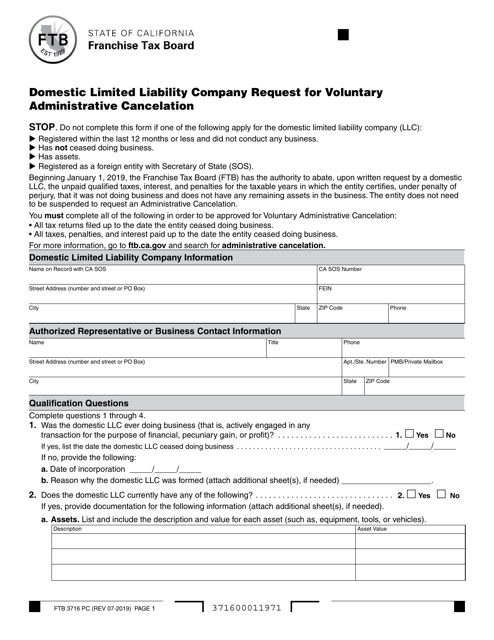

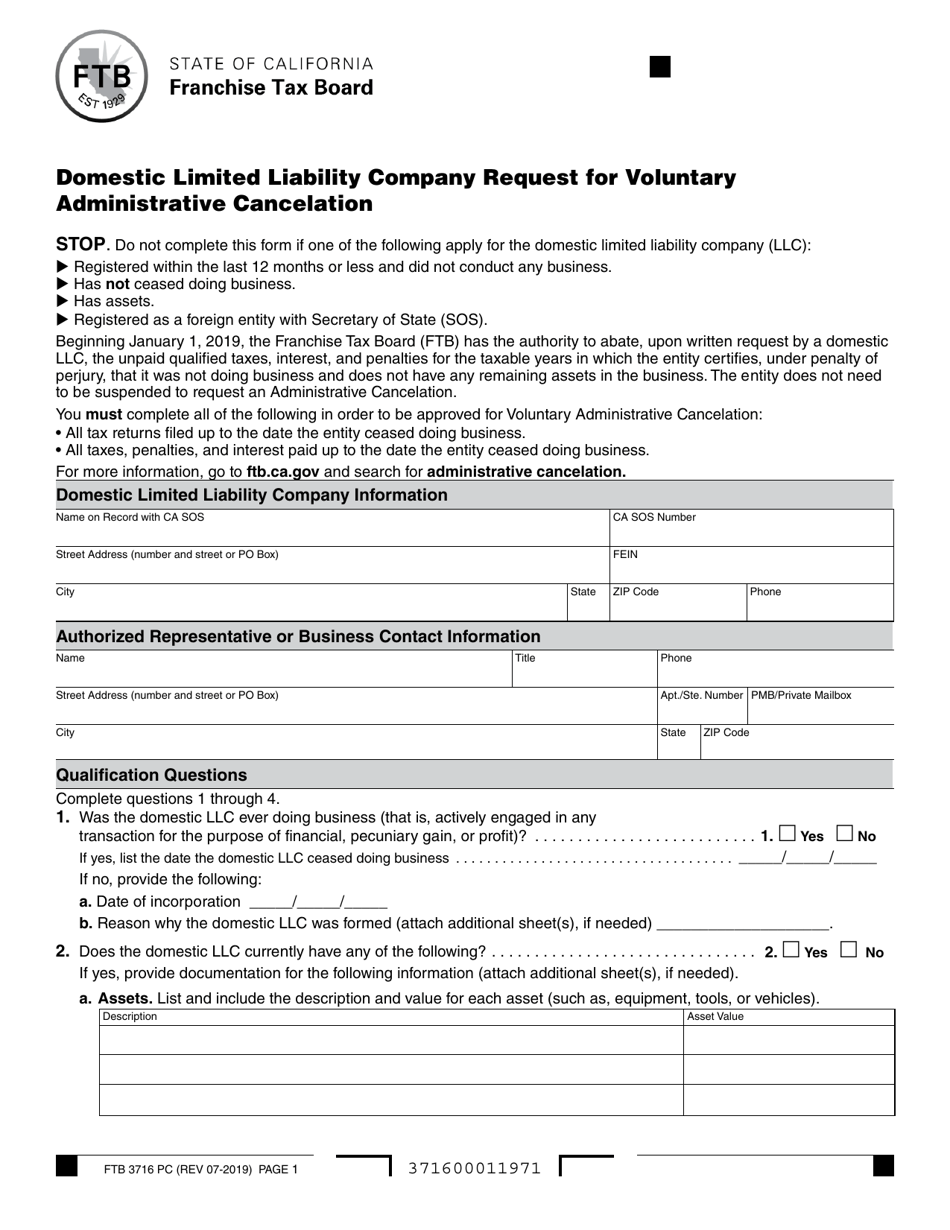

Form FTB3716 PC Domestic Limited Liability Company Request for Voluntary Administrative Cancelation - California

What Is Form FTB3716 PC?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3716 PC?

A: Form FTB3716 PC is a form used in California to request voluntary administrative cancellation of a domestic limited liability company.

Q: What is a domestic limited liability company?

A: A domestic limited liability company is a type of business entity that combines aspects of a corporation and a partnership. It provides limited liability protection to its owners while allowing for flexible management and taxation options.

Q: Why would someone request voluntary administrative cancellation for a domestic limited liability company?

A: There can be several reasons for requesting voluntary administrative cancellation, such as the company no longer being in operation, the owners wanting to dissolve the company, or not meeting certain legal requirements.

Q: What is the purpose of Form FTB3716 PC?

A: The purpose of this form is to notify the California Franchise Tax Board (FTB) of the company's intent to voluntarily cancel its legal existence.

Q: Are there any fees associated with filing Form FTB3716 PC?

A: Yes, there is a filing fee of $20.

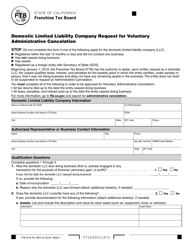

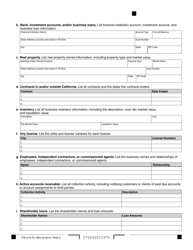

Q: Are there any specific requirements for filling out Form FTB3716 PC?

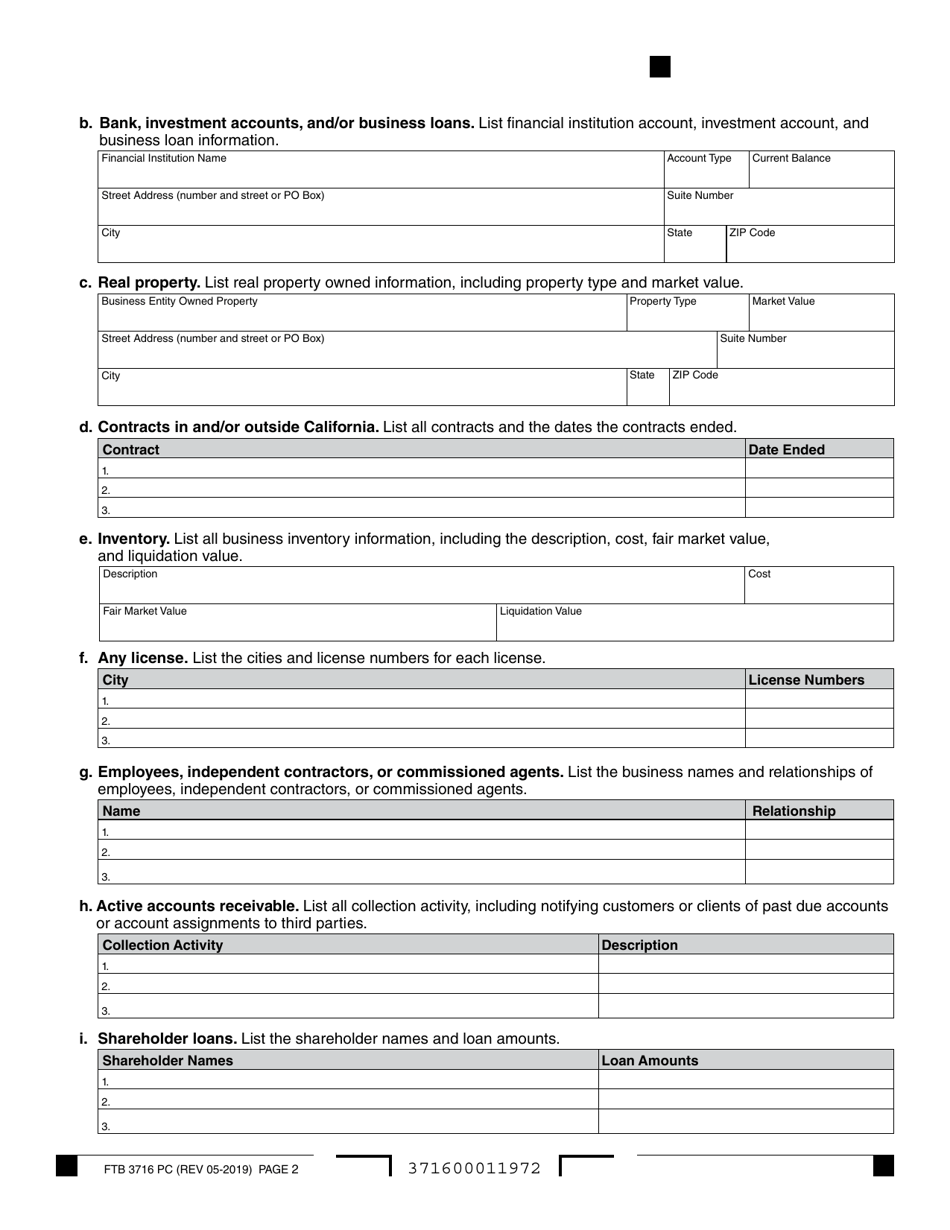

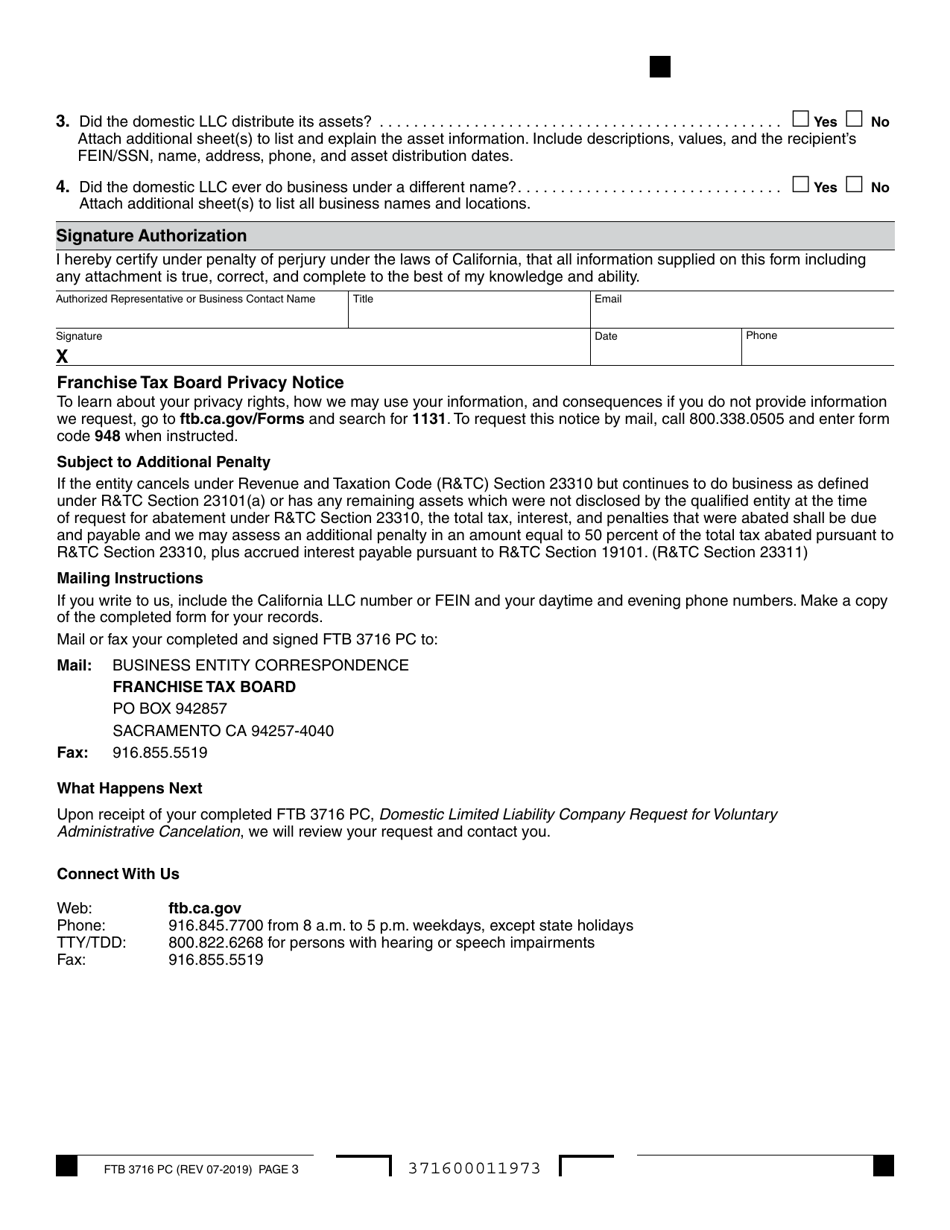

A: Yes, you will need to provide the LLC's name, the date of cancellation, reasons for cancellation, signatures of authorized persons, and any additional required information or attachments.

Q: Can an individual file Form FTB3716 PC for a domestic limited liability company?

A: No, only authorized persons, such as the LLC's managers or members, can file this form.

Q: What happens after filing Form FTB3716 PC?

A: After filing Form FTB3716 PC, the California Franchise Tax Board (FTB) will process the request and, if approved, the company's legal existence will be administratively cancelled.

Q: Is it necessary to file Form FTB3716 PC if a domestic limited liability company has already dissolved or been canceled?

A: Yes, it is necessary to file this form as it notifies the California Franchise Tax Board (FTB) of the company's intent to voluntarily cancel its legal existence.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3716 PC by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.