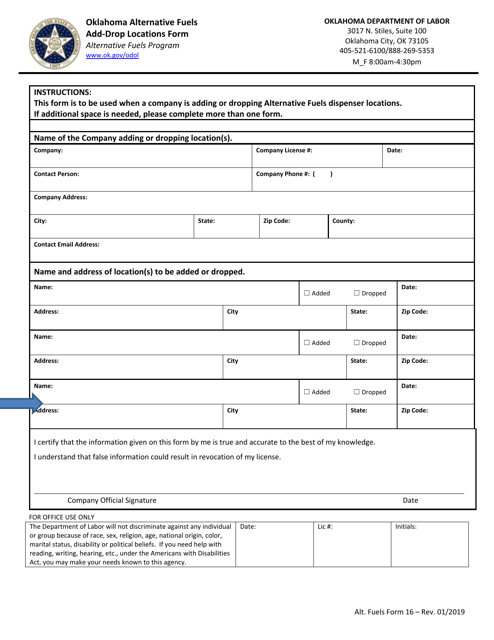

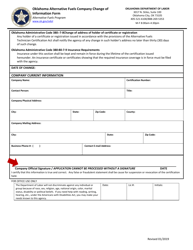

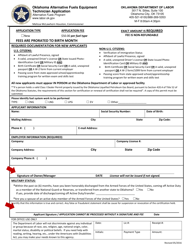

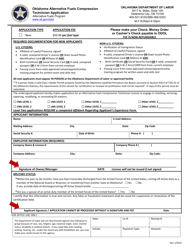

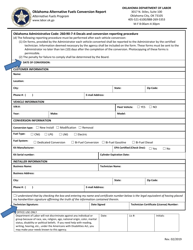

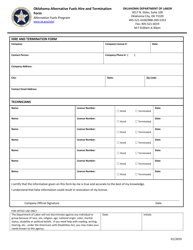

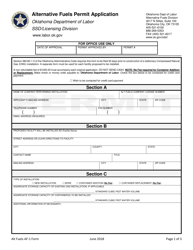

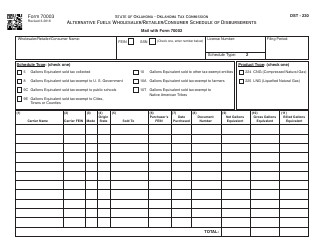

Form 16 Oklahoma Alternative Fuels Add-Drop Locations Form - Oklahoma

What Is Form 16?

This is a legal form that was released by the Oklahoma Department of Labor - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

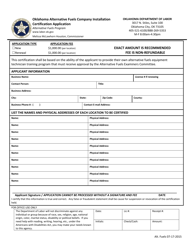

Q: What is Form 16?

A: Form 16 is a document used in Oklahoma for reporting alternative fuels add-drop locations.

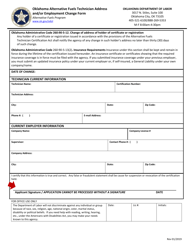

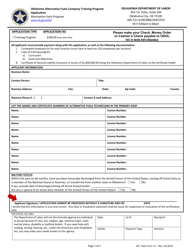

Q: What are alternative fuels add-drop locations?

A: Alternative fuels add-drop locations are places where alternative fuels can be purchased and delivered to a vehicle's fuel tank.

Q: What is the purpose of Form 16?

A: The purpose of Form 16 is to provide information about the alternative fuels add-drop locations in Oklahoma.

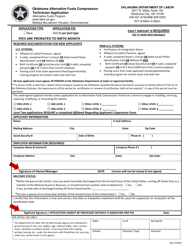

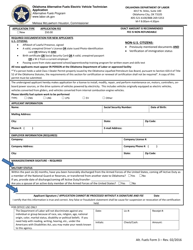

Q: Who needs to fill out Form 16?

A: Any individual or business that operates an alternative fuels add-drop location in Oklahoma needs to fill out Form 16.

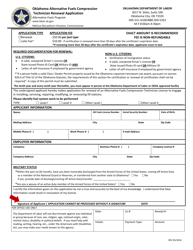

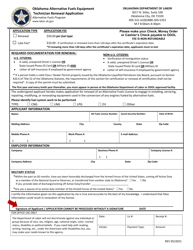

Q: When is Form 16 due?

A: Form 16 is due on or before the 20th day of the month following the end of the quarter.

Q: What information is required on Form 16?

A: Form 16 requires information about the alternative fuels add-drop location, including the name and address of the location, the type of fuel being distributed, and the volume of fuel distributed.

Q: Are there any penalties for not filing Form 16?

A: Yes, there are penalties for not filing Form 16, including late filing fees and interest charges on any unpaid taxes.

Q: Is there a fee for filing Form 16?

A: No, there is no fee for filing Form 16.

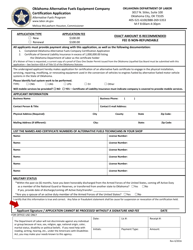

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Oklahoma Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 16 by clicking the link below or browse more documents and templates provided by the Oklahoma Department of Labor.