This version of the form is not currently in use and is provided for reference only. Download this version of

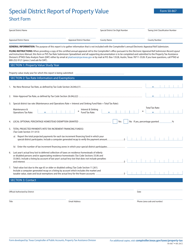

Form 50-105

for the current year.

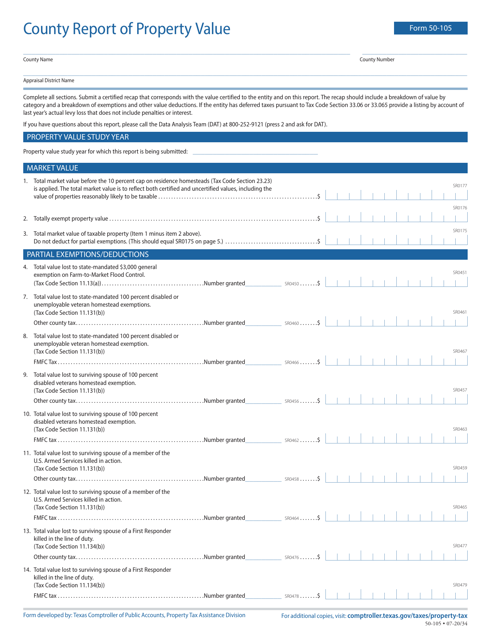

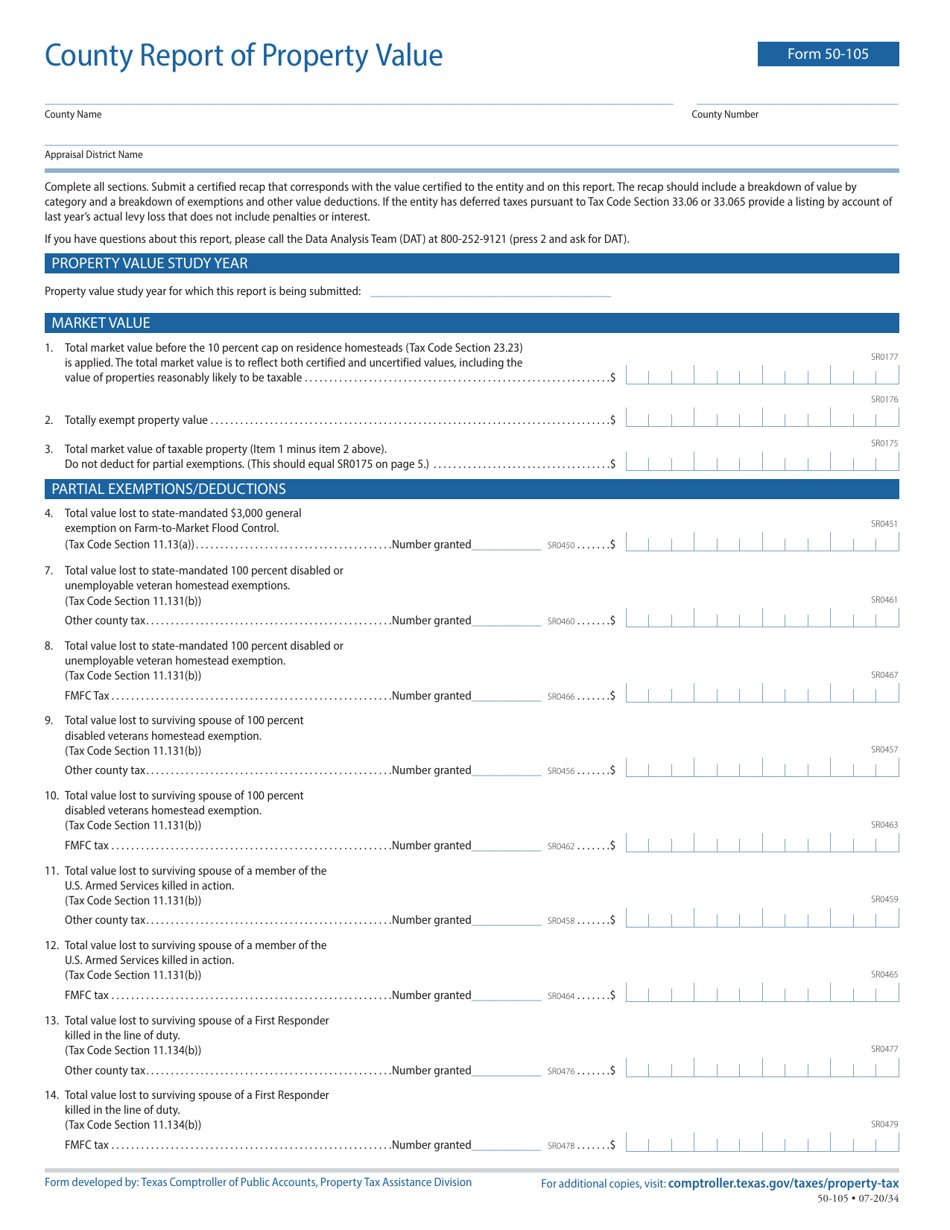

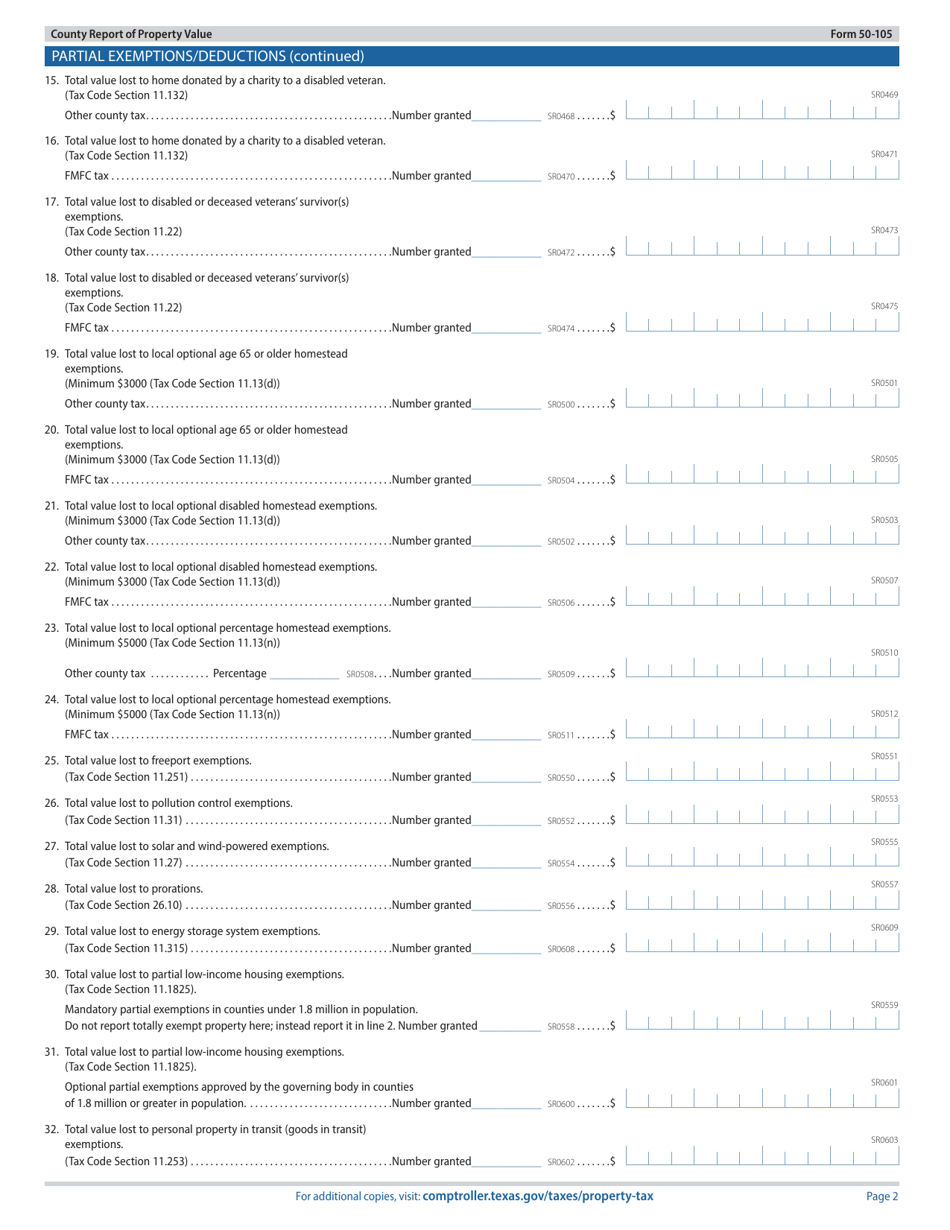

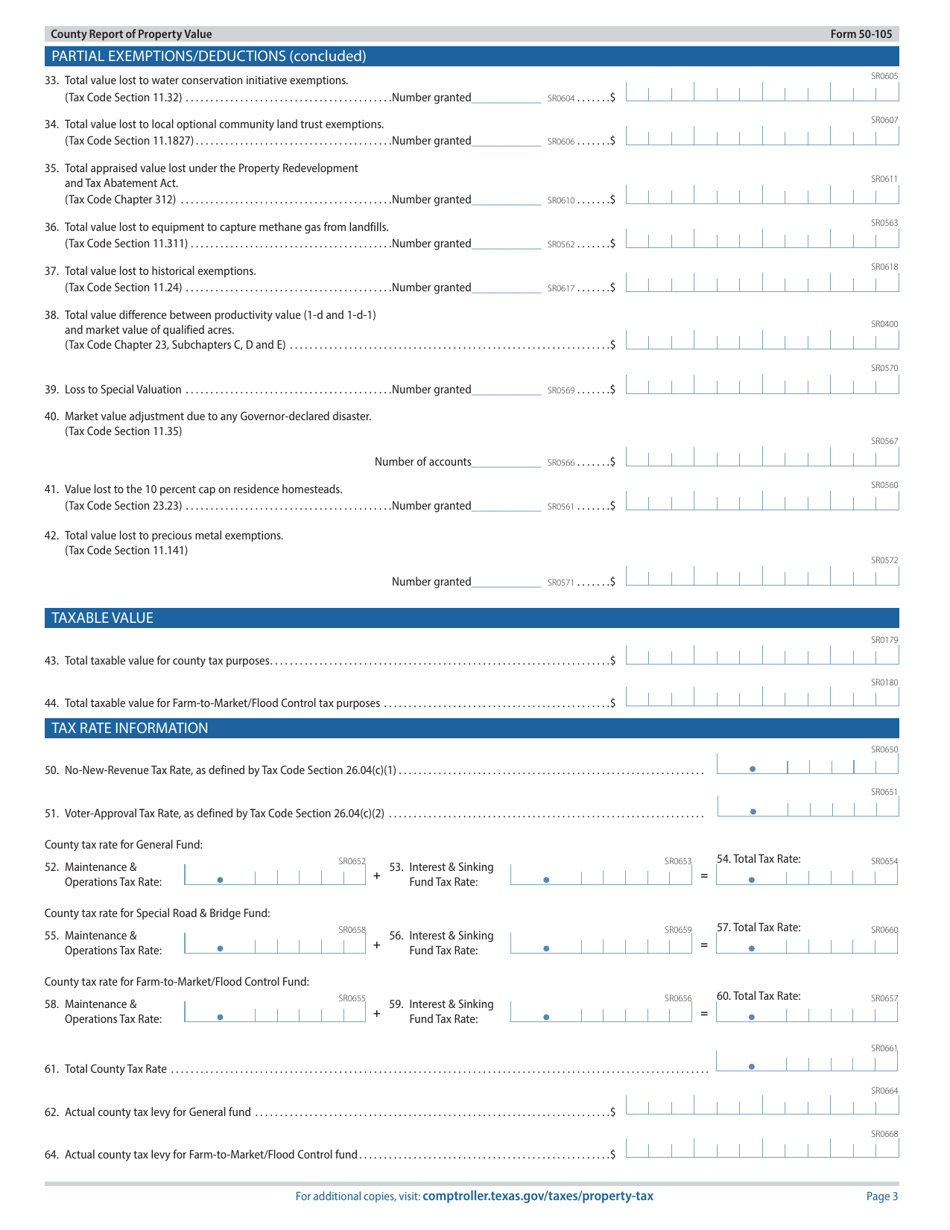

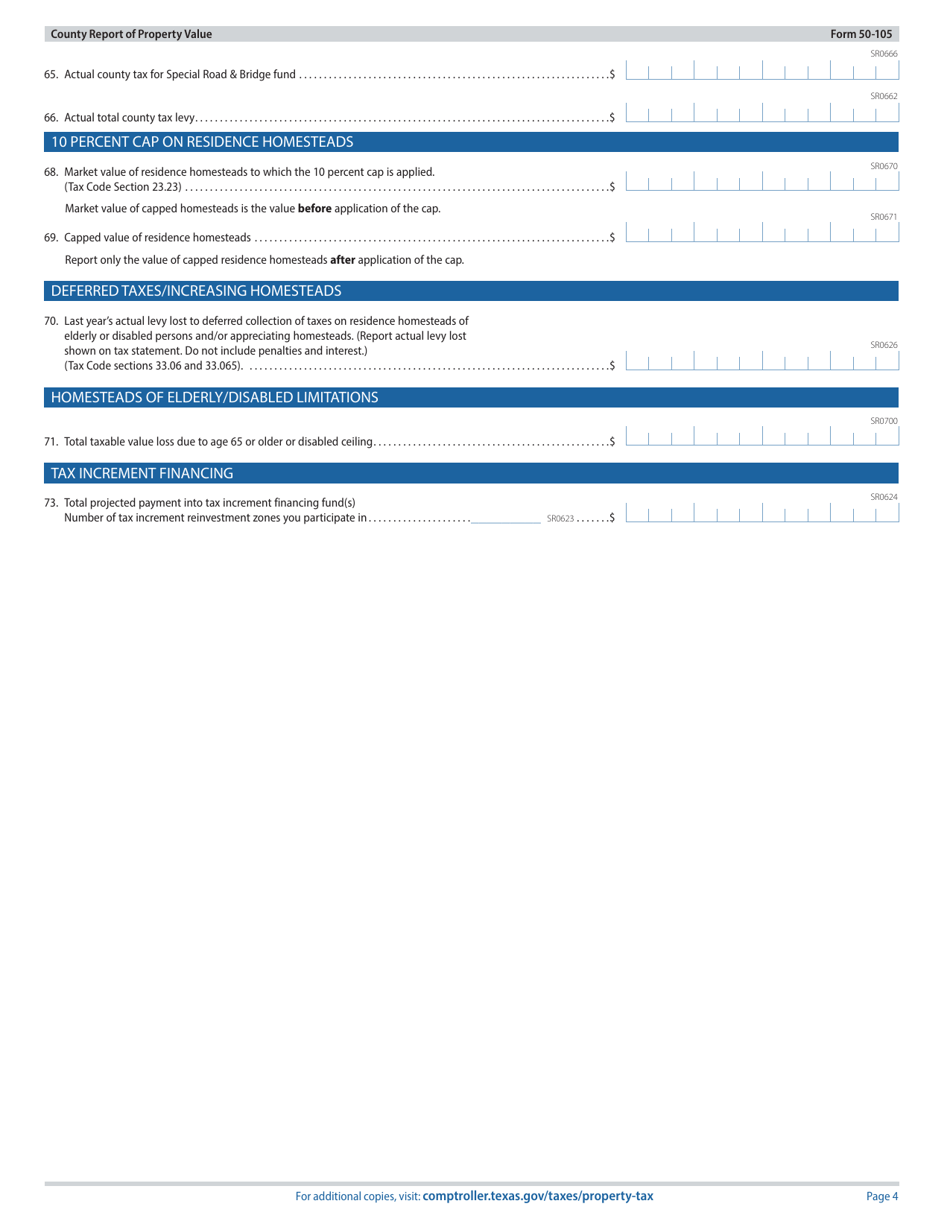

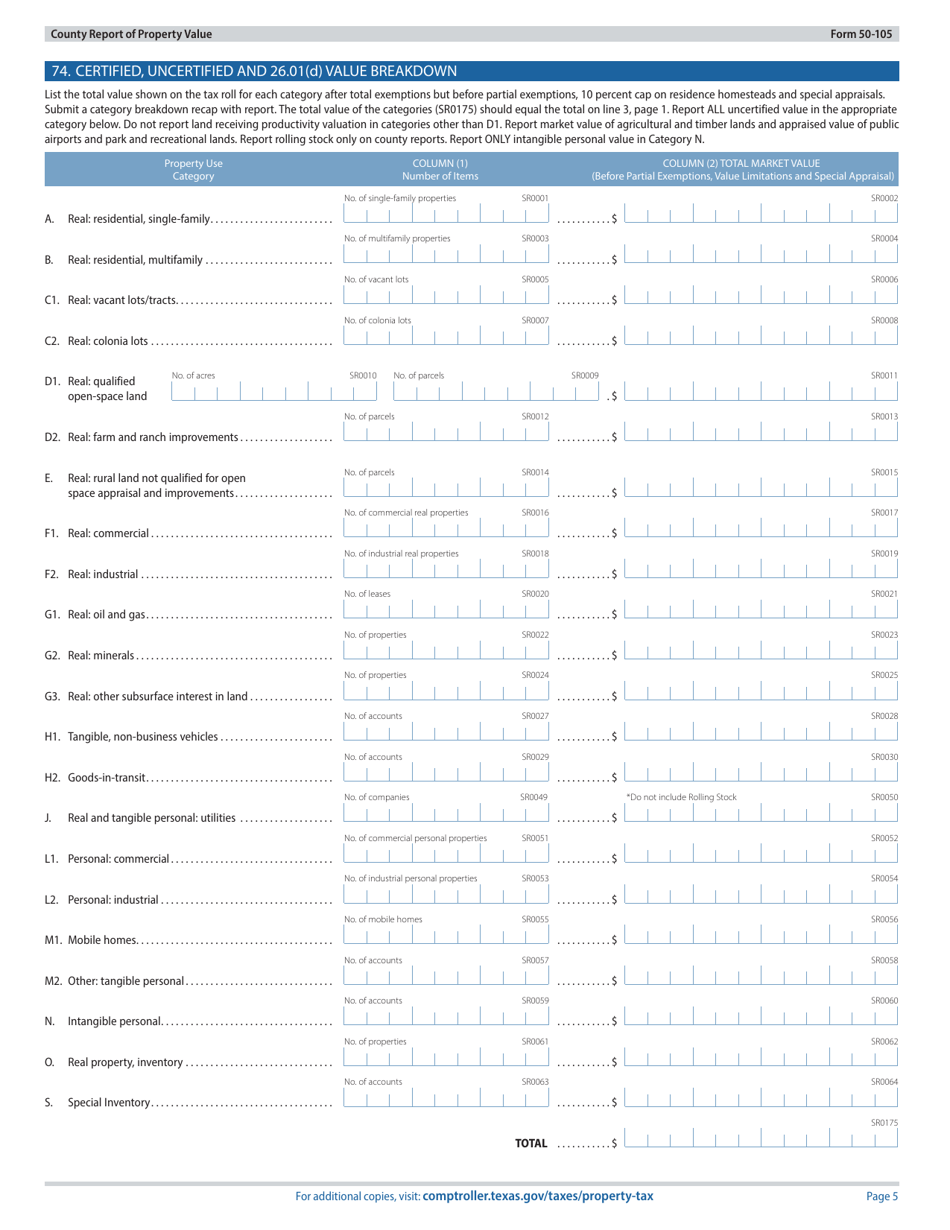

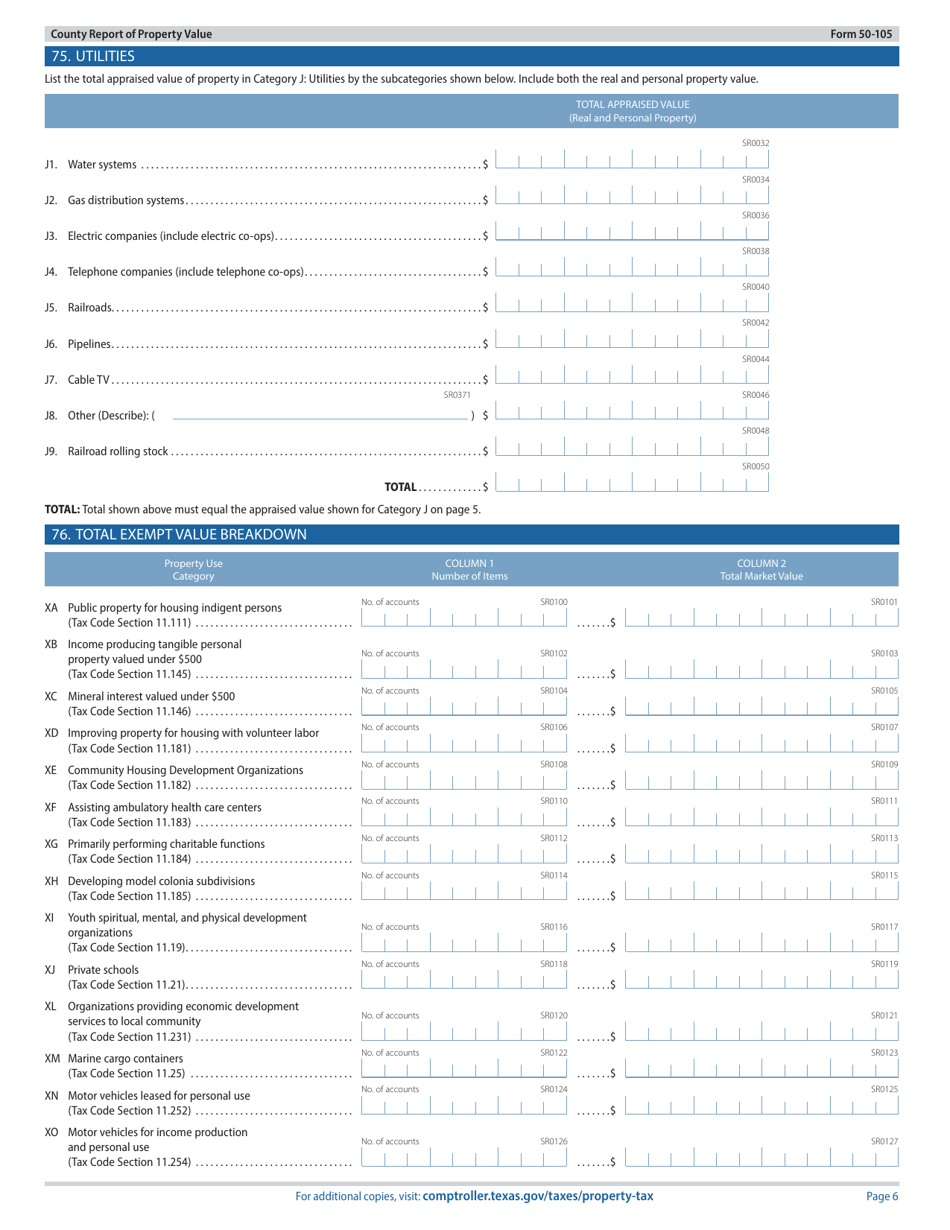

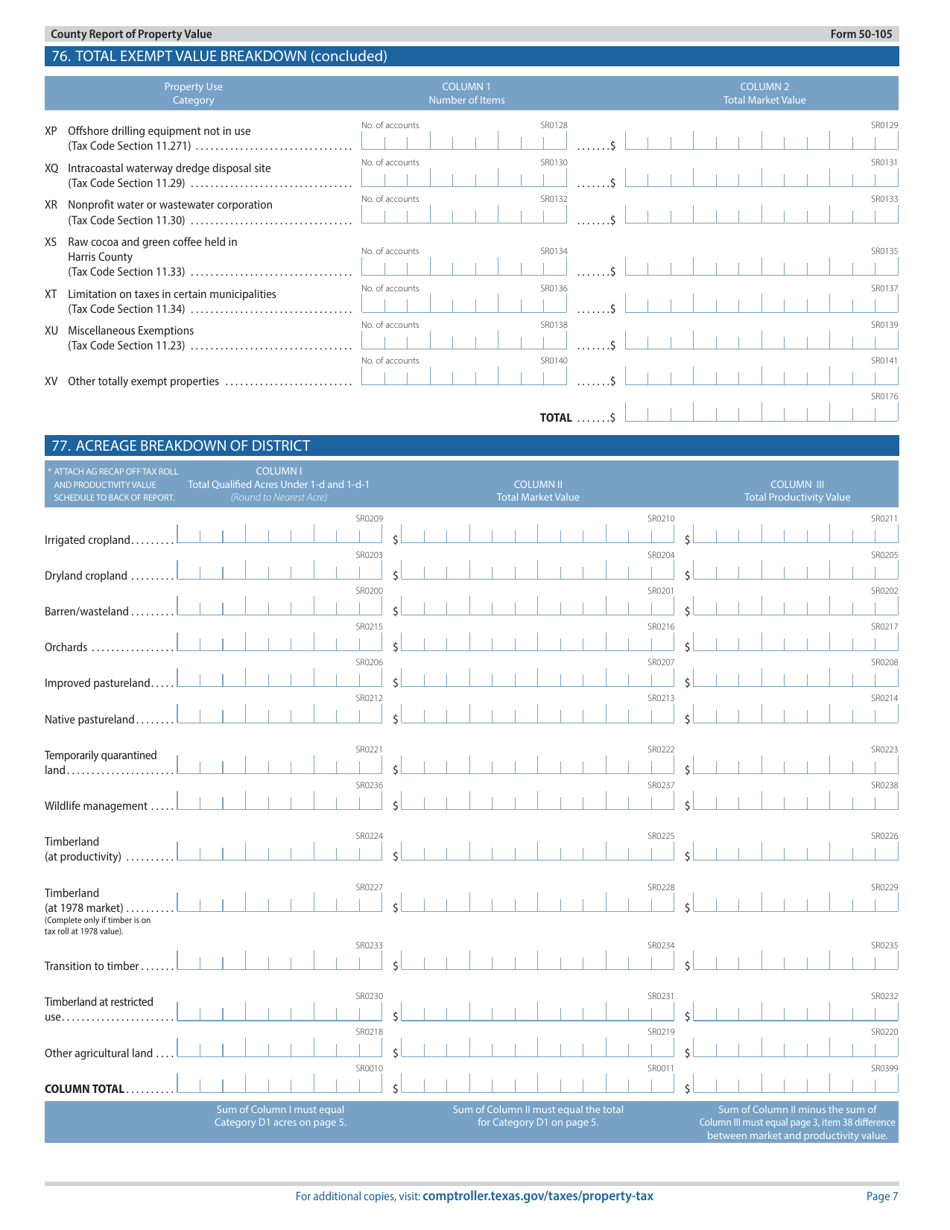

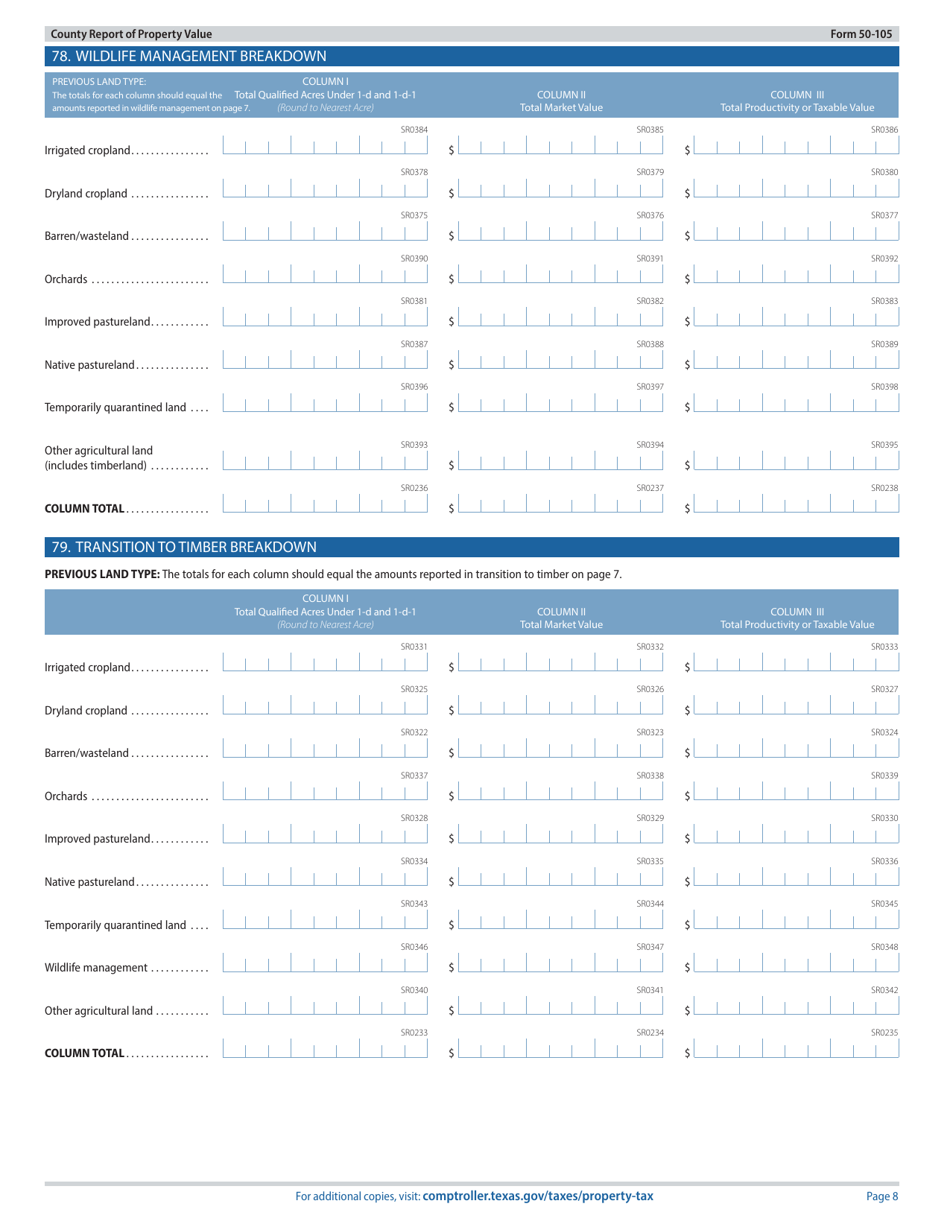

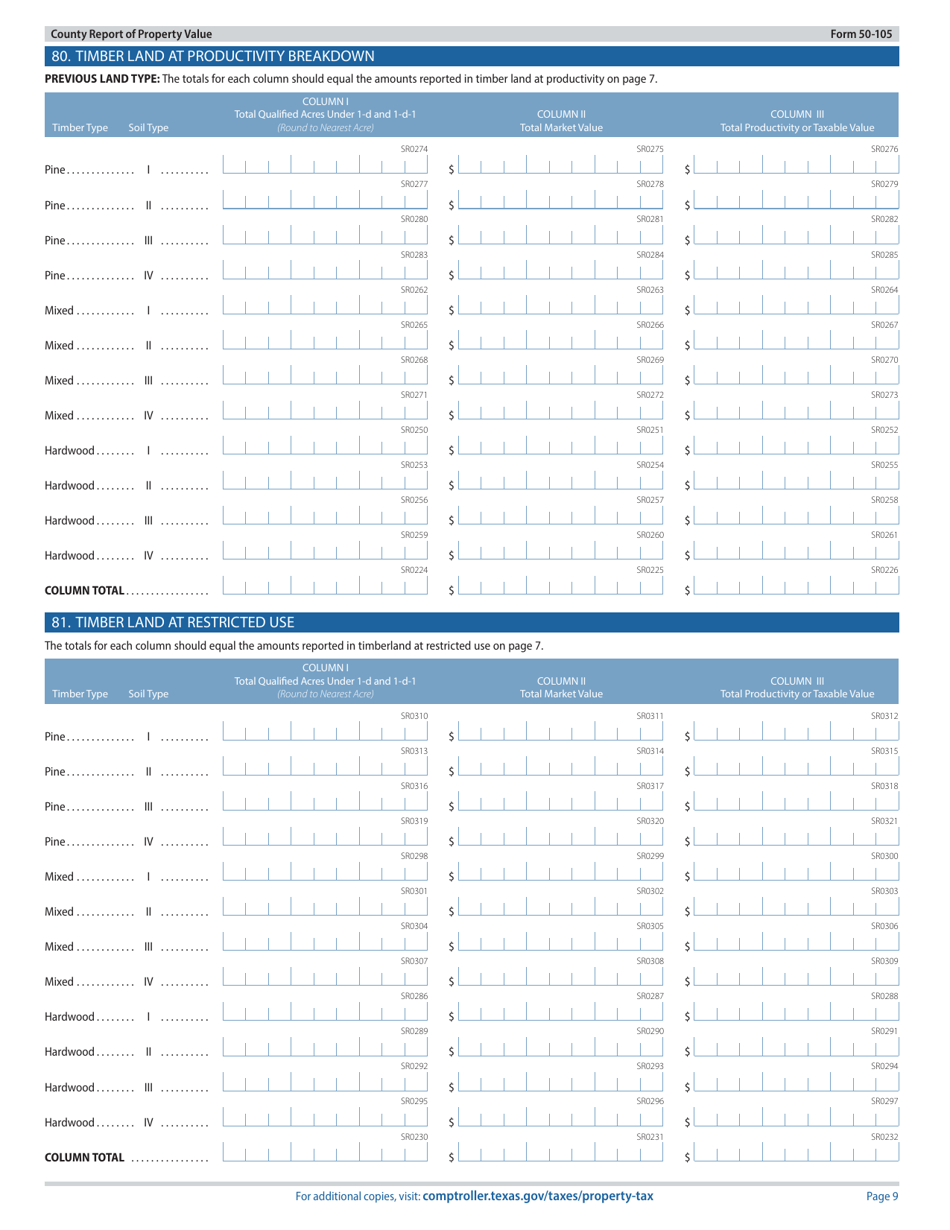

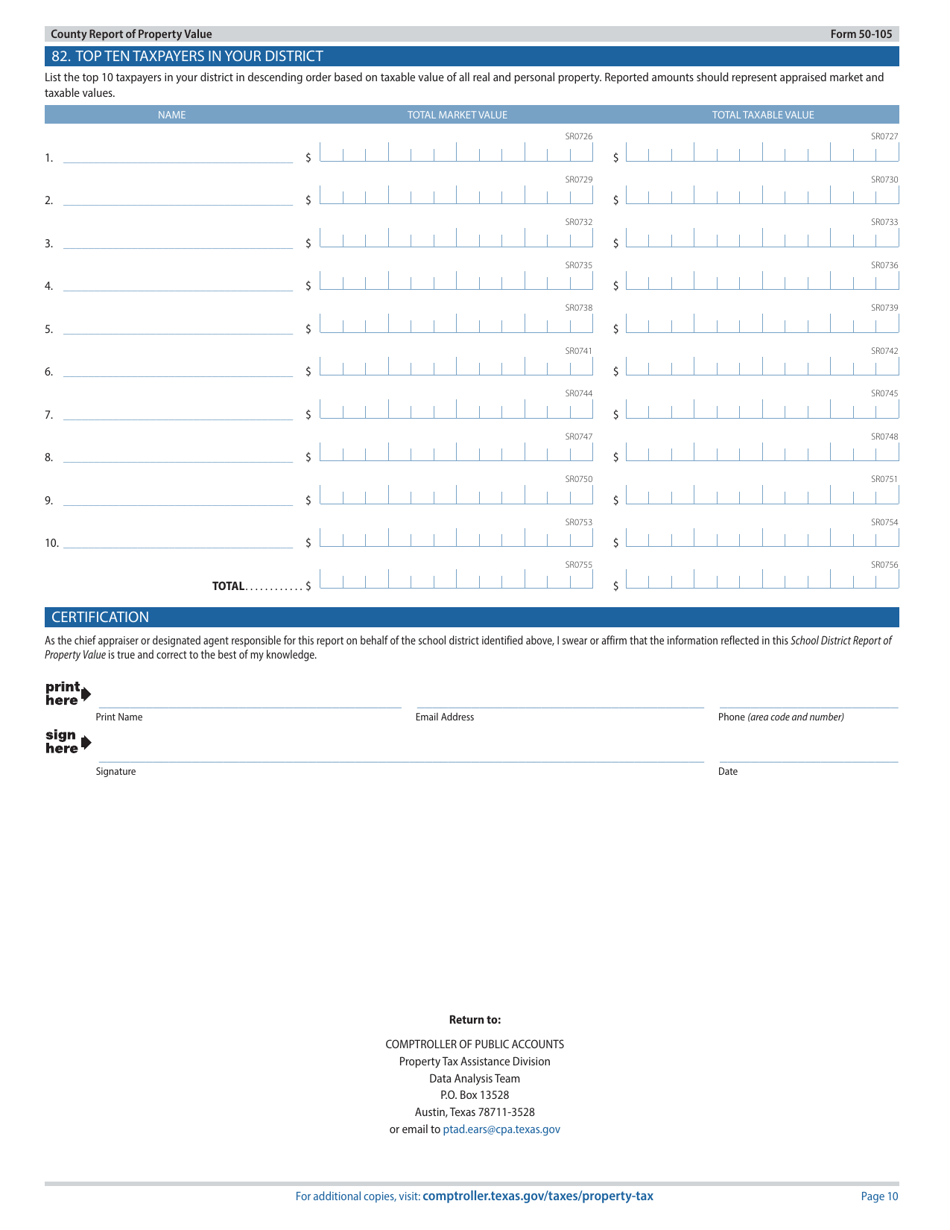

Form 50-105 County Report of Property Value - Texas

What Is Form 50-105?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-105 County Report of Property Value?

A: Form 50-105 County Report of Property Value is a form used in Texas to report the value of properties in a county.

Q: Who needs to file Form 50-105 County Report of Property Value?

A: Property owners, including individuals and businesses, need to file Form 50-105 County Report of Property Value.

Q: When is Form 50-105 County Report of Property Value due?

A: Form 50-105 County Report of Property Value is due on April 15th of each year.

Q: What information is required to complete Form 50-105 County Report of Property Value?

A: The form requires information about the property's owner, location, description, market value, and various other details.

Q: Is there a penalty for not filing Form 50-105 County Report of Property Value?

A: Yes, there may be penalties for not filing or for filing late. It is important to submit the form on time to avoid penalties.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-105 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.