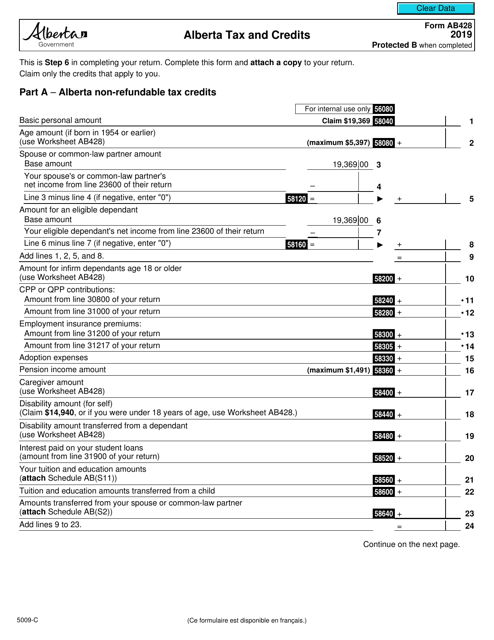

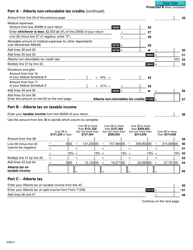

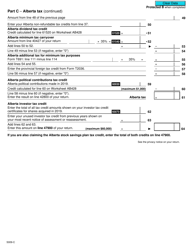

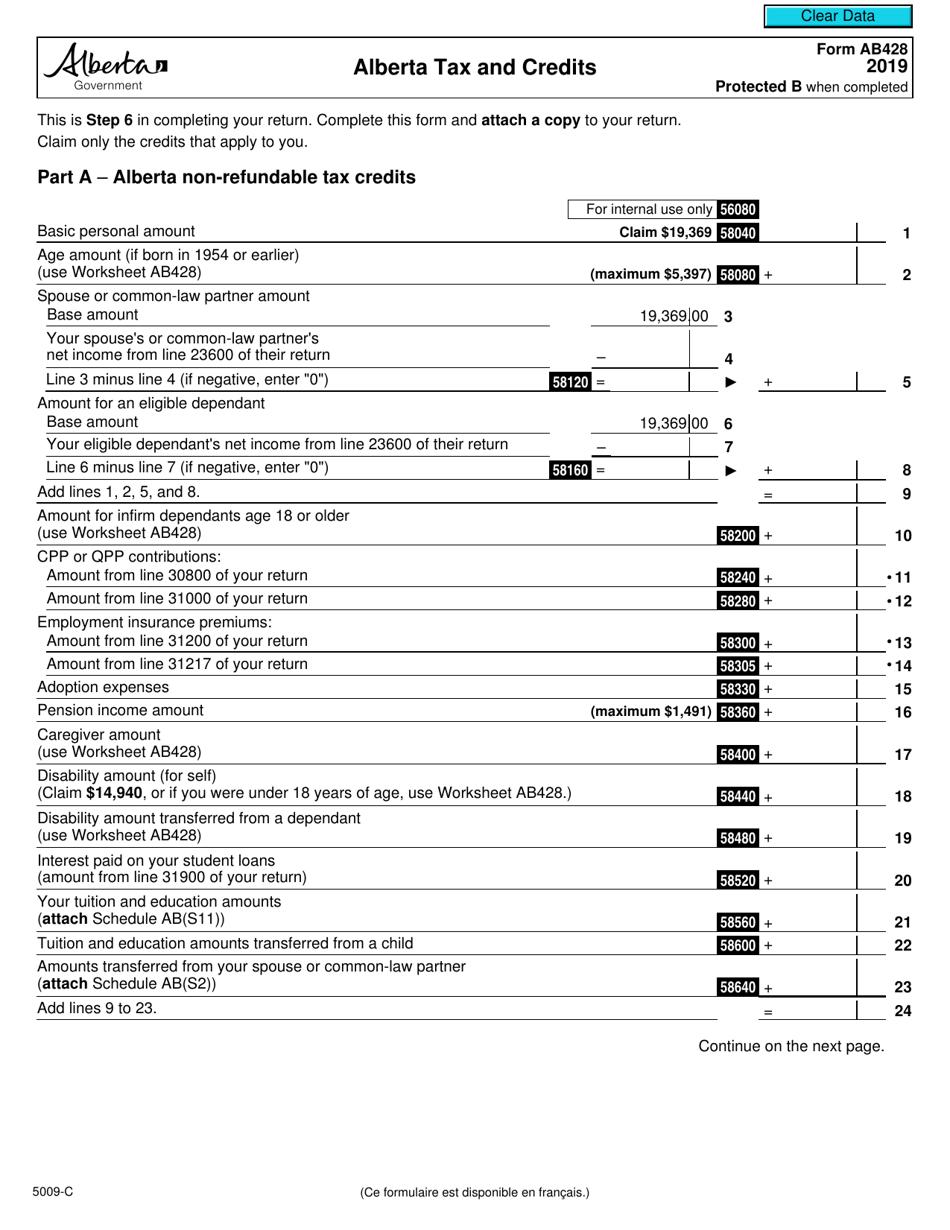

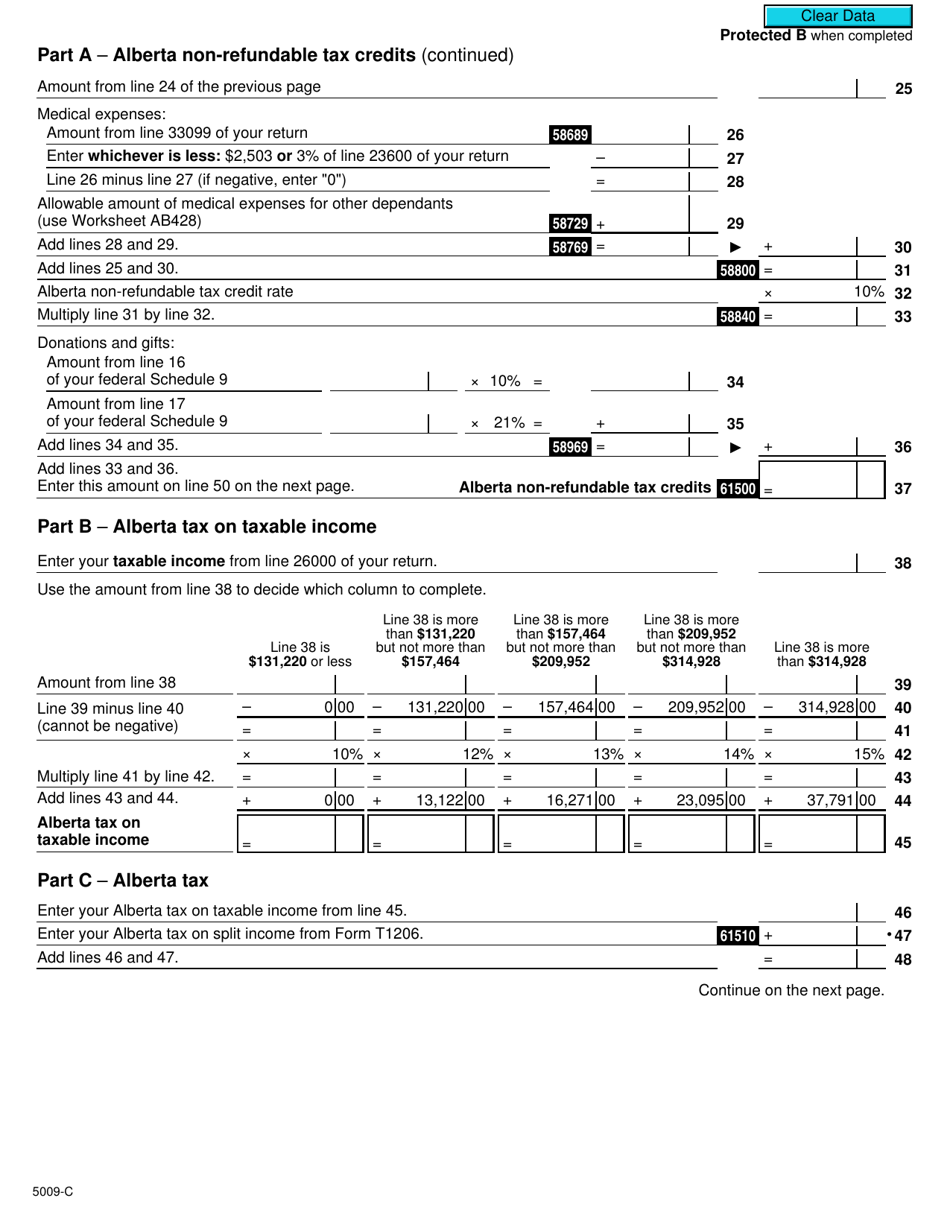

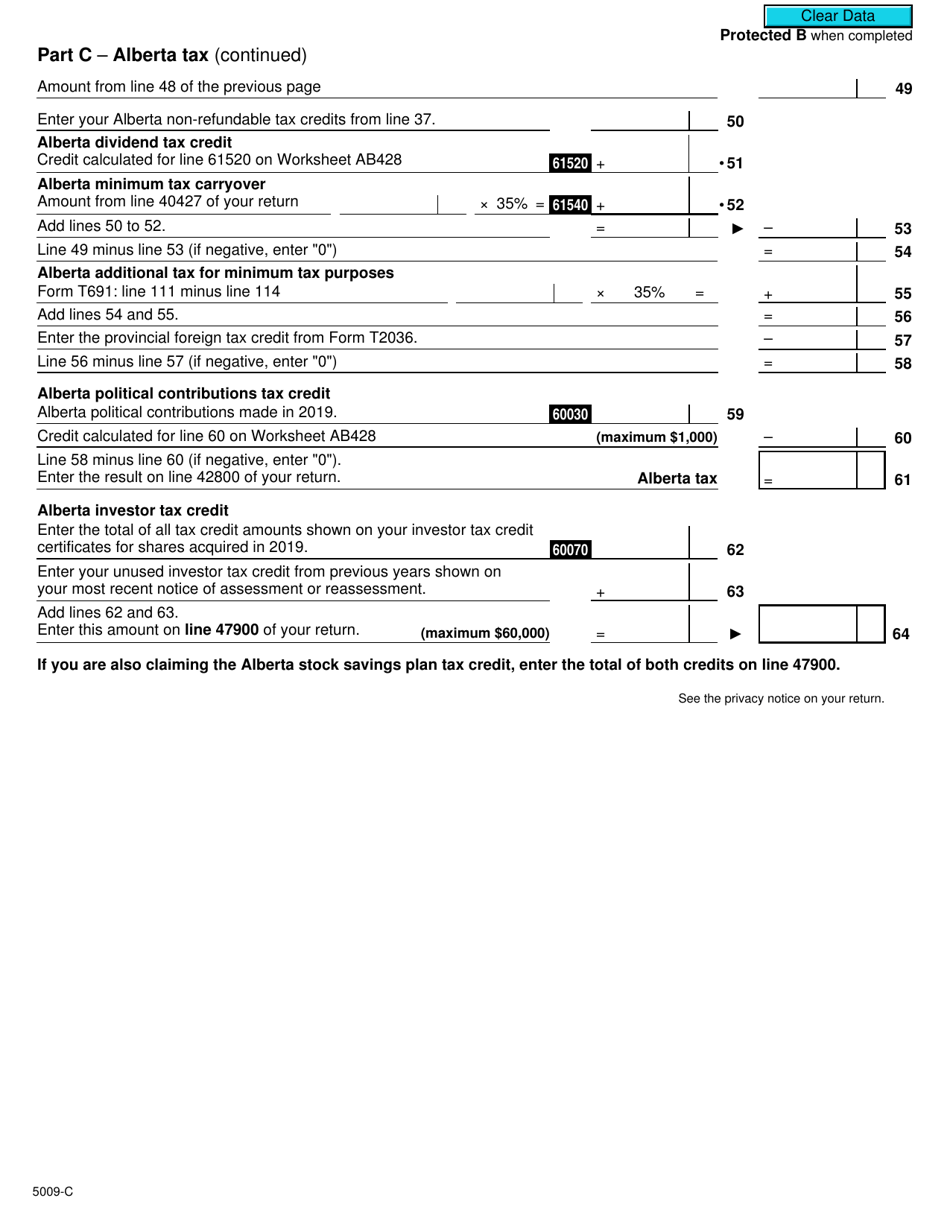

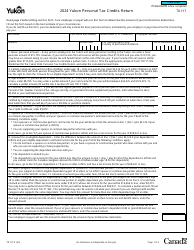

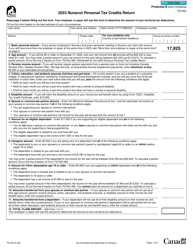

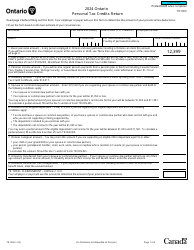

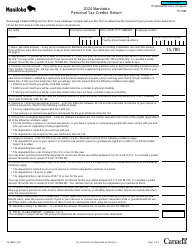

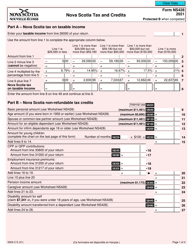

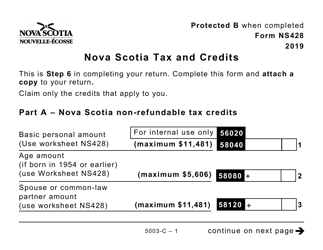

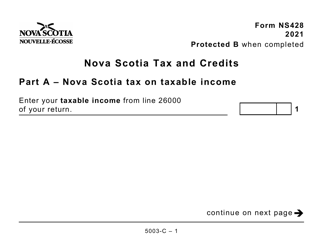

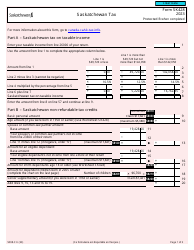

Form AB428 (5009-C) Alberta Tax and Credits - Canada

Form AB428 (5009-C) is the Alberta Tax and Credits form used by residents of Alberta, Canada, to calculate their provincial income tax and claim various tax credits specific to the province.

The Form AB428 (5009-C) Alberta Tax and Credits in Canada is typically filed by individuals who are residents of Alberta and need to report their provincial tax and claim any applicable credits.

FAQ

Q: What is Form AB428?

A: Form AB428 is a tax form used in the province of Alberta in Canada.

Q: What does Form AB428 include?

A: Form AB428 includes information about your income, deductions, and credits specifically for residents of Alberta.

Q: Who should fill out Form AB428?

A: Residents of Alberta who are filing their taxes in Canada should fill out Form AB428.

Q: When is the deadline to submit Form AB428?

A: The deadline to submit Form AB428 is generally April 30th of each year.

Q: What credits are available on Form AB428?

A: Form AB428 includes credits such as the Alberta Family Employment Tax Credit, Alberta Child Benefit, and Alberta Climate Leadership Adjustment Rebate.

Q: What if I need help filling out Form AB428?

A: If you need help filling out Form AB428, you can consult the CRA's official guide or seek assistance from a tax professional.