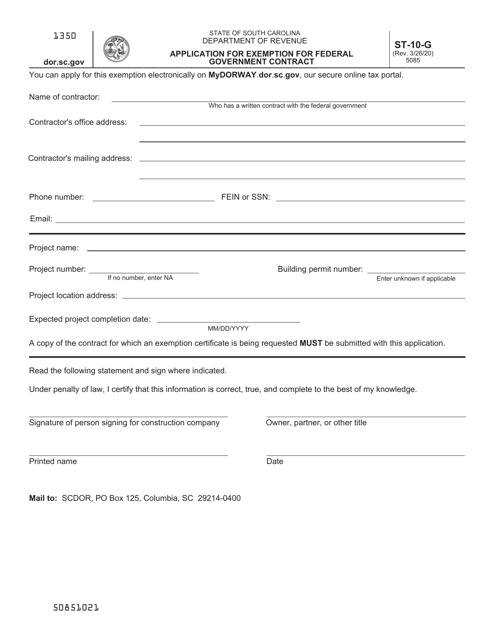

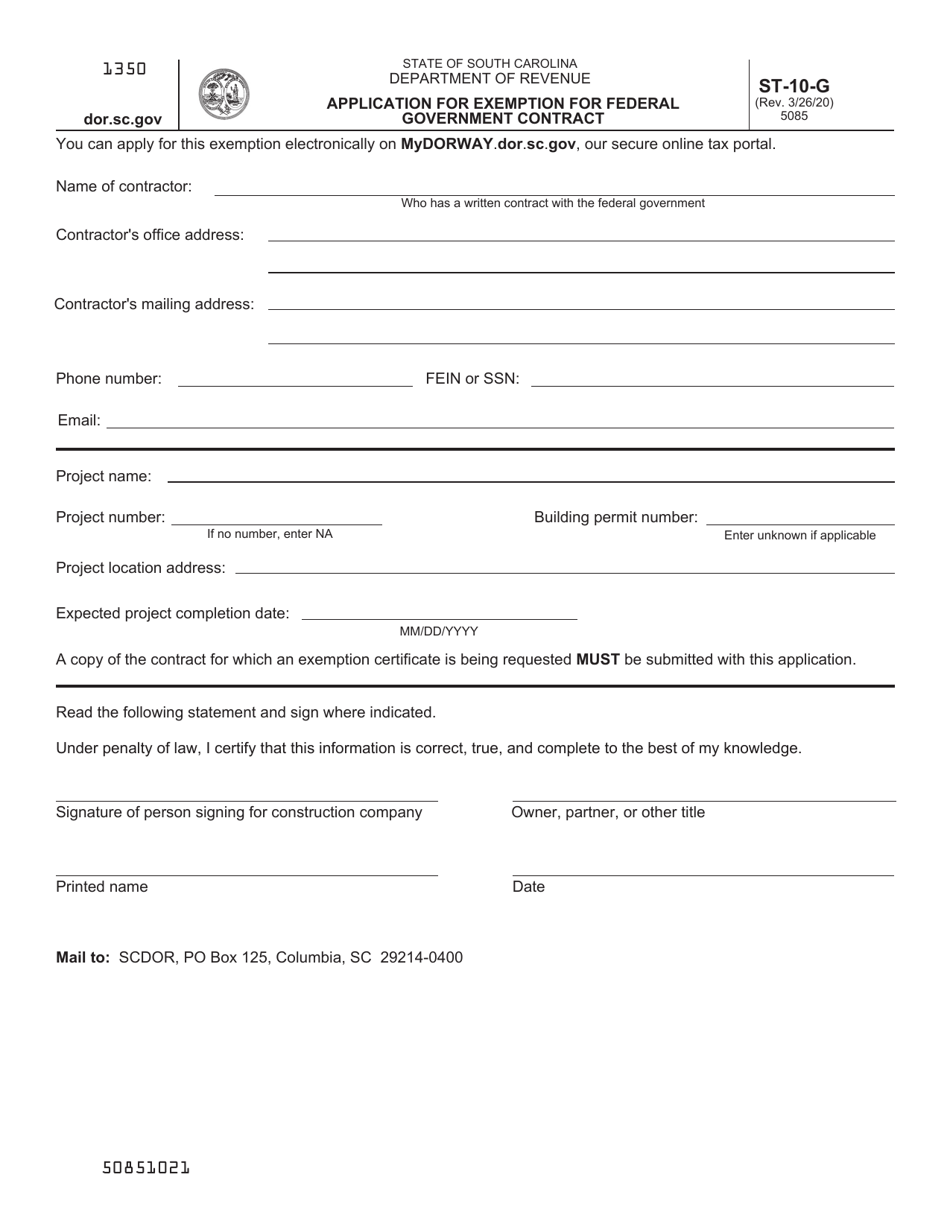

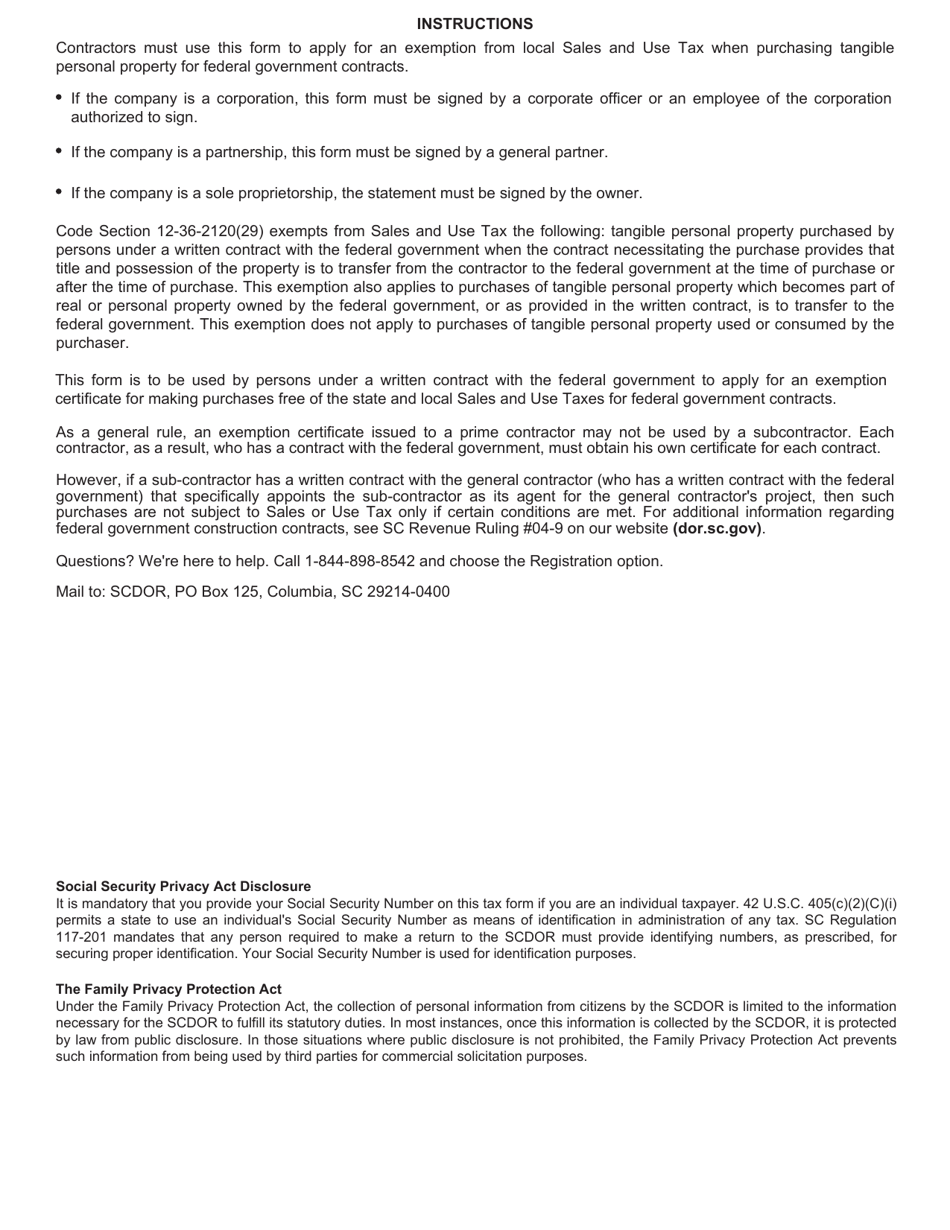

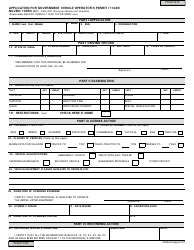

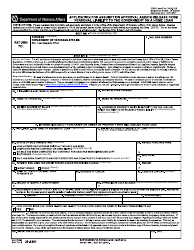

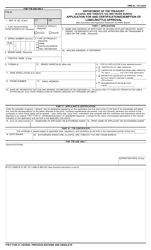

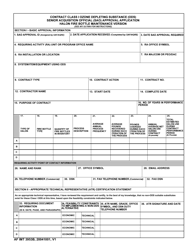

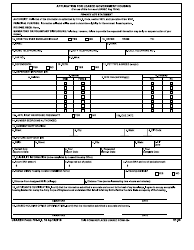

Form ST-10-G Application for Exemption for Federal Government Contract - South Carolina

What Is Form ST-10-G?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-10-G?

A: Form ST-10-G is an application for exemption for federal government contracts in South Carolina.

Q: Who can use Form ST-10-G?

A: Form ST-10-G can be used by individuals or businesses that are seeking an exemption for federal government contracts in South Carolina.

Q: What is the purpose of Form ST-10-G?

A: The purpose of Form ST-10-G is to apply for an exemption from South Carolina sales and use tax on materials, supplies, equipment, and fuel used in federal government contracts.

Q: How do I fill out Form ST-10-G?

A: You need to provide your personal or business information, details about the federal government contract, and the reasons for requesting the exemption.

Q: Is there a deadline for submitting Form ST-10-G?

A: There is no specific deadline mentioned for submitting Form ST-10-G. However, it is recommended to submit the form as soon as possible.

Q: Are there any fees for submitting Form ST-10-G?

A: No, there are no fees associated with submitting Form ST-10-G.

Q: What should I do after submitting Form ST-10-G?

A: After submitting Form ST-10-G, you should keep a copy of the form for your records and await a response from the South Carolina Department of Revenue regarding your exemption request.

Form Details:

- Released on March 26, 2020;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-10-G by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.