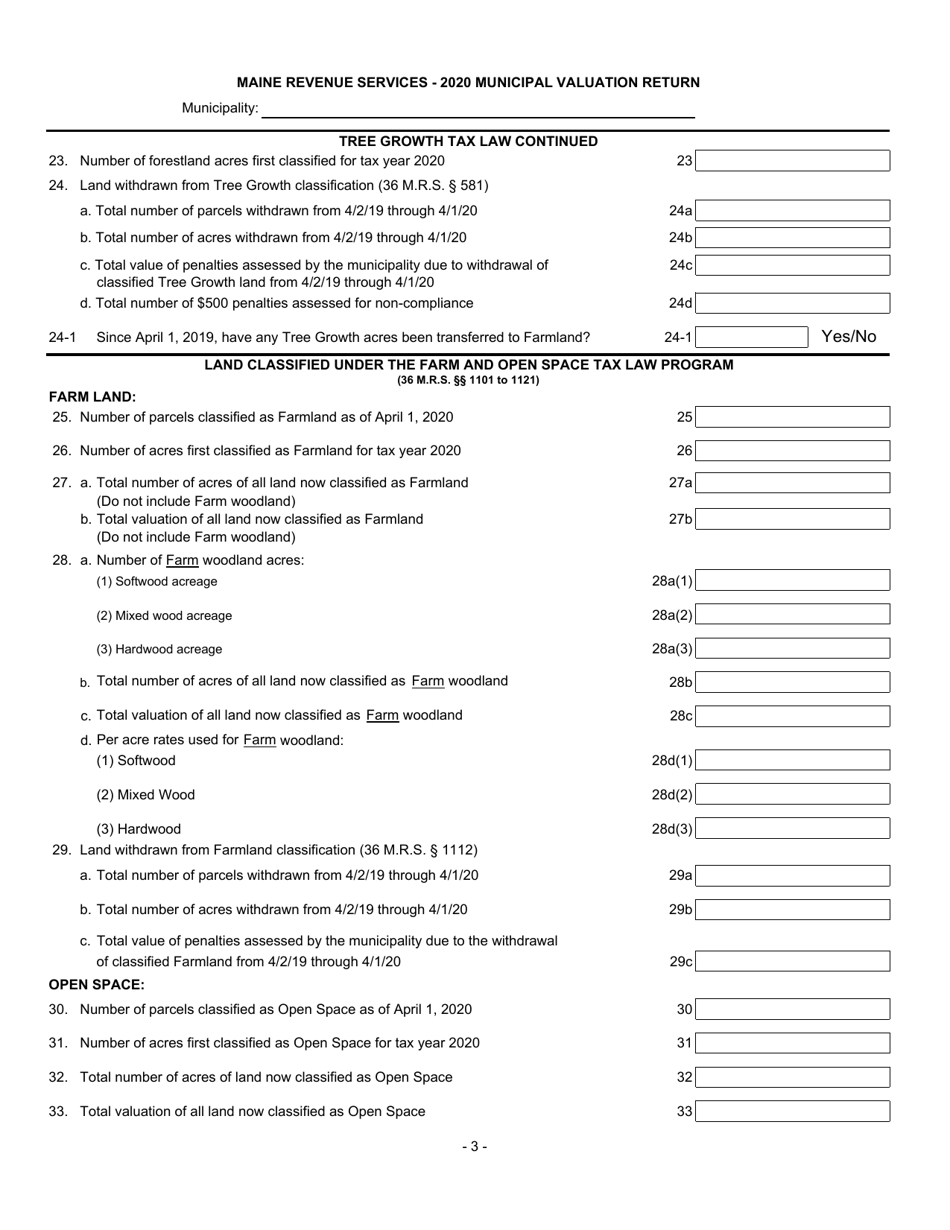

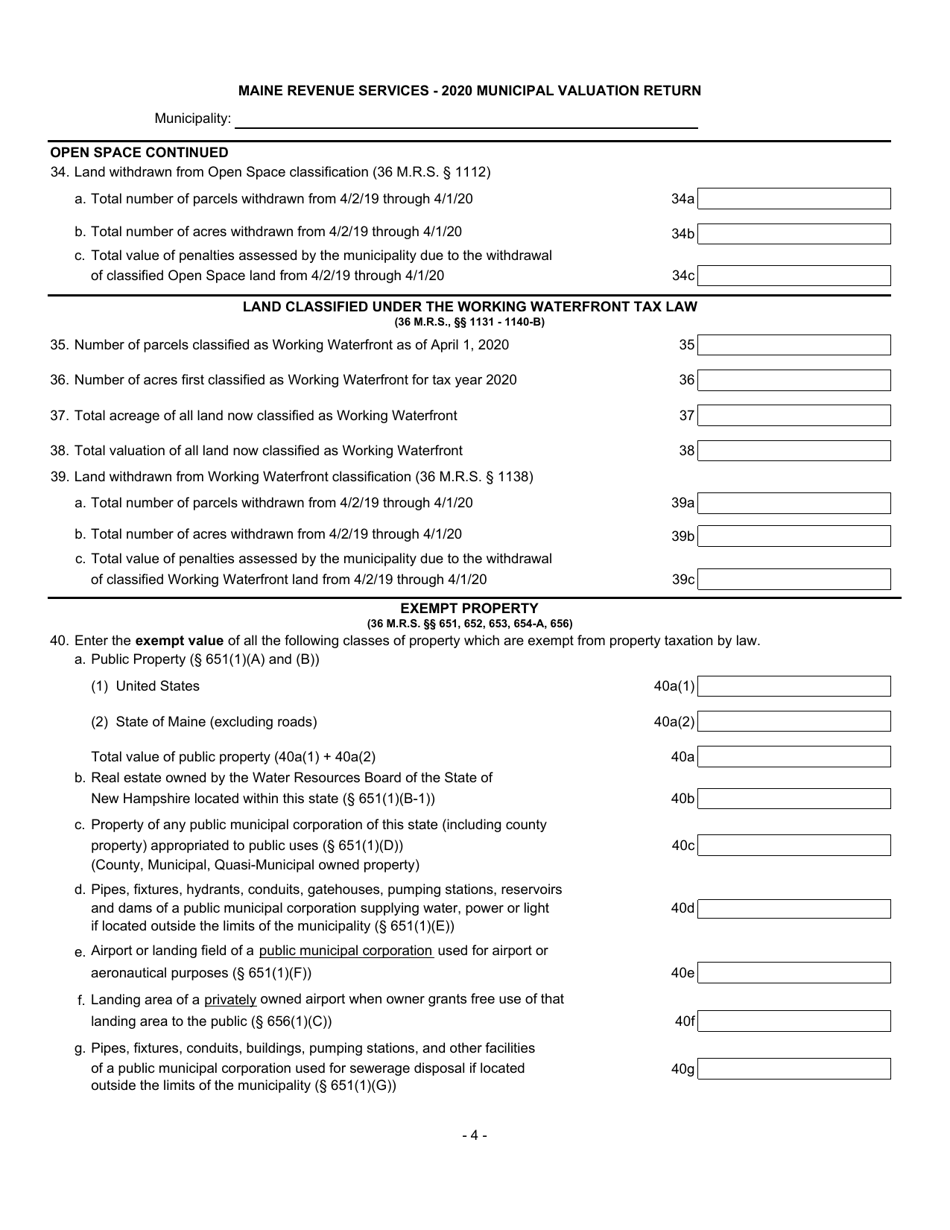

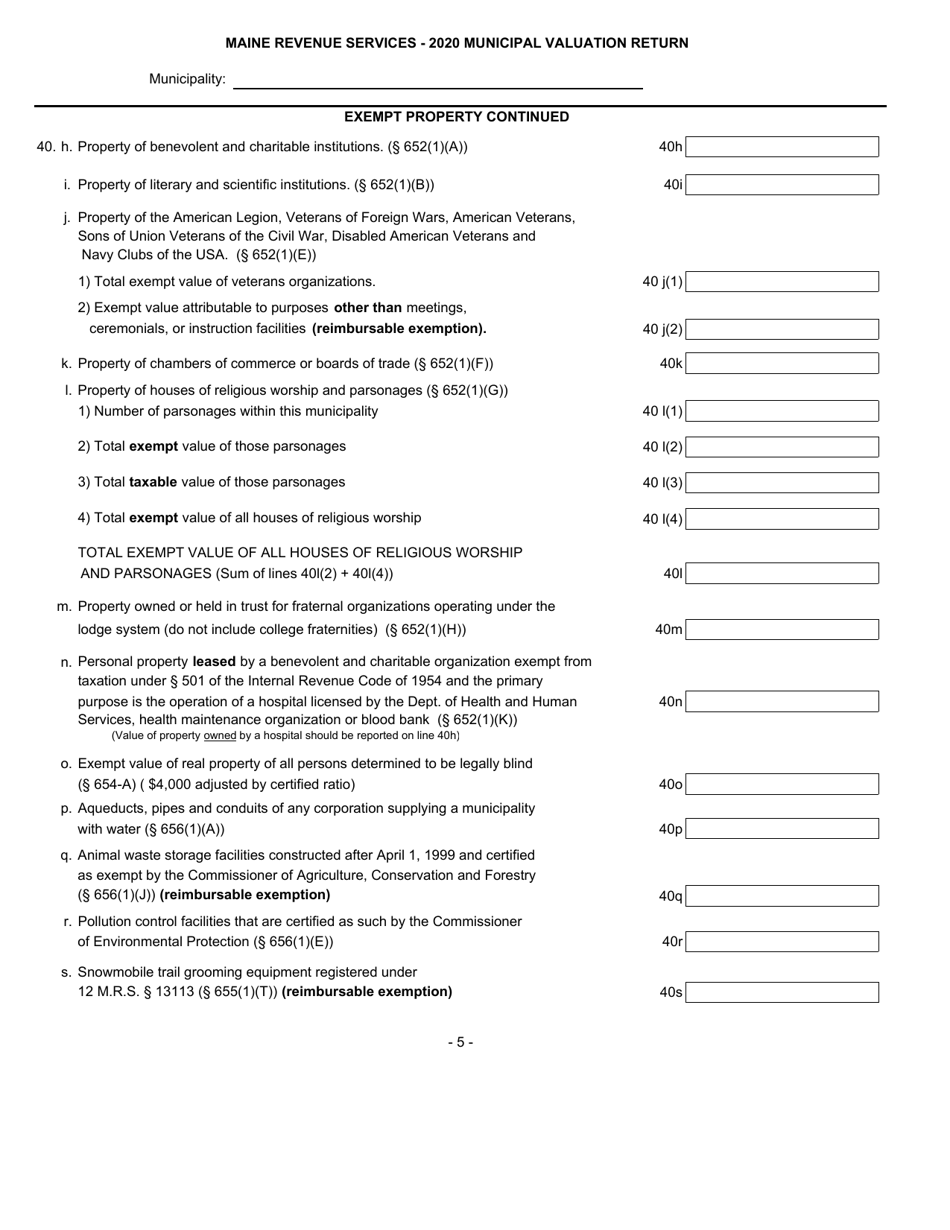

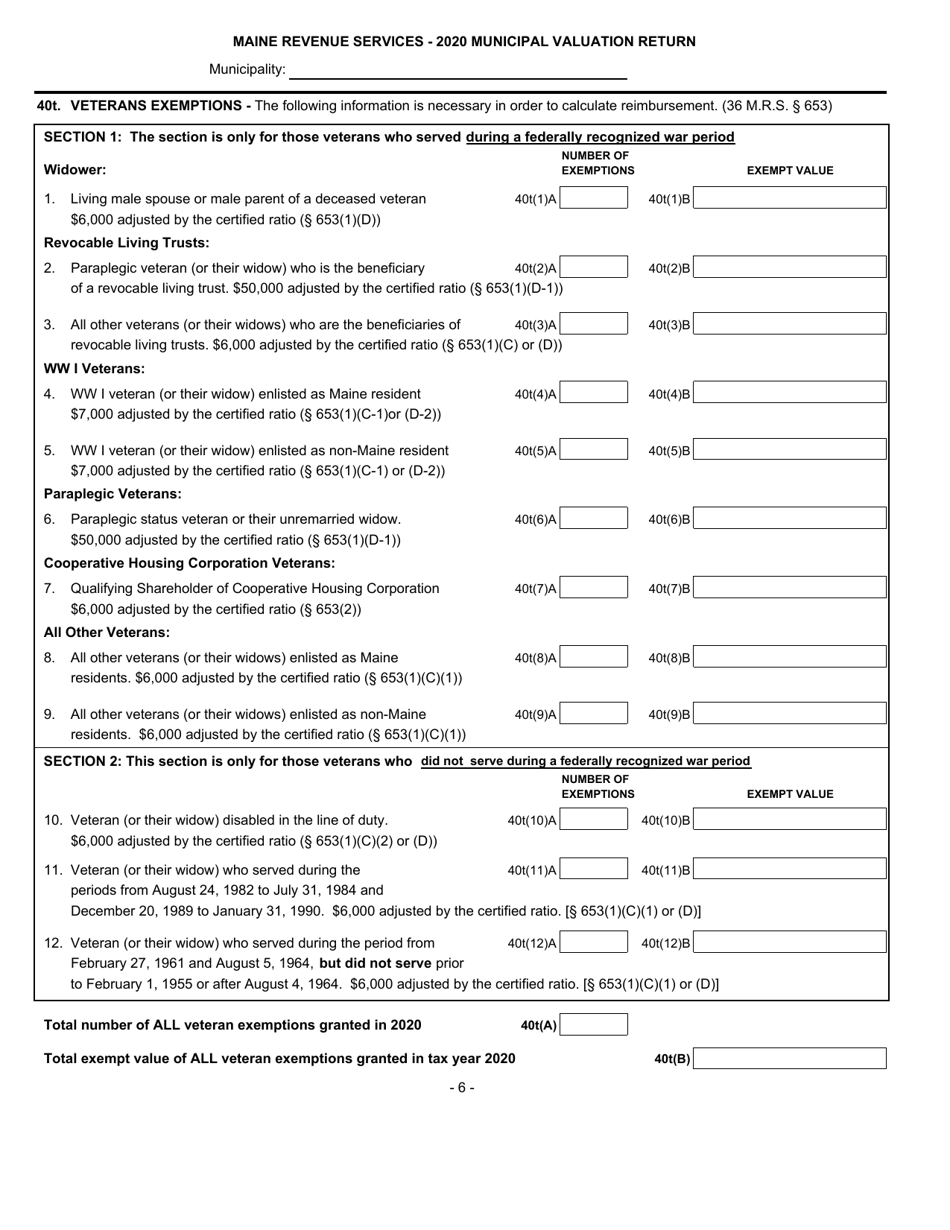

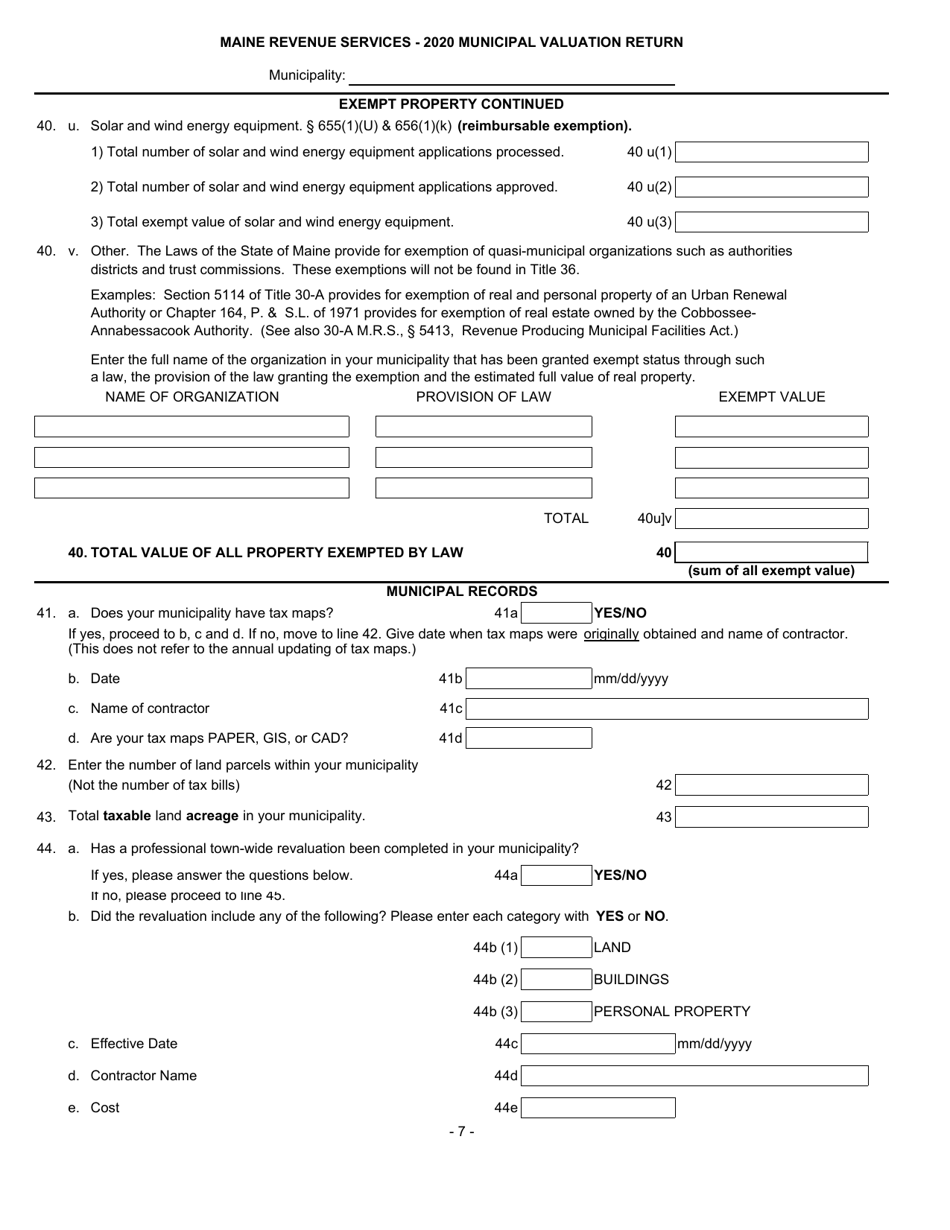

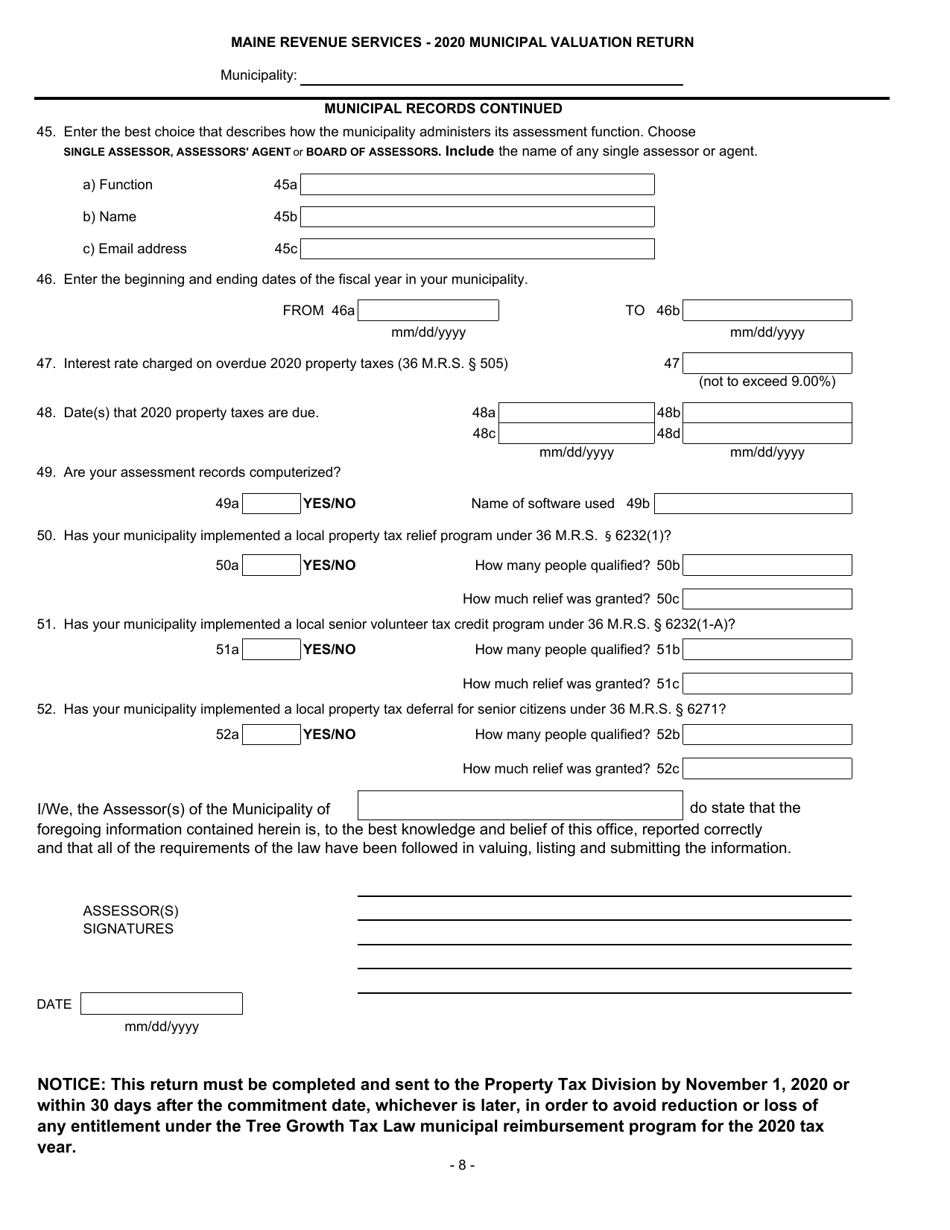

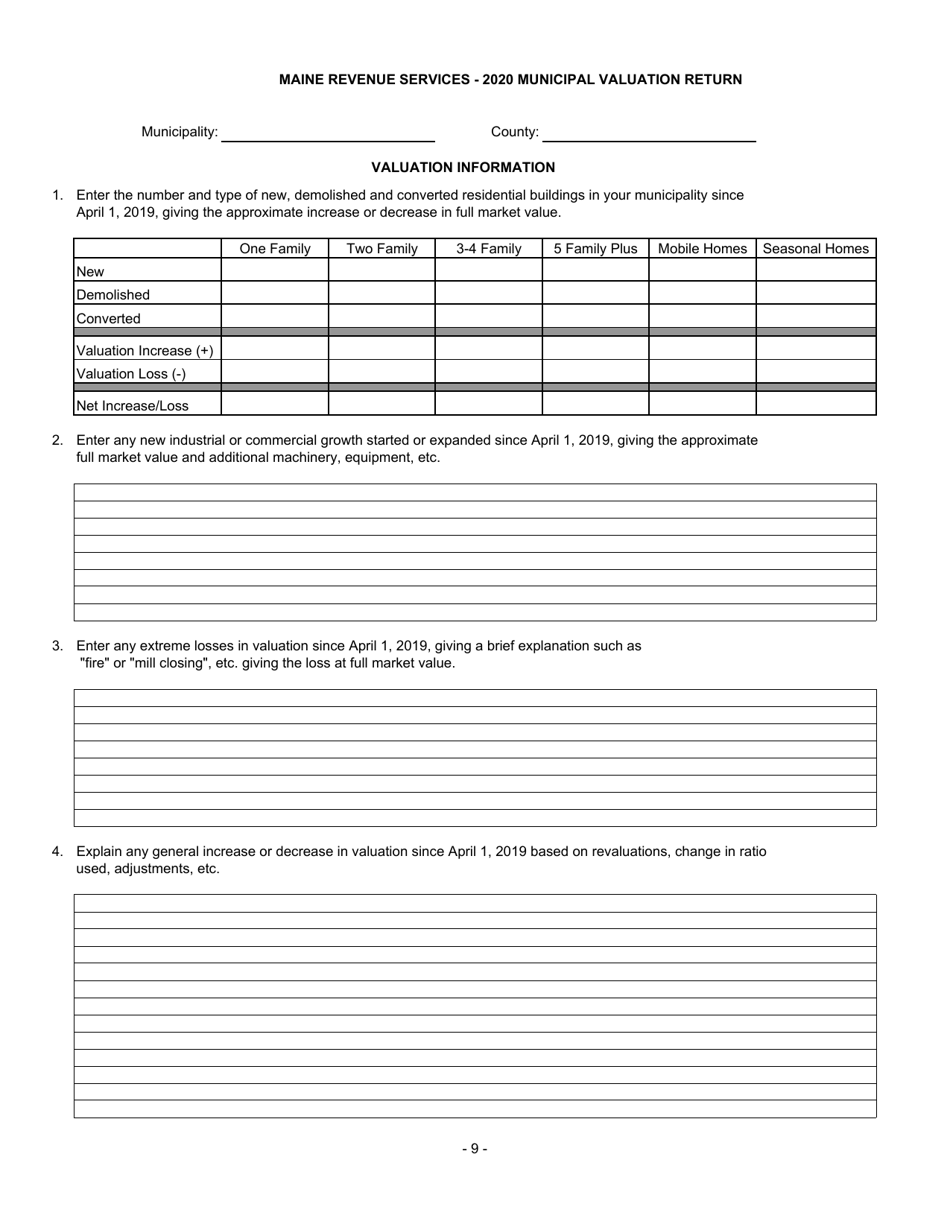

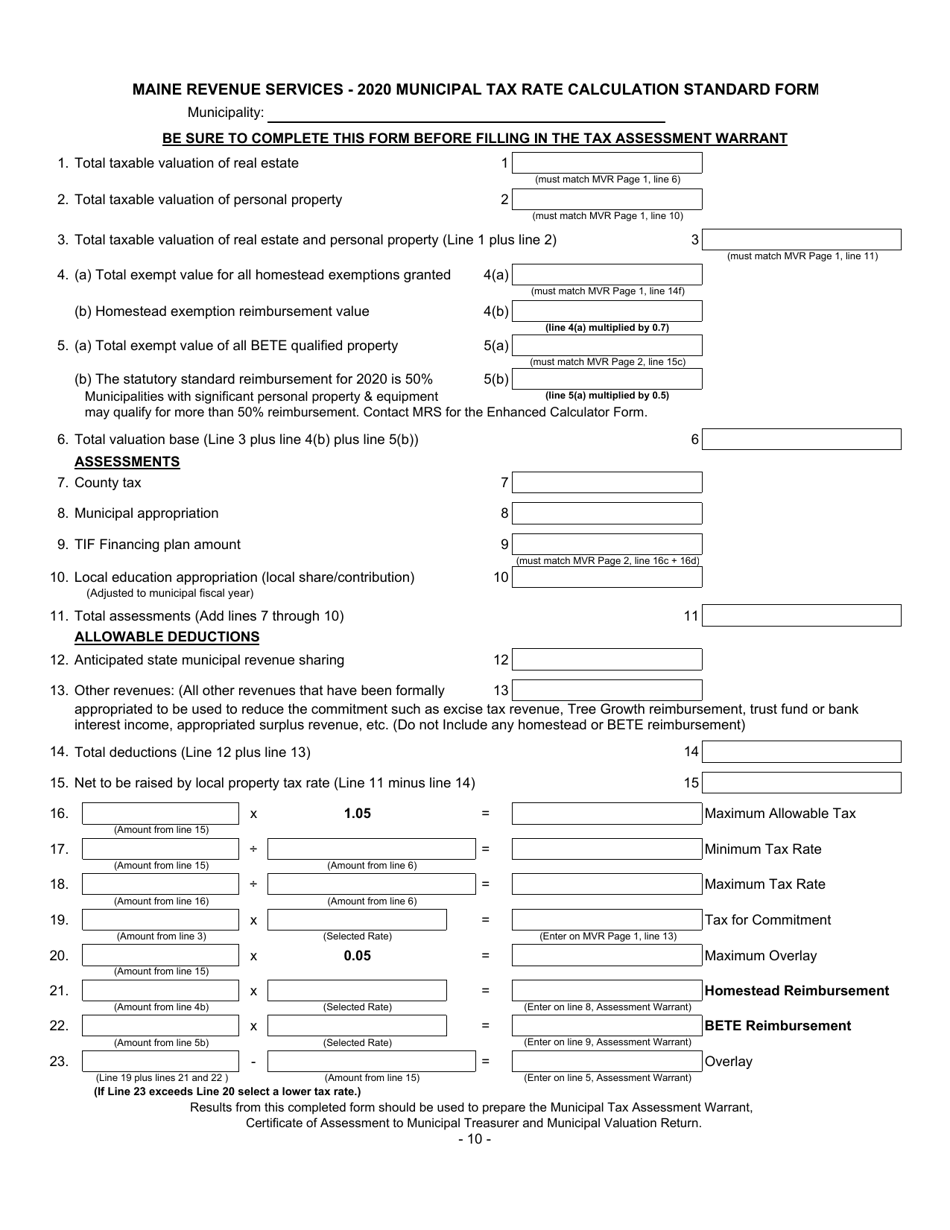

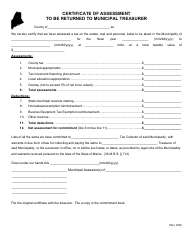

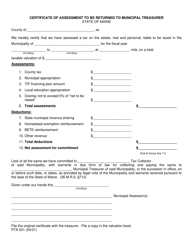

Municipal Valuation Return - Maine

Municipal Valuation Return is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

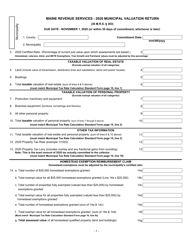

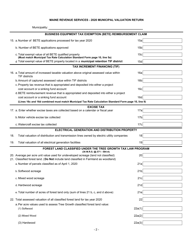

Q: What is a Municipal Valuation Return?

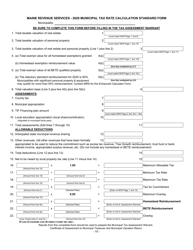

A: A Municipal Valuation Return is a form that property owners in Maine must complete and submit to their municipality to provide information about their property for tax assessment purposes.

Q: Why do I need to submit a Municipal Valuation Return?

A: Submitting a Municipal Valuation Return is required by law in Maine. It helps assessors determine the value of your property for tax purposes based on its current condition and characteristics.

Q: When do I need to submit the Municipal Valuation Return?

A: The deadline for submitting the Municipal Valuation Return varies by municipality in Maine. You should check with your local assessor's office to find out the specific deadline for your property.

Q: What information do I need to provide on the Municipal Valuation Return?

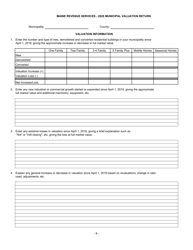

A: The Municipal Valuation Return typically asks for information such as the property's physical characteristics, improvements made to the property, and any income-generating elements on the property.

Q: What happens if I don't submit a Municipal Valuation Return?

A: Failure to submit a Municipal Valuation Return in Maine could result in penalties, such as the assessment of an estimated value for your property or the loss of certain tax exemptions.

Form Details:

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.