This version of the form is not currently in use and is provided for reference only. Download this version of

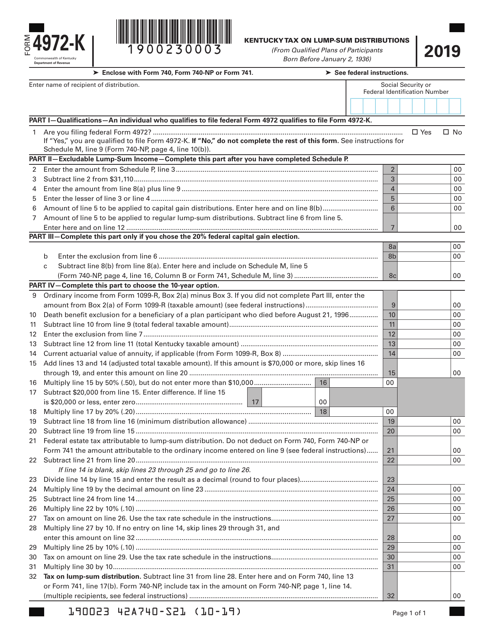

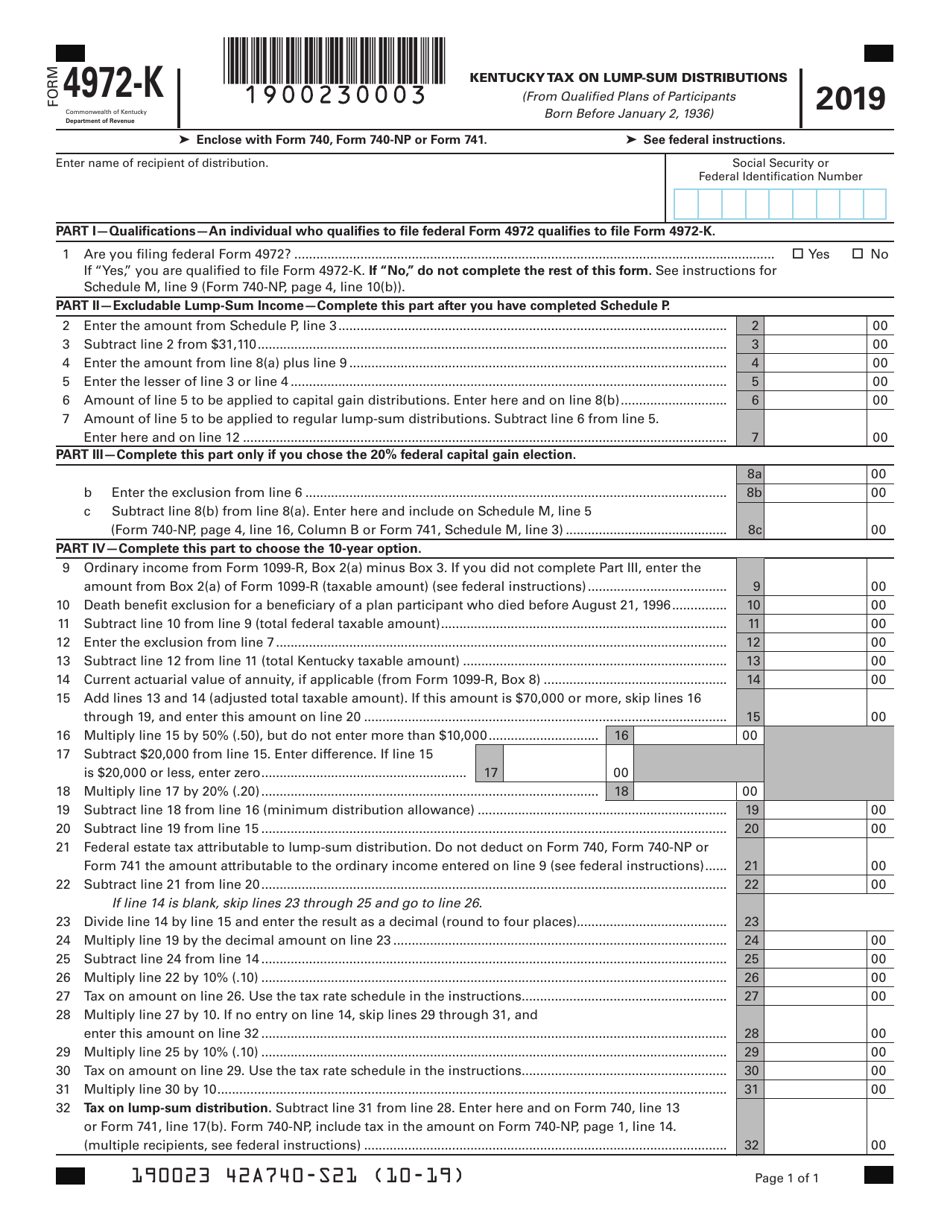

Form 4972-K

for the current year.

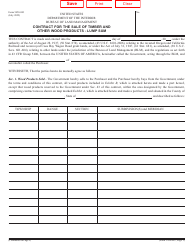

Form 4972-K Kentucky Tax on Lump-Sum Distributions - Kentucky

What Is Form 4972-K?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4972-K?

A: Form 4972-K is the Kentucky Tax on Lump-Sum Distributions form.

Q: What is the purpose of Form 4972-K?

A: Form 4972-K is used to calculate and report the tax on lump-sum distributions from certain retirement plans.

Q: Who needs to file Form 4972-K?

A: Kentucky residents who receive a lump-sum distribution from a retirement plan and owe tax on that distribution need to file Form 4972-K.

Q: Do I need to file Form 4972-K if I don't owe tax on the lump-sum distribution?

A: No, you only need to file Form 4972-K if you owe tax on the lump-sum distribution.

Q: What information do I need to complete Form 4972-K?

A: You will need to provide information about the retirement plan, the distribution, and any applicable exemptions or credits.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4972-K by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.