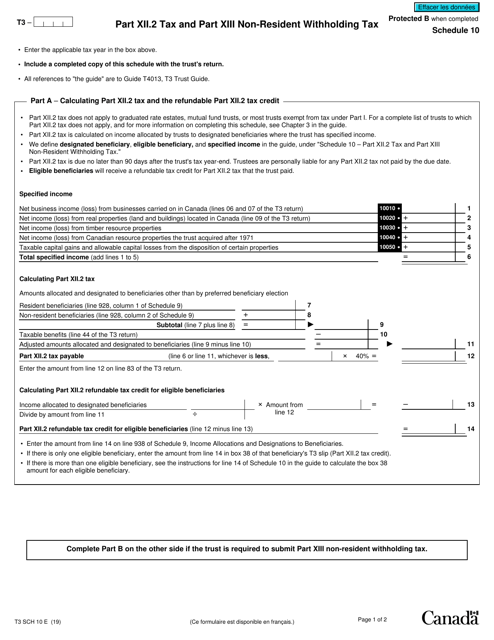

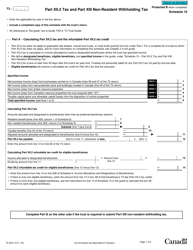

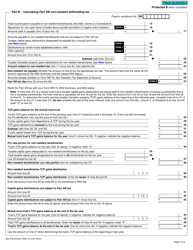

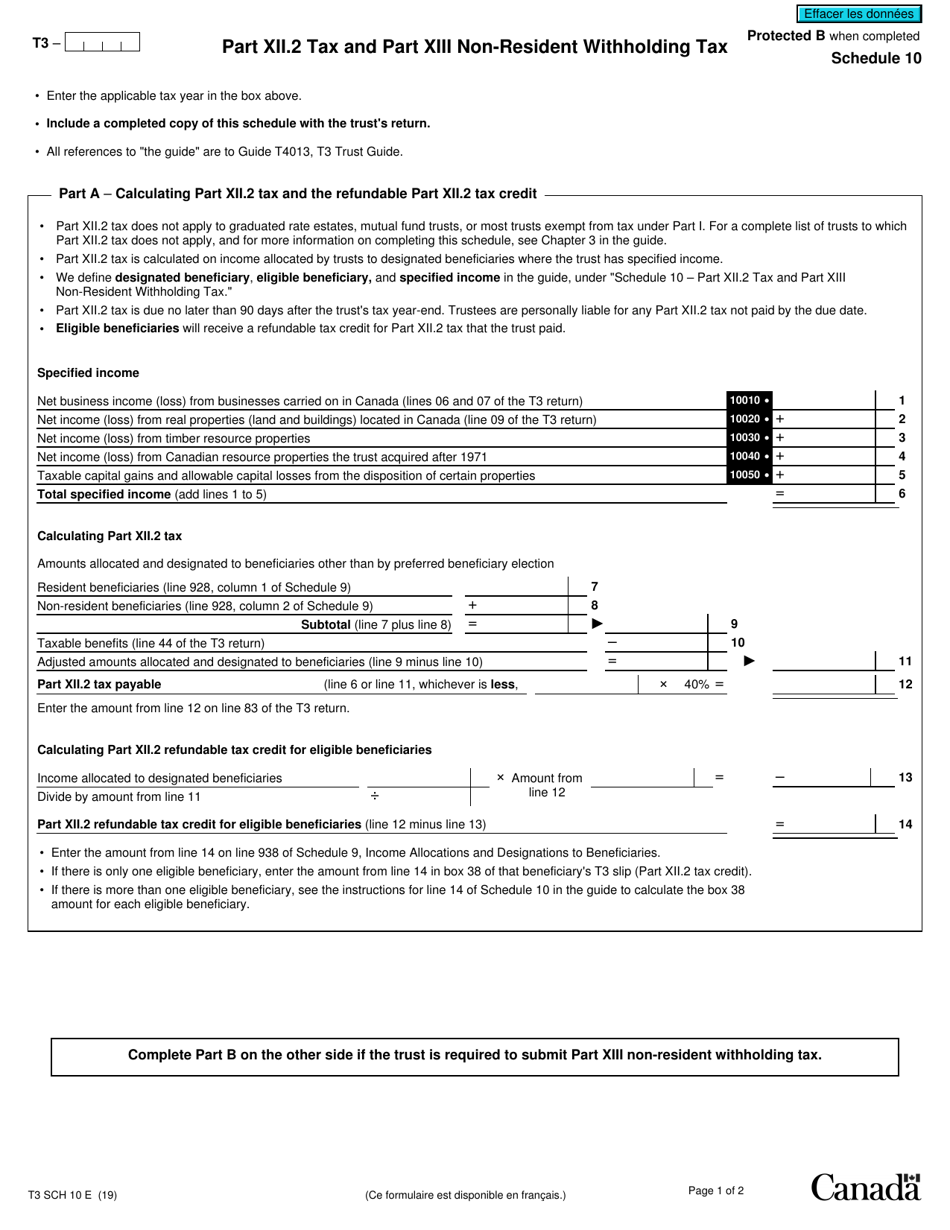

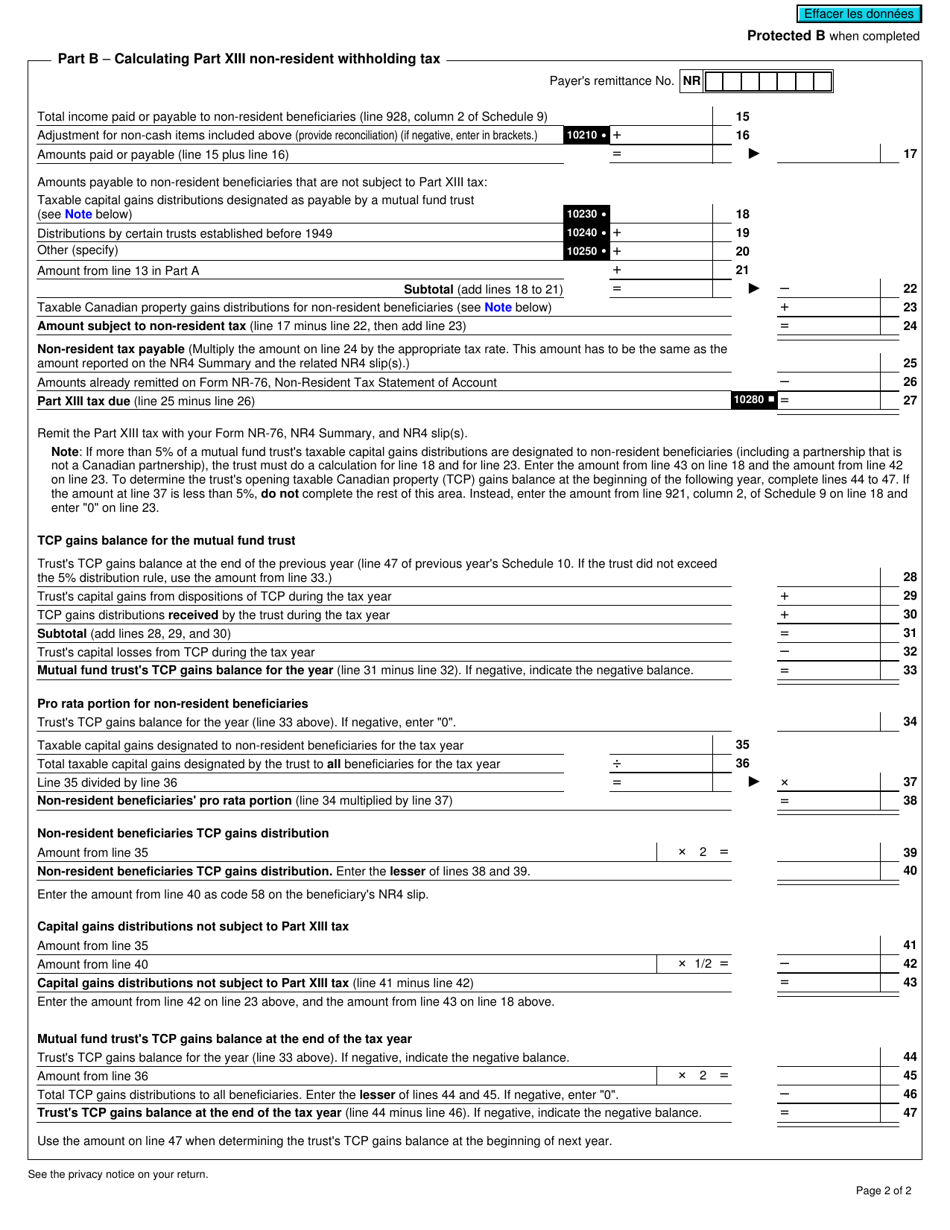

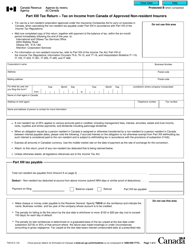

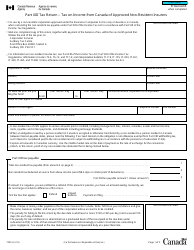

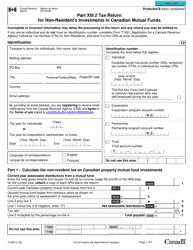

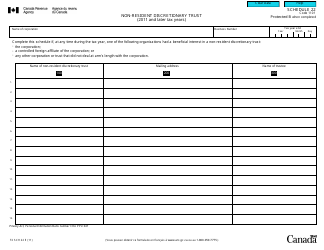

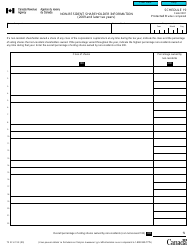

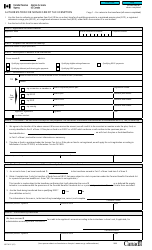

Form T3 Schedule 10 Part XII.2 Tax and Part Xiii Non-resident Withholding Tax - Canada

Form T3 Schedule 10 Part XII.2 Tax and Part XIII Non-resident Withholding Tax is used in Canada for reporting and paying taxes related to income earned by non-residents and withholding taxes on certain payments made to non-residents.

The Form T3 Schedule 10 Part XII.2 Tax and Part XIII Non-resident Withholding Tax in Canada is filed by the estate or trust that is subject to these taxes.

FAQ

Q: What is Form T3 Schedule 10?

A: Form T3 Schedule 10 is a tax form used in Canada to report tax and non-resident withholding tax for trusts.

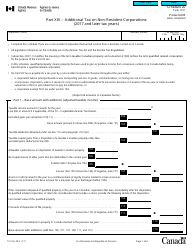

Q: What is Part XII.2 tax?

A: Part XII.2 tax is a type of tax that is imposed on certain distributions made by trusts.

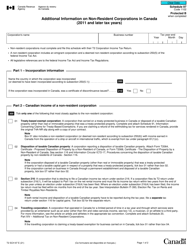

Q: What is Part XIII non-resident withholding tax?

A: Part XIII non-resident withholding tax is a tax withheld by payers in Canada on certain types of income paid to non-residents.

Q: Who uses Form T3 Schedule 10?

A: Trusts in Canada use Form T3 Schedule 10 to report tax and non-resident withholding tax.

Q: Why is Part XII.2 tax applicable?

A: Part XII.2 tax is applicable when a trust makes certain distributions to its beneficiaries.

Q: Why is Part XIII non-resident withholding tax applicable?

A: Part XIII non-resident withholding tax is applicable when income is paid to non-residents of Canada.

Q: What information needs to be included in Form T3 Schedule 10?

A: Form T3 Schedule 10 requires information such as identification details of the trust, details of tax and non-resident withholding tax calculations, and information about distributions and income paid.

Q: When is Form T3 Schedule 10 filed?

A: Form T3 Schedule 10 is filed along with the trust's T3 tax return, which is due by the March 31st following the end of the tax year.