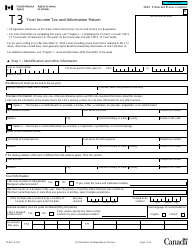

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1061

for the current year.

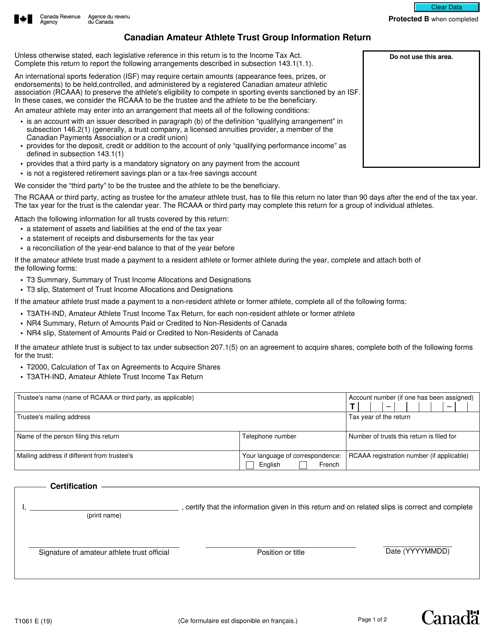

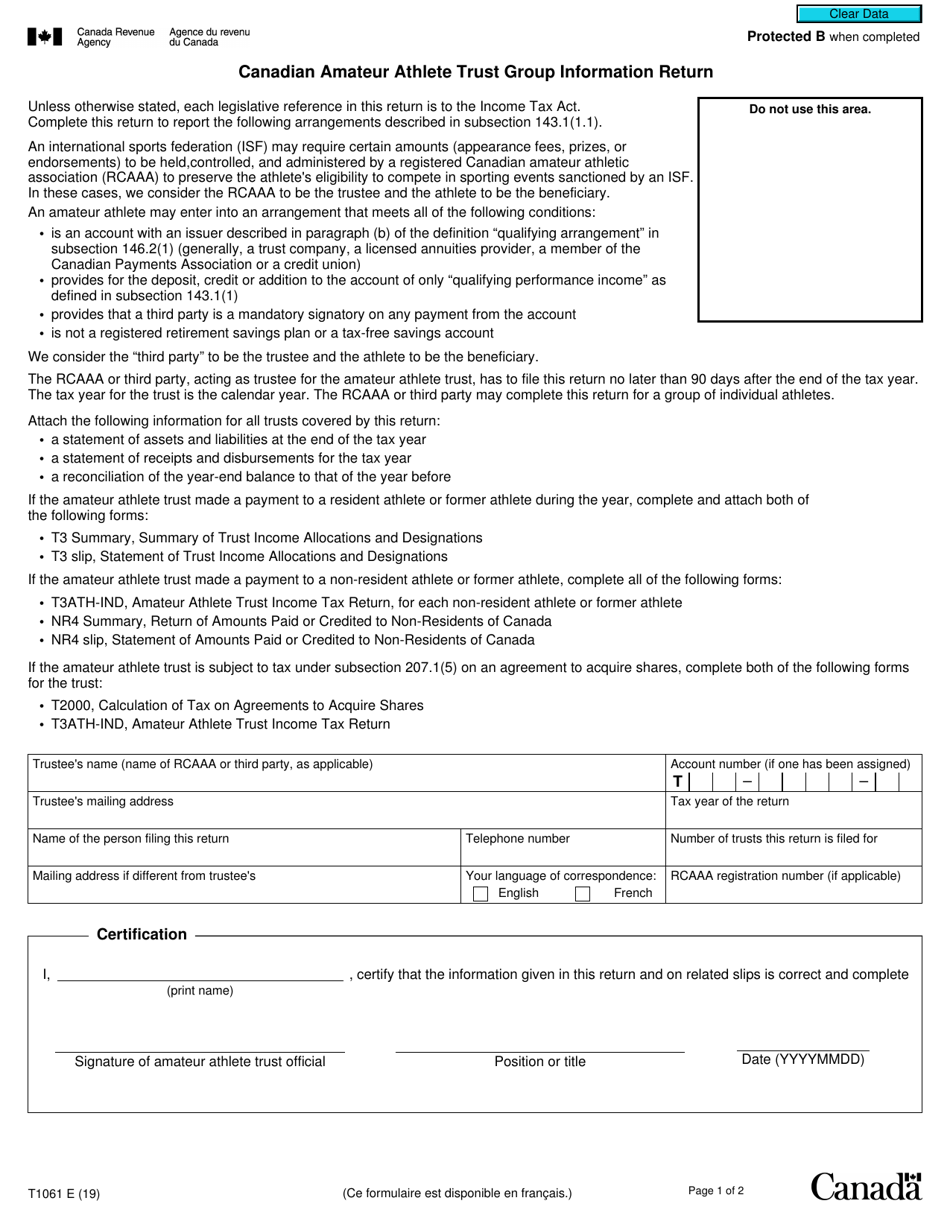

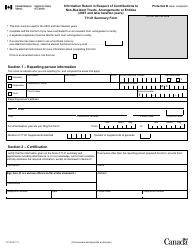

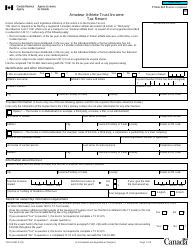

Form T1061 Canadian Amateur Athletic Trust Group Information Return - Canada

Form T1061 is the Canadian Amateur Athletic Trust (CAAT) Group Information Return, which is used to report information about a CAAT group to the Canada Revenue Agency (CRA). The CAAT group is a group of registered amateur athletic associations that have joined together to use a common registration number for their registered amateur athletic activities. The purpose of this form is to provide the CRA with information about the CAAT group and its activities.

The Form T1061 Canadian Amateur Athletic Trust Group Information Return is filed by the Canadian amateur athletic trust group.

FAQ

Q: What is Form T1061?

A: Form T1061 is the Canadian Amateur Athletic Trust Group Information Return.

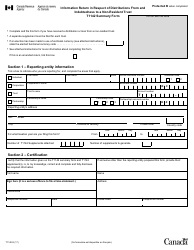

Q: Who needs to file Form T1061?

A: Any Canadian amateur athletic trust group that received a gift from a qualified donor during the taxation year needs to file Form T1061.

Q: What is a Canadian amateur athletic trust group?

A: A Canadian amateur athletic trust group is a group that has been established and resident in Canada and is operating exclusively for the purpose of promoting amateur athletics in Canada.

Q: What is a qualified donor?

A: A qualified donor is an individual, corporation, or partnership that has made a gift of money or specified property to a Canadian amateur athletic trust group.

Q: What information is required to complete Form T1061?

A: The form requires information about the trust group, the gifted amount, the donor, and the purpose of the gift.

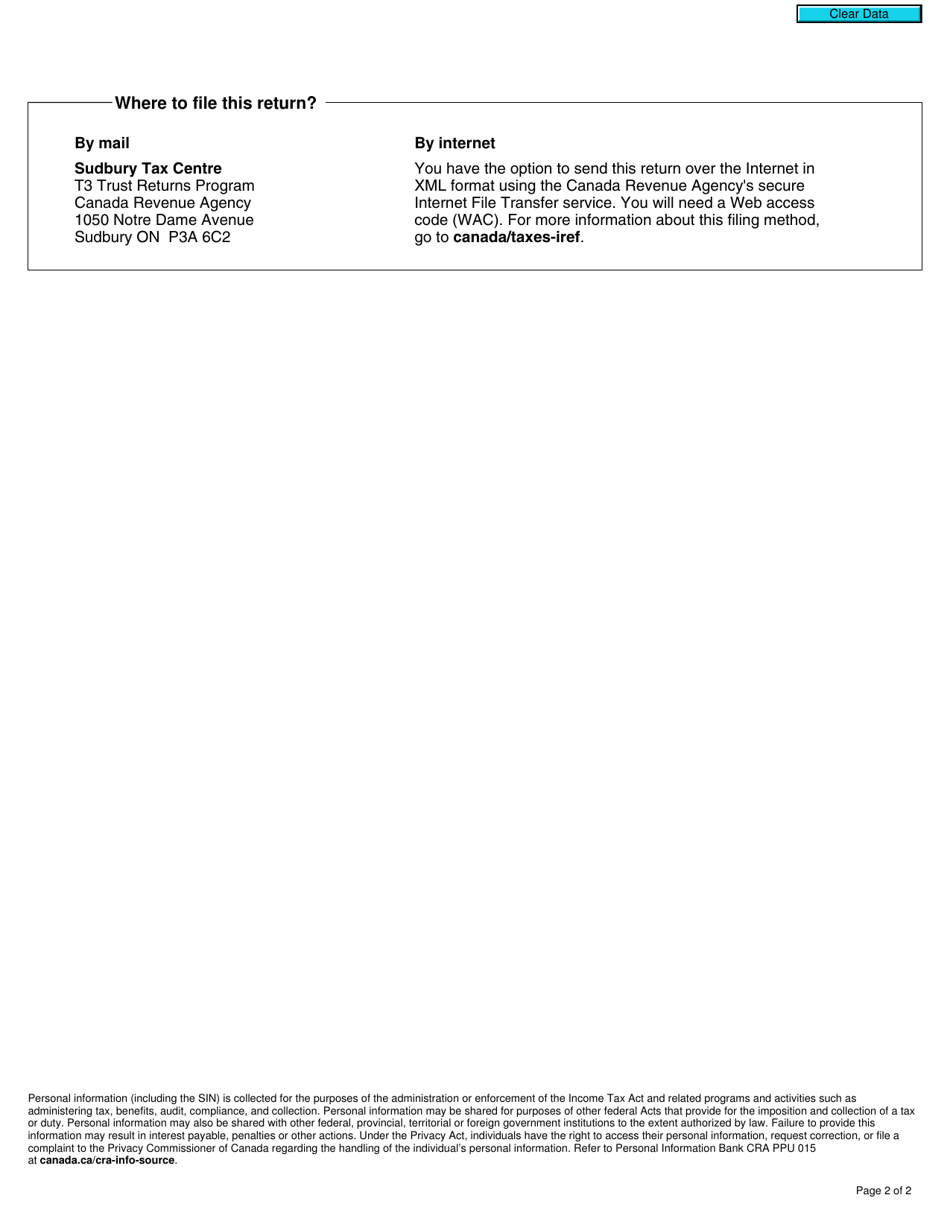

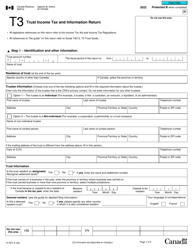

Q: What is the deadline for filing Form T1061?

A: Form T1061 must be filed on or before the trust group's filing due date, which is within 180 days after the end of the trust group's taxation year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing. The penalty is $25 for each day the return is late, up to a maximum of $2,500.