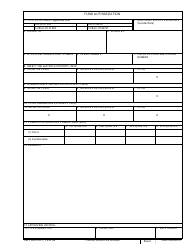

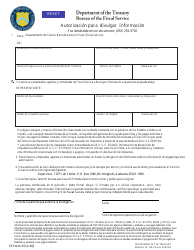

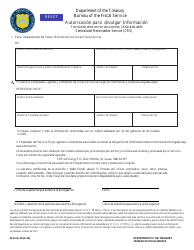

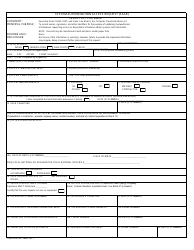

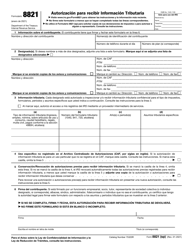

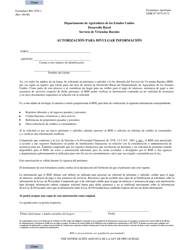

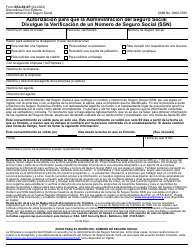

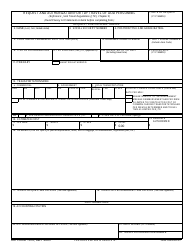

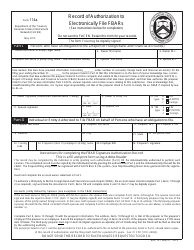

Authorization (SBA Express / Export Express Loan)

Authorization (SBA Express/Export Express Loan) is a 2-page legal document that was released by the U.S. Small Business Administration and used nation-wide.

FAQ

Q: What is an SBA Express/Export Express Loan?

A: An SBA Express/Export Express Loan is a type of loan offered by the Small Business Administration (SBA) that provides expedited financing to small businesses for their working capital needs or export activities.

Q: How does an SBA Express/Export Express Loan work?

A: With an SBA Express/Export Express Loan, small businesses can borrow up to a certain limit ($350,000 for SBA Express and $500,000 for Export Express) and receive a streamlined application and approval process from participating lenders.

Q: What can the funds from an SBA Express/Export Express Loan be used for?

A: The funds from an SBA Express/Export Express Loan can be used for various purposes, such as working capital, inventory purchase, equipment financing, debt refinancing, and export-related activities.

Q: Who is eligible for an SBA Express/Export Express Loan?

A: Small businesses that meet the SBA's size standards and have a solid credit history are typically eligible for an SBA Express/Export Express Loan.

Q: Are collateral and personal guarantees required for an SBA Express/Export Express Loan?

A: Collateral and personal guarantees are generally not required for SBA Express Loans up to $25,000. However, lenders may require collateral for higher loan amounts.

Q: What is the maximum interest rate for an SBA Express/Export Express Loan?

A: The maximum interest rates for SBA Express/Export Express Loans are set by the SBA but may vary depending on the loan amount and the term of the loan.

Q: How long does it take to receive funding from an SBA Express/Export Express Loan?

A: The timeline for funding an SBA Express/Export Express Loan can vary depending on the lender, but it is generally faster compared to other SBA loan programs.

Q: Can an SBA Express/Export Express Loan be used to refinance existing debt?

A: Yes, an SBA Express/Export Express Loan can be used to refinance existing debt, as long as it improves the cash flow of the business and meets the SBA's guidelines.

Q: Are there any fees associated with an SBA Express/Export Express Loan?

A: Yes, there are fees associated with an SBA Express/Export Express Loan, including guarantee fees and lender fees. The specific fees will vary depending on the lender and the loan amount.

Form Details:

- The latest edition currently provided by the U.S. Small Business Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.