Minnesota Income Tax Withholding - Minnesota

Minnesota Income Tax Withholding is a legal document that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota.

FAQ

Q: What is Minnesota income tax withholding?

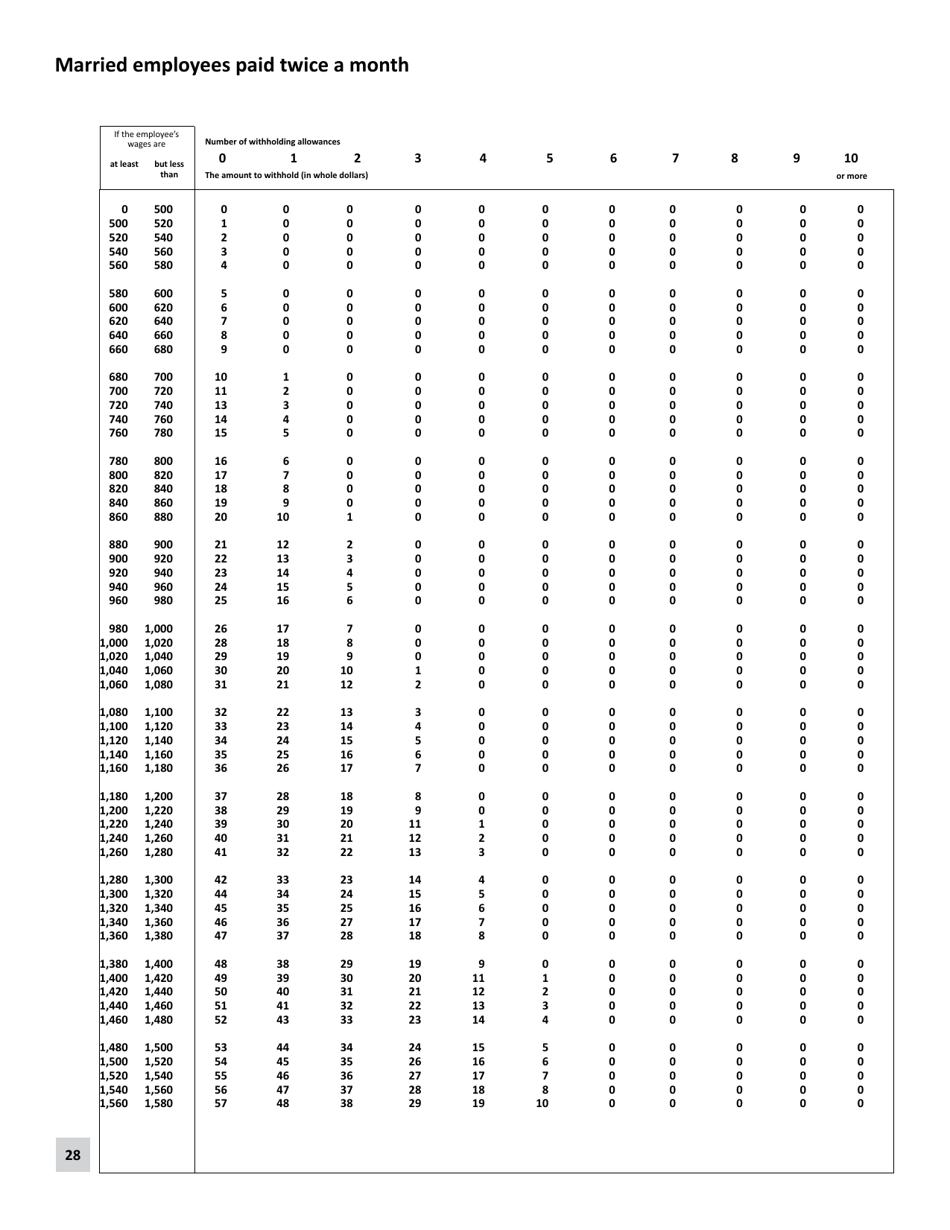

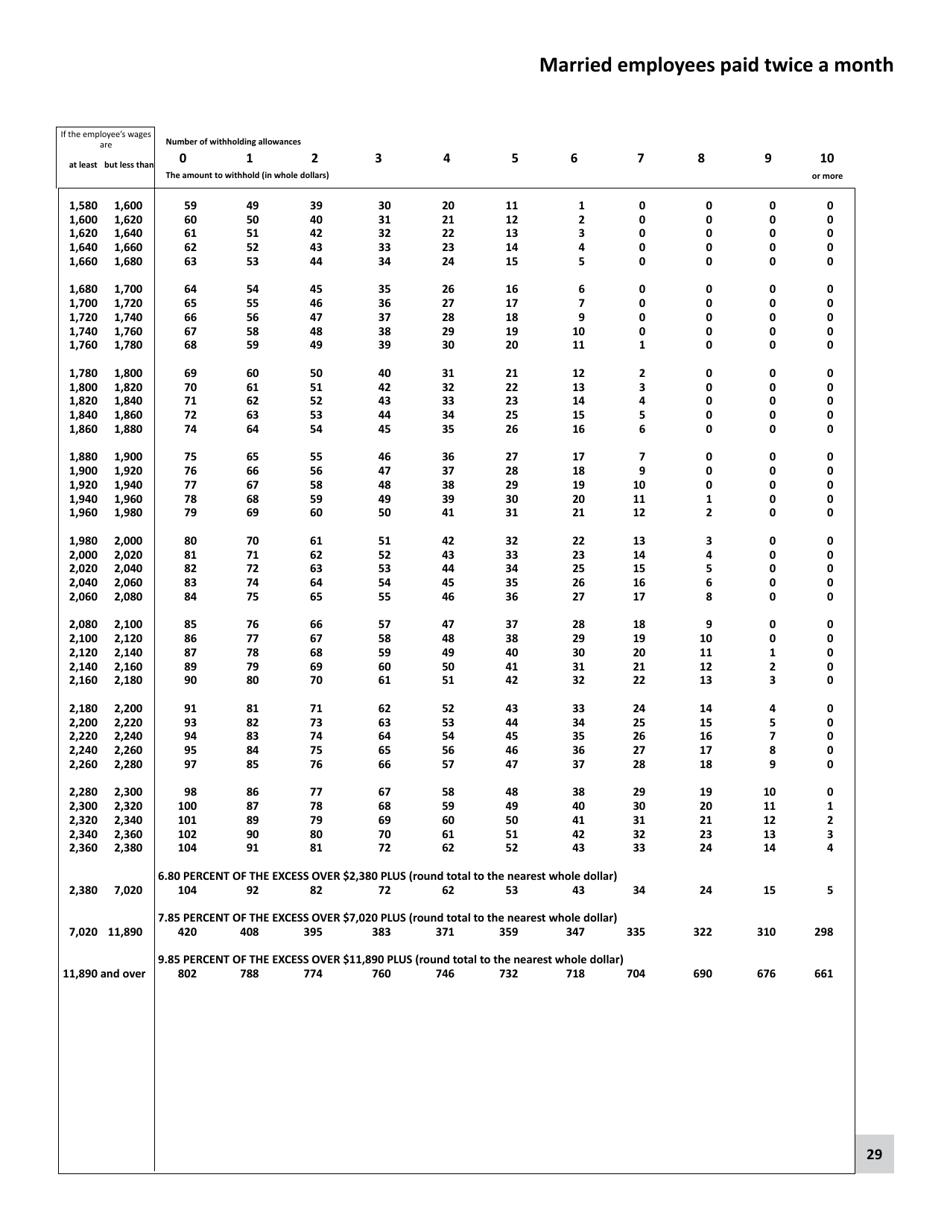

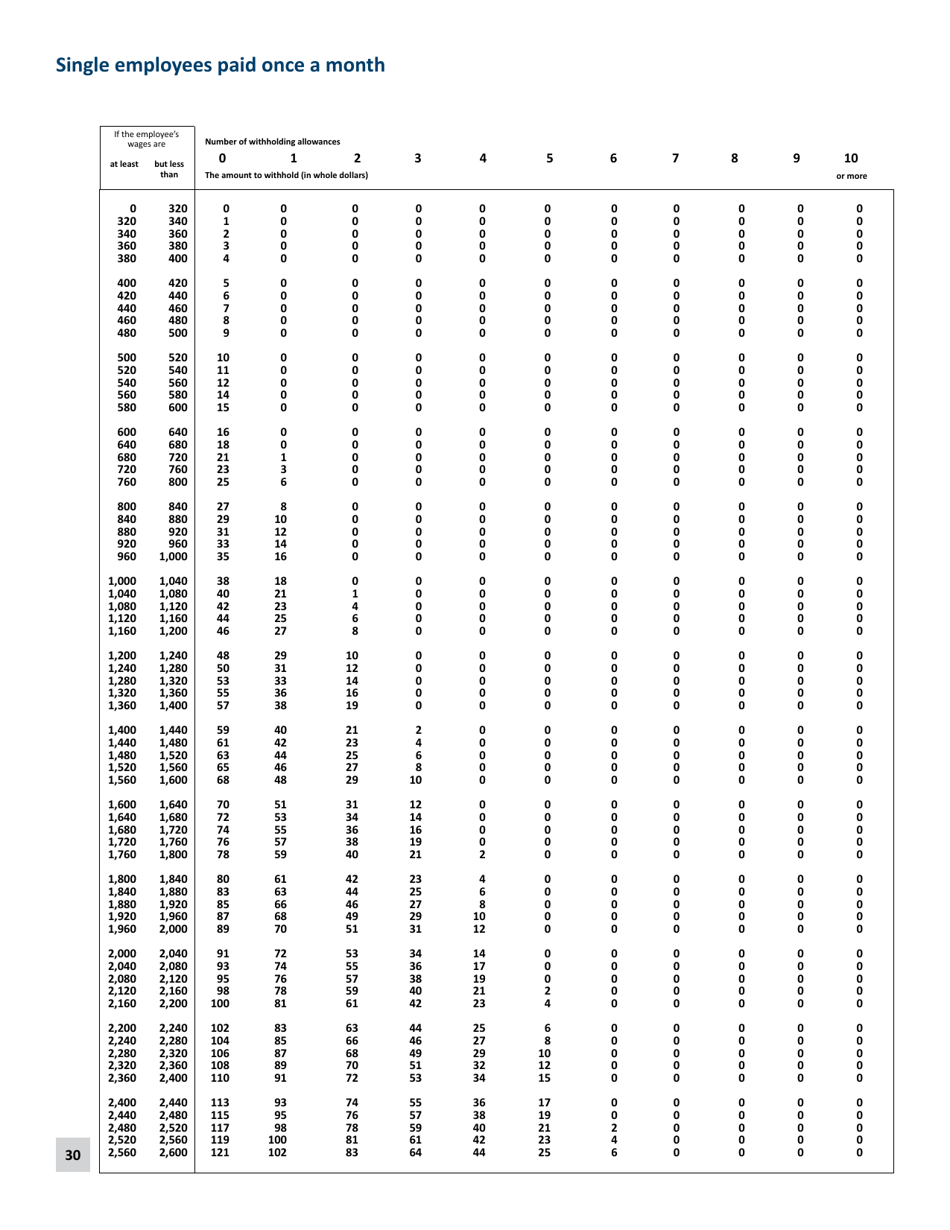

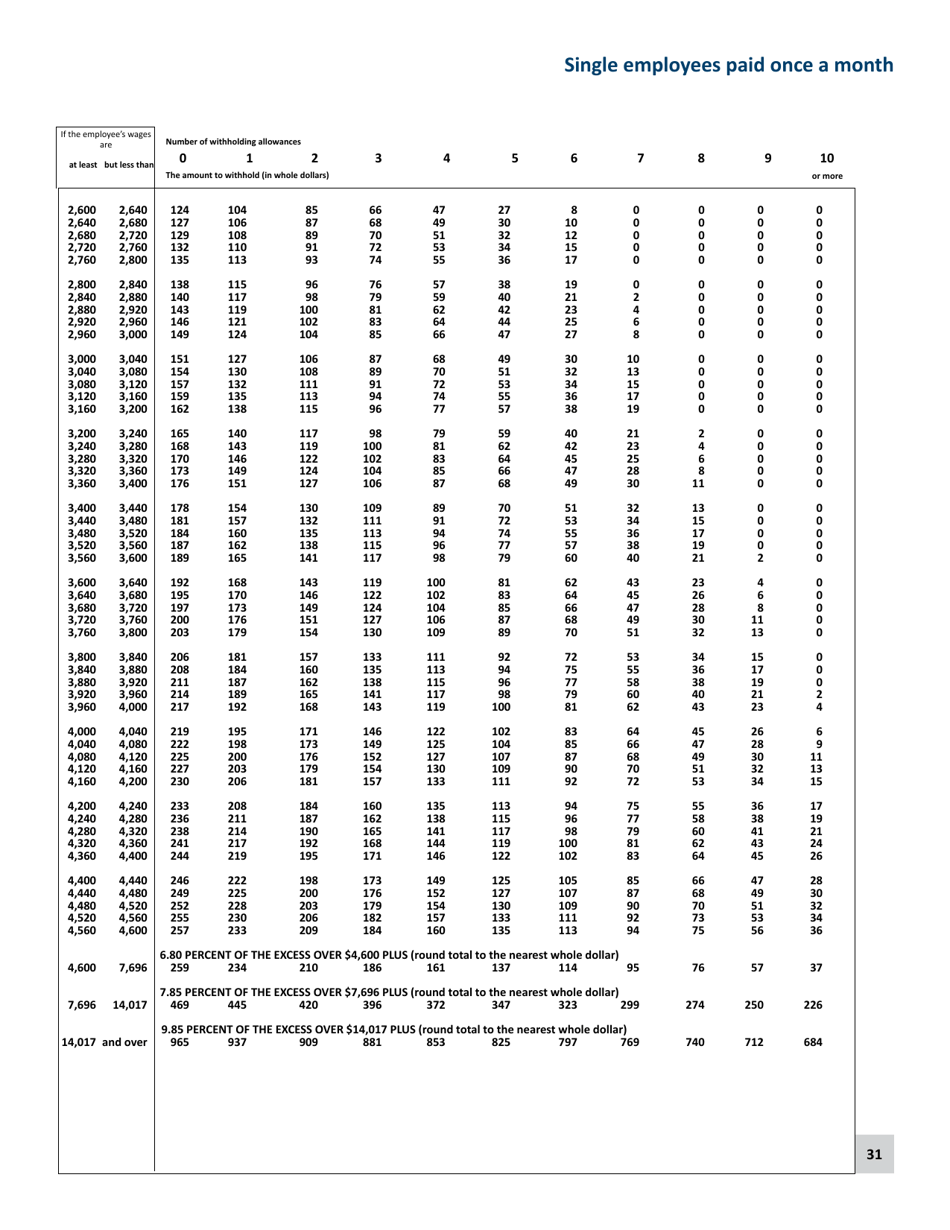

A: Minnesota income tax withholding is the amount of money that is withheld from your paycheck by your employer to cover your state income tax liability.

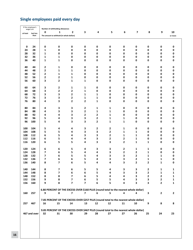

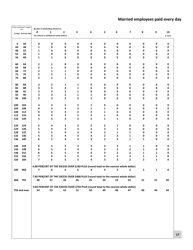

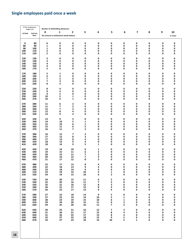

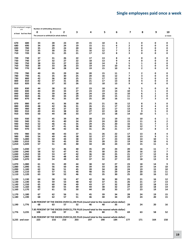

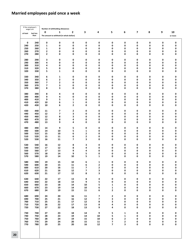

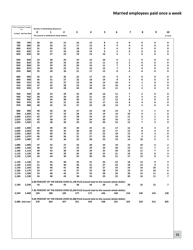

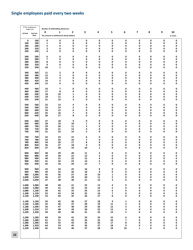

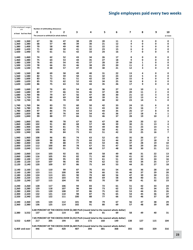

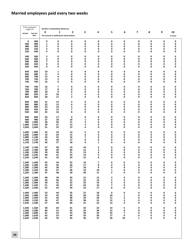

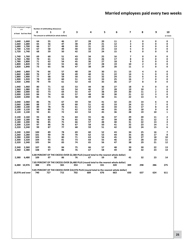

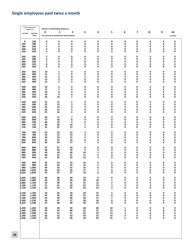

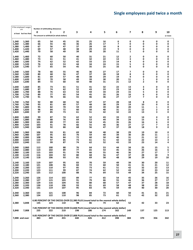

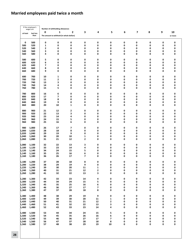

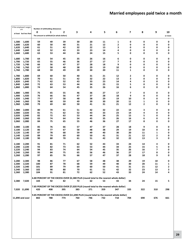

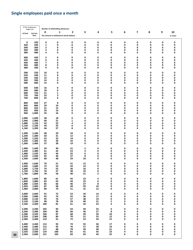

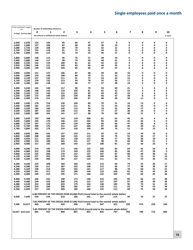

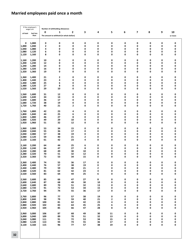

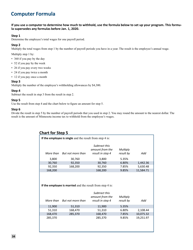

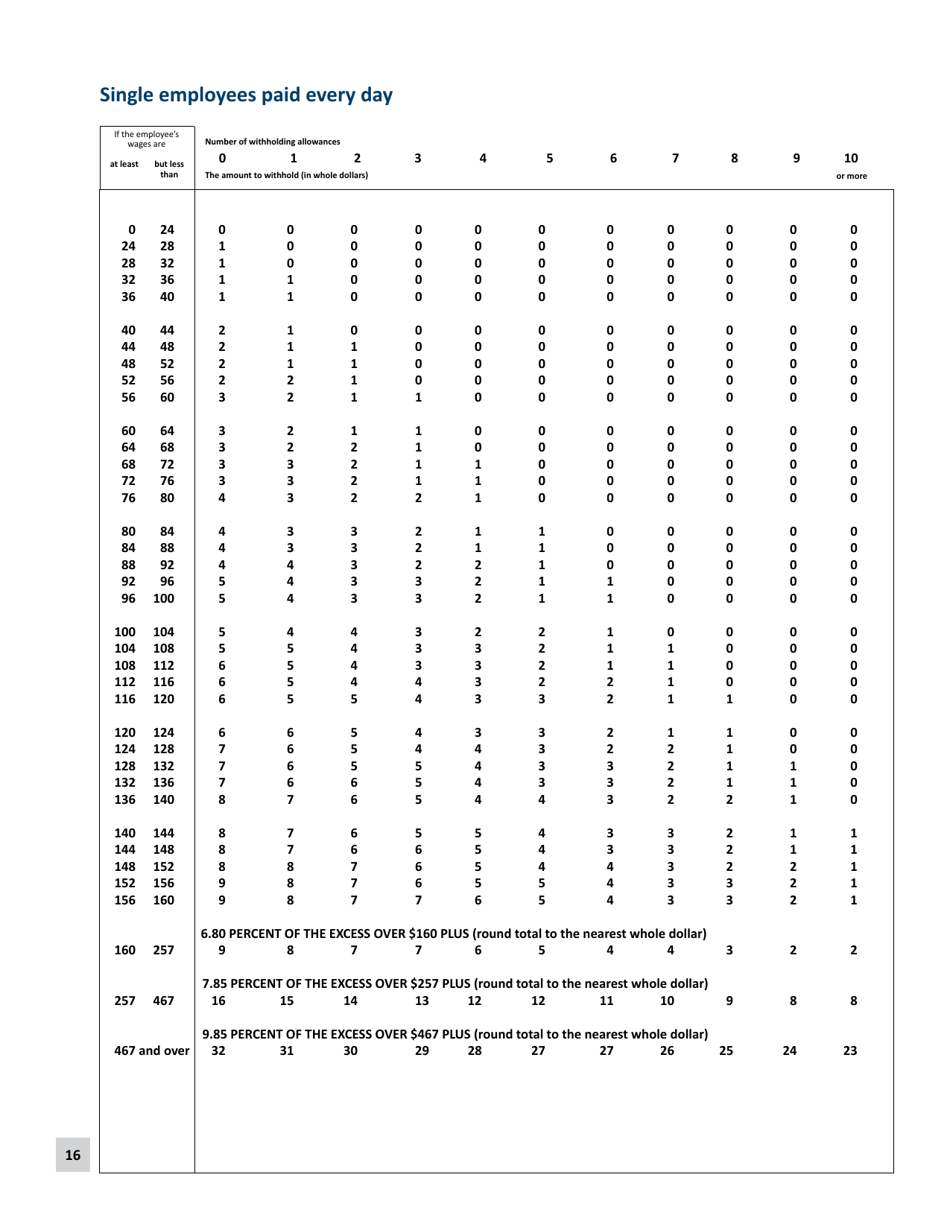

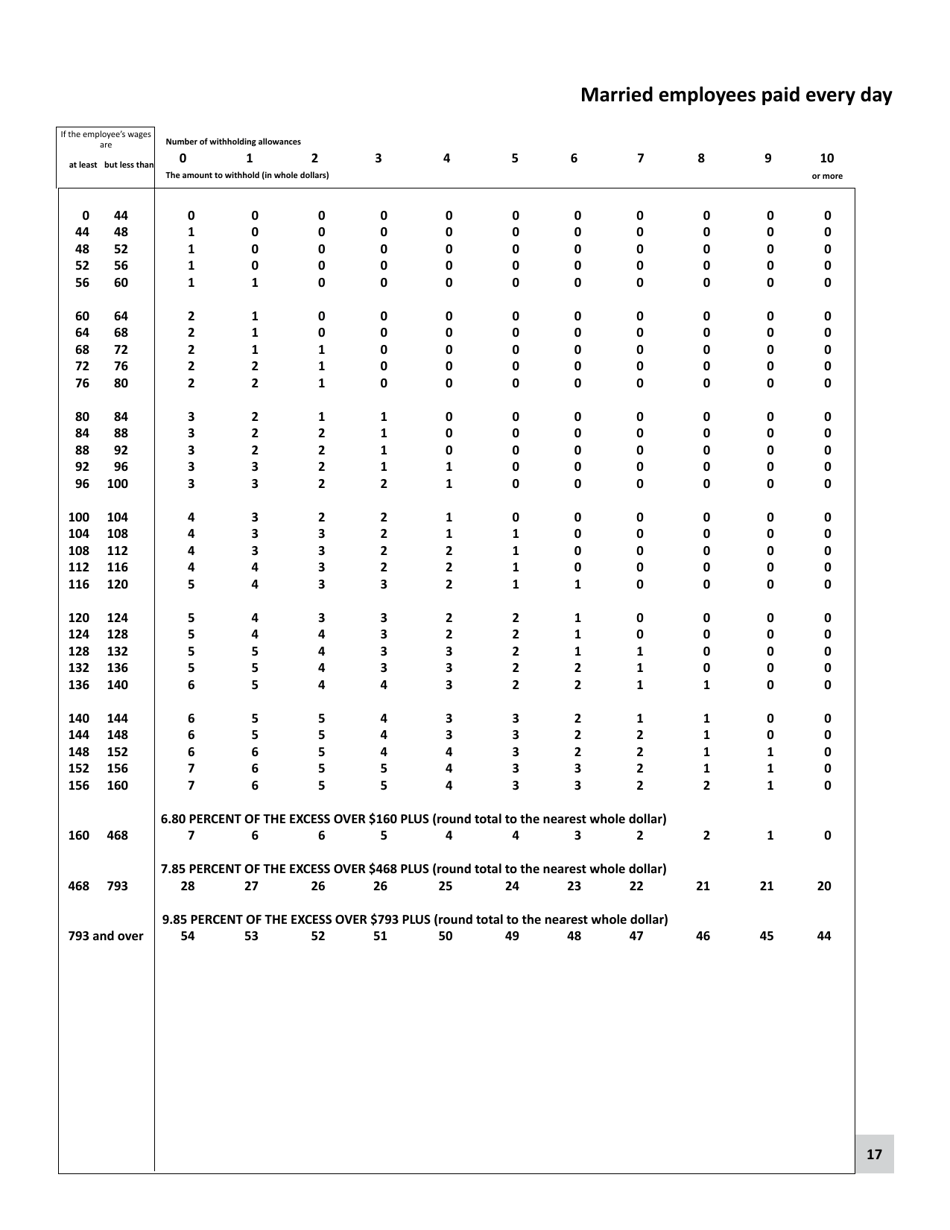

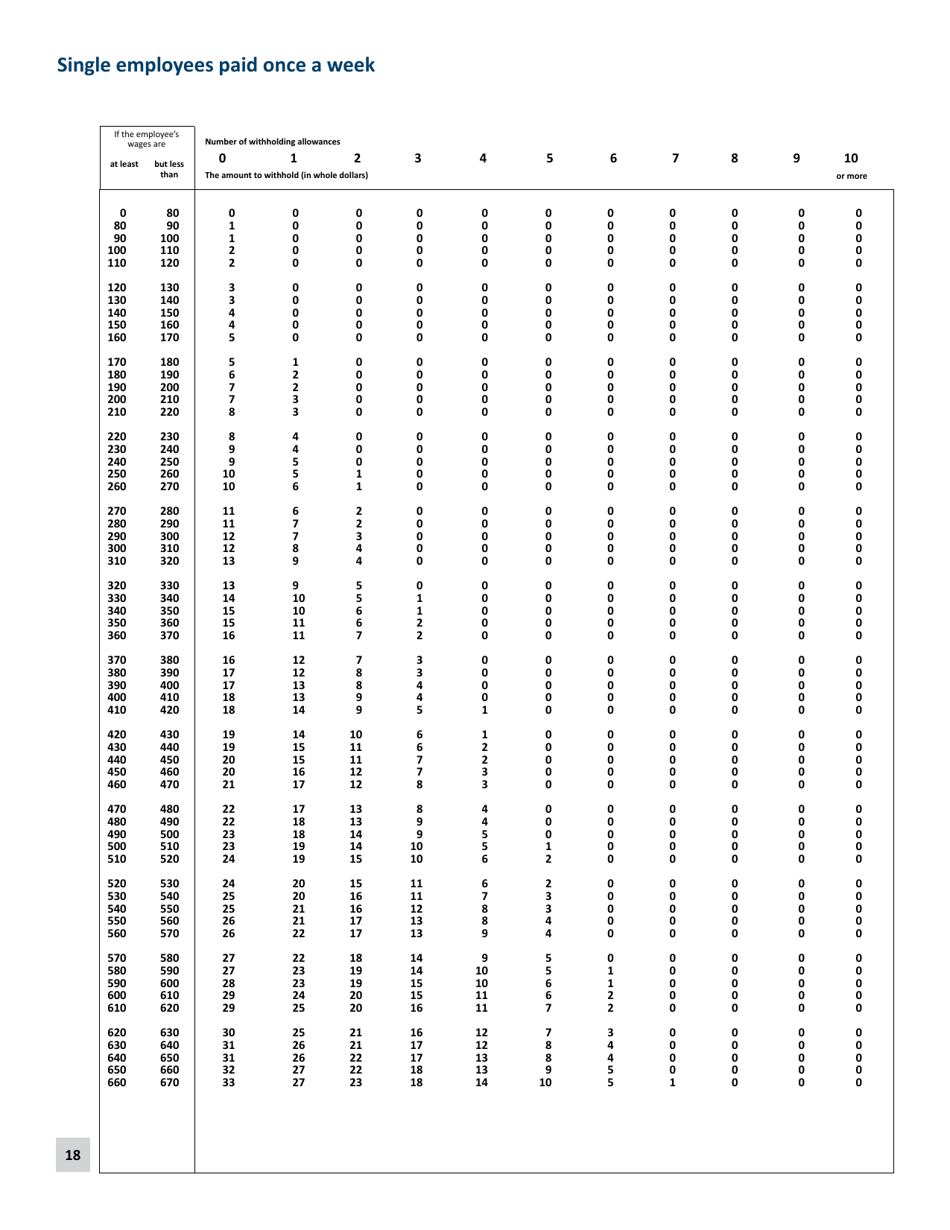

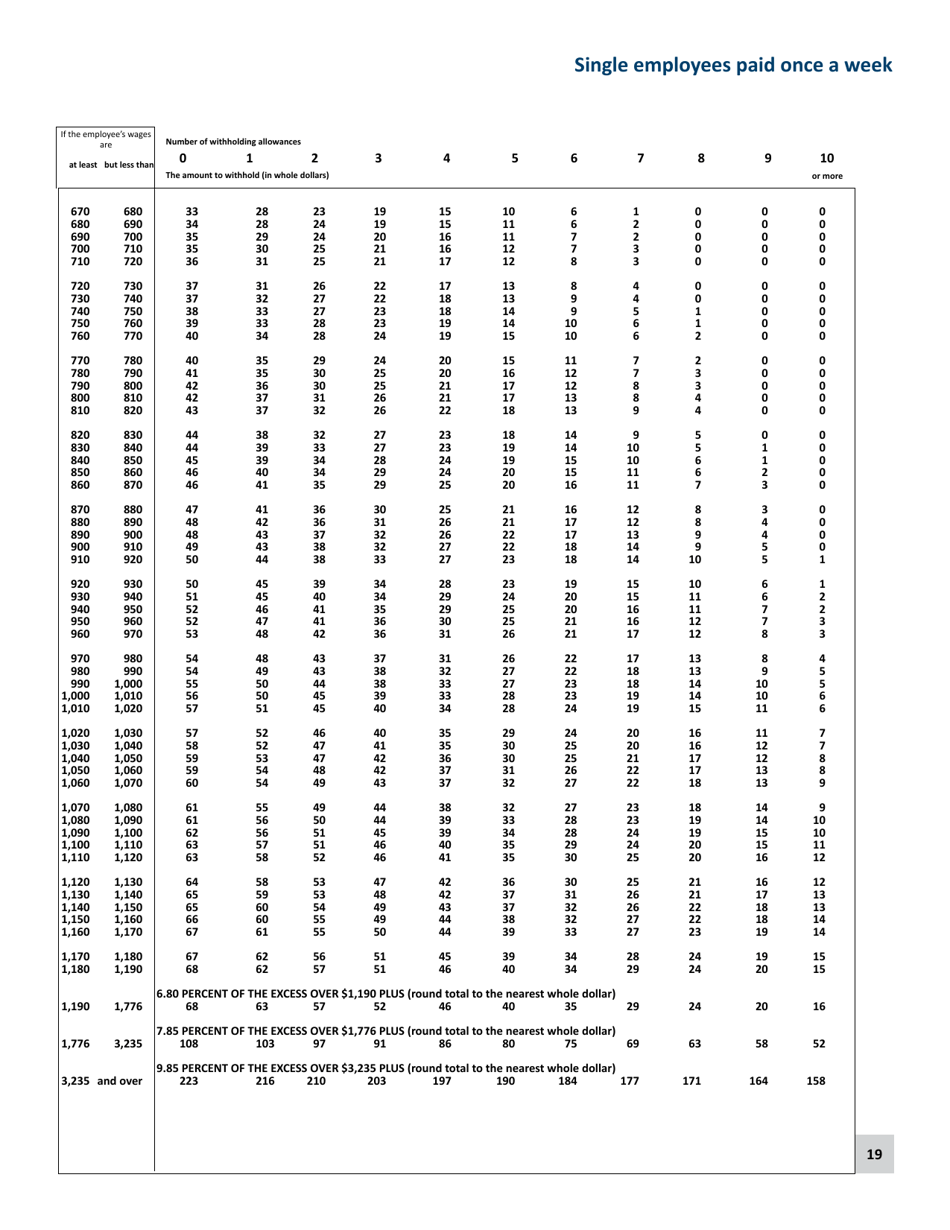

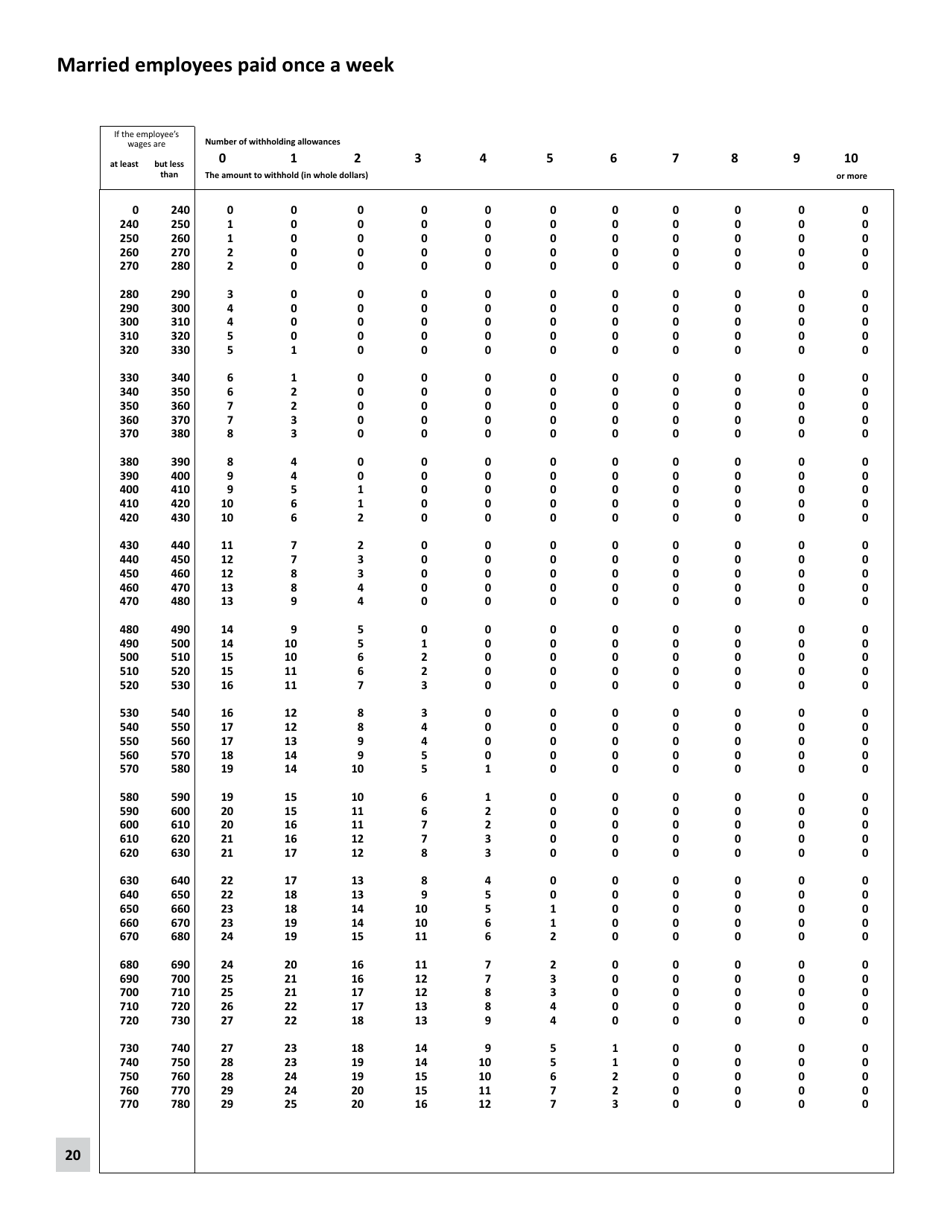

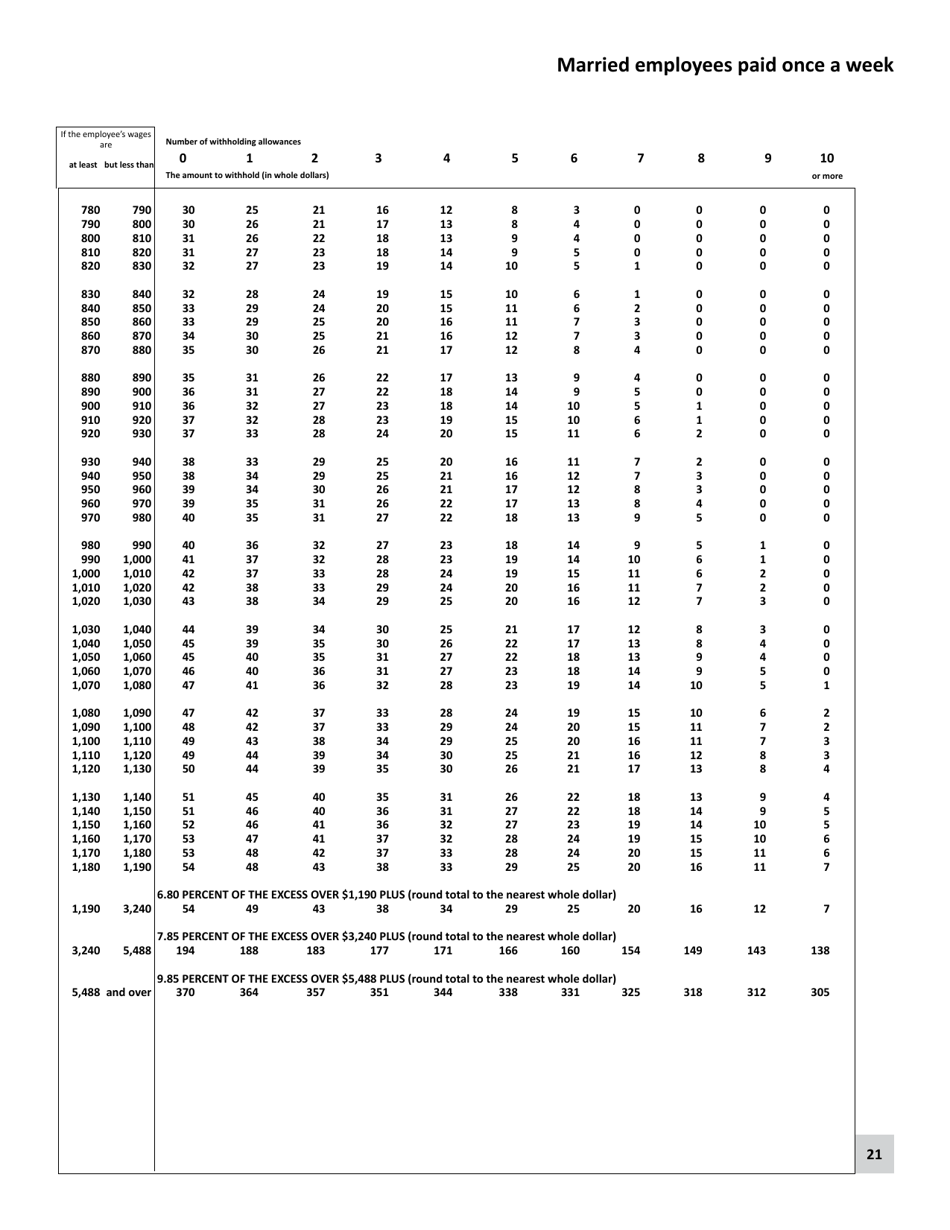

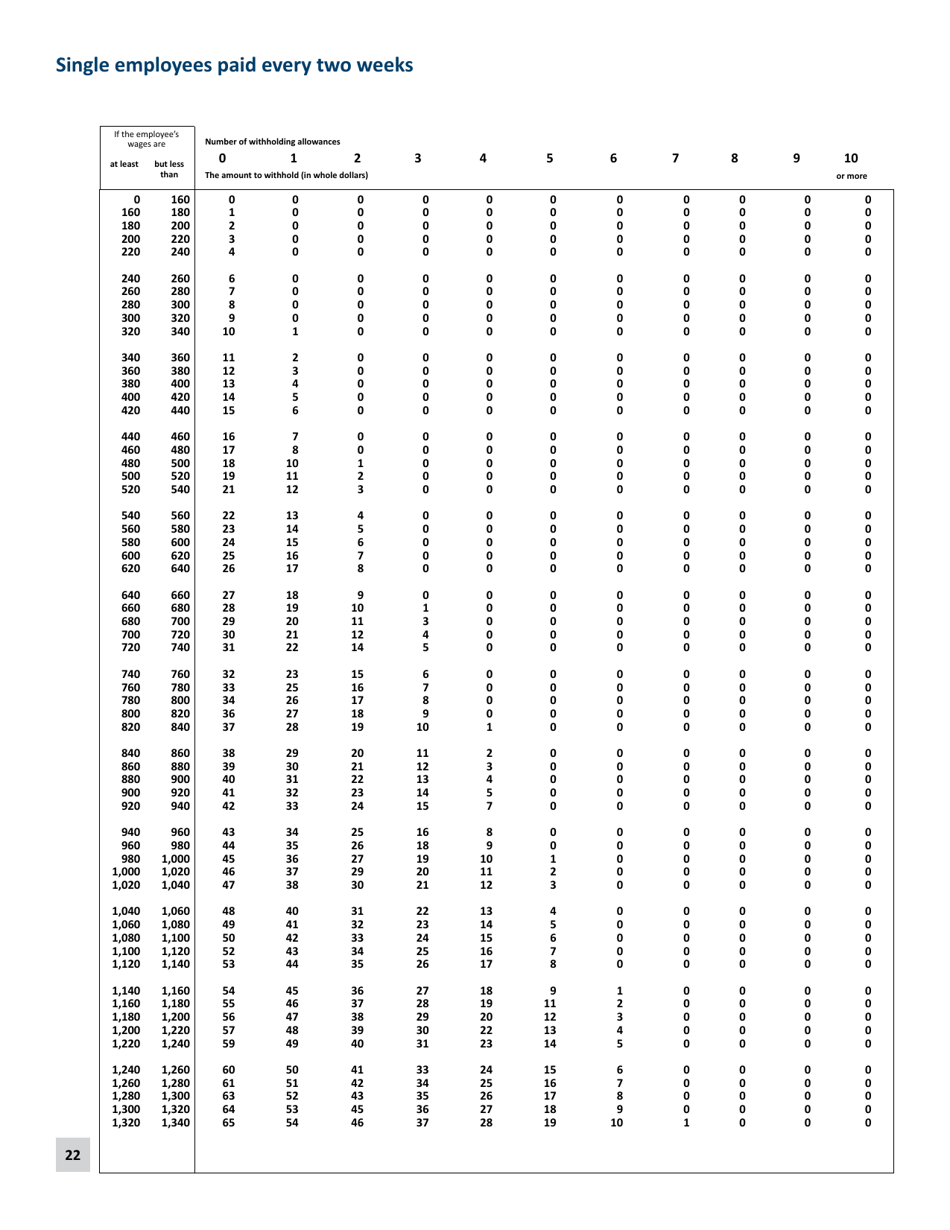

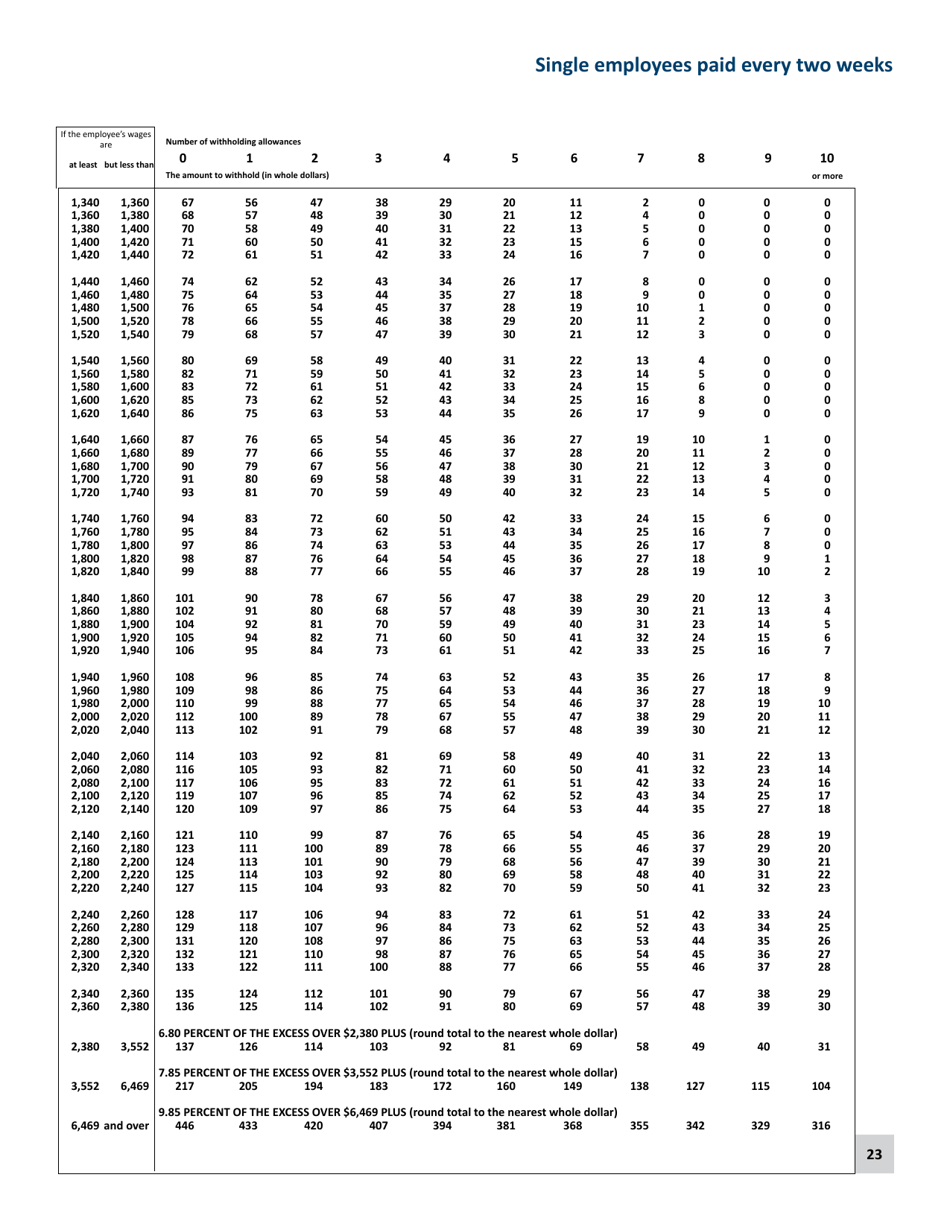

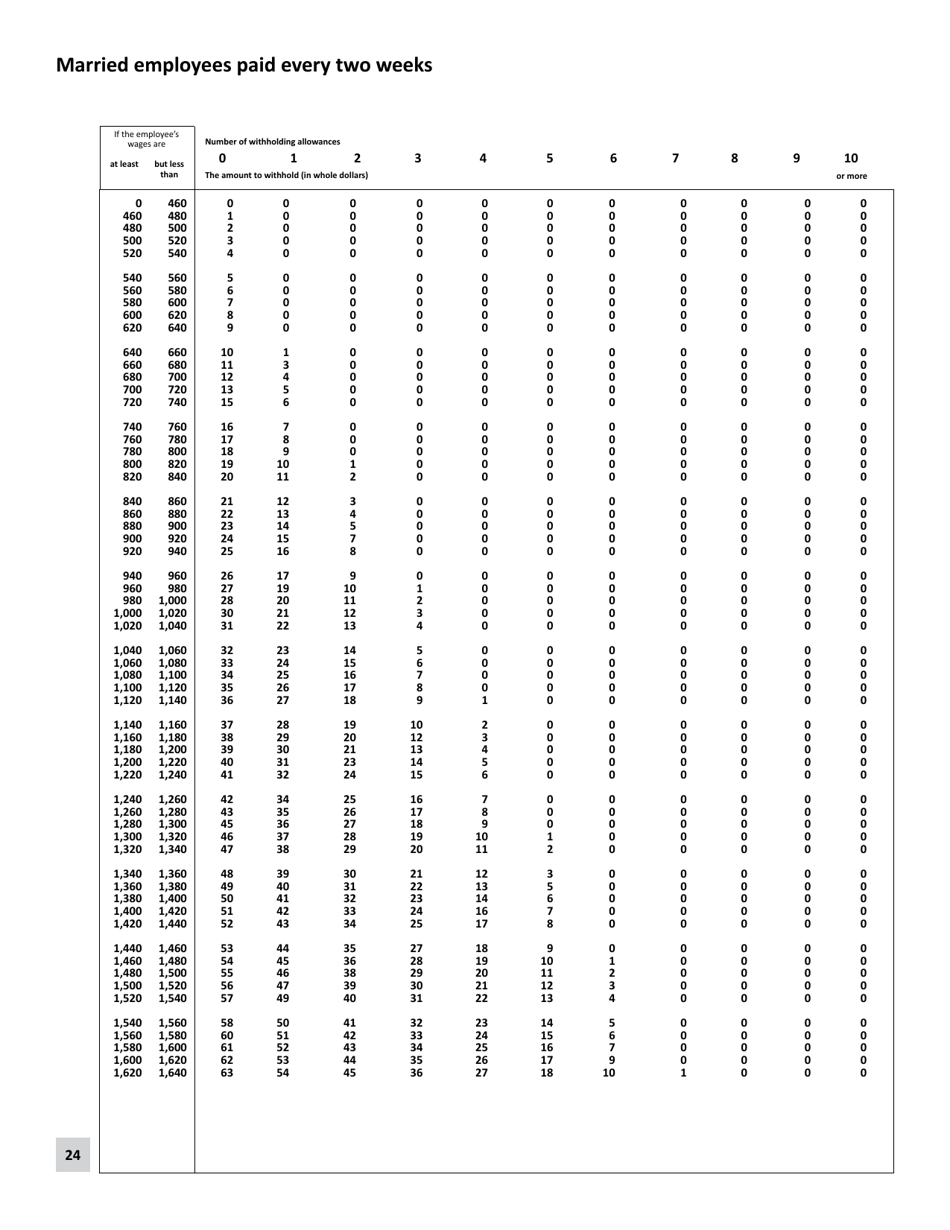

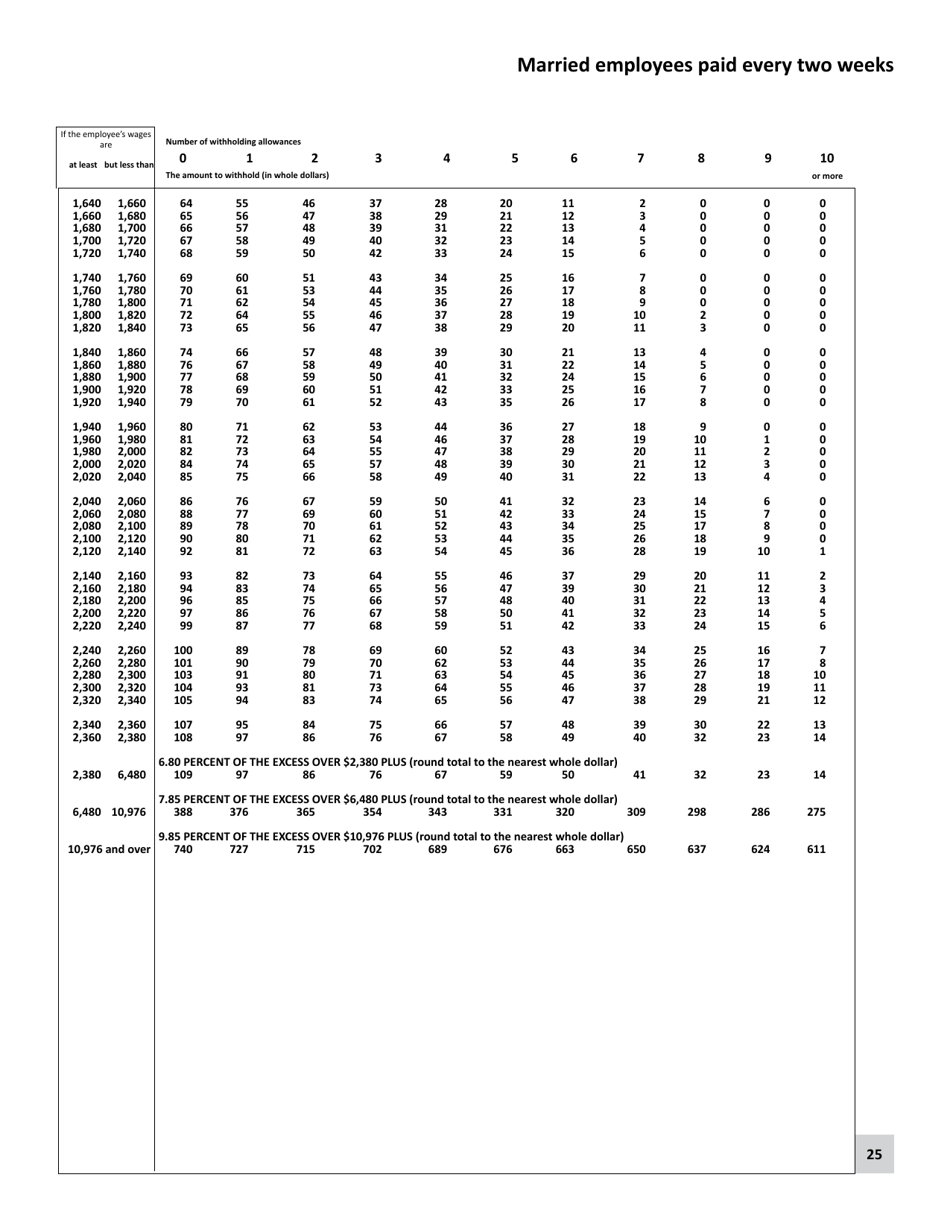

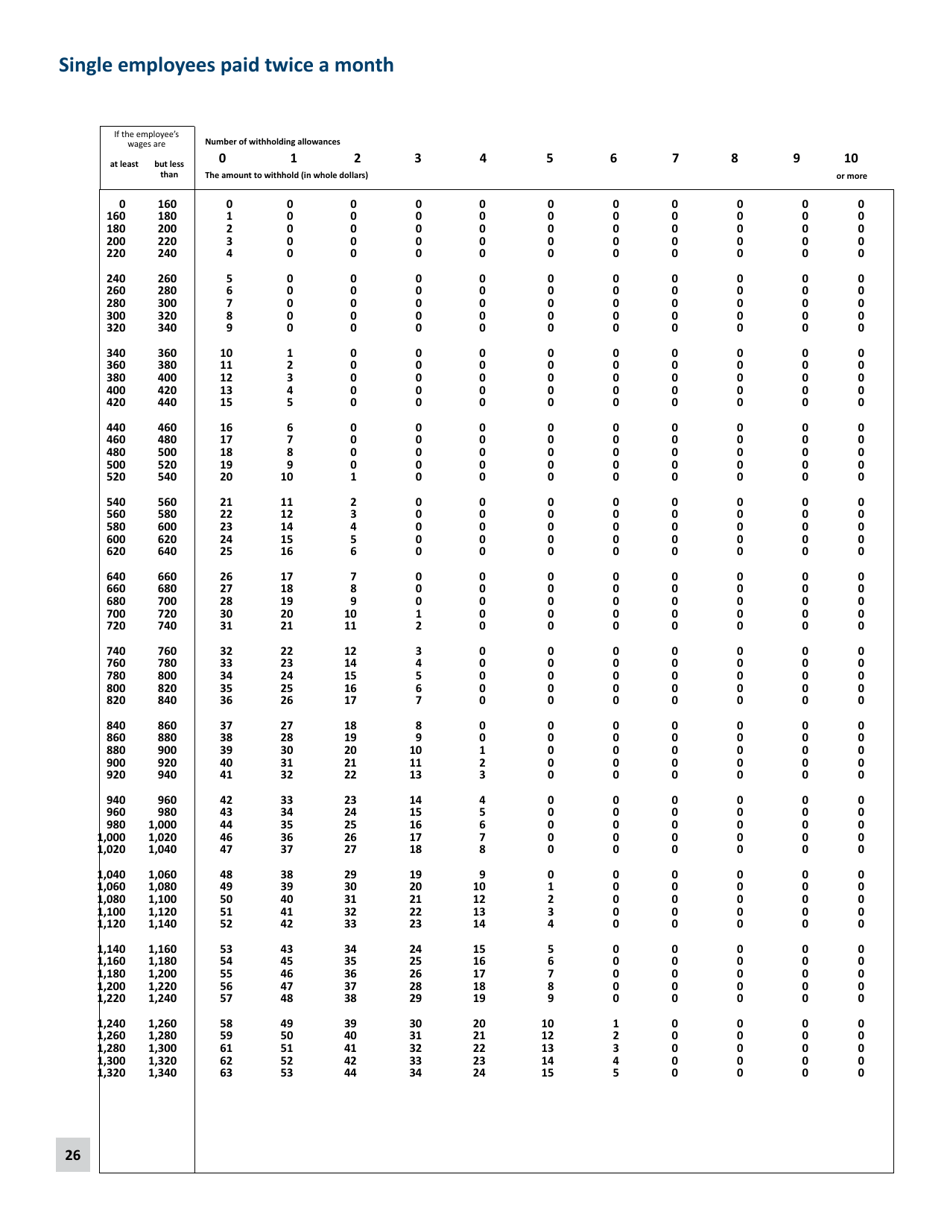

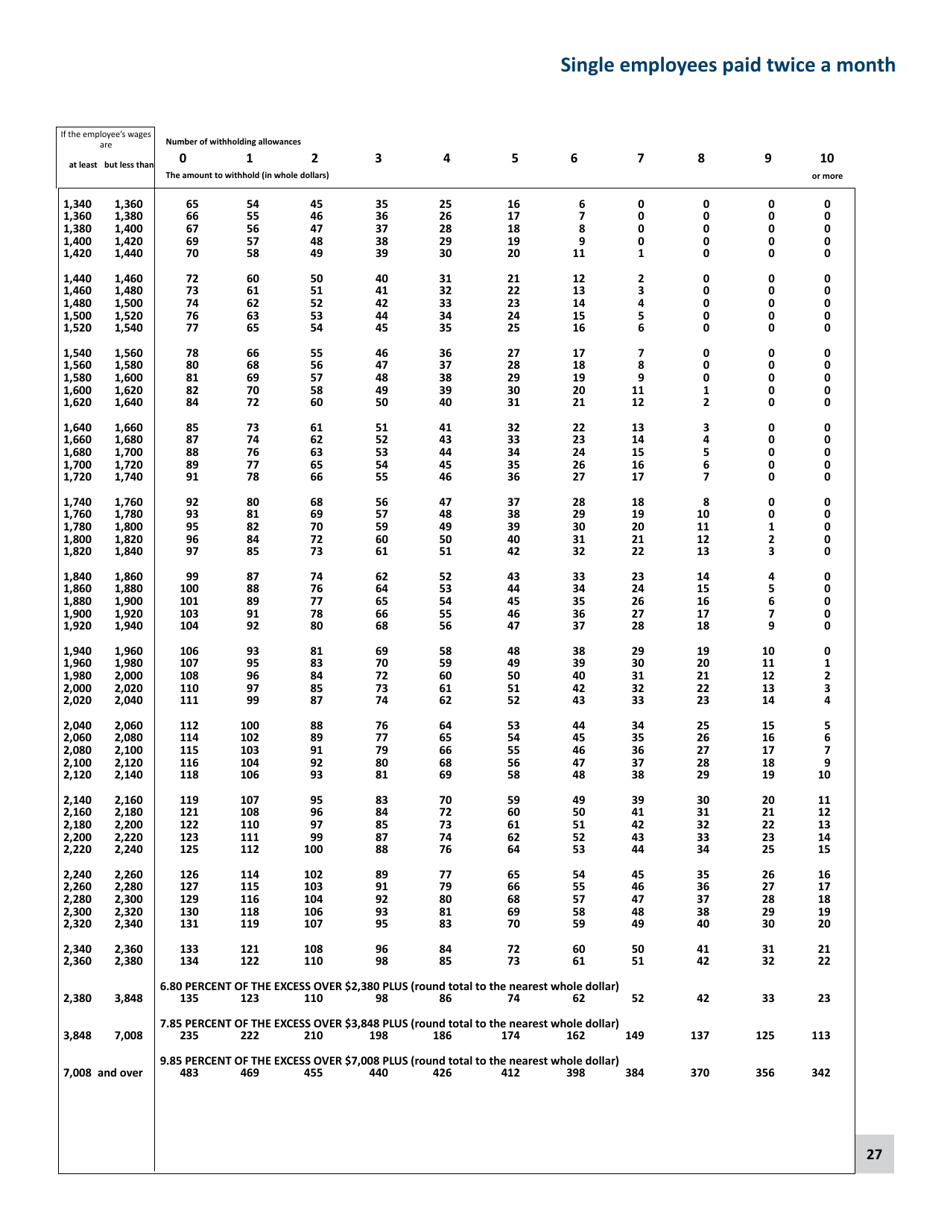

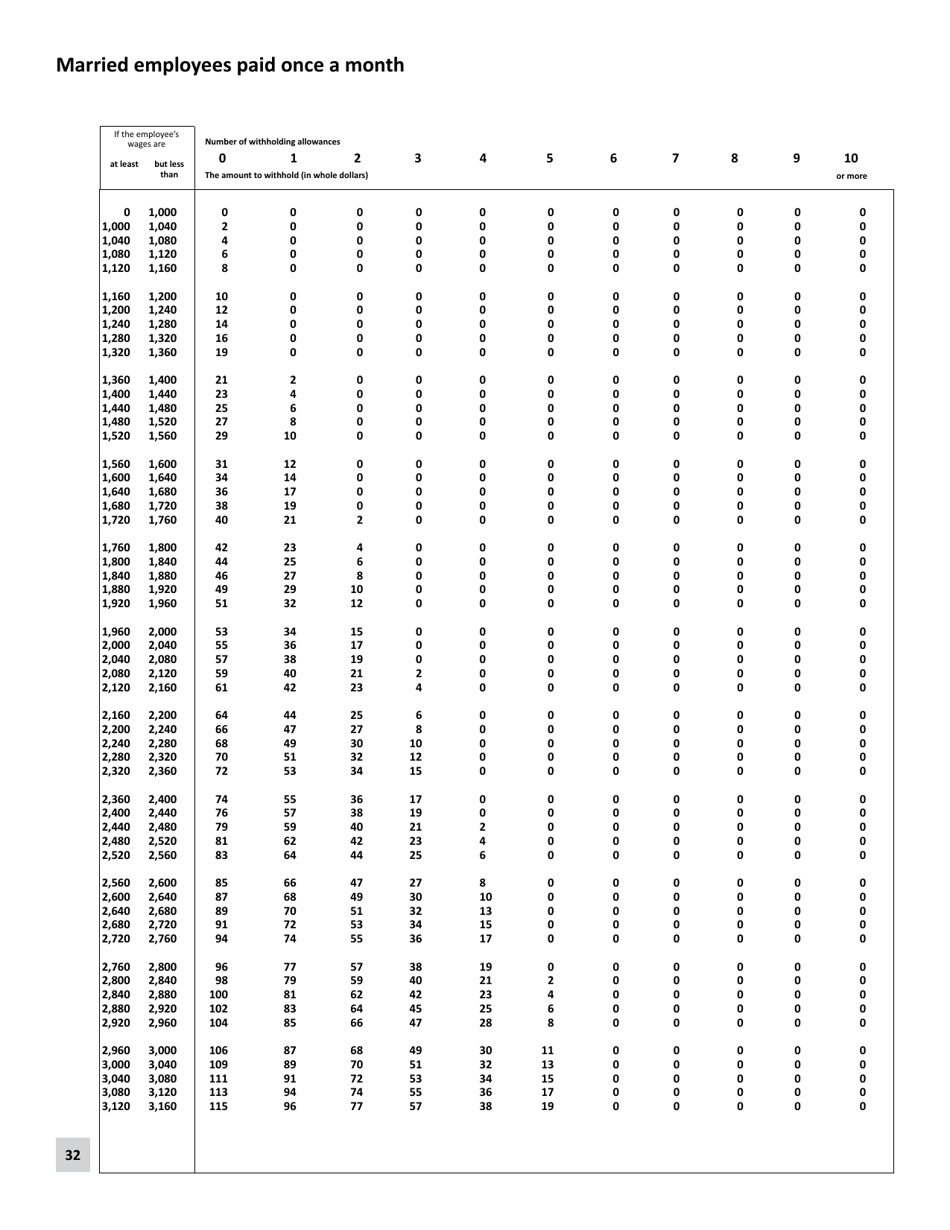

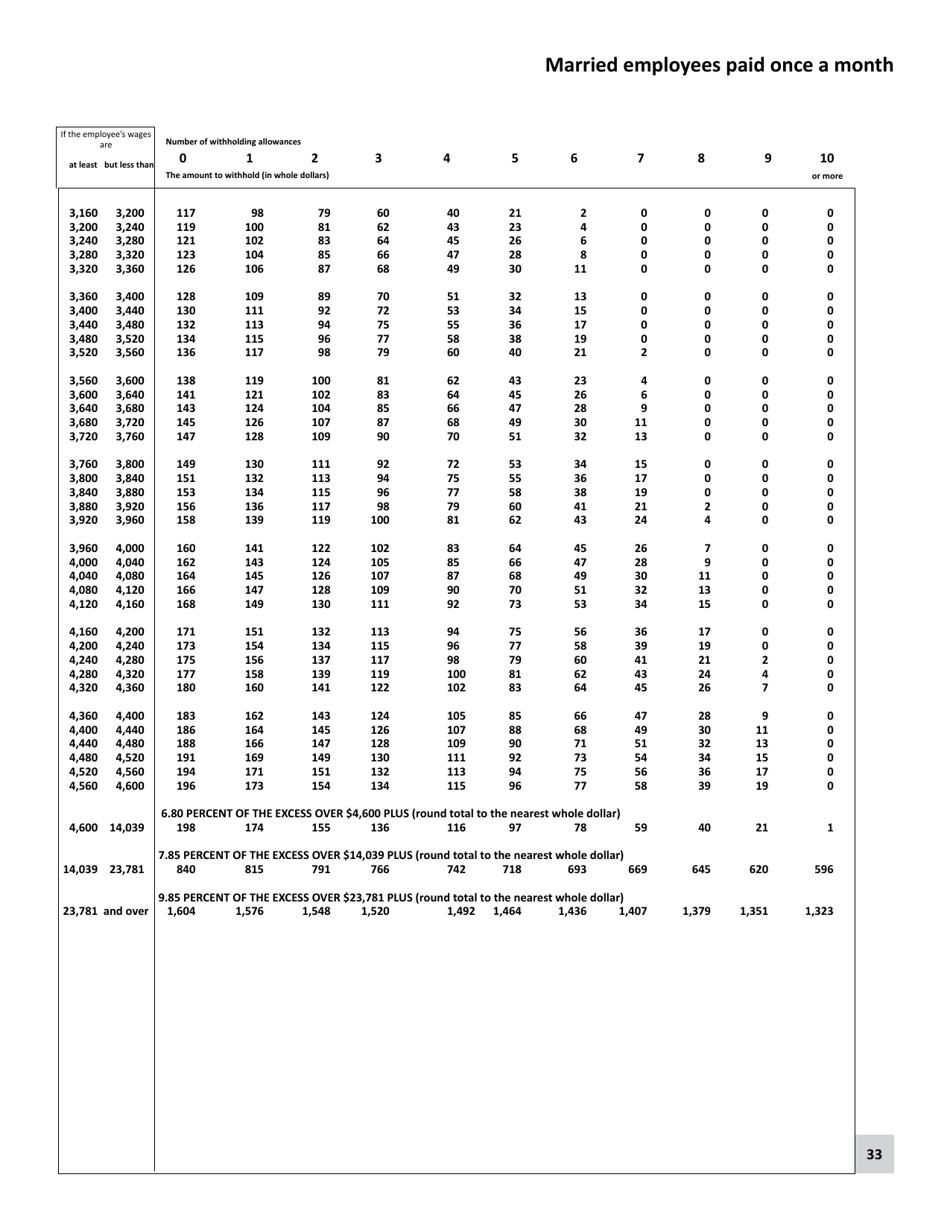

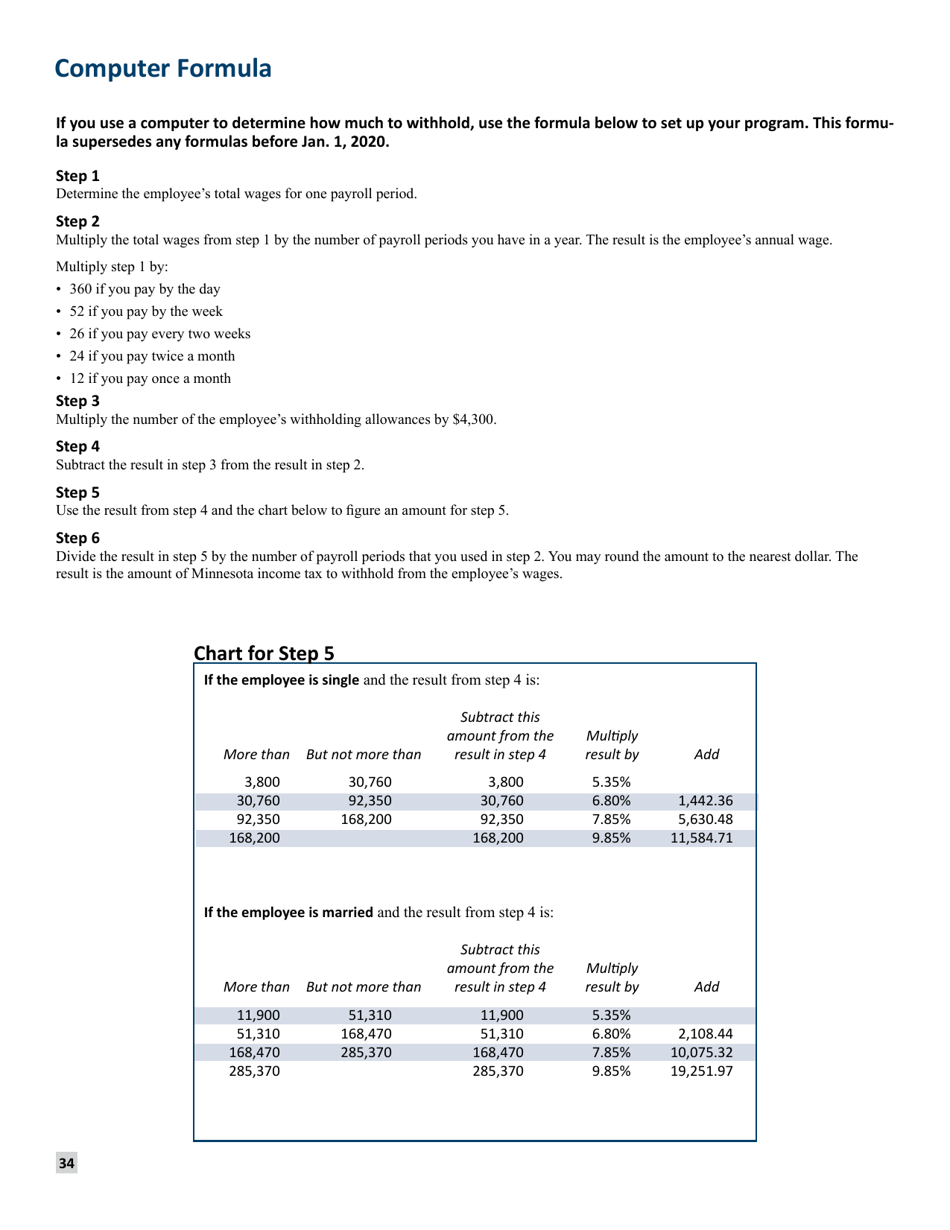

Q: How is Minnesota income tax withholding calculated?

A: Minnesota income tax withholding is calculated based on the information you provide on the state W-4 form, such as your filing status, exemptions, and estimated income.

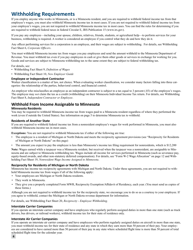

Q: Do all employers in Minnesota withhold income tax?

A: Yes, all employers in Minnesota are required to withhold state income tax from their employees' wages.

Q: Can I adjust my Minnesota income tax withholding?

A: Yes, you can adjust your Minnesota income tax withholding by submitting a new state W-4 form to your employer.

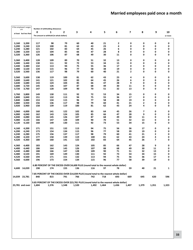

Q: How often is Minnesota income tax withholding taken from my paycheck?

A: Minnesota income tax withholding is typically taken from your paycheck each pay period, whether that is weekly, bi-weekly, or monthly.

Q: What happens if I have too much Minnesota income tax withheld?

A: If you have too much Minnesota income tax withheld, you may be eligible for a refund when you file your state income tax return.

Q: What happens if I don't have enough Minnesota income tax withheld?

A: If you don't have enough Minnesota income tax withheld, you may end up owing additional taxes when you file your state income tax return.

Q: Are there any exemptions or deductions available for Minnesota income tax withholding?

A: Yes, there are various exemptions and deductions available for Minnesota income tax withholding, such as the dependent exemption and the standard deduction.

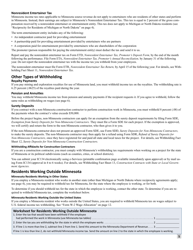

Q: Can I opt out of Minnesota income tax withholding?

A: No, you cannot opt out of Minnesota income tax withholding if you are employed in the state.

Q: Do I need to file a separate tax return for Minnesota?

A: Yes, if you are a resident of Minnesota or have income from Minnesota sources, you will need to file a separate state income tax return.

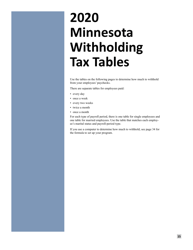

Q: Is Minnesota income tax progressive?

A: Yes, Minnesota income tax is progressive, which means that higher income earners are subject to higher tax rates.

Q: What is the current Minnesota income tax rate?

A: The current Minnesota income tax rates range from 5.35% to 9.85%, depending on the amount of taxable income.

Q: When is the deadline to file Minnesota income tax return?

A: The deadline to file your Minnesota income tax return is typically April 15th, the same as the federal income tax deadline.

Q: Can I e-file my Minnesota income tax return?

A: Yes, you can e-file your Minnesota income tax return if you choose to do so.

Q: Can I deduct federal taxes paid on my Minnesota income tax return?

A: No, you cannot deduct federal taxes paid on your Minnesota income tax return.

Q: What is the penalty for underpayment of Minnesota income tax?

A: The penalty for underpayment of Minnesota income tax varies depending on the amount owed and the length of time it remains unpaid.

Q: Is Social Security income taxable in Minnesota?

A: Yes, Social Security income is generally taxable in Minnesota.

Q: Are pension payments taxable in Minnesota?

A: Yes, pension payments are generally taxable in Minnesota.

Q: Can I claim a refundable tax credit on my Minnesota income tax return?

A: Yes, there are several refundable tax credits available on your Minnesota income tax return, such as the Working Family Credit and the Child and Dependent Care Credit.

Form Details:

- The latest edition currently provided by the Minnesota Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.