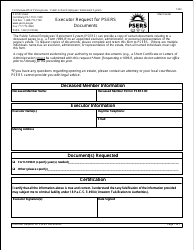

Form PSRS-1309 Request for Recalculation Estimate Due to Change in Marital Status or Death of Survivor Annuitant - Pennsylvania

What Is Form PSRS-1309?

This is a legal form that was released by the Pennsylvania Public School Employees' Retirement System - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PSRS-1309?

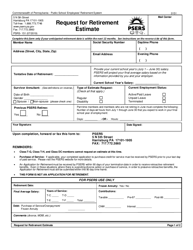

A: Form PSRS-1309 is a request form used in Pennsylvania to estimate a recalculation due to a change in marital status or death of a survivor annuitant.

Q: When should I use Form PSRS-1309?

A: You should use Form PSRS-1309 in Pennsylvania when you need to request a recalculation estimate due to a change in marital status or the death of a survivor annuitant.

Q: How do I obtain Form PSRS-1309?

A: You can obtain Form PSRS-1309 by contacting the appropriate Pennsylvania retirement system or pension office.

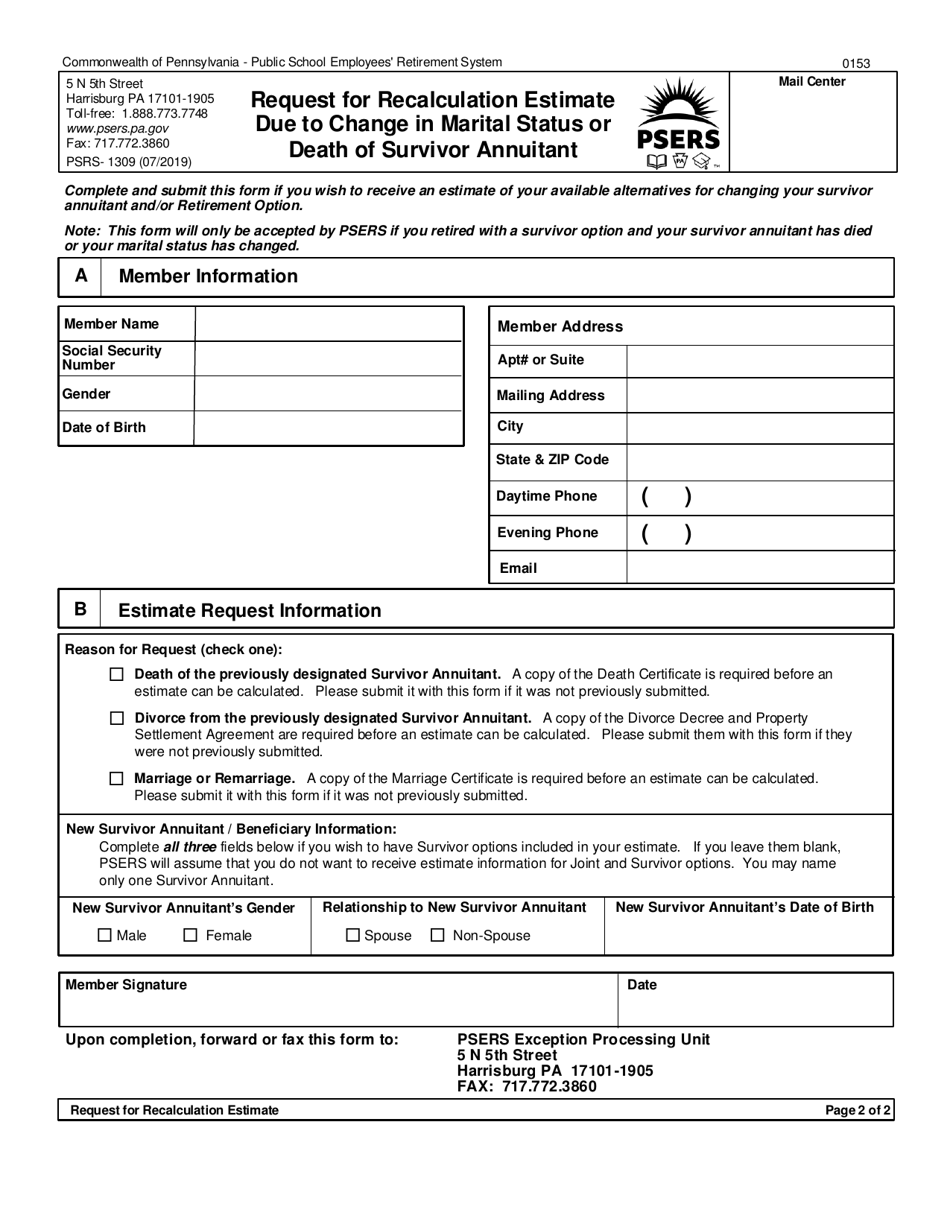

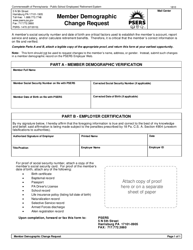

Q: What information is required on Form PSRS-1309?

A: Form PSRS-1309 requires information such as member and beneficiary details, date of event, and documentation supporting the change in marital status or death.

Q: Is there a deadline for submitting Form PSRS-1309?

A: The deadline for submitting Form PSRS-1309 varies depending on the specific retirement system or pension office in Pennsylvania. It is best to check with them for the specific deadline.

Q: What happens after submitting Form PSRS-1309?

A: After submitting Form PSRS-1309, the retirement system or pension office will review your request and provide you with an estimate of the recalculation based on the change in marital status or death of a survivor annuitant.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Pennsylvania Public School Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PSRS-1309 by clicking the link below or browse more documents and templates provided by the Pennsylvania Public School Employees' Retirement System.