This version of the form is not currently in use and is provided for reference only. Download this version of

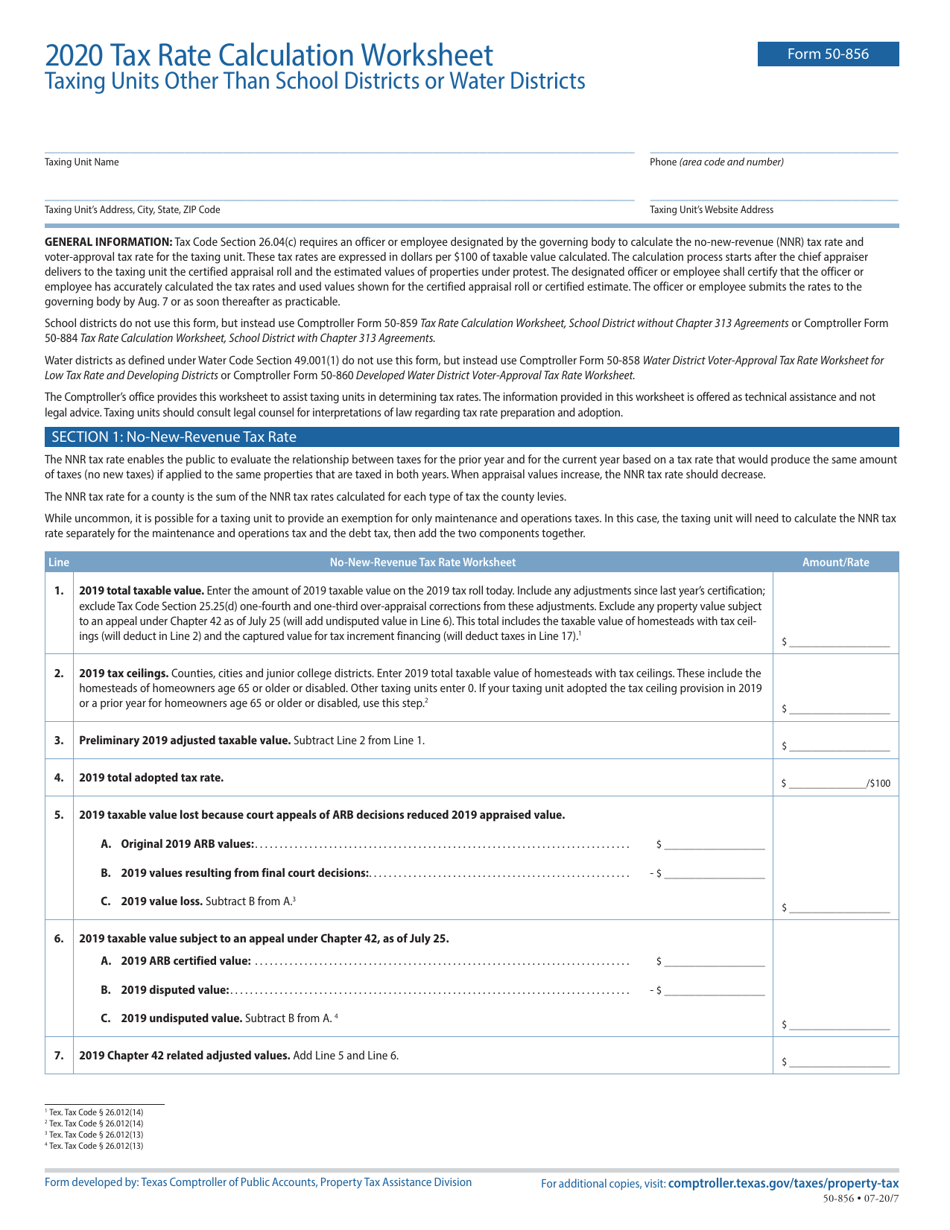

Form 50-856

for the current year.

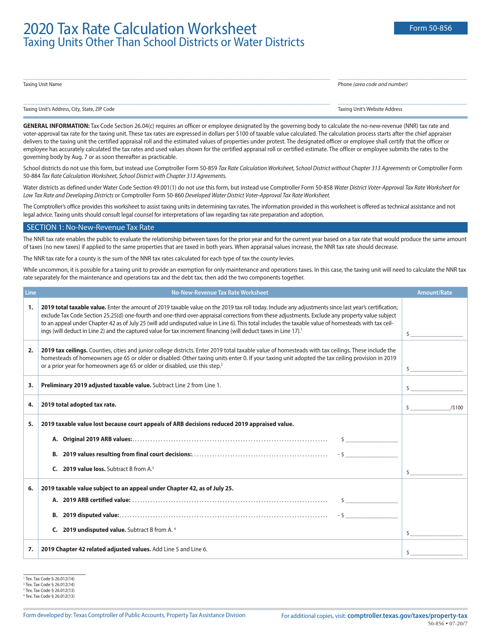

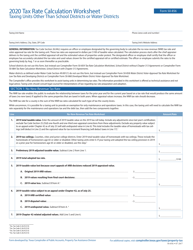

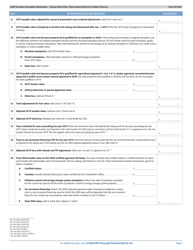

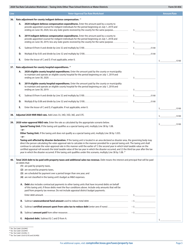

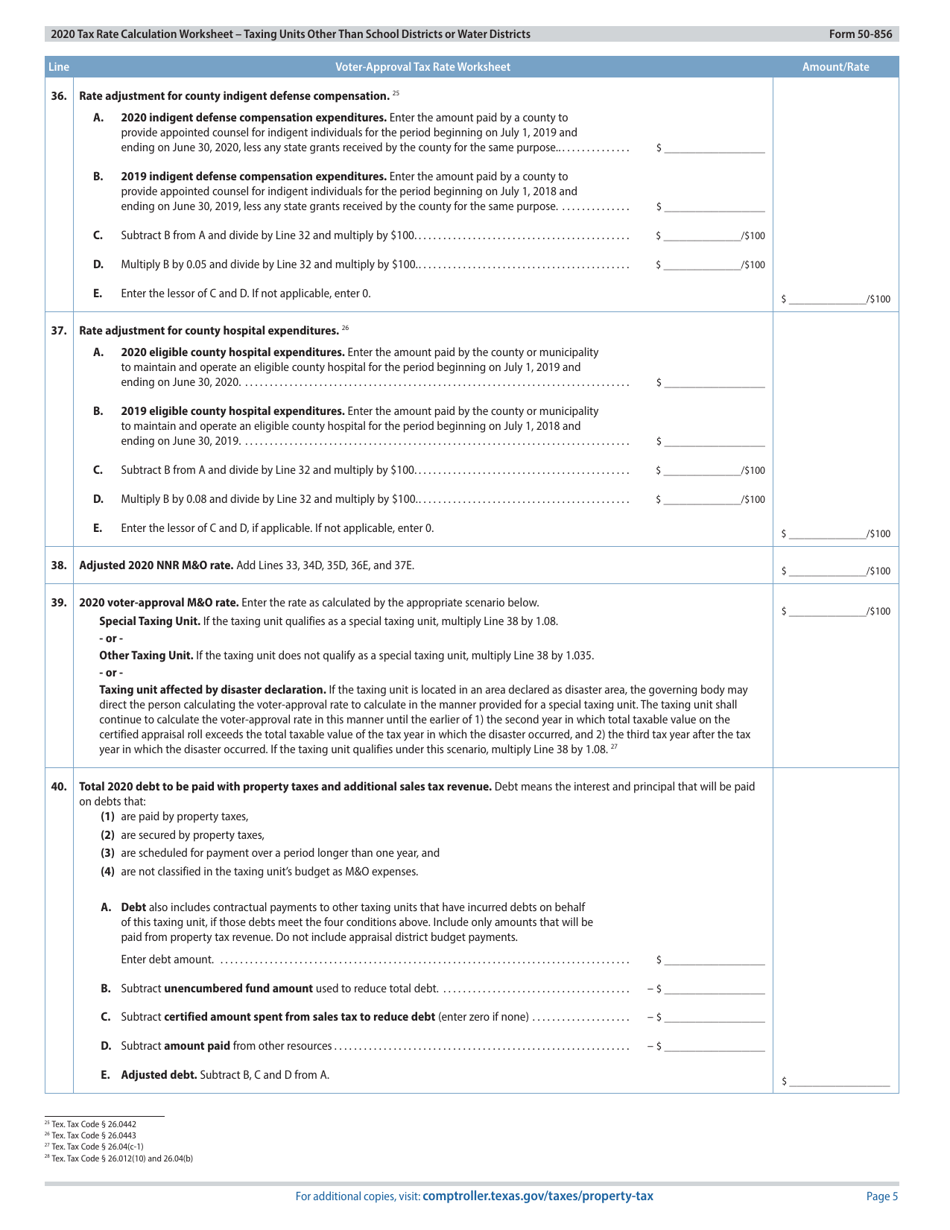

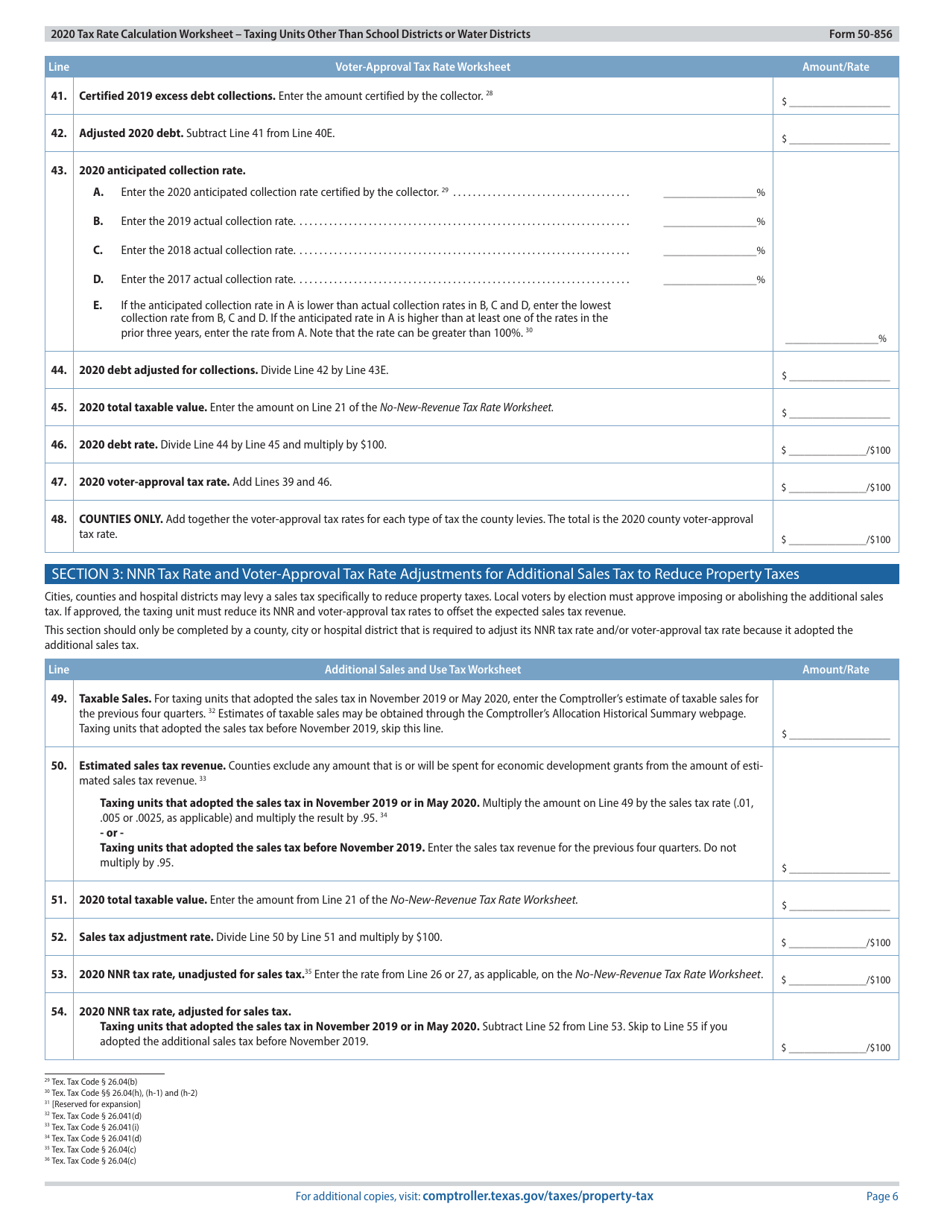

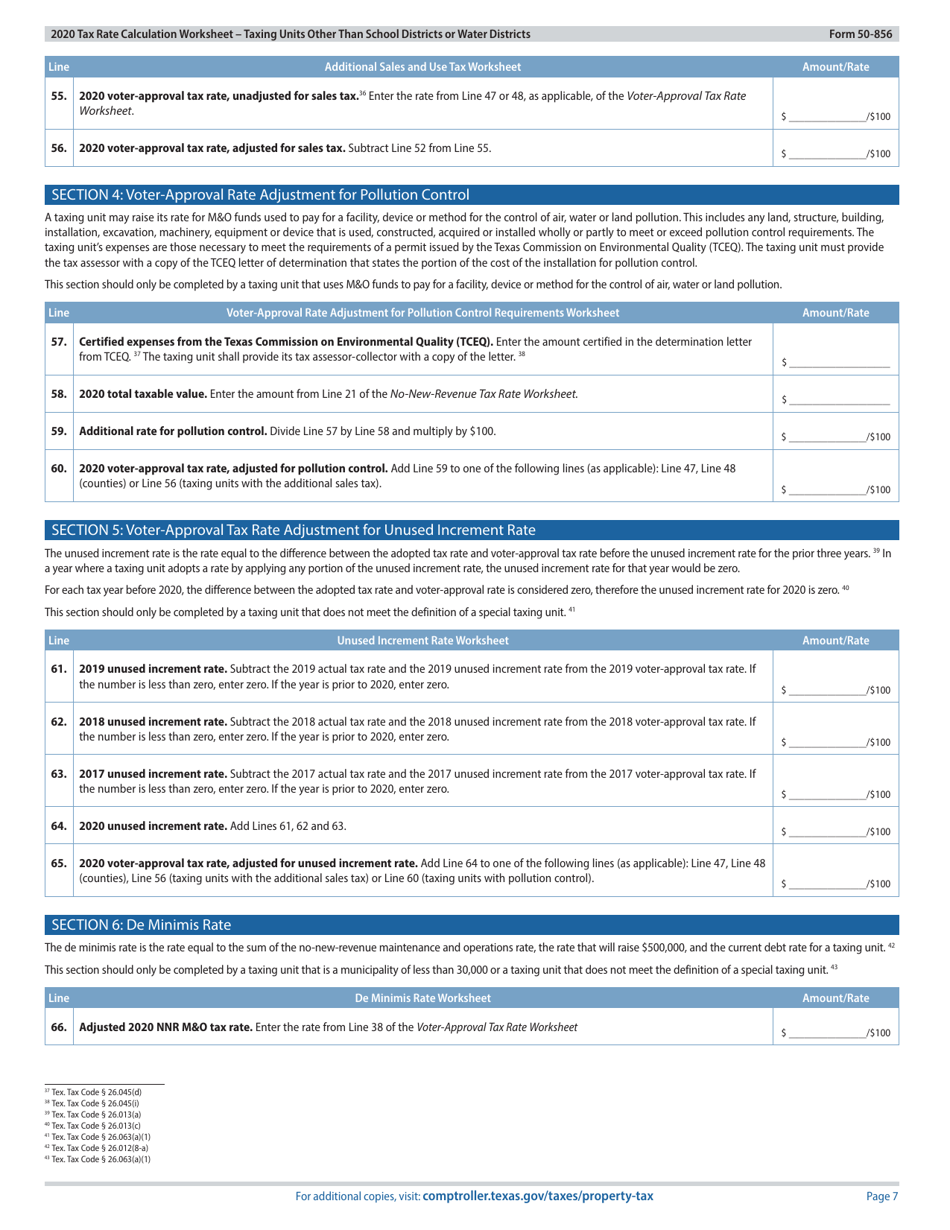

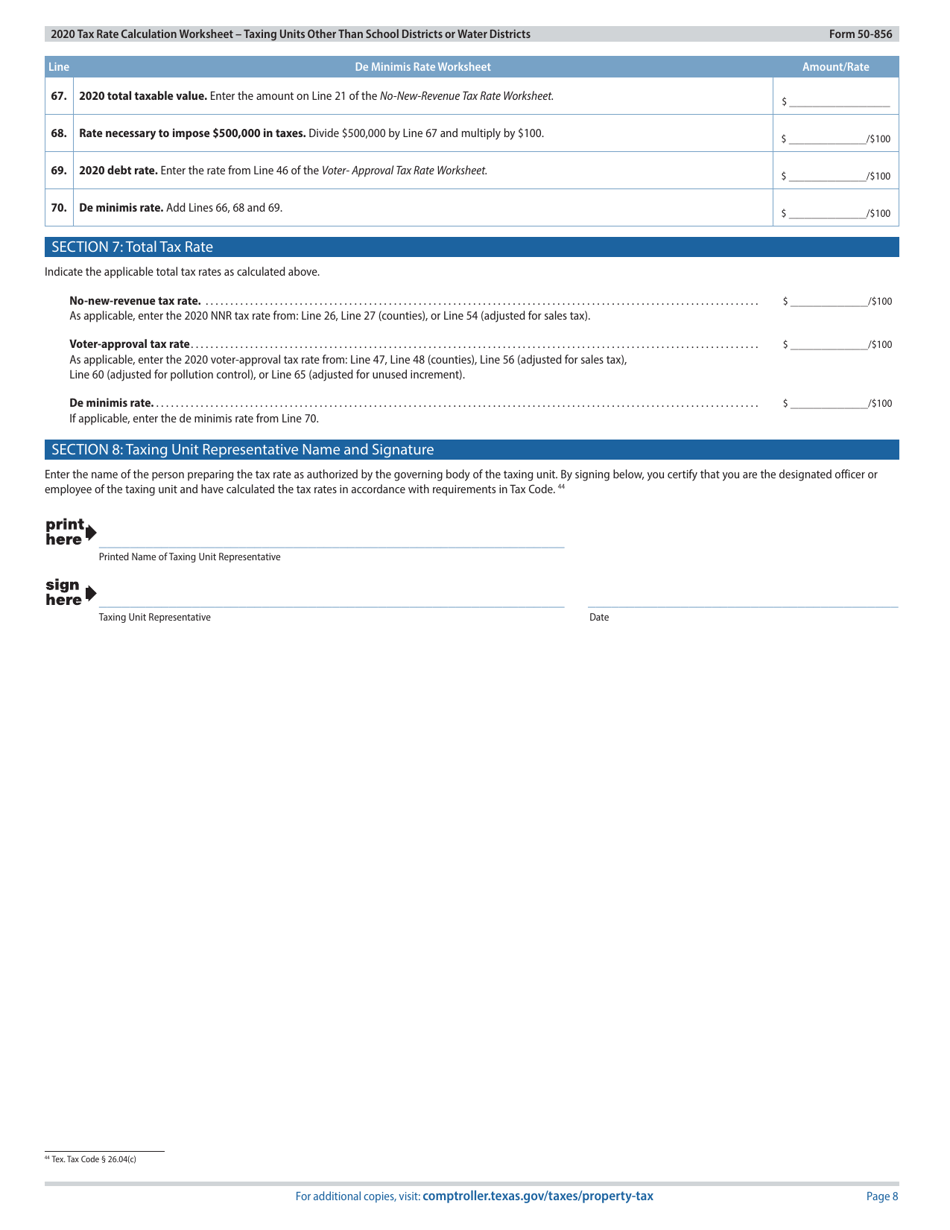

Form 50-856 Tax Rate Calculation Worksheet - Taxing Units Other Than School Districts or Water Districts - Texas

What Is Form 50-856?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-856?

A: Form 50-856 is a tax rate calculation worksheet specifically for taxing units other thanschool districts or water districts in Texas.

Q: Who should use Form 50-856?

A: This form should be used by taxing units other than school districts or water districts in Texas to calculate their tax rates.

Q: What is the purpose of Form 50-856?

A: The purpose of Form 50-856 is to assist taxing units in Texas in calculating their tax rates for units other than school districts or water districts.

Q: What information is needed to complete Form 50-856?

A: To complete Form 50-856, you will need information on the taxing unit's budgeted expenditures, taxable value of property, and any adjustments or exemptions.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-856 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.