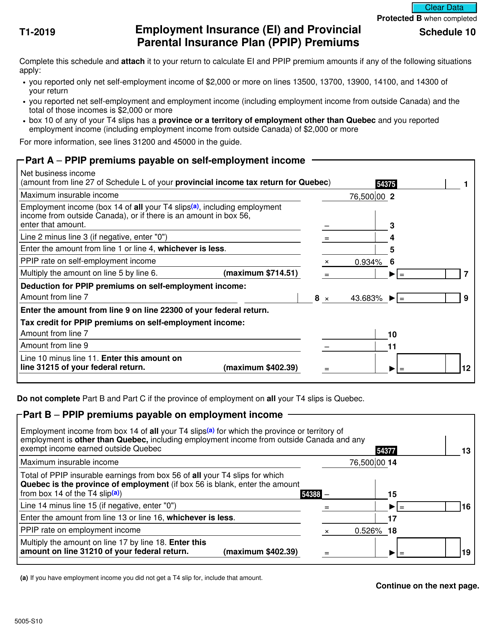

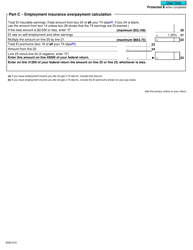

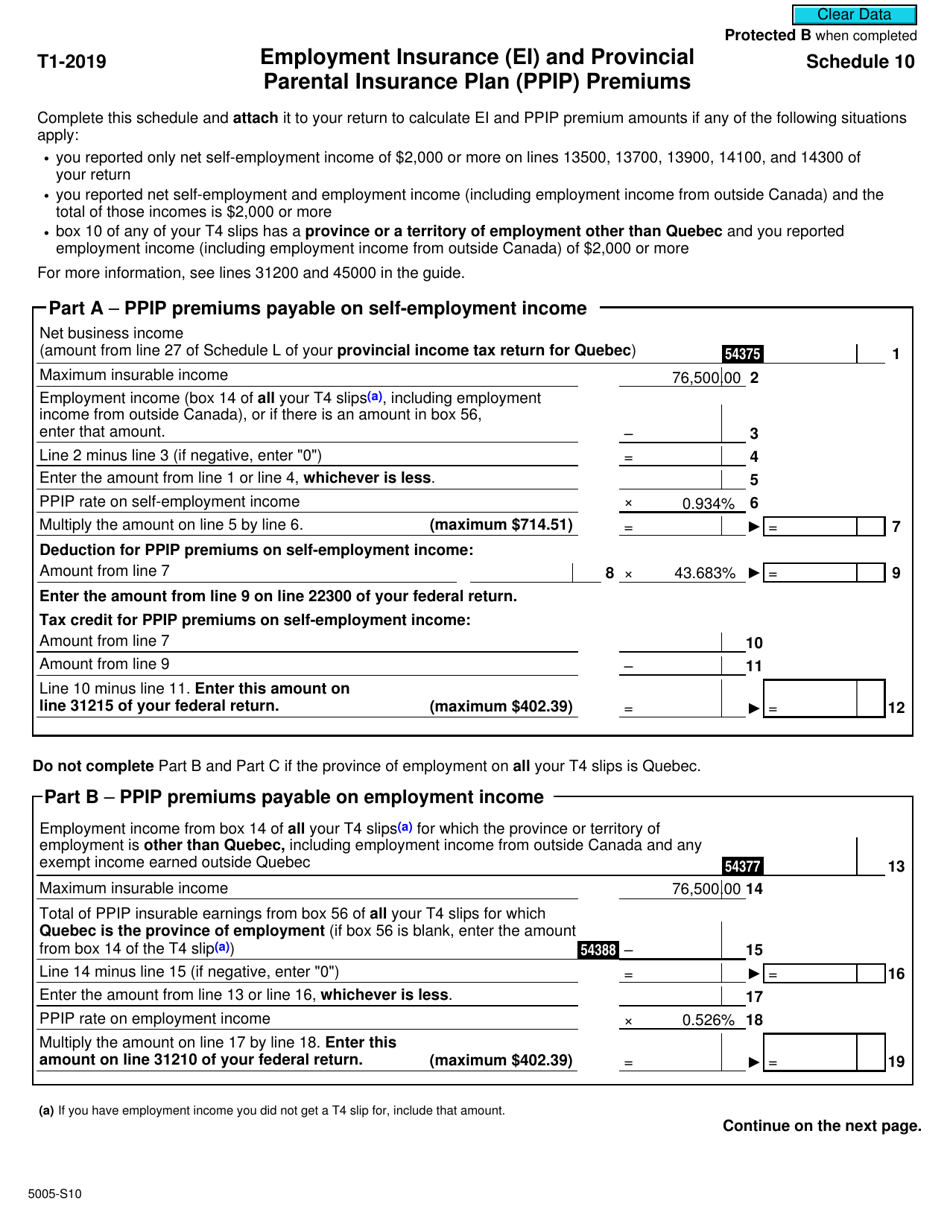

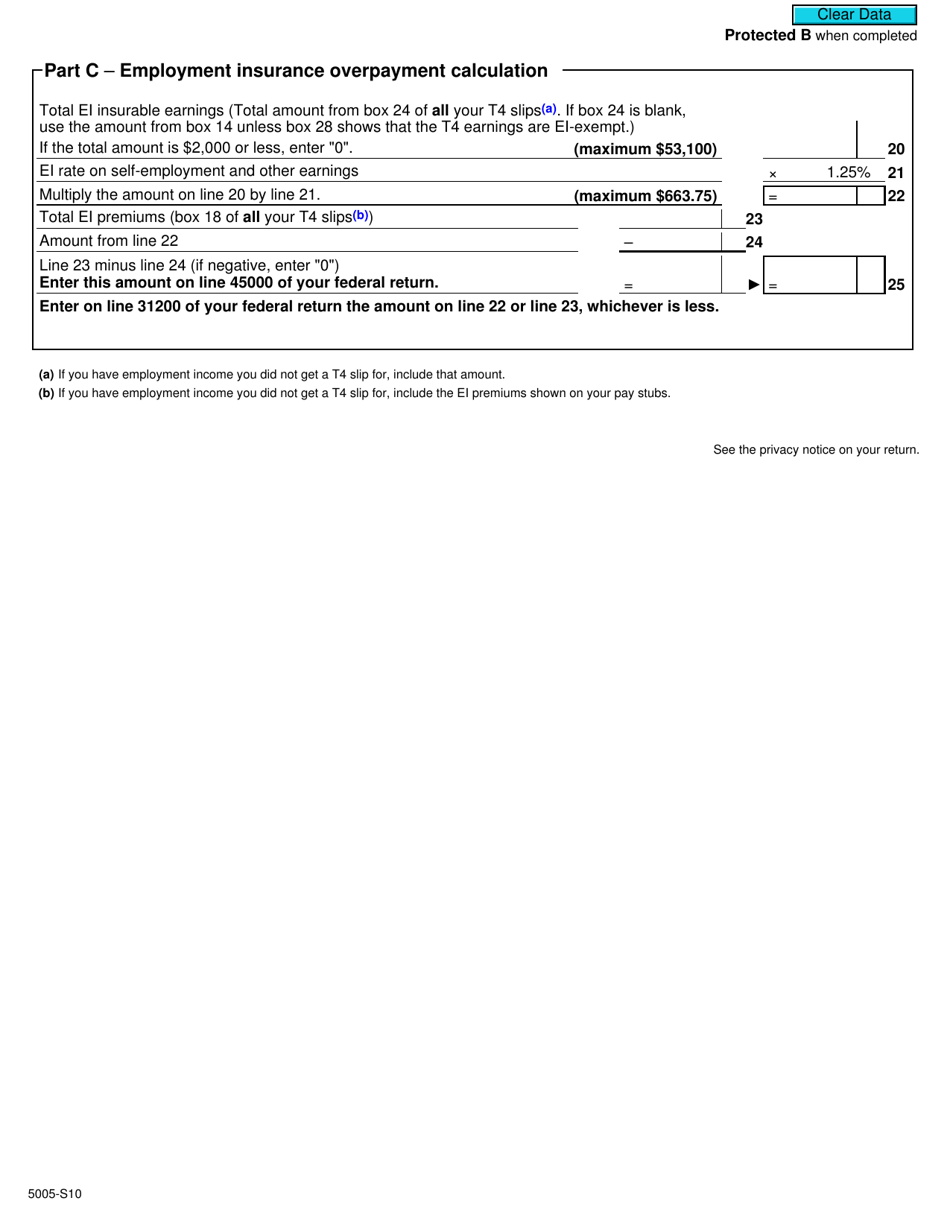

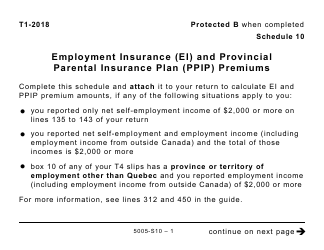

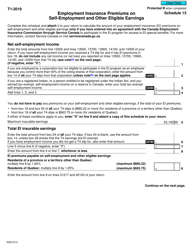

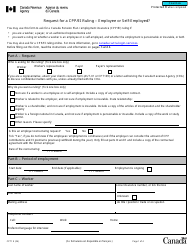

Form 5005-S10 Schedule 10 Employment Insurance (Ei) and Provincial Parental Insurance Plan (Ppip) Premiums (For Qc and Non-residents Only) - Canada

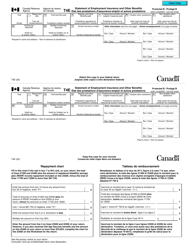

Form 5005-S10 Schedule 10 is used in Canada for reporting Employment Insurance (EI) and Provincial Parental Insurance Plan (PPIP) premiums. It is specifically for residents of Quebec and non-residents.

Employers in Quebec and non-residents in Canada file the Form 5005-S10 Schedule 10 for Employment Insurance (EI) and Provincial Parental Insurance Plan (PPIP) premiums.

FAQ

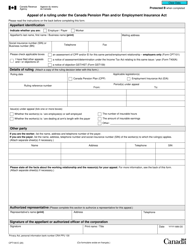

Q: Who needs to fill out Form 5005-S10?

A: Form 5005-S10 needs to be filled out by individuals in Quebec and non-residents for reporting Employment Insurance (EI) and Provincial Parental Insurance Plan (PPIP) premiums.

Q: What is the purpose of Form 5005-S10?

A: The purpose of Form 5005-S10 is to report Employment Insurance (EI) and Provincial Parental Insurance Plan (PPIP) premiums for individuals in Quebec and non-residents.

Q: Who is required to pay Employment Insurance (EI) premiums?

A: Most employees and self-employed individuals in Canada are required to pay Employment Insurance (EI) premiums.

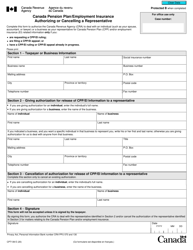

Q: What is the Provincial Parental Insurance Plan (PPIP)?

A: The Provincial Parental Insurance Plan (PPIP) is a program in Quebec that provides benefits to individuals who are on parental leave.

Q: Who are considered non-residents for the purpose of Form 5005-S10?

A: Non-residents for the purpose of Form 5005-S10 are individuals who do not reside in Canada.

Q: What information is required to be reported on Form 5005-S10?

A: Form 5005-S10 requires the reporting of Employment Insurance (EI) and Provincial Parental Insurance Plan (PPIP) premiums, as well as personal information such as name, address, and Social Insurance Number (SIN).

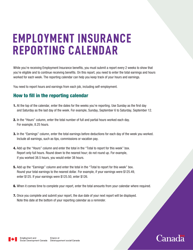

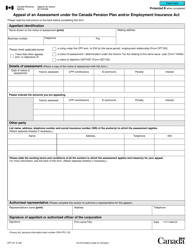

Q: When is Form 5005-S10 due?

A: Form 5005-S10 is typically due on or before the last day of February following the end of the reporting year.