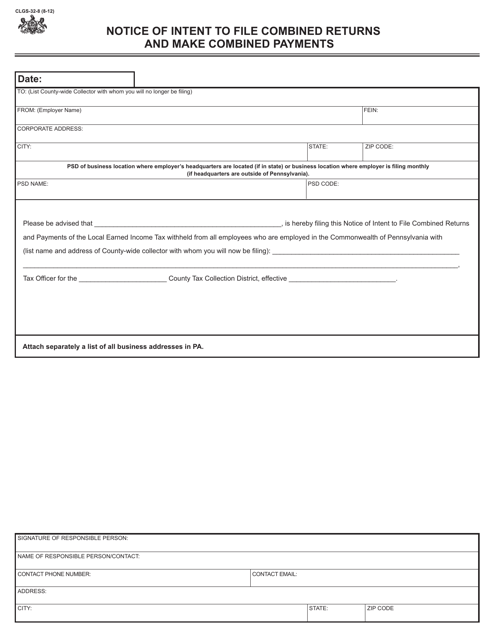

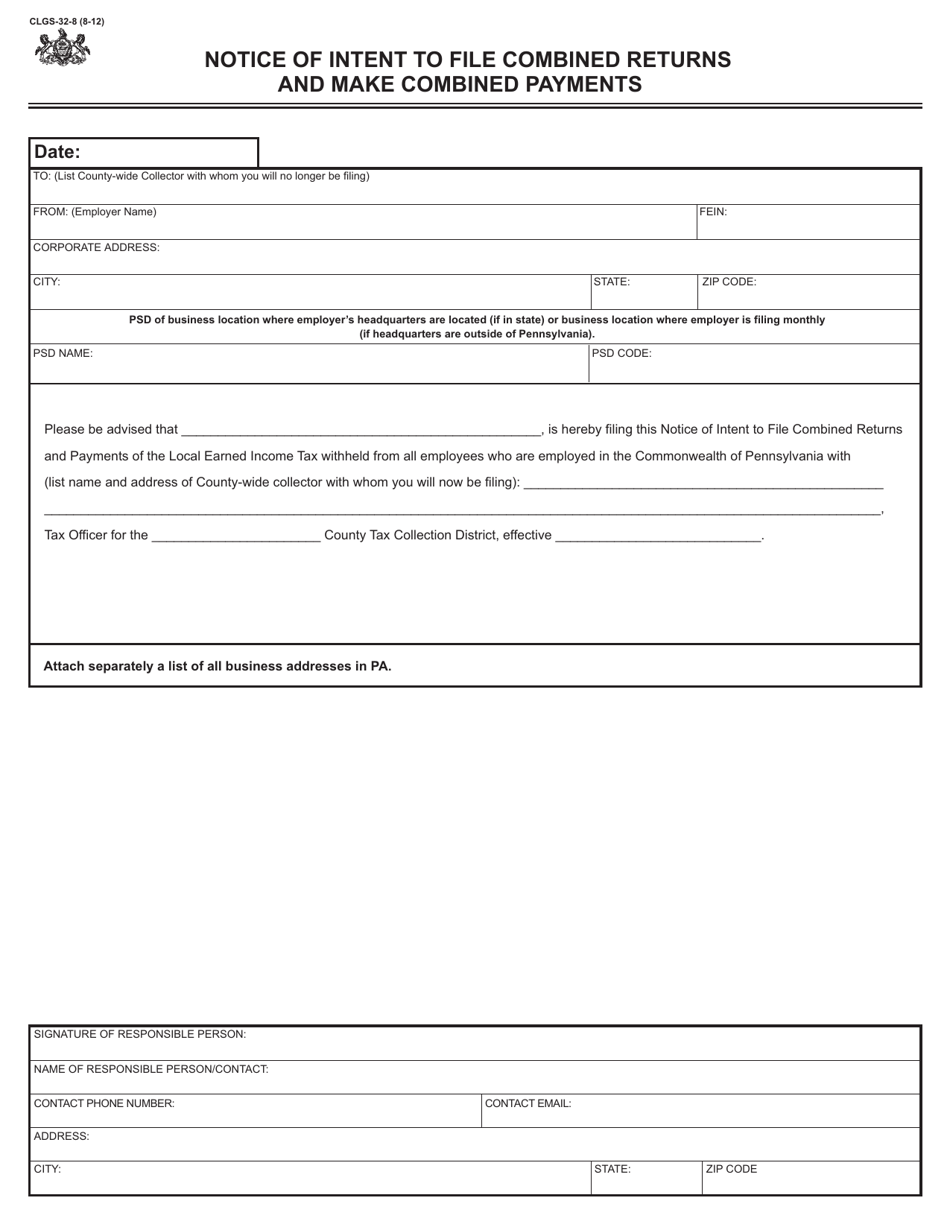

Form CLGS-32-8 Notice of Intent to File Combined Returns and Make Combined Payments - Pennsylvania

What Is Form CLGS-32-8?

This is a legal form that was released by the Pennsylvania Department of Community and Economic Development - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CLGS-32-8?

A: Form CLGS-32-8 is the Notice of Intent to File Combined Returns and Make Combined Payments form used in Pennsylvania.

Q: What is the purpose of Form CLGS-32-8?

A: The purpose of Form CLGS-32-8 is to notify the Pennsylvania Department of Revenue of the intent to file combined tax returns and make combined tax payments for affiliated entities.

Q: Who needs to file Form CLGS-32-8?

A: Affiliated entities in Pennsylvania who intend to file combined tax returns and make combined tax payments must file Form CLGS-32-8.

Q: What information is required on Form CLGS-32-8?

A: Form CLGS-32-8 requires information such as the names and identification numbers of the affiliated entities, the type of combined return being filed, and the confirmation that the required federal schedules have been filed with the IRS.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the Pennsylvania Department of Community and Economic Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CLGS-32-8 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Community and Economic Development.